Funding Rate is regarded by many industry insiders as one of the most revolutionary mechanisms in the cryptocurrency derivatives market. As market mechanisms continue to mature, the funding rate itself quietly records the deep changes in market behavior from rough to refined.

The XBTUSD perpetual contract launched by BitMEX in 2016 is the longest-lasting and most data-rich Bitcoin perpetual contract in the current crypto industry. This article systematically analyzes the funding rate data from May 2016 to May 2025, attempting to reveal how the funding rate has gradually evolved from early extreme volatility to today's "institutional-level stability," with a particular focus on the significant convergence phenomenon observed during the bull market of 2024-2025.

Basic Concepts of Perpetual Contracts and Funding Rates

Perpetual contracts were pioneered by BitMEX, breaking the traditional futures requirement to settle on a specific expiration date, thus quickly becoming the core product of cryptocurrency derivatives trading. To ensure that the trading price of perpetual contracts remains highly consistent with the spot price, the designers introduced the funding rate mechanism: during each fixed billing period, if the contract price is higher than the spot price, long position holders must pay the funding rate to short position holders; and vice versa. When the funding rate is positive, market sentiment is generally considered bullish; when the funding rate is negative, it suggests stronger selling pressure. For this reason, the funding rate is not only an important source of income for arbitrageurs but is also seen as a "barometer" that reflects market sentiment in real-time.

This article delves into the changes in the funding rate of XBTUSD over the past nine years. Our main findings show that XBTUSD has undergone a significant transformation from previous high volatility to unprecedented stability, even during the market cycle of 2024-2025 when Bitcoin reached a historic high of over $100,000.

Nine-Year Evolution Overview: From "Wild West" to "Institutionalization"

