Written by: Thejaswini MA

Translated by: Block unicorn

Introduction

January 2024 feels like another era. It’s only been eighteen months, but looking back, it seems very distant. For cryptocurrency, it’s an epic akin to "The Bridge on the River Kwai."

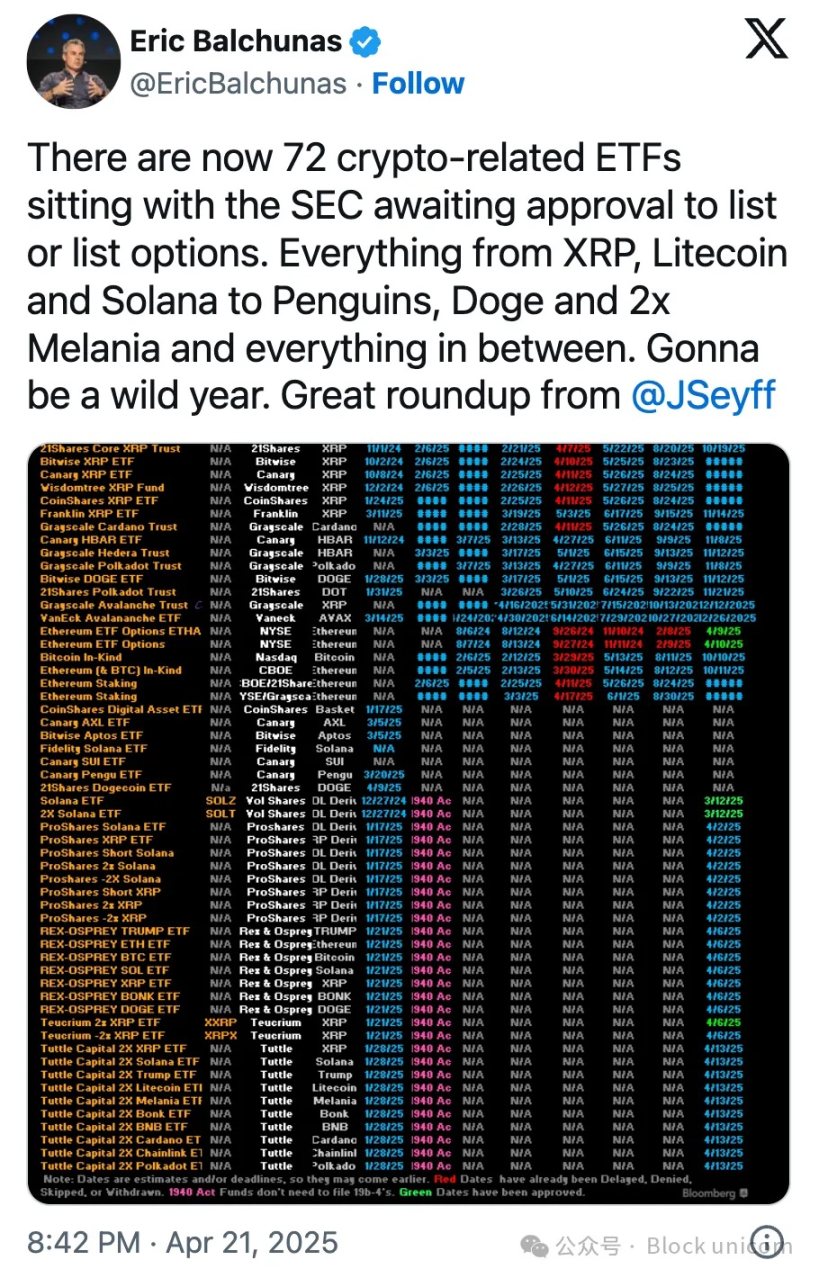

On January 11, 2024, the spot Bitcoin ETF began trading on Wall Street. About six months later, on July 23, 2024, the spot Ethereum ETF made its debut. Fast forward eighteen months, and the desk of the U.S. Securities and Exchange Commission (SEC) is piled high with applications—72 cryptocurrency ETF applications, and the number is still growing.

From Solana to Dogecoin, Ripple (XRP), and even PENGU, asset management firms are racing to package every conceivable digital asset into regulated products. Bloomberg analysts Eric Balchunas and James Seyffart have raised the approval probability for most applications to "90% or higher," indicating that we are about to witness the largest expansion of cryptocurrency investment products in history.

2024 is completely different from now in 2025. Back then, it was a tough struggle for recognition; now everyone wants a piece of the pie.

Bitcoin's $107 Billion Wealth

To understand why altcoin ETFs are important, one must first grasp that the success of the spot Bitcoin ETF has far exceeded expectations. They have rewritten the entire script of asset management.

