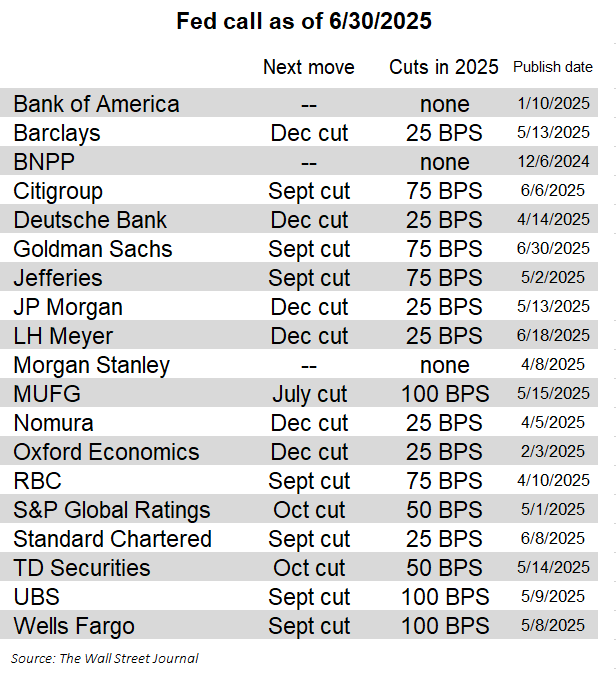

⚡️ The latest interest rate cut predictions from Wall Street have been released—

If we take a median: starting from September, a total of 50bps cut for the year has basically become a mild dovish consensus among institutions.

Goldman Sachs' reasoning for this round of downward revision is quite subtle: they believe the inflation shock from tariffs is a one-time event, while longer-term deflationary forces (such as supply chain recovery and real estate correction) are still slowly taking effect.

The current market is like a fully drawn bow—everyone knows the arrow is going to be shot, but no one knows which morning it will happen.

It's not that the direction is unclear; rather, it's too clear.

Everyone knows what will happen next, so no one dares to act first. Funds are hesitant to chase, and the main players are not in a hurry to pull.

I currently have three points of understanding and judgment to share—

1⃣ An interest rate cut is no longer a suspense; the suspense is whether the market pricing dares to lead.

The current market is in a typical "expectations exist, but realization does not" state.

Emotionally, we are waiting for the landing,

Strategically, we are waiting for the turning point.

The market is in a gap period between expectations and pricing, implying that "the expectation of an interest rate cut has been half digested" structurally, so the market now seems to be hanging in mid-air and unable to move up because everyone is waiting.

Waiting for what? Definitely waiting to resolve that 25bps or 50bps, waiting for a turning point signal that can completely break through the market.

2⃣ What is the signal: is the pricing a technical interest rate cut or a cyclical easing?

The former is a technical correction, while the latter is the real market that can drive asset premium re-evaluation.

If in the next two to three months, more signs point to the Federal Reserve entering a new round of cyclical easing, that would be the real time to heavily increase positions.

Just like after the first interest rate cut in July 2019, U.S. stocks, BTC, and gold all soared together; no one had time to think because the funds had already set up the game in advance, just waiting to reap the rewards.

One thing to understand is that it’s not that the market rises only after an interest rate cut, but rather when "the market dares to price in more future interest rate cuts," that’s when the market truly has imagination.

3⃣ Don’t just focus on the interest rate cut itself; pay attention to whether there are new outlets for liquidity.

The truly powerful signal is the moment of strong interest rate cuts + strong asset price increases resonating together.

For example, in my view, a weakening DXY trend + weakening U.S. Treasury yields is the earliest reaction window.

Additionally, the simultaneous launch of cryptocurrency stock trading platforms by Kraken, Bybit, and Robinhood is also a key signal, indicating an important point:

The liquidity released by interest rate cuts now has more escape routes, no longer limited to banks and brokerages, and can flow directly into the asset market through on-chain infrastructure.

So my personal strategy now is:

Don’t focus on K-lines; focus on reversal signals: pay more attention to the bond market and U.S. dollar liquidity indicators, and see if there is any early resonance between BTC/ETH and the Nasdaq/gold.

Maintain position flexibility and pre-select the asset structure to increase positions: cash flow assets + new liquidity tracks.

Continuously observe on-chain, focusing on the growth of non-U.S. dollar paths, such as RWA projects, on-chain usage of stablecoins, and the situation of non-U.S. KYC funds entering.

The market is often most suppressed at the peak of interest rates, but the initial stage of the easing cycle is actually the biggest explosion window.

And the two most common mistakes retail investors make during this phase are:

Waiting until the shoe drops before they start preparing to get on board.

Repeatedly trying and failing until they run out of bullets, and on the day when there is a real market, they are no longer on the bus.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。