Original|Odaily Planet Daily (@OdailyChina)

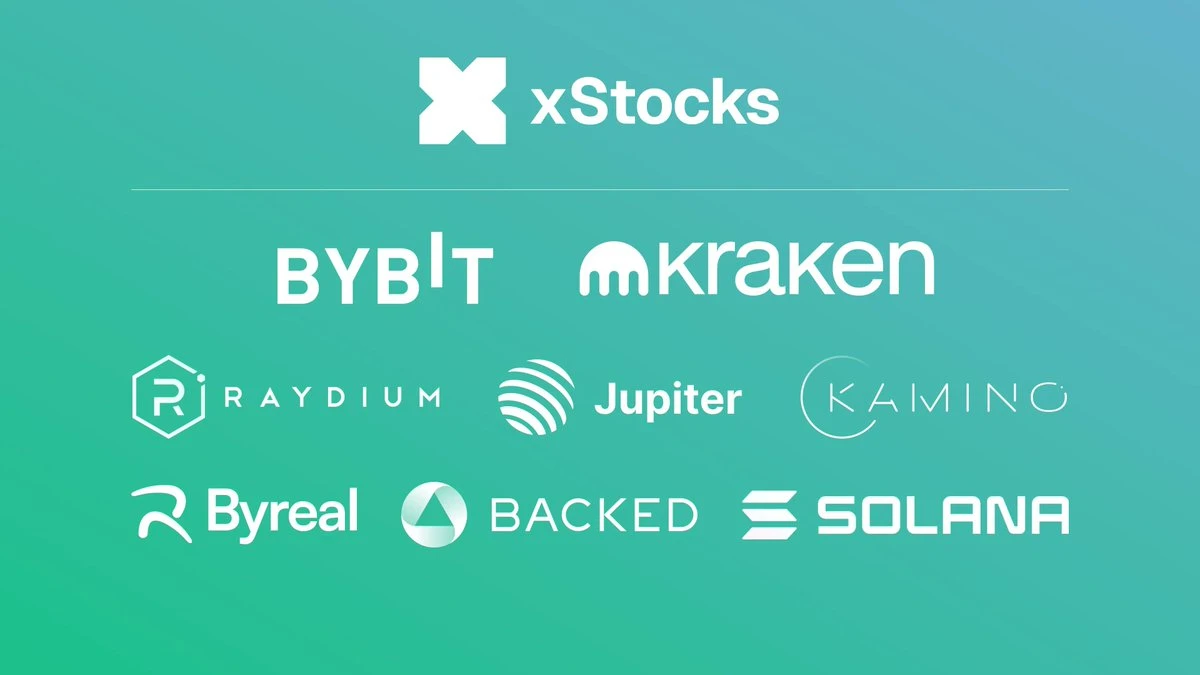

Following the launch of tokenized Coinbase US stock in March, RWA asset issuer Backed has introduced a new initiative—this time they have partnered with the US cryptocurrency exchange Kraken to launch the US stock tokenization trading platform xStocks. As a pioneer in the "US stock tokenization market," xStocks ignited enthusiasm for collaboration in the crypto market within just two days. In addition to Kraken, crypto platforms and projects such as Bybit, Raydium, Solflare, Kamino, Jupiter, Chainlink, and AlchemyPay have joined its alliance. Platforms like GMGN and Backpack have also launched some US stock token trading windows, leading many to believe that this move may signal the start of a counteroffensive for crypto assets in the US stock market.

However, a series of questions have arisen. Can the tokens purchased on the xStocks platform be redeemed for US stocks? How is the price anchored? What are the specific fees? Do holders of US stock tokens have dividend rights or voting rights? My colleague Asher today briefly traded some US stock tokens through GMGN (details can be found in “I traded US stocks on-chain, and my mindset was already floating on the first day”). During the practical test, he encountered many detailed issues. While the general principles can be understood, discussions among the Odaily Planet Daily reporter team revealed that specific practices still require further verification and observation. In light of this, we have compiled a Q&A list for readers' reference, and we also welcome everyone to leave comments discussing related issues or pointing out errors.