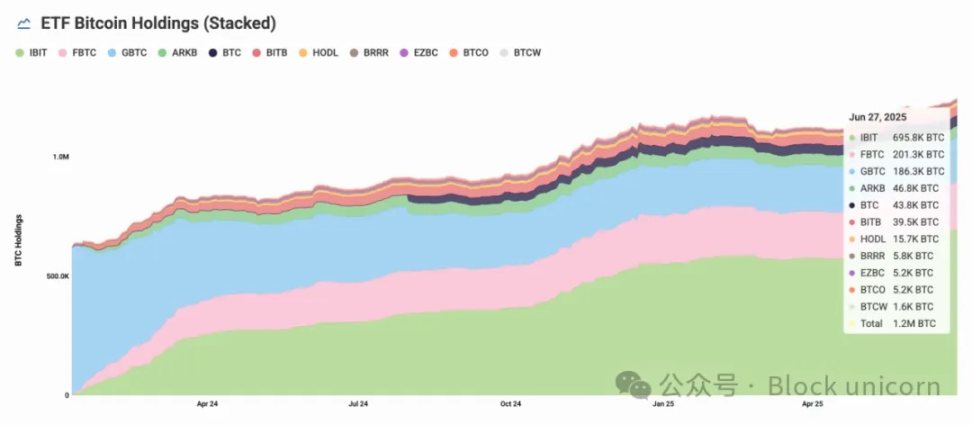

Within a year, Bitcoin ETFs attracted $107 billion, becoming the most successful ETF issuance in history—eighteen months later, the asset size reached $133 billion.

BlackRock's IBIT alone holds over $74 billion worth of 694,400 Bitcoins. All ETFs combined control 1.23 million Bitcoins—approximately 6.2% of the total supply.

When BlackRock's Bitcoin ETF accumulated $70 billion in assets faster than any fund in history, what did it prove? The demand for exposure to crypto assets through traditional investment tools is real, massive, and underexplored. Institutions, retail investors, almost everyone is lining up.

This success has created a feedback loop that validates the concept: as ETFs siphon off Bitcoin supply, exchange trading balances decline. Institutional holdings accelerate. Bitcoin price stability improves. The entire cryptocurrency market gains unprecedented legitimacy. Even during market volatility, institutional funds continue to flow in. These are not day traders or retail speculators, but pension funds, family offices, and sovereign wealth funds that view Bitcoin as a legitimate asset class.

It is this success that has led to approximately 72 altcoin applications queued at the SEC as of April.

Why ETFs?

You can buy altcoins on cryptocurrency exchanges, so what’s the use of ETFs? The core of market operation lies in mainstream recognition. The status of ETFs is a milestone for cryptocurrencies.

This legitimacy allows them to exist on traditional stock exchanges under existing financial regulations. Crypto ETFs enable investors to buy and sell digital assets like trading stocks through regular brokerage accounts.

For most retail investors who are unfamiliar with how cryptocurrencies work, this is a lifesaver. There’s no need to set up wallets, protect private keys, or deal with the technical details of blockchains. Even if you overcome the wallet barrier, risks still exist—hacks, lost private keys, and exchange collapses. The custody and security of ETFs are managed on behalf of investors, providing high liquidity assets traded on mainstream traditional exchanges.

The Altcoin Gold Rush

These applications reveal the prospects for future development. Major institutions like VanEck, Grayscale, Bitwise, and Franklin Templeton have submitted applications for Solana ETFs, with approval probabilities as high as 90%. Nine independent issuers also hope to participate in the competition for SOL, including the newcomer Invesco Galaxy, which has proposed the stock code QSOL.

Ripple (XRP) applications follow closely, with multiple applications targeting this payment-focused cryptocurrency. ETFs for Cardano, Litecoin, and Avalanche are also under review.

Even meme coins are not exempt. Major issuers have submitted ETFs for Dogecoin and PENGU.

"I’m surprised we haven’t seen a Fartcoin ETF application yet," said Bloomberg's Eric Balchunas on X.

Why is all this happening now? It’s the result of multiple forces converging, creating a perfect environment for the surge of altcoin ETFs. The Trump administration's friendly stance towards cryptocurrencies marked a dramatic regulatory shift, with new SEC Chairman Paul Atkins abolishing Gary Gensler's "regulation by enforcement" approach and establishing a crypto task force to create clear rules.

The climax of this regulatory thaw is the SEC's recent clarification that "protocol staking activities" do not constitute a securities offering—contrary to the previous administration's aggressive crackdown on staking providers like Kraken and Coinbase.

The recognition of Bitcoin and altcoins by institutions, combined with the corporate cryptocurrency reserve craze and Bitwise research showing that 56% of financial advisors are now willing to allocate crypto assets, has created unprecedented demand for diversified crypto exposure beyond Bitcoin and Ethereum.

Economic Reality Check

While Bitcoin ETFs have proven there is significant institutional demand, early analyses suggest that the acceptance of altcoin ETFs will be markedly different.