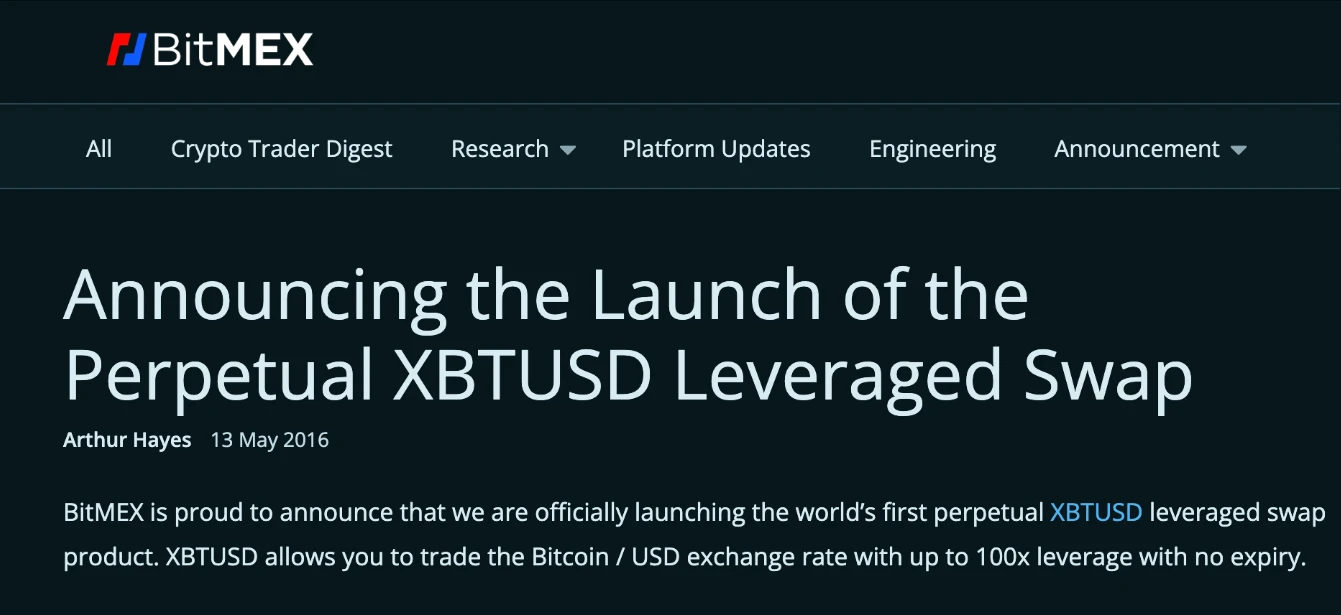

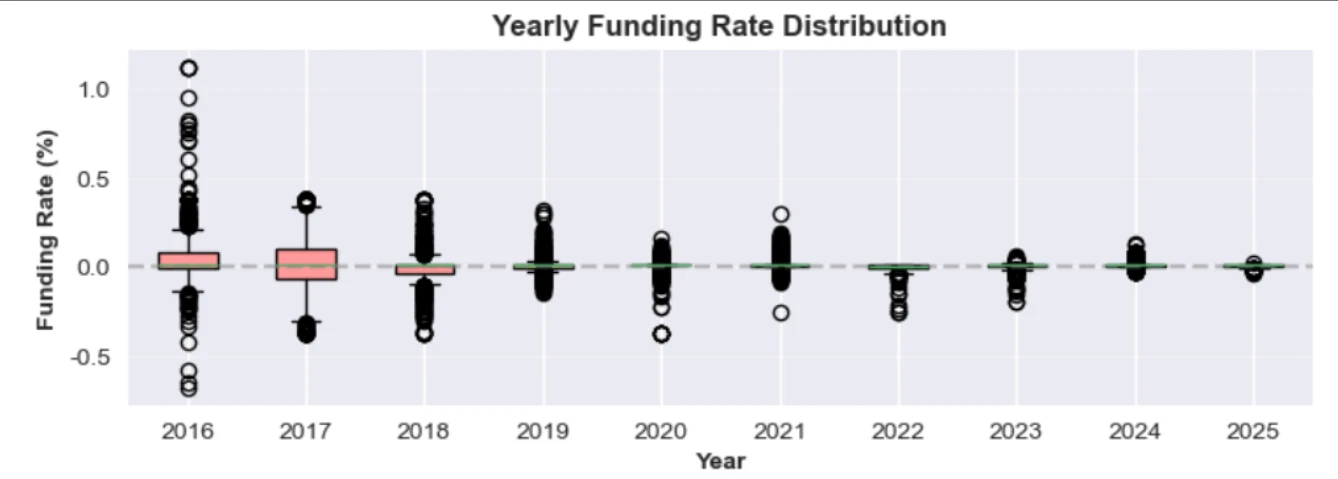

Figure 1

Looking at the nine years of data, we find that the frequency of extreme funding rate events has decreased by 90% compared to historical peaks, while the annualized volatility has been compressed to a narrow range of ±10%. Such stability is unprecedented in the history of Bitcoin derivatives.

This nearly decade-long transformation can be divided into three distinct phases that shaped today's funding rate landscape:

Phase One: The Wild West Era (2016-2018)

In the first two years of its debut (2016-2018), data shows that the characteristics of the funding rate market were marked by extreme inefficiency and astonishing volatility. Figure 1 dramatically contrasts the early and current funding rate behavior of XBTUSD:

Funding rates frequently exceeded ±0.3%, equivalent to an annualized rate of over ±1000%

The 2017 bull market saw the highest concentration of extreme events in Bitcoin's history

Over 250 extreme funding events were recorded in 2017 alone, representing almost daily occurrences of market inefficiency

Extreme funding periods lasted 6-8+ intervals (2-3 days), indicating persistent market inefficiency

Phase Two: Gradual Maturity (2018-2024)

During the period from 2018 to 2024, the XBTUSD funding rate market began to self-correct:

Annual extreme events significantly decreased from over 250 in 2017 to about 130 in 2019

The distribution of funding rates gradually compressed towards a normal range

Key market shocks such as COVID-19, LUNA, and the FTX collapse triggered significant volatility, although at a lower frequency

Phase Three: The Giants Enter (2024-Present)

Two key developments in early 2024 redefined the market landscape:

January 2024: Bitcoin ETF Launch

Institutional arbitrage interest surged as the spot ETF made large-scale spot-futures arbitrage trading possible

The ETF anchored contract prices more closely to spot prices, compressing the funding rate and eliminating significant arbitrage spreads

February 2024: Ethena Protocol Launch

Ethena introduced systematic funding rate arbitrage through synthetic stablecoins, gaining substantial adoption (over $4 billion TVL)

The influx of institutional and retail arbitrage capital into the arbitrage market further brought funding rates closer to zero.

