Source: Pendle

Pendle: Leading the Yield Market, TVL Hits New High of $5.29 Billion

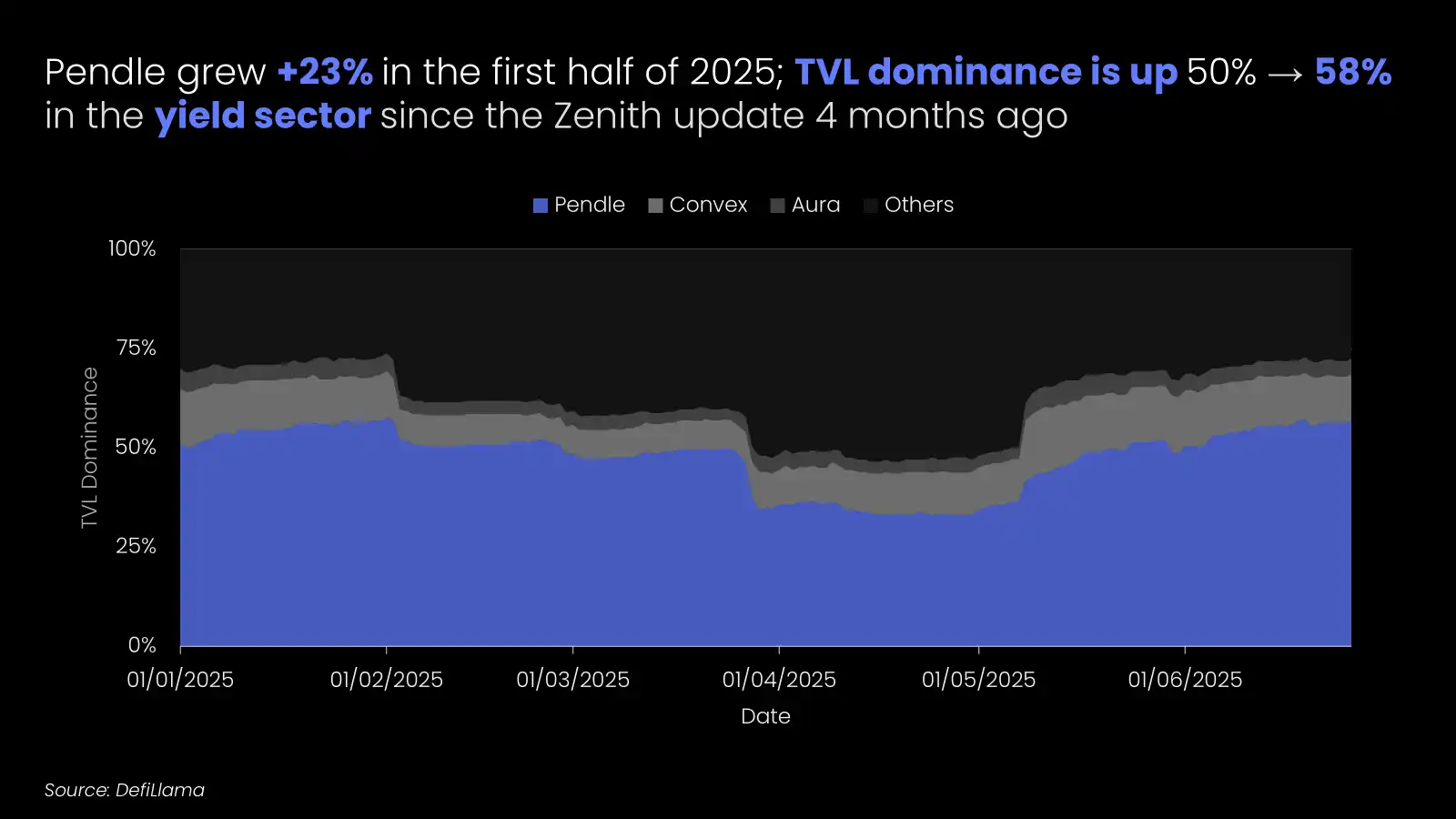

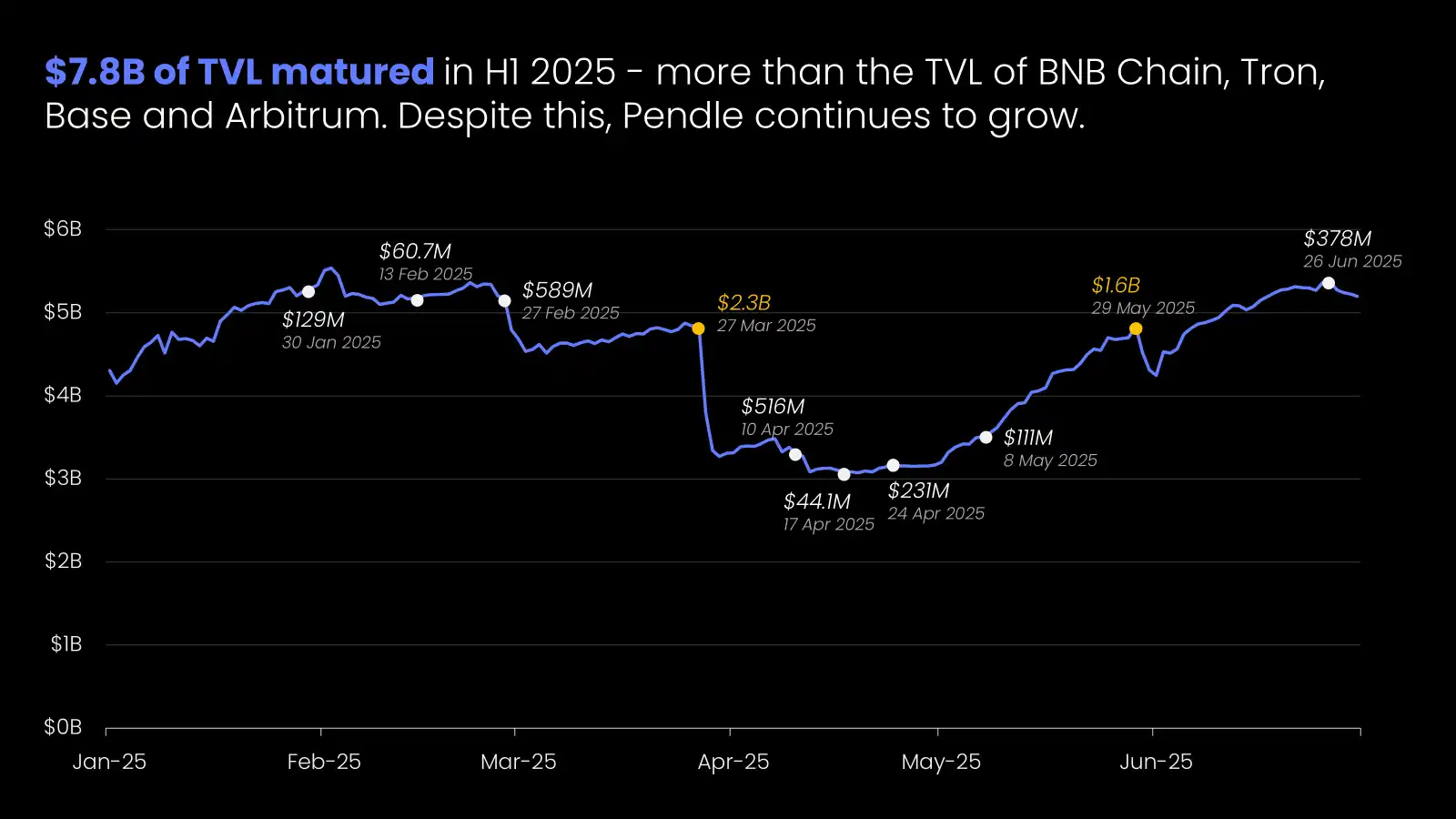

Pendle's dominance in the yield space continues to strengthen. Since the beginning of 2025, Pendle's total value locked (TVL) has grown by 23%, reaching a new high of $5.29 billion. The share of TVL has also significantly increased, currently holding 58% of the market share. In the first half of 2025, the total amount of TVL that matured was $7.8 billion, a 25% increase compared to the peak of the points frenzy in the first half of 2024. Despite a large-scale treasury maturity for Pendle, the total value locked (TVL) continues to grow as users keep extending their positions. This is equivalent to extending bonds worth over $7.8 billion on-chain, with Pendle acting as a crypto fixed-income exchange. During this period, every PT and LP exchange was completed smoothly.

