Original Title: "Circle In-Depth Analysis: Opportunities and Challenges for the Stablecoin Giant"

Original Author: dddd, Biteye

In the global digital currency market, stablecoins serve as an increasingly important bridge connecting traditional finance and the cryptocurrency world. As the second-largest stablecoin by market share, USDC (USD Coin) and its issuer, Circle, have recently garnered significant market attention. Since Circle's IPO in early June at a price of $31, its stock price has soared to nearly $200 (peaking at $298.99). This remarkable stock performance not only reflects the growth trajectory of the stablecoin industry but also reveals the opportunities and challenges faced by this emerging financial tool. This article will delve into the issuance mechanism, profit model, competitive advantages of USDC, as well as Circle's financial status and investment value.

01 USDC's Issuance Mechanism and Profit Model

Capital Assurance System

USDC employs a stringent capital assurance mechanism. For every 1 USDC purchased, investors must deposit 1 dollar as a reserve. To ensure the safety of investors' funds, USDC implements a separation of ownership and control. Legally, Circle, as the issuer, holds ownership of the USDC reserves and manages these assets in a "trustee capacity." USDC holders, by holding the tokens, enjoy actual control over the reserves, while Circle can only operate the reserves according to user instructions. In terms of custody, the USDC reserves are held by BNY Mellon in a dedicated account, ensuring the safety and independence of the funds. Investment management is handled by the globally renowned asset management company BlackRock, primarily investing in its managed money market funds, with U.S. Treasury bonds as the main investment target, generating returns through interest rate differentials.

Risks and Limitations of the Profit Model

Although USDC's profit model is relatively stable, it also has clear risks and limitations. First, the income from reserves is entirely determined by BlackRock's money market funds (which mainly invest in short-term government bonds), and Circle lacks proactive control over this income. According to Circle's 2024 financial report, the interest income from USDC reserves was $1.661 billion, with a total issuance of $60 billion, resulting in an actual annualized yield of 2.77%, while the yield on U.S. six-month Treasury bonds during the same period was 4.2%. This data indicates that the yield of BlackRock's managed money market funds is significantly lower than the returns from direct investments in government bonds, primarily due to factors such as management fees, liquidity management requirements (which necessitate holding some cash), and the need for risk diversification in the investment portfolio.

Secondly, reserve income is highly sensitive to fluctuations in government bond interest rates; profits increase when rates rise and decrease when rates fall. This passivity makes Circle's profitability highly dependent on macroeconomic conditions and changes in monetary policy. The current interest rate hike cycle by the Federal Reserve has provided Circle with a relatively favorable income environment, but once a rate cut cycle begins, the company's profitability will face significant pressure.

More importantly, Circle cannot exclusively enjoy all the profits generated by USDC. Due to historical partnerships, Circle must share the investment income from USDC with Coinbase. The specific distribution mechanism is that all USDC earnings on the Coinbase platform belong to Coinbase, while earnings outside the platform are split 50/50 between the two parties. This arrangement results in Circle actually receiving only 38.5% of the total investment income from USDC, while 61.5% of the income goes to Coinbase (calculated based on 2024 financial data).

Market Competition and Channel Expansion

To reduce dependence on Coinbase, Circle is actively exploring new distribution channels. The company has partnered with Binance, paying $60.25 million and monthly trading rewards in exchange for Binance's support. This strategy has proven effective, as Binance has become the largest USDC trading market globally, accounting for 49% of total trading volume, successfully reducing Coinbase's market share.

However, this competitive relationship has also brought new challenges. Coinbase has designated USDC as the core settlement token on the Base chain, collaborating with Stripe to support USDC on the Base chain, and offering users holding USDC in the Coinbase Advance version of the derivatives market up to 12% returns to maintain its market position and distribution revenue.

02 Competitive Analysis of USDC and USDT

Market Share Comparison

In the stablecoin market, USDT still holds a dominant position. As of May 31, 2025, USDT's market capitalization reached $153 billion, accounting for 61.2% of the market share, while USDC's market capitalization was $61 billion, accounting for 24.4%. The issuance growth rate of USDT continues to exceed that of USDC, demonstrating its strong position in the market.

Competitive Advantages of USDC

Despite lagging behind USDT in market share, USDC has significant advantages in several areas.