The Legendary Returns of Rate Arbitrage

Understanding this evolution may be fascinating from an academic perspective, but traders care about one thing: profit. How have historical returns been for BitMEX traders participating in funding rate arbitrage strategies?

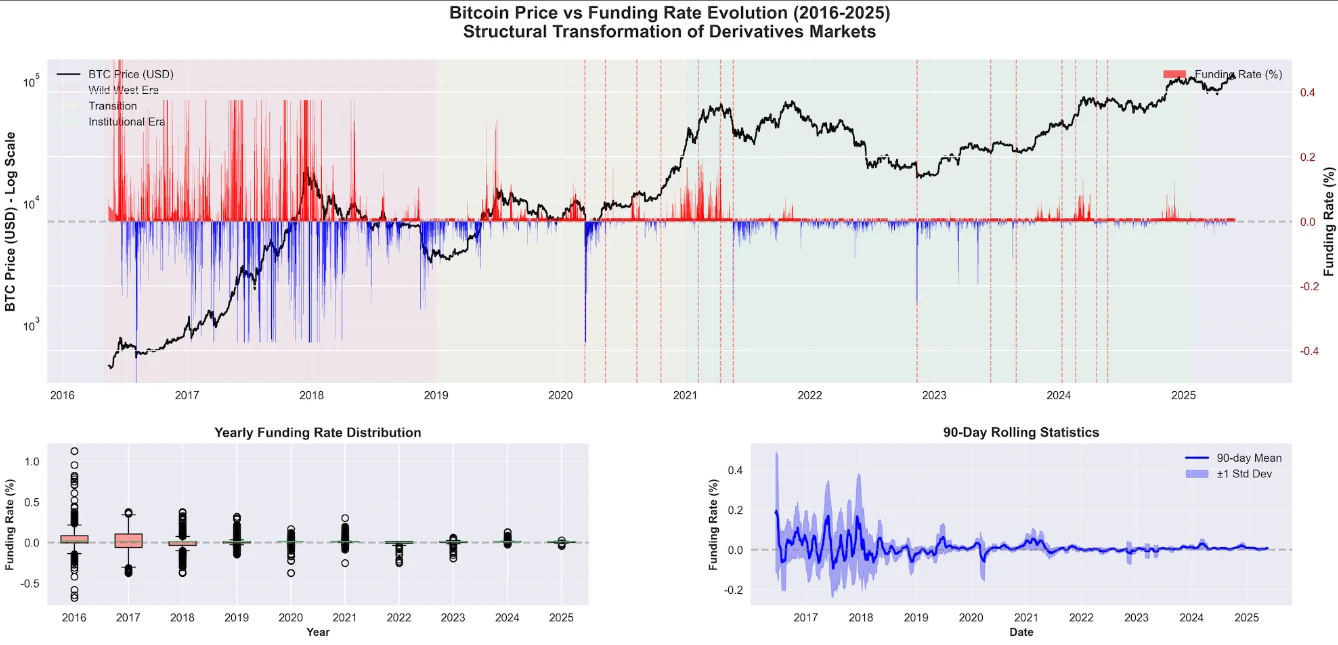

To answer this question, we conducted a comprehensive backtesting analysis covering the entire nine-year history of XBTUSD funding rate data. The results revealed a shocking fact about Bitcoin funding rates: a simple $100,000 investment in funding rate arbitrage in 2016 has grown to $8 million today.

Figure 2 compares the cumulative profits from funding rate arbitrage (green) and simple Bitcoin holding (orange) from 2016 to the present. While the market is often busy chasing Bitcoin's dramatic price fluctuations, the opportunities in funding rate arbitrage have provided one of the best risk/return profits. This strategy offers an astonishing 873% annualized return, with a perfect record—no losing years, no significant drawdowns, just a continuous accumulation of profits that turned a modest six-figure investment into generational wealth.

The Bitcoin Payment Multiplier Effect of BitMEX

BitMEX pays funding rates in Bitcoin rather than USDT, creating wealth multiplier opportunities for arbitrageurs. Any funding payment received in 2016 when Bitcoin was $500 has appreciated 200 times after Bitcoin reached $100,000 in 2024.