Pendle: Stablecoin DeFi Wave Provides Core Yield Infrastructure

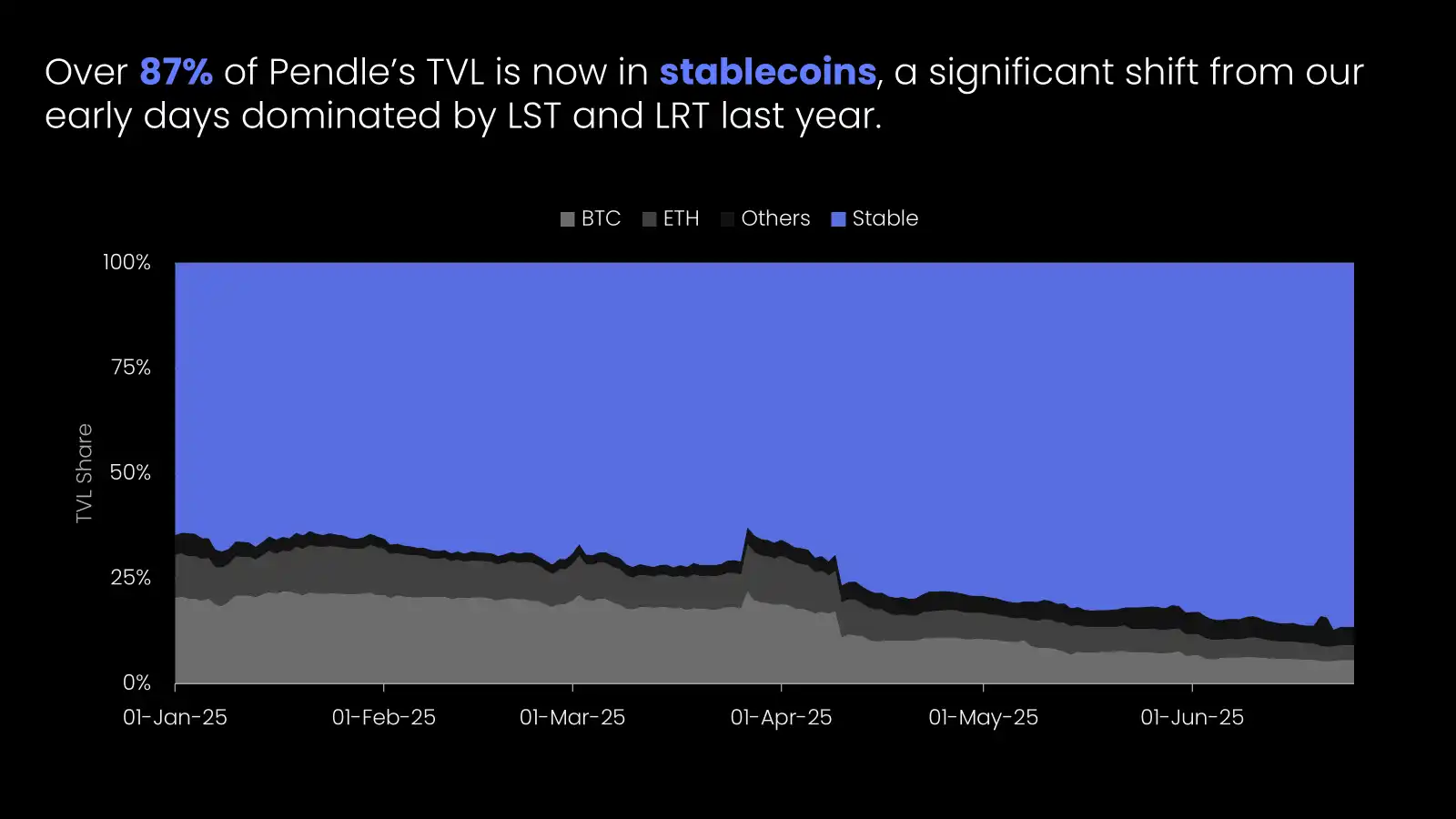

Pendle's TVL continues to be dominated by a large number of stablecoins, currently over 87% denominated in stablecoins. Pendle is a narrative driver, always at the forefront of the most powerful trends in DeFi, similar to what Pendle has done for LST, LRT, BTCfi, and now stablecoins. With the introduction of the GENIUS Act and giants like Amazon, Walmart, and Revolut exploring their own stablecoin plans, this vertical is rapidly becoming the next gold rush in cryptocurrency, and Pendle is positioned to meet this surge in demand, providing core yield infrastructure for the upcoming institutional-grade, stablecoin-driven DeFi wave.