Transparency and Audit Advantages: USDC adopts a "100% transparent peg" model, with reserve assets consisting solely of cash (23%) and short-term U.S. Treasury bonds (77%), audited monthly by firms such as Grant Thornton and releasing public reports. By the fourth quarter of 2024, the reserve size reached $43 billion. This transparency has led institutions like BlackRock and Goldman Sachs to choose USDC as a cross-border settlement tool, with institutional holdings reaching 38% in 2024.

In contrast, USDT has faced investigations due to reserve transparency issues and encountered controversies from 2017 to 2019, ultimately settling for $41 million. Although USDT improved its reserve structure after 2024, its "self-attestation" model still suffers from insufficient transparency.

Regulatory Compliance: USDC holds a New York BitLicense, EU MiCA license, and Japanese FSA certification, becoming the first global stablecoin approved for circulation in Japan. By participating in the U.S. GENIUS Act legislation, USDC is poised to become an "industry benchmark" under a regulatory framework, successfully attracting banks like JPMorgan and Citibank to join its payment network in 2024.

USDT, on the other hand, employs a "gray area" strategy, with its headquarters in Hong Kong and registered in the British Virgin Islands, operating in a regulatory gray zone. The EU MiCA legislation has excluded USDT from the compliance list, causing its market share in the EU to plummet from 12% in early 2024 to 5%.

Investor Trust: During the Silicon Valley Bank incident in 2023, USDC briefly fell to $0.87, but after Circle publicly verified its reserves the next day, the price rebounded to $0.99 within 48 hours, demonstrating the market recovery capability of its compliance model. BlackRock only accepts USDC as collateral in its on-chain fund products, reflecting institutional trust in it.

Penetration into Traditional Finance: USDC has partnered with SWIFT to develop a "Digital Dollar Payment Gateway," connecting 150 international banks in 2024, aiming to become the "blockchain version of SWIFT" for corporate cross-border settlements.

Impact of Regulatory Policies

The introduction of the "2025 U.S. Stablecoin Innovation Guidance and Establishment Act" (GENIUS Act) may reshape the stablecoin market landscape. As the first federal regulatory framework for stablecoins in the U.S., this act could make USDC the only globally compliant stablecoin, attracting more institutions to include it in their asset management products.

For USDT, if the act requires stablecoin issuers to be federally chartered banks, USDT's offshore registration may prohibit it from operating in the U.S., potentially resulting in a loss of 20% of its market share.

03 Financial Analysis of Circle

Profitability Analysis

Circle's financial condition presents some contradictory characteristics. In terms of profitability, the company's gross margin is 24.00%, significantly lower than the industry median of 50.18% (with "industry" referring to banking and fintech companies like PayPal, Visa, Stripe). This is primarily due to revenue being sourced from BlackRock-managed money funds, with yields constrained by U.S. Treasury bond rates, lacking pricing power, and incurring channel fees.

However, Circle's EBITDA margin is 11.43%, slightly above the industry median of 10.43%, indicating good operational efficiency. More notably, the company's net profit margin reaches 9.09%, far exceeding the industry median of 3.57%, reflecting high efficiency in managing operational costs.

Low Asset Utilization

Circle performs poorly in asset utilization. The company's asset turnover ratio is only 0.05 times, far below the industry median of 0.59 times, meaning that every $1 of assets generates only $0.05 in revenue. The total asset return rate (ROA) is 0.28%, also significantly lower than the industry median of 2.05%.

The fundamental reason for this situation is that Circle has invested a large amount of funds in government bonds, which, while stable, yield low returns, leading to low asset utilization efficiency. However, as long as Circle can retain more funds, the total profit generated will still be considerable.

Cash Flow Situation

Circle demonstrates excellent cash flow management, with operating cash flow reaching $324 million, far exceeding the industry median of $113.92 million. This is primarily due to regulatory requirements for stablecoin businesses, which necessitate maintaining high cash reserves.

Growth Prospects and Concerns

Circle's revenue growth is strong, with a growth rate of 15.57%, 2.6 times the industry median of 5.95%. However, the company has experienced significant deterioration in profit growth. EBITDA growth is -31.75%, EBIT growth is -32.57%, and earnings per share growth is -61.90%, resulting in a situation of "increased revenue without increased profit." This situation is mainly due to a substantial increase in costs during the company's expansion. Distribution and trading costs increased by 71.3%, marketing expenses reached $3.9 million, and the company's salary expenses grew by 23.7% year-on-year.

04 Valuation Analysis and Investment Perspective

Current Valuation Level