If BitMEX had paid funding in USDT like other exchanges, the $8 million profit would be closer to $800,000—still impressive, but far from the compounding effect created by Bitcoin payments, making funding arbitrage one of the most profitable strategies in cryptocurrency history.

Figure 2

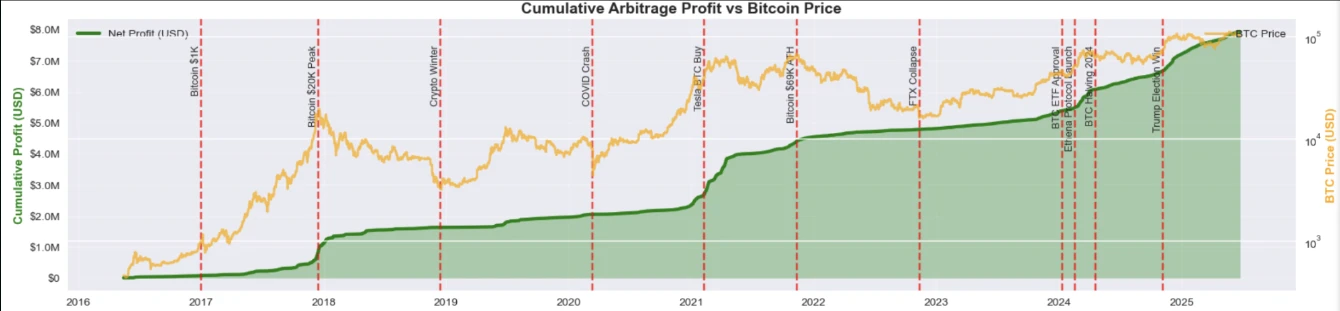

Figure 3

Figure 3 breaks down the risk-adjusted metrics, revealing why funding rate arbitrage has achieved such impressive results. In 9,941 funding periods, XBTUSD had a positive funding rate 71.4% of the time, meaning that about three out of every four funding periods were profitable.

While these historical returns paint a picture that is almost too good to be true, experienced traders know that past performance rarely predicts future results—especially when the market structure undergoes fundamental changes.