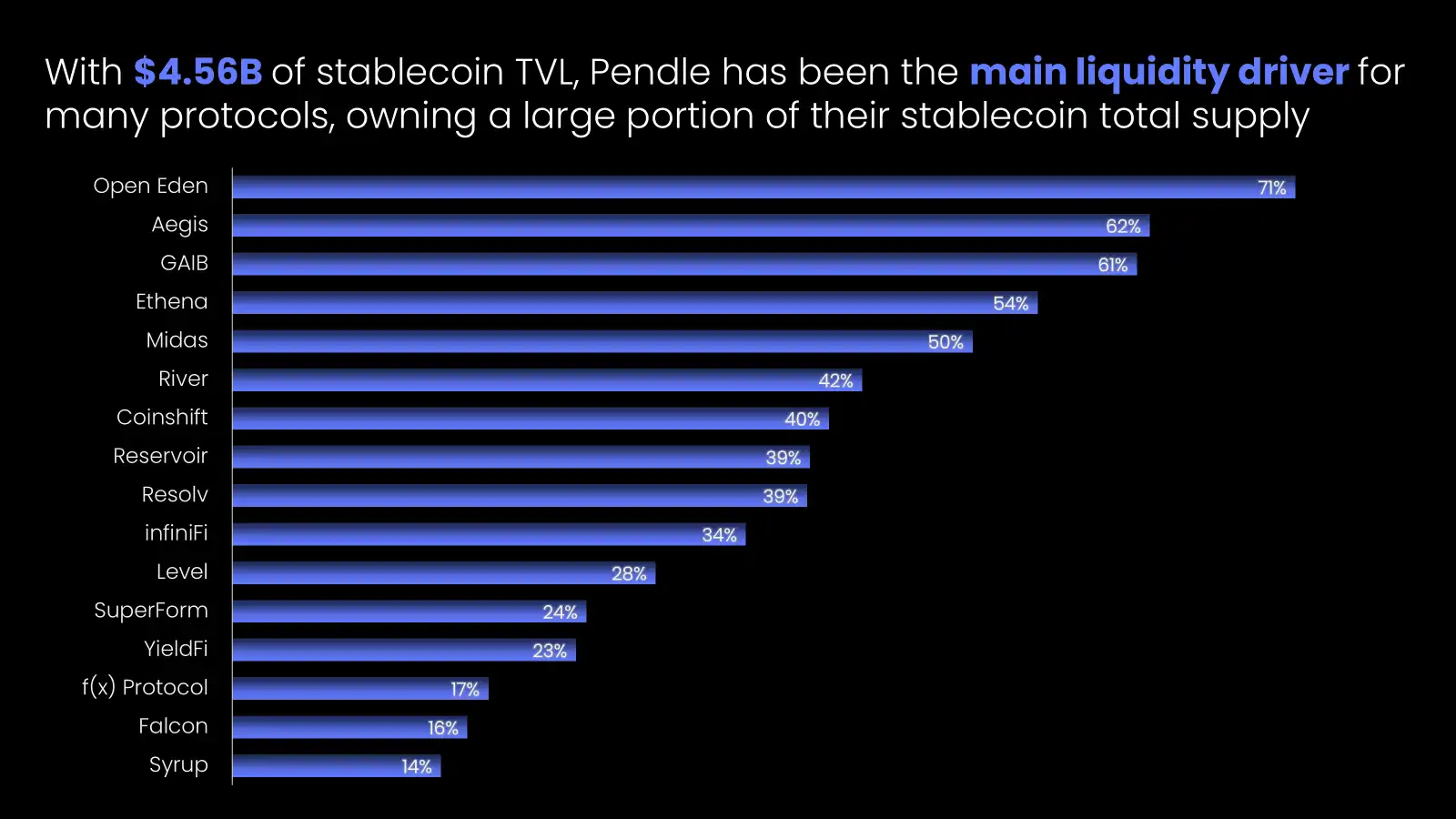

Pendle: The Main Liquidity Engine for Yield Protocols

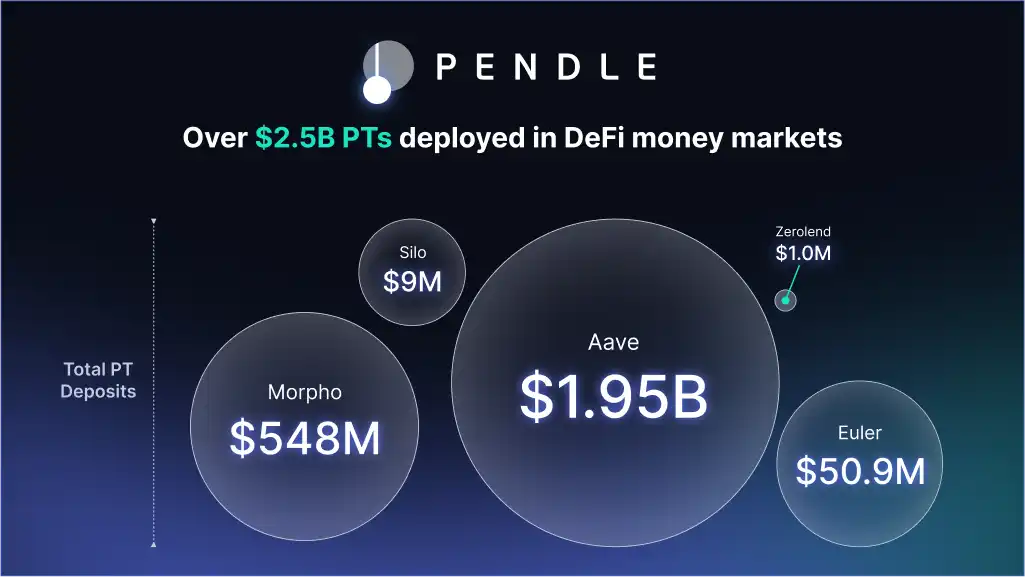

Notably, 50% of Ethena's TVL is attributed to Pendle. OpenEden launched its first mining pool on Pendle in early April, and since then, its TVL has grown nearly fourfold. As of today, Pendle holds over 70% of the total supply of USDO. Meanwhile, Pendle's financial system has seen tremendous growth over the past two quarters. The total value of PT deployed as collateral has doubled from $1.2 billion to $2.5 billion in just four months since the Zenith update, with its share of collateral across all lending platforms rising from 3.3% to 5%. Recently, Pendle laid the groundwork to support Pendle LP tokens as collateral, with Silo Finance being the first platform to deploy this integration. The risk profile of LP collateral differs from that of PT collateral, allowing users to leverage yields while retaining potential upside on points. One of Pendle's main tasks for the remainder of this year is to accelerate the adoption of LP as collateral across more platforms and ecosystems.