Katalin Tischhauser, head of research at Sygnum Bank, estimates that the total inflow for altcoin ETFs will reach "hundreds of millions to a billion dollars"—far below Bitcoin's achievement of $107 billion.

Even the most optimistic estimates suggest that the total inflow for altcoin ETFs will be less than 1% of Bitcoin's achievement. Fundamentally, this makes economic sense.

Ethereum's performance further highlights this gap. Despite being the second-largest cryptocurrency, its ETF attracted only about $4 billion in net inflows over 231 trading days—just 3% of Bitcoin's $133 billion achievement. Even with an additional $1 billion inflow in the last 15 trading days, Ethereum's institutional appeal remains far behind Bitcoin, indicating that altcoin ETFs face a more daunting challenge in attracting investor attention.

Bitcoin benefits from first-mover advantage, regulatory clarity, and an institutionally understandable "digital gold" narrative.

Now, 72 applications are chasing a market that may only support a few winners.

Staking Changes the Game

One distinction between altcoin ETFs and Bitcoin ETFs is the income generated through staking. The SEC's approval of staking opens the door for ETFs to stake their held assets and distribute the earnings to investors.

Ethereum staking currently offers an annualized yield of 2.5-2.7%. After deducting ETF fees and operating costs, investors may receive a net yield of 1.9-2.2%—not high by traditional fixed-income standards, but significant when combined with potential price appreciation.

Staking for Solana also offers similar opportunities.

This creates a new revenue model for ETF issuers and provides investors with a new value proposition. Staking ETFs no longer just provide price exposure but become income-generating assets that can justify their fees while offering passive income.

Several Solana ETF applications explicitly include staking provisions, with issuers planning to stake 50-70% of their holdings while retaining liquidity reserves. Invesco Galaxy's Solana ETF application specifically mentions using "trusted staking providers" to generate additional returns. However, staking increases operational complexity.

ETF managers managing staked crypto assets face multiple challenges: they must balance maintaining enough un-staked and liquid assets to meet investor redemption demands while staking as much as possible to maximize returns. They also need to manage "slashing" risks, where funds may be lost if validators (nodes that help secure the network) make mistakes or violate rules. Running validators requires technical expertise and reliable infrastructure to ensure everything runs smoothly and securely. Therefore, this is not an easy risk to manage. Managing staked assets in crypto ETFs is a complex balancing act. While not impossible, it is highly challenging.

For the Bitcoin and Ethereum ETFs that have been approved and launched, staking is not an option, as the SEC under Gary Gensler viewed staking as a violation of securities laws, constituting an unregistered securities offering. That is no longer the case.

Fee Compression is Coming

The large number of applications almost guarantees fee compression. When 72 products compete for limited institutional funds, pricing becomes a major differentiating factor. Traditional cryptocurrency ETFs charge management fees of 0.15-1.5%, but competition may drive these fees down.

Some issuers may even leverage staking earnings to subsidize management fees, launching zero-fee or negative-fee products to attract assets. The Canadian market provides a precedent: several Solana ETFs waived management fees in their initial stages.

This fee compression benefits investors but also puts pressure on issuers' profitability. Only the largest and most efficient operators will survive in the inevitable consolidation. As the market filters winners and losers, mergers, closures, and transformations are expected.

Our Perspective

The surge of altcoin ETFs is changing perceptions of crypto investment.

Bitcoin ETFs have achieved tremendous success. Ethereum ETFs offer a second option, but their adoption is lukewarm due to complexity and disappointing returns. Now, asset management firms see different cryptocurrencies as having different uses.

Solana has become a speed-oriented investment, XRP has become a payment-oriented investment, Cardano is marketed with "academic rigor," and even Dogecoin is seen as a story of mainstream adoption. If you are building a portfolio, this makes sense. Cryptocurrencies are no longer a strange asset class but have become dozens of investments with different risk characteristics and use cases.

Bitcoin, the largest cryptocurrency by market capitalization, has become an extension of traditional portfolios for many ordinary investors who have participated in the stock market. For these investors, Bitcoin is viewed as a complementary asset class that provides diversification and a hedge against market uncertainty. In contrast, Ethereum has not achieved the same level of mainstream integration. Despite being the second-largest cryptocurrency, most retail and institutional investors do not see Ethereum ETFs as a core part of their portfolios.

We need to observe what differences altcoin ETFs will offer to avoid repeating the mistakes of Ethereum ETFs.

But this also shows the extent to which cryptocurrencies have deviated from their roots. When meme coins receive ETF applications, when 72 products compete for attention, and when fees are compressed like other commodity businesses, you are witnessing the complete mainstreaming of an industry.

The question is whether this has created real value or merely packaged speculation into a regulatory-approved shell. This may depend on your perspective. Asset management companies see new revenue sources in a crowded market. Investors gain easy exposure to crypto through familiar products.

The market will decide who is right.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。