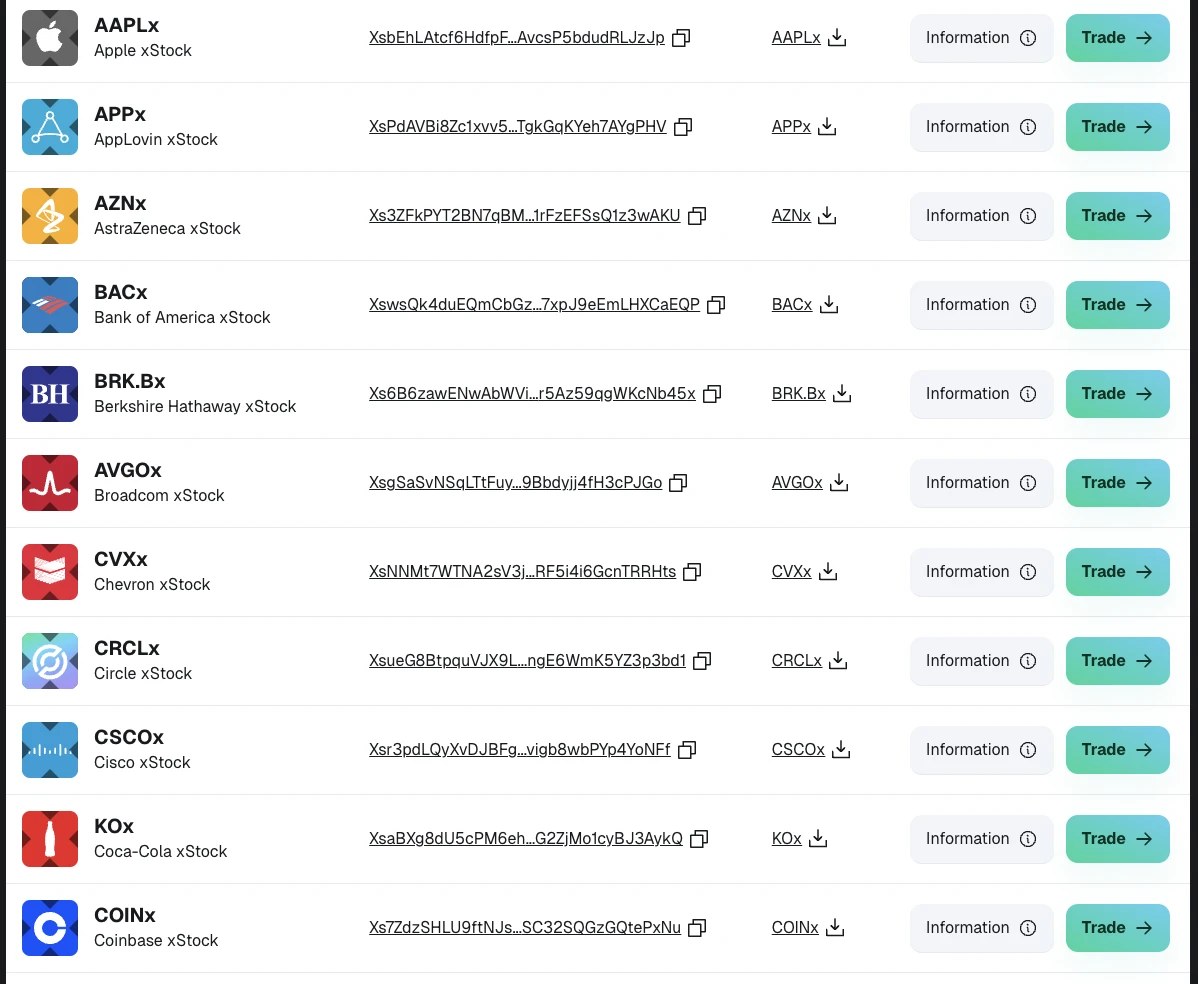

Q1: What US stock tokens are currently supported by xStocks?