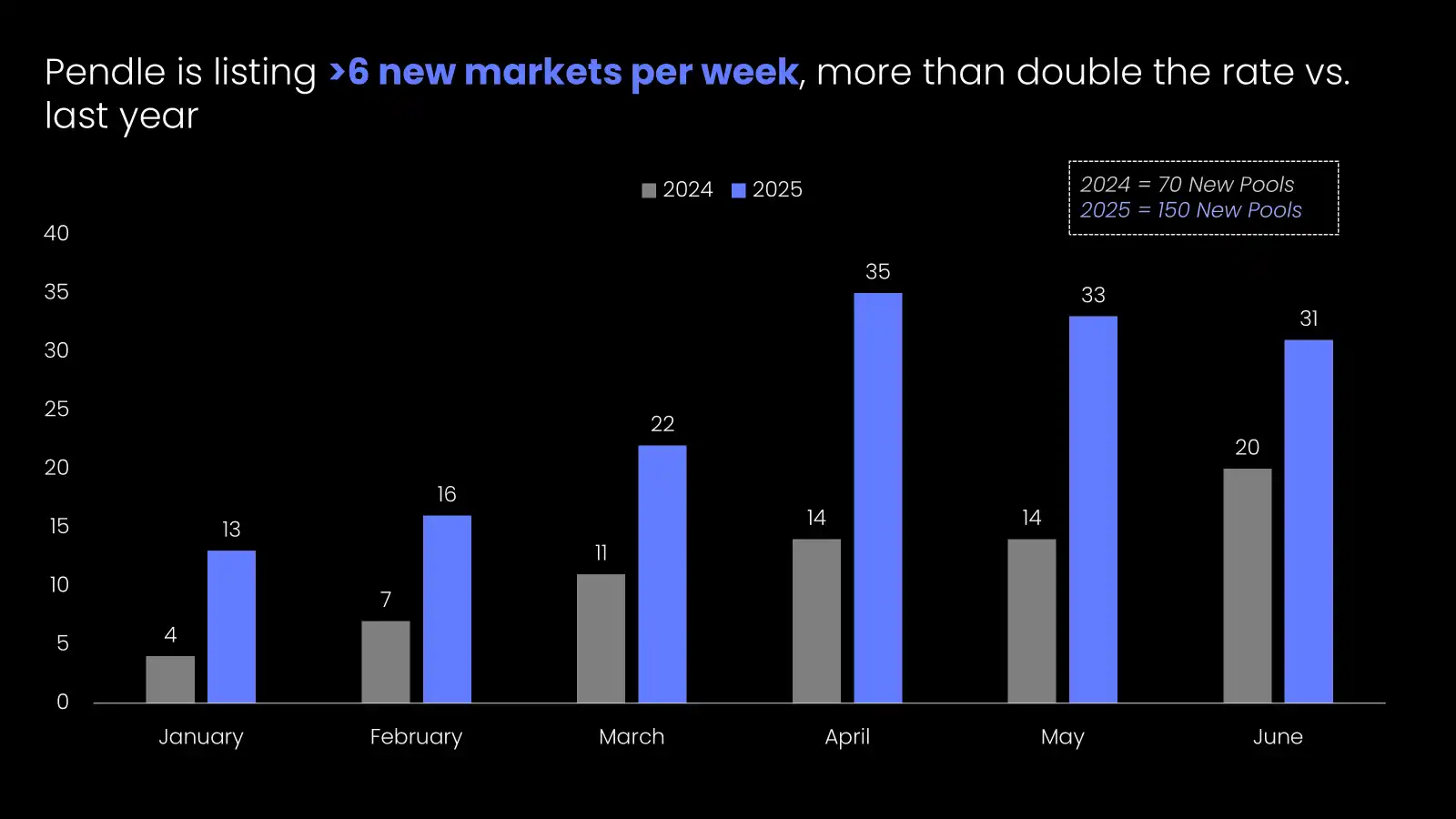

Yield trading as a vertical continues to gain attention, with Pendle's user growth exceeding 70,000 and trading volume surpassing $16 billion in the past six months. The launch of the deployment portal further supports this momentum, enabling community-led deployments to play a key role in more effectively scaling Pendle. During the same period, Pendle has deployed 150 pools: an increase of 114% compared to the same period last year. As Pendle gradually expands the use of this feature, it is expected to accelerate Pendle's organic growth.