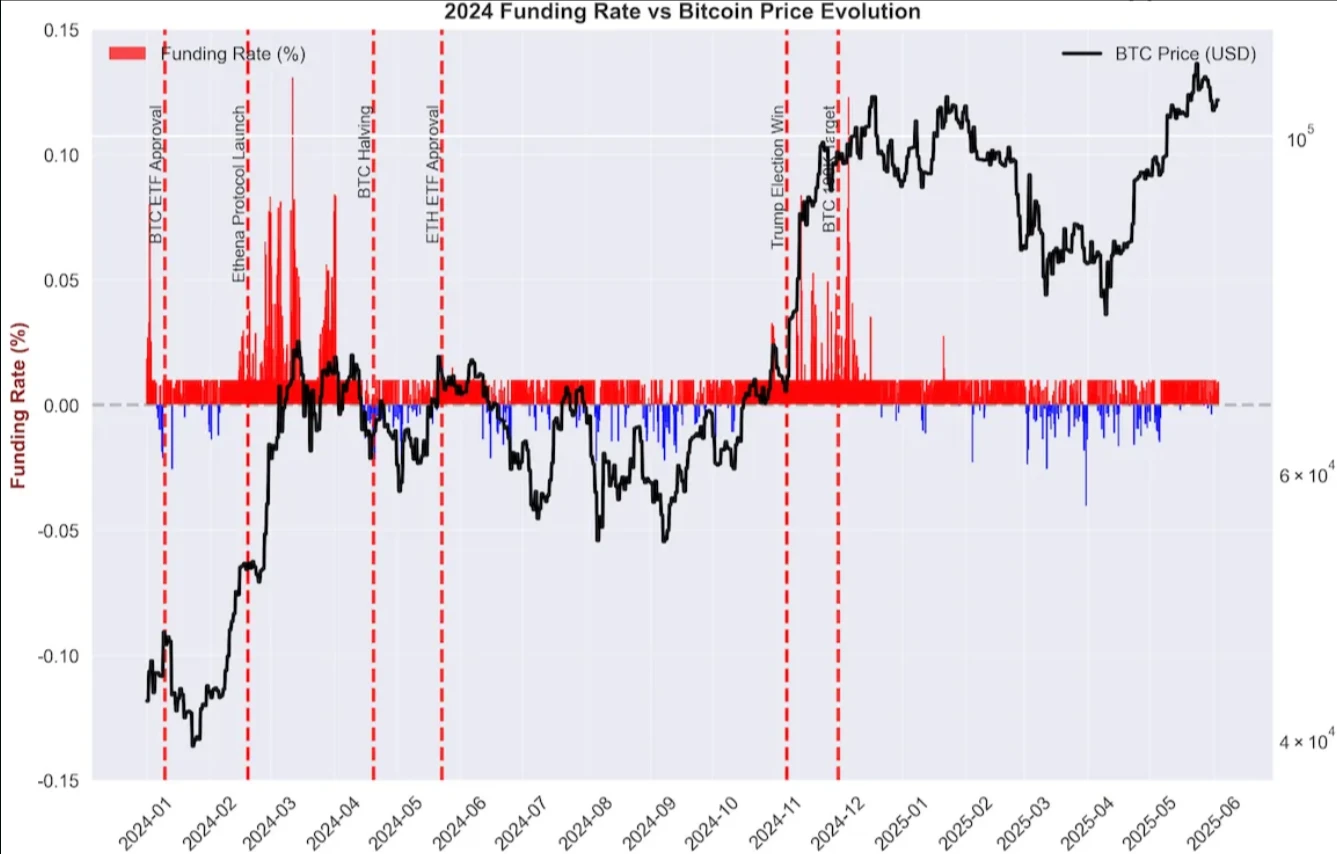

This paints a positive picture of the current state of funding rates. Many have noticed that its excess opportunities seem to be disappearing. Despite Bitcoin breaking historical highs in 2024, the funding rate has refused to surge.

Given market developments and Bitcoin's increasing establishment, the lack of high funding rates poses a critical question for basis traders, yield farmers, and Ethena YT/sUSDe holders: has the funding rate become a thing of the past?

Funding Squeeze: Where Have the High Rates Gone?

Compared to the bull markets of 2017 and 2021, the funding rates during Bitcoin's new highs in 2024-2025 have been unusually calm: the peak value was only 0.1308%, which is not only less than half of the peaks in previous cycles but often wiped out almost instantly after appearing. From the data, the average rate is only 0.0173%, far below the psychological expectations of many traders.