According to xStocks official website, the platform currently supports the following US stocks:

NVIDIA, Coinbase, Circle, Berkshire Hathaway, McDonald's, Chevrolet, Apple, Amazon, Mastercard, JPMorgan Chase, Meta (formerly Facebook), Tesla, Strategy, S&P 500 Index, and 61 other US stock tokens.

Overview of some US stock tokens

According to its official website, compared to traditional stock brokers, the US stock tokens issued by xStocks have advantages such as 24/7 trading (with price oracle support from Chainlink), free transfer, no trading fees (limited to Kraken channels), support for DeFi integration, and ease of use.

Overview of advantages

Q2: Is there a 1:1 real stock reserve corresponding to the tokens?

According to the current information on the platform, xStocks does indeed have a corresponding 1:1 real stock reserve, but it is mainly managed by some cooperative custodians, so the authenticity of this information still needs to be verified.

According to Backed official website and xStocks US stock token introduction information, most US stock custodians include the following institutions:

Maerki Baumann & Co. AG, a Swiss private bank focused on investment consulting and asset management, also providing services for external asset management institutions. The company is headquartered in Zurich and was founded in 1932. In addition to traditional private banking services, Maerki Baumann also offers sustainable investment solutions, professional consulting, personalized services, and indirect real estate investments. Furthermore, the company has a partnership with Bitcoin Suisse Ltd., a leading Swiss crypto financial service provider.

InCore Bank AG, a B2B trading bank headquartered in Zurich, Switzerland, focusing on traditional and digital assets. It was established in 2007 and is a regulated bank supervised by the Swiss Financial Market Supervisory Authority (FINMA).

Alpaca Securities LLC, a US brokerage firm established in 2015, with its official X platform account being @AlpacaHQ.

As for the redemption mechanism of numerous US stock tokens, according to product page information, the fund currently does not charge management fees, but may introduce a maximum annual management fee of 0.25% in the future; when buying and redeeming, the maximum fee is 0.50% of the user's investment value; the redemption amount is based on the market price of the stock (reference source: Nasdaq, https://finance.yahoo.com), minus up to 0.5% investor fees (minimum $100). The amount will be adjusted due to management fees, foreign exchange hedging errors, currency conversion, etc.

Additionally, crypto KOL @_FORAB previously published an analysis of the principles behind xStocks tokenized stock circulation, stating that (the tokenization of US stocks is mainly) controlled by a parent company registered in Switzerland, which manages Backed Assets in Jersey. They purchase stocks in the US stock market through the IBKR Prime channel under Interactive Brokers and then transfer them to a segregated account under Clearstream. Clearstream is a custodian under the Frankfurt Stock Exchange that helps them hold these stocks. Once the buying, transferring, and depositing operations are completed, a contract deployed on the Solana chain is triggered to issue corresponding stock tokens, meaning that for every 1,000 shares of Tesla stock bought and stored, 1,000 TSLAx tokens will be minted on-chain at a 1:1 ratio.

Q3: What crypto partners does xStocks have?

According to statistics from xStocks official and Backed official X platform account releases, its crypto partners include the following platforms and projects:

Solana ecosystem: Raydium, Kamino, Jupiter

Oracles: Chainlink

Payment platforms: AlchemyPay

Other supporting channels: backpack, GMGN

Officially released partner information

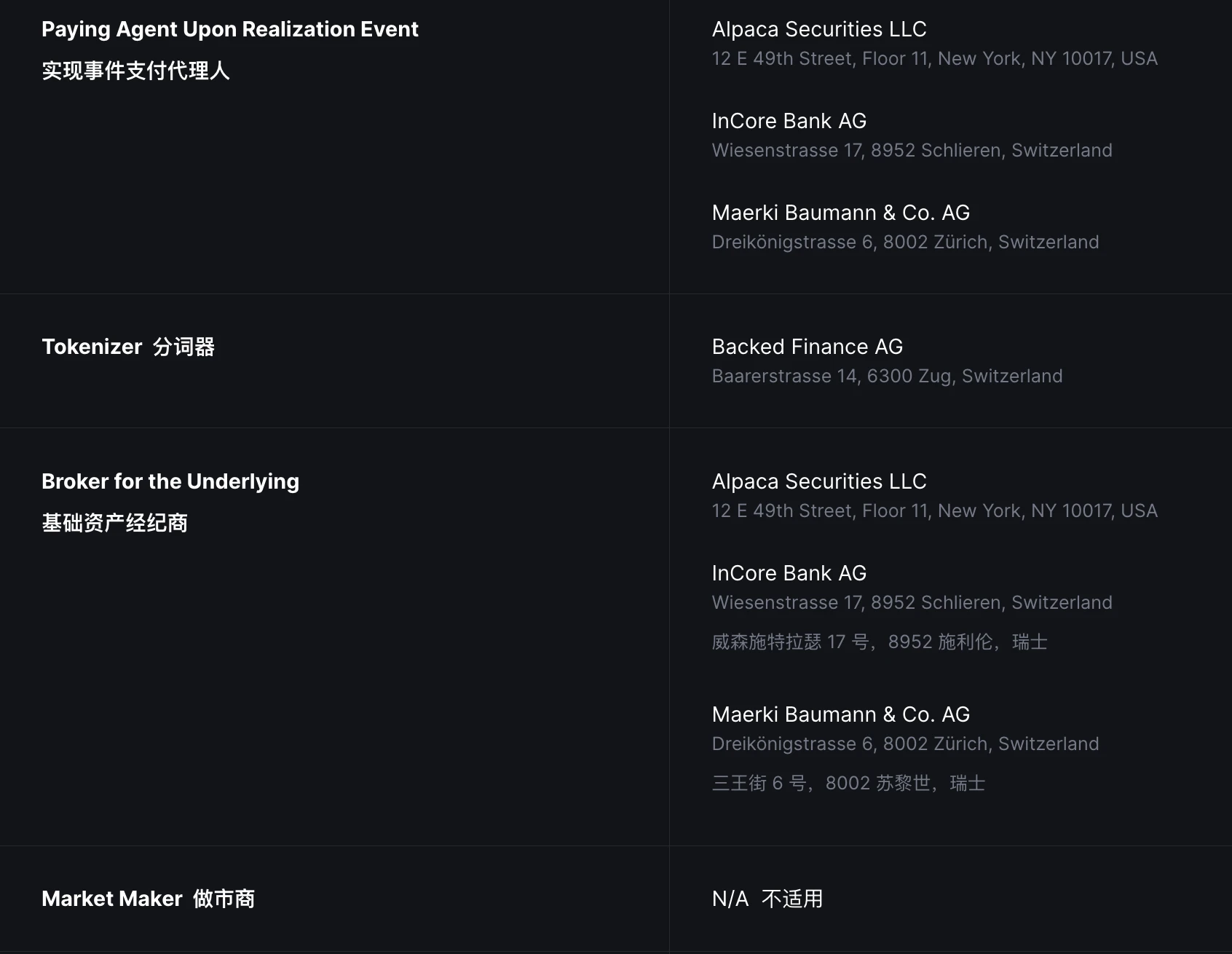

Q4: What service providers offer the US stock tokenization services for xStocks?

Specifically, these US stock tokens are issued on-chain by the issuer Backed, and their corresponding stock custodians include one US brokerage and two Swiss companies (banks) mentioned earlier. Additionally, there are security agents and authorized participants.