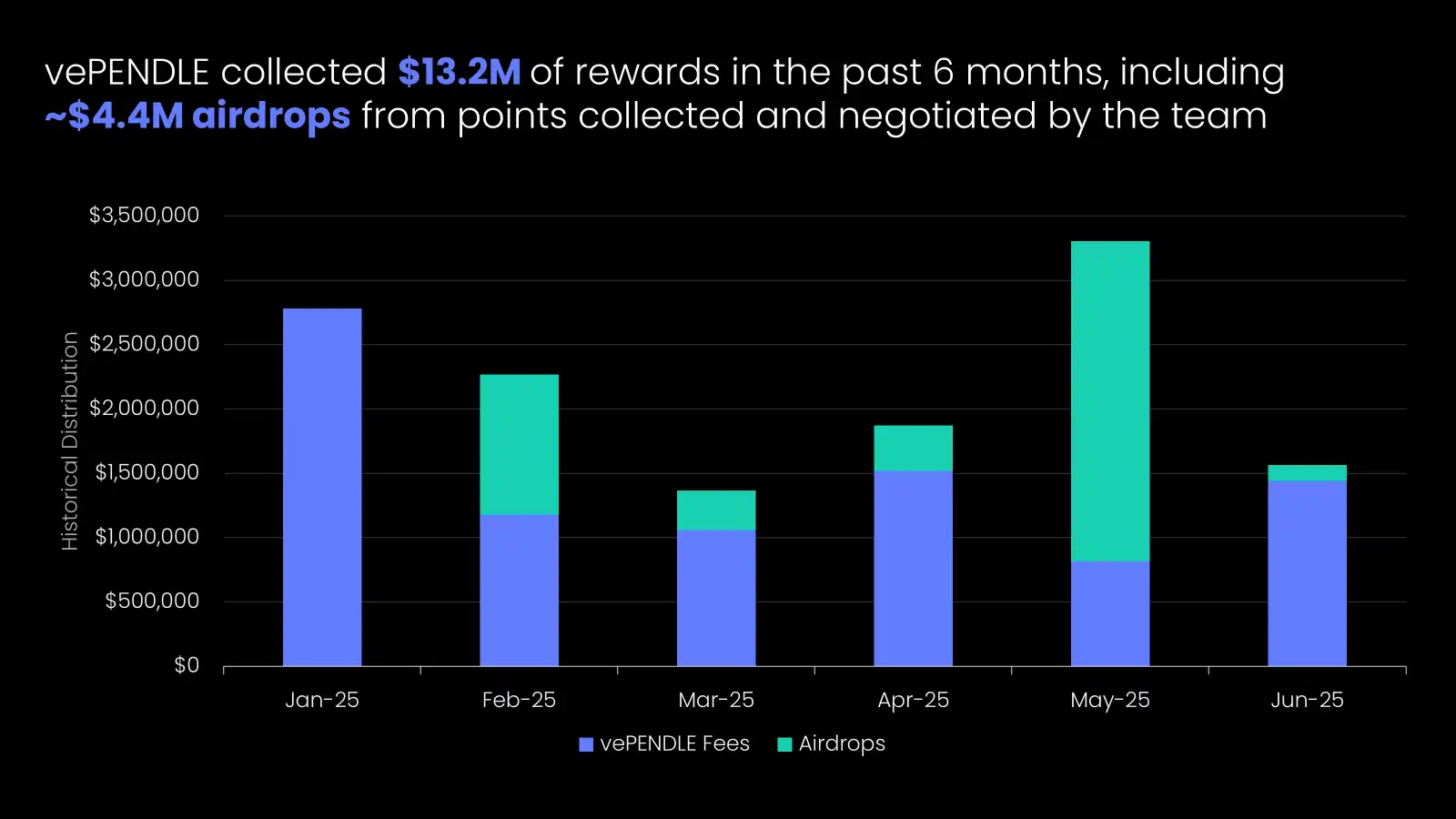

Meanwhile, vePENDLE holders continue to directly benefit from Pendle's growth momentum, earning $13.1 million in fees over the past six months, a 66% increase compared to the first half of 2024. This figure includes protocol fees and airdrops provided by the Pendle team. With Citadels and Boros set to launch soon, these revenue streams flowing into the vePENDLE ecosystem will further increase.

Pendle: Future Outlook

As retail giants enter the stablecoin space with the support of the GENIUS Act, new opportunities may drive further development in the stablecoin market.

The Federal Reserve's upcoming dovish policies may spark more investor interest in DeFi, as investors flock to higher-yielding on-chain investment areas. This trend may also drive demand for stablecoin PT, as stablecoin PT offers investors a way to lock in attractive fixed income before interest rate cuts.

Pendle is about to enter the final phase of the Boros stress test, which will open new sources of speculation for financing rate yields.

The first Citadels will go live, including but not limited to Pendle PT, available for non-EVM chains.

This article is from a submission and does not represent the views of BlockBeats.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。