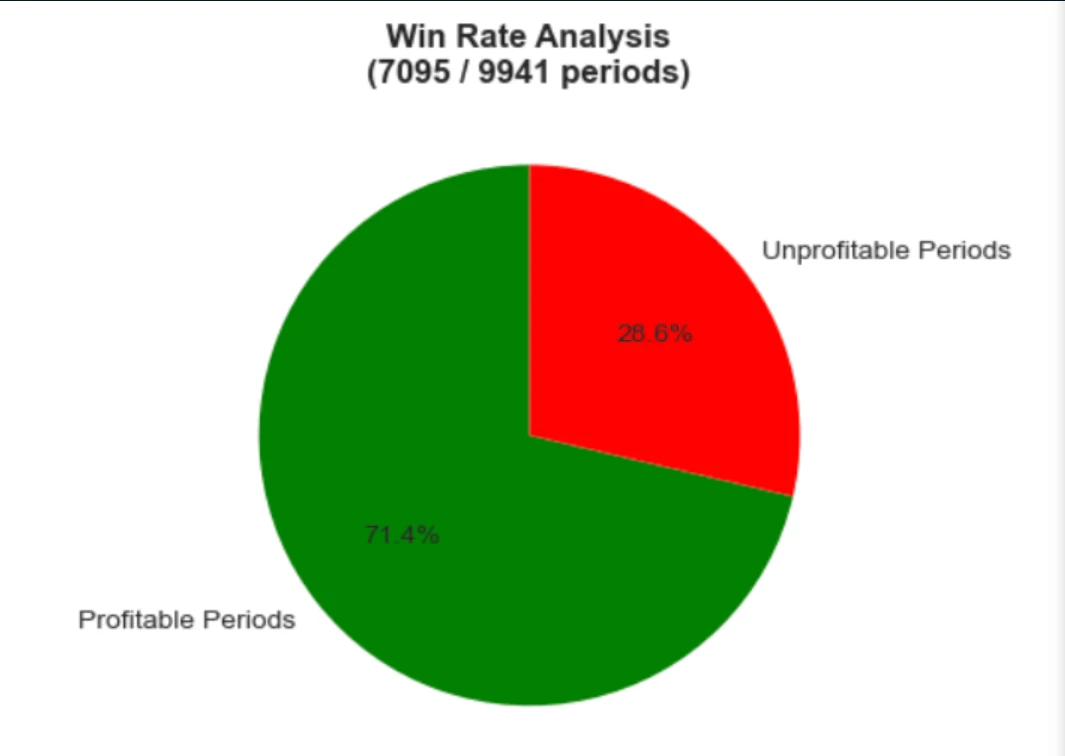

Figure 4

Past Bull Market Performance

2017 Bull Market: Funding rates frequently exceeded 0.2%, with peaks over 0.3%

First Peak of 2021: Sustained rates of about 0.2-0.3% for several weeks

Second Peak of 2021: Still reached 0.07-0.1% during the upward trend

Disappointing Reality of 2024

Maximum Rate: 0.1308% (less than half of previous bull markets)

Sustained High Rates: Almost nonexistent

Average Rate: 0.0173% (despite Bitcoin prices exceeding $70,000)

Figure 4 clearly visualizes this shift—how, compared to historical periods, most funding rates are now tightly clustered around the zero line, with far fewer extreme outliers.

This has led arbitrage traders to question their future profitability or made yield-generating protocols doubt whether "funding rate alpha" has disappeared.

So what can explain this behavior? Two main theories attempt to explain why the funding rate goldmine seems to be drying up:

Theory 1: Institutional Invasion

Large-scale institutional and DeFi arbitrage capital quickly neutralizes funding deviations.

The launch of ETFs and protocols like Ethena are rapidly correcting funding anomalies, leading to market saturation and a swift return to neutral funding rates.

Theory 2: Efficiency Revolution

The market structure has permanently evolved to institutional-level efficiency.

Improved market depth, liquidity, and cross-market arbitrage have eliminated persistent extreme events.

Current State of Funding Rates: What the Data Reveals

Before declaring the death of funding arbitrage, our analysis uncovered three interesting findings:

Finding 1: High Funding Rates Have Become Brief

Comparison of the 2024 vs. 2021 bull market at a Bitcoin price of $53,000:

High funding rates still occur, but they are shorter and more predictable. The opportunities have not disappeared—they have evolved.

Finding 2: Funding Rate Opportunities Still Exist Post-ETF

Contrary to the "saturation" theory, the approval of Bitcoin ETFs actually increased funding rates in the first three months, indicating that funding rates may still persist with more institutional arbitrage.

Pre-ETF Period: October 2023 - January 2024 (0.011% average)

Post-ETF Period: January 2024 - March 2024 (0.018% average)

Net Impact: +69% increase in funding rate

Institutional adoption has created a systemic demand imbalance, resulting in consistent (if smaller) arbitrage opportunities.

Finding 3: Sustained Positive Funding Rate

Figure 5

As shown in Figure 5, despite increased institutional participation and the introduction of major basis trading opportunities such as Bitcoin ETFs and DeFi protocols, the funding rate has remained positive.

This indicates that the market has found a new equilibrium—a balance where a sustained positive funding rate coexists with complex arbitrage activities. Although the magnitude of these rates is more moderate compared to previous cycles, their stability and persistence demonstrate the market's acceptance of this new normal.

End Point or New Starting Point?

Through nine years of evolution, the Bitcoin funding rate has transformed from a "speculative roller coaster" to an "institutional-level pendulum." The basis trading brought by spot ETFs and the systematic arbitrage of DeFi protocols like Ethena have collectively built a deeper, more stable, and more efficient derivatives ecosystem. While the Wild West era has been sealed away, funding rate arbitrage has not gone extinct—it has simply entered a new era centered on high-speed execution, refined risk control, and cross-exchange integration.

For traders still hoping to achieve excess returns through funding rates, the true competitive advantage is no longer the blind courage to endure high volatility, but rather a comprehensive refinement of infrastructure speed, capital efficiency, and strategy iteration capabilities. Only in this way can one continue to uncover their own Alpha in an increasingly institutionalized ocean.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。