It is worth noting that perhaps because the market for tokenized US assets is still in its early stages, xStocks has not set up a market maker role at this stage.

Source: https://assets.backed.fi/legal-documentation/service-providers

Q5: What countries and regions are prohibited from using xStocks and Backed platforms?

According to Backed's official onboarding information, the platform does not serve high-risk jurisdictions such as Iran, North Korea, Syria, and the United States.

Additionally, it emphasizes: "Backed will not sell its tokens to US persons, nor will it sell tokens for the accounts or interests of US persons. Tokens will not be promoted, offered, or solicited in the United States."

It is clear that although they are engaged in the business of US stock tokenization, they still maintain a respectful distance from the US legal system, avoiding the "unregistered securities" risk that arose from the Mirror Protocol launched by Terra.

Q6: Do holders of US stock tokens have voting rights or dividends corresponding to the underlying assets?

To be clear, no.

Source: https://assets.backed.fi/terms-of-service

Additionally, trading operations related to xStocks' US stock tokens do not require KYC, but according to onboarding document information, individual or corporate users related to the Backed platform must complete KYC before logging in to participate in trading.

Q7: What arbitrage opportunities exist for the Crypto Native community?

Currently, aside from benefiting from the volatility of US stocks by buying low and selling high, the crypto community can also earn returns through activities like providing liquidity (LP).

Moreover, due to factors such as liquidity and "trading time differences," there are often price discrepancies between stock tokens and real stocks. It is recommended to read the article “Overview of 5 Arbitrage Opportunities under 'Coin-Stock Parallel',” which also provides references for time zone arbitrage, cross-market arbitrage, event-driven arbitrage, and more.

It is worth noting that since the LP pools corresponding to the platforms accessing xStocks are shared, the opportunities for price arbitrage among these platforms are relatively small.

Q8: If liquidity continues to be insufficient, will xStocks introduce new market-making mechanisms and market makers in the future?

Currently, the official information has not provided further details, and opinions among representatives in the crypto market vary.

Siong, co-founder of Jupiter, stated that classic AMMs are not suitable for stock tokens and that a new AMM design is needed to achieve higher liquidity. Ordinary trading terminals are also not applicable, as issues such as market cap mismatches may arise.

Yuxian, founder of the security company SlowMist, also stated that after stock tokenization, the stock market has introduced new gameplay in cryptocurrency, which also brings new risks in cryptocurrency. If it becomes popular, there will be innovation and conflict between the old and new worlds, with each containing elements of the other.

As for specific risks, I personally believe that we can glean some insights from the "attempts at stock tokenization" promoted by platforms like Terra and FTX, which include but are not limited to regulatory risks, price manipulation risks, and short-term volatility risks.

Q9: Are the team members behind Backed, the developer of xStocks, the original team from the Rug project DAOStack?

According to existing information, yes.

According to previous revelations by crypto KOL @cryptobraveHQ in a post, the team behind xStocks is from the original zero project DAOStack. Based on information related to the Israeli development company Backed behind xStocks, its three co-founders Adam Levi, Yehonatan Goldman, and Roberto Isaac Klein all have previous entrepreneurial experience in the crypto space with DAOStack, which essentially ceased operations in 2020. After raising about $30 million through the GEN ICO, the team did not even bother to list on a small exchange and let the project fade away after issuing the tokens. The DAOStack team then went on to create @xStocksFi, primarily driven by investors from Coinbase and others. Detailed records of Backed company information can also be found on LinkedIn.

For more information on this insider story, see the article: “In-depth Investigation of xStocks Developer Backed: 'Zero' Team's Second Entrepreneurship and Growth of Music Management Projects.”

Q10: Will Backed issue its own token?

The explosive popularity of xStocks has also sparked speculation in the market about whether the company behind it, Backed, plans to issue its own token. However, according to official documents, there are no plans to issue a token.

Source: https://docs.backed.fi/frequently-asked-questions

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。