Many investors may have questions about "BTC Snowball" and "Accumulator Options (AQ)" when planning their Bitcoin investment allocation. These two structured products sound logically similar, but which one is more suitable for me? If you have USDT and wish to allocate it to Bitcoin but are unsure how to choose between these structured products, don't worry. This article will help you understand the structural logic, target audience, and performance of these two common BTC structured financial products in simple and accessible language.

1. What is BTC Snowball?

"Snowball" is a non-principal-protected structured financial product, and its name vividly suggests that the returns grow larger like a snowball. In simple terms, purchasing a BTC Snowball is like depositing USDT in a fixed-term account that "earns interest." When the BTC price fluctuates within an agreed range, you can continuously "earn interest"; if the price reaches the preset knock-out price (take-profit price), the product will automatically end early and settle the returns, effectively helping you "knock out and take profit" to lock in gains. On the other hand, to control risk, the Snowball also sets a knock-in price (protection price): if the BTC price falls below this level, the product will trigger a knock-in event**, and your principal will be converted into BTC at the initially agreed price, thus "passively buying Bitcoin at a low." To put it simply, the Snowball is somewhat like a high-interest deposit with conditions: you earn interest during normal times, buy low when the market drops sharply, and *lock in profits when the market rises too much*.

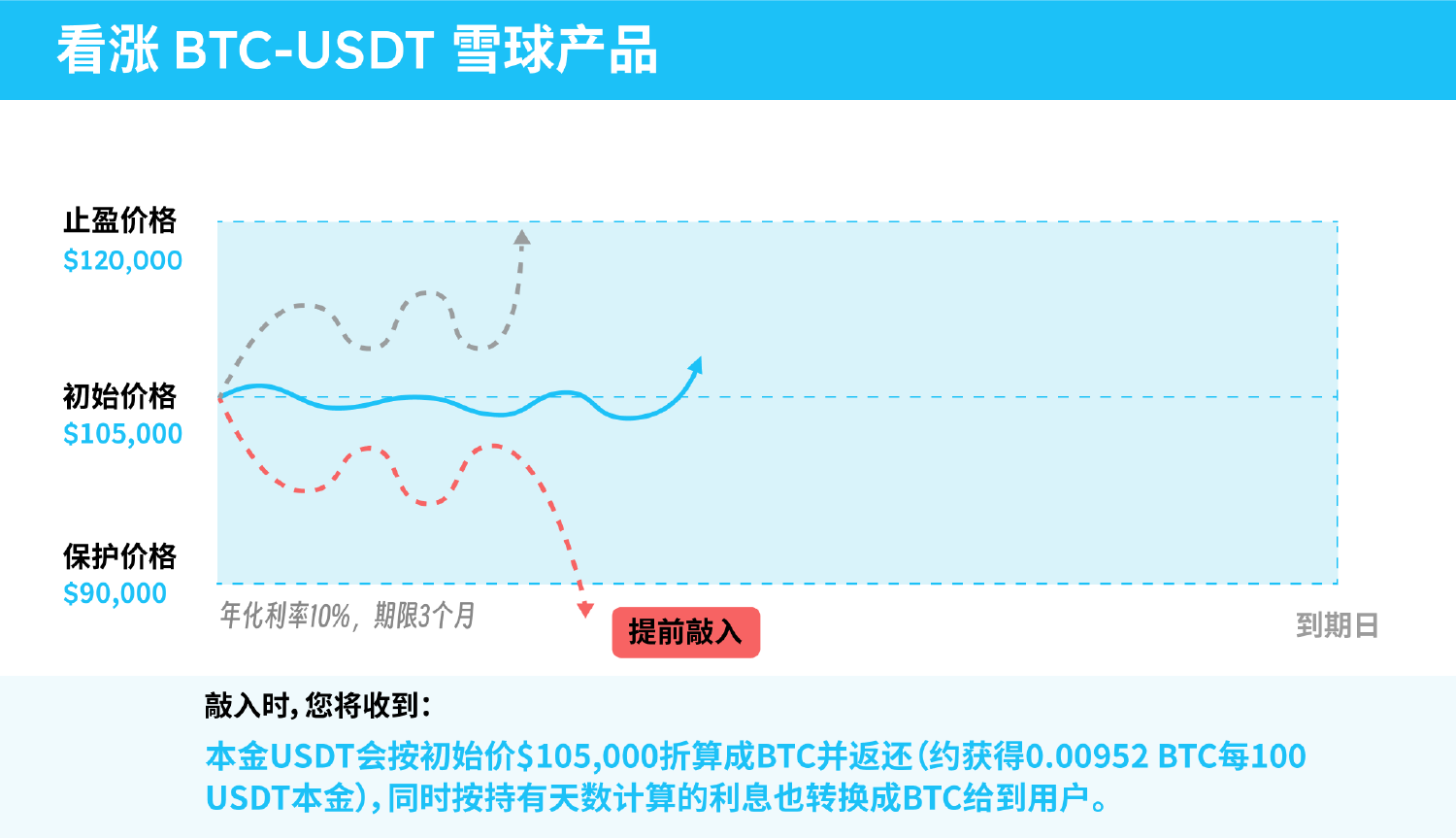

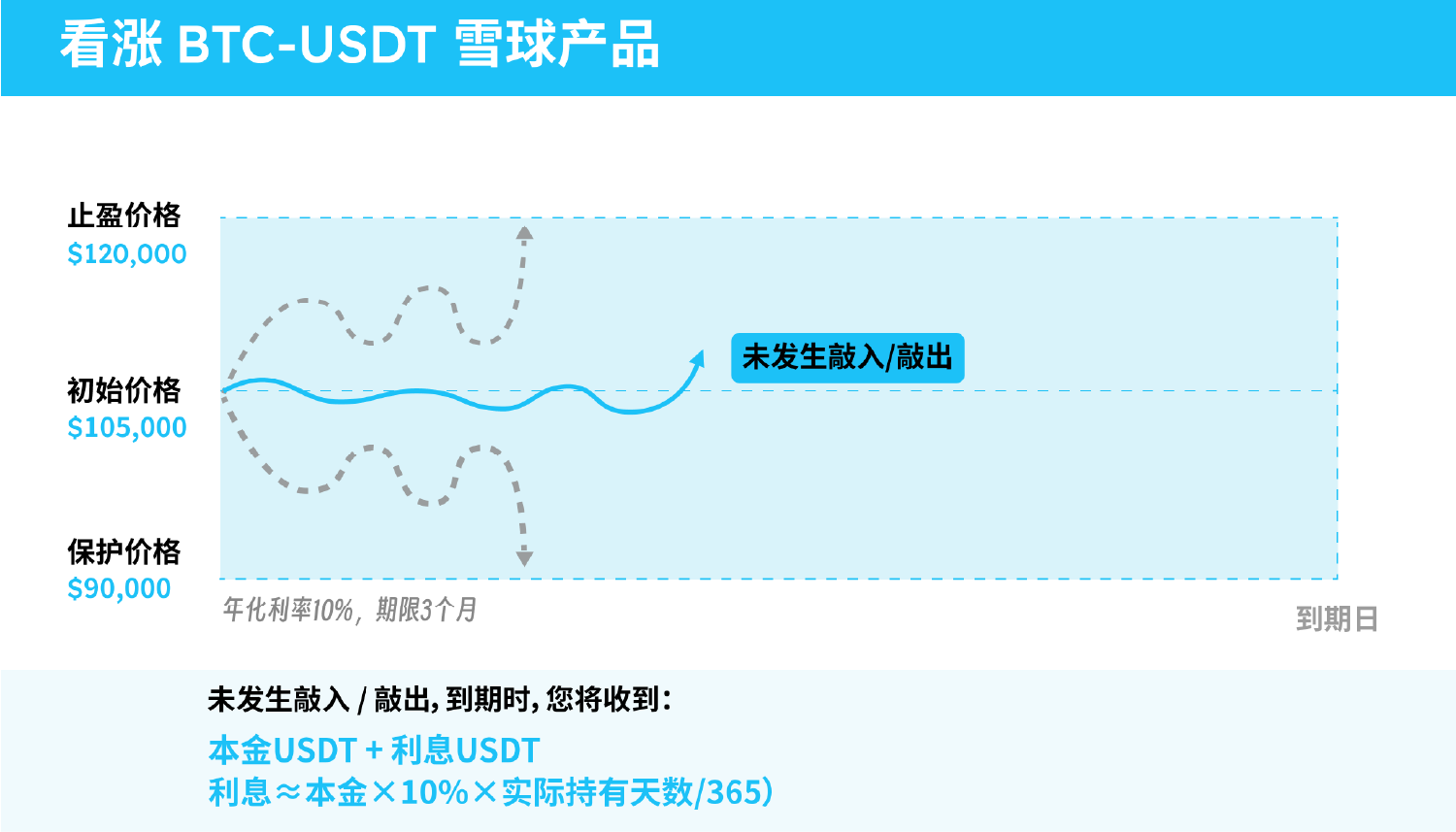

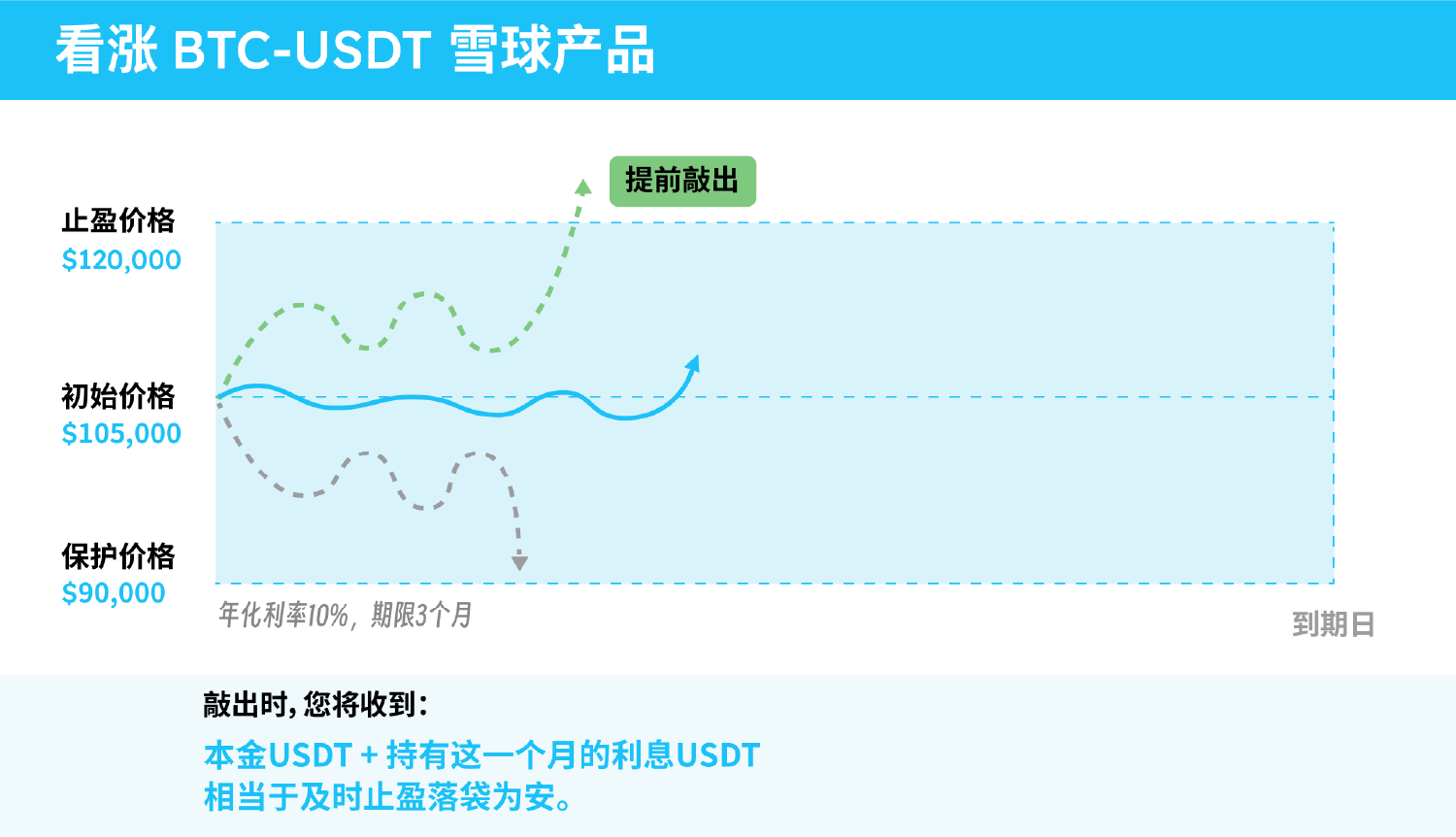

For example, suppose the current BTC price is $105,000, and an investor buys a bullish BTC Snowball product with a take-profit price set at $120,000 and a protection price at $90,000, with an annualized interest rate of 10% and a term of 3 months. In the following observation period, there could be the following three scenarios:

This illustrates the risk of the Snowball: in an extreme one-sided downtrend, the principal may be converted into BTC at the initially higher price, resulting in a certain loss. Overall, the Snowball is suitable for investors who have a judgment on the market, want to earn higher interest returns, and can accept the worst-case scenario of receiving Bitcoin back.

In summary: **The core features of the Snowball product are "earning interest" and "range protection." When the BTC price is stable, the Snowball can provide higher interest returns than ordinary deposits; when the price rises significantly, it automatically takes profit to preserve gains; when the price falls sharply, investors passively receive coins, which is equivalent to being slightly "stuck" in a high position (this risk requires investors to be psychologically prepared). Therefore, the Snowball is suitable for moderately risk-averse investors who hope to *"earn returns" and do not mind ultimately receiving coins.*

2. What is BTC Accumulator Options (AQ)?

"Accumulator Options" (AQ) sounds sophisticated, but it can be simply understood as a contract for "buying coins in batches at a discount." It allows you to purchase BTC at a pre-agreed discounted price (exercise price) regularly over a certain period, regardless of the market price at that time. This is somewhat like a wholesale stocking agreement: you and the counterparty (market maker) agree, "I am willing to buy a certain amount of BTC at $100,000 every day for the next N days," where $100,000 is slightly lower than the current market price of $105,000. If the BTC price continues to fluctuate below the knock-out price (for example, $115,000), you can buy cheap BTC every day at $100,000, gradually accumulating your position. If BTC rises too sharply, and one day the closing price exceeds the knock-out price of $115,000, the contract will automatically cancel (knock out), and subsequent purchases will stop—because the market price has exceeded the agreed price, the opportunity to buy at a discount ends. Doesn't it sound a bit like encountering a discount event while shopping: as long as the price is within the discount range, you buy a little every day; if the price surges beyond the discount limit, the event ends early?

But the Accumulator Options also have an important mechanism: multiple purchases (also known as double purchases, etc.). This means that once the BTC price falls below your discounted price, you not only continue to buy but can also double your purchases! This sounds crazy, but the logic is straightforward—since you are optimistic about BTC and willing to buy at $100,000, when the market drops to a lower price of $90,000, it means a bigger discount, so you "get to buy more cheaply" 💰. Therefore, many AQ contracts stipulate that if the market price falls below the exercise price on a certain day, the purchase quantity for that day will double (or increase by an agreed multiple). Returning to the previous example: with an exercise price of $100,000 and a knock-out price of $115,000. If BTC fluctuates around $100k, you buy, for example, 0.01 BTC (for $1,000) every day; if one day BTC drops below $100k to $95k, you will need to buy double the quantity of 0.02 BTC (still priced at $100k, requiring $2,000). Thus, the lower the price falls, the more you buy, fully "buying low" to accumulate Bitcoin 📉. Of course, this multiple purchase mechanism also carries risks: if BTC continues to plummet, you will be buying a large amount at a higher contract price, losing more than if you had bought at the market price directly, and you may even invest more than originally planned. Therefore, AQ is more suitable for those who are firmly optimistic about BTC's long-term value and plan to accumulate coins continuously—because regardless of market fluctuations, they will ultimately receive a batch of Bitcoin purchased at a fixed discount price, and short-term paper losses can be compensated by long-term appreciation.

In summary: The core of Accumulator Options lies in "discounted regular investments" and "quantity adjustments based on market conditions." When the BTC price is within a range or falls, you can buy at a predetermined discount price (the lower the price, the more you buy), effectively executing a regular investment and low-buy strategy automatically; when the price rises too quickly, the contract ends early to prevent you from buying at high prices. AQ is suitable for investors with a higher risk tolerance who believe in BTC's long-term appreciation potential and wish to accumulate coins at lower prices, as this product essentially automates long-term accumulation operations.

3. Who is more suitable for you: Snowball or AQ?

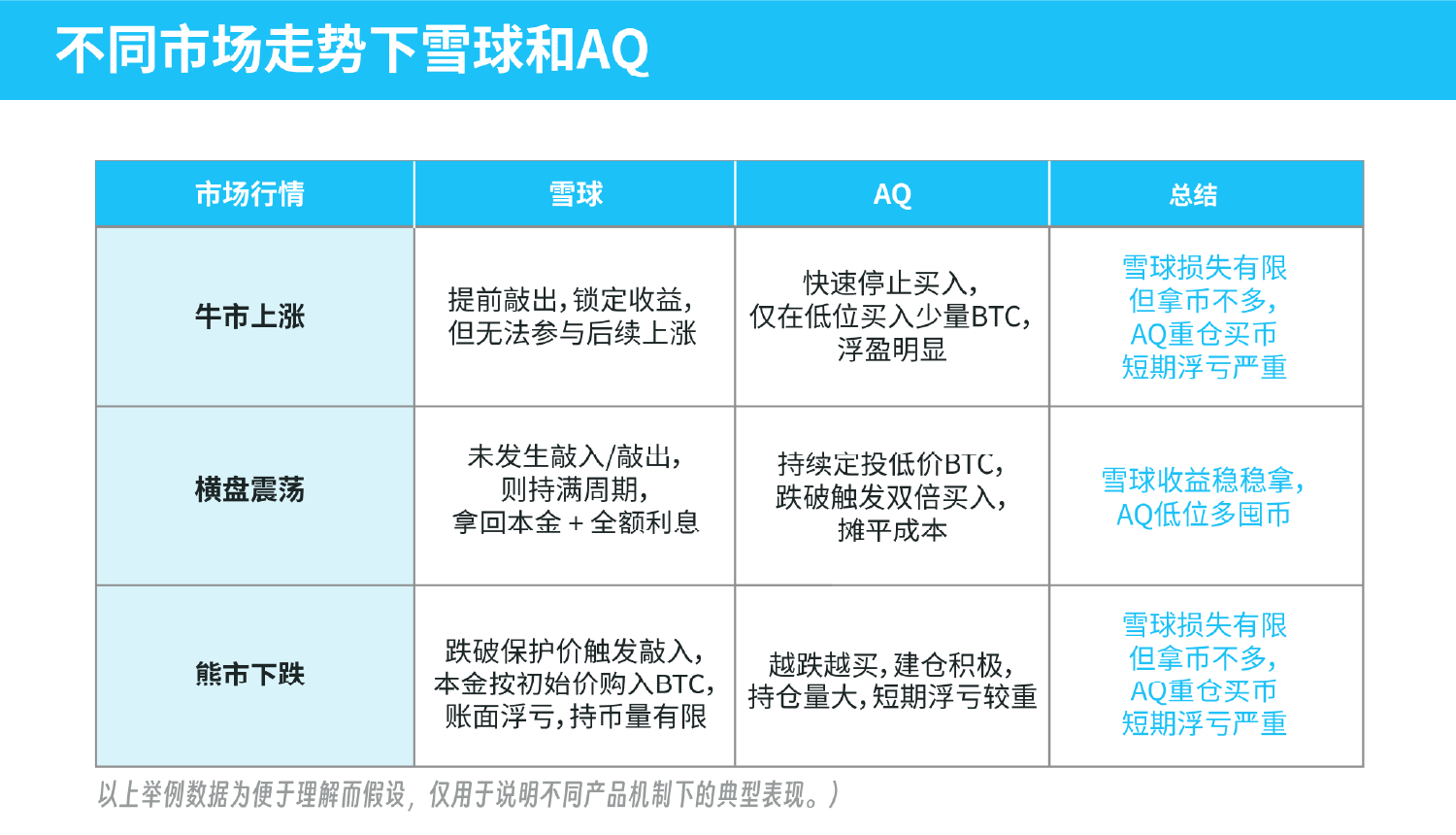

From the explanations above, it can be seen that although both Snowball and AQ are BTC structured products, their positioning and target audiences differ significantly:

Snowball: Suitable for conservative investors whose primary goal is to obtain returns. If you just bought USDT and want to earn higher returns than storing stablecoins, but are unsure about BTC's short-term trend or do not plan to hold a large amount of Bitcoin long-term, the Snowball would be a good choice. Its yield is usually higher than ordinary financial products, and it can provide considerable returns when the market is stable or slightly rising; even if you encounter a sharp drop and passively receive coins, the amount of BTC you get is limited, which is equivalent to being slightly "stuck," with a smaller risk exposure than directly holding coins. In short, the Snowball is more like a financial product focused on "earning interest primarily, with receiving coins as a secondary goal."

Accumulator Options (AQ): Suitable for aggressive investors who firmly believe in BTC's long-term value. If you originally plan to invest regularly and accumulate coins, willing to buy more as prices drop, and are pursuing low-cost accumulation of more BTC rather than short-term interest, then AQ may better meet your needs. It is essentially an automated regular investment + low-buy mechanism that helps you buy Bitcoin at a discount in a volatile or declining market. It is important to note that AQ requires higher capital strength and risk tolerance: you need sufficient funds to cope with potential double purchases and be able to withstand temporary losses. Therefore, AQ is more like a "coin accumulation tool," suitable for investors who have long-term plans for Bitcoin allocation and a higher risk appetite.

If these two products still sound somewhat similar and you are unsure how to choose, consider your investment goals and risk preferences: do you value stable returns more, or do you want to accumulate coins during fluctuations? Choose Snowball for the former and AQ for the latter, just like the difference between "saving money to earn interest" and "regular investment to accumulate coins." Of course, any investment is not a binary choice; you can also flexibly combine these two types of products based on market conditions and your asset allocation needs, using part of your funds in Snowball to earn interest while using another part in AQ to buy coins at lower prices, taking advantage of both.

4. Investment Tips: Pay Attention to Risk Tolerance and Choose Compliant Platforms

Regardless of whether you ultimately lean towards Snowball or AQ, acting within your means and understanding product risks is the primary prerequisite. The returns and risks of structured products are often proportional: high returns come with high risks, and novice investors must fully understand the product terms (such as knock-out price, knock-in price, discounted purchases, multiple purchases, etc., which have been explained above) before deciding whether to participate. Clarify your risk tolerance and allocation goals: if you hope for stable appreciation, hold fewer coins and earn more interest; if you believe BTC will rise in the long term, use discounts to accumulate coins, but also be able to withstand short-term fluctuations.

Finally, it is strongly recommended that everyone participate in such BTC structured product investments through compliant and reliable platforms. Matrixport, as a leading global one-stop cryptocurrency financial service platform, offers a range of functions including cryptocurrency trading, investment, lending, custody, RWA, and research, with a fund management and custody volume of $6 billion, dedicated to providing diverse crypto financial solutions for global users, helping them maximize fund utilization and achieve continuous asset appreciation.

On the Matrixport platform, the investment threshold for Snowball and Accumulator Options products is relatively low, starting from just a few hundred dollars, and the terms are flexible, ranging from a few days, making it suitable for ordinary investors to try. These products operate on compliant platforms, with transparent mechanisms and professional risk control measures to better protect investors' rights and fund safety.

Investment and financial management do not have fixed formulas; choosing the right tools is crucial. I hope this article helps you better understand the differences between Snowball and Accumulator Options, allowing you to make informed choices based on your situation to achieve stable returns and seize investment opportunities. Wishing everyone successful investments and a growing wealth snowball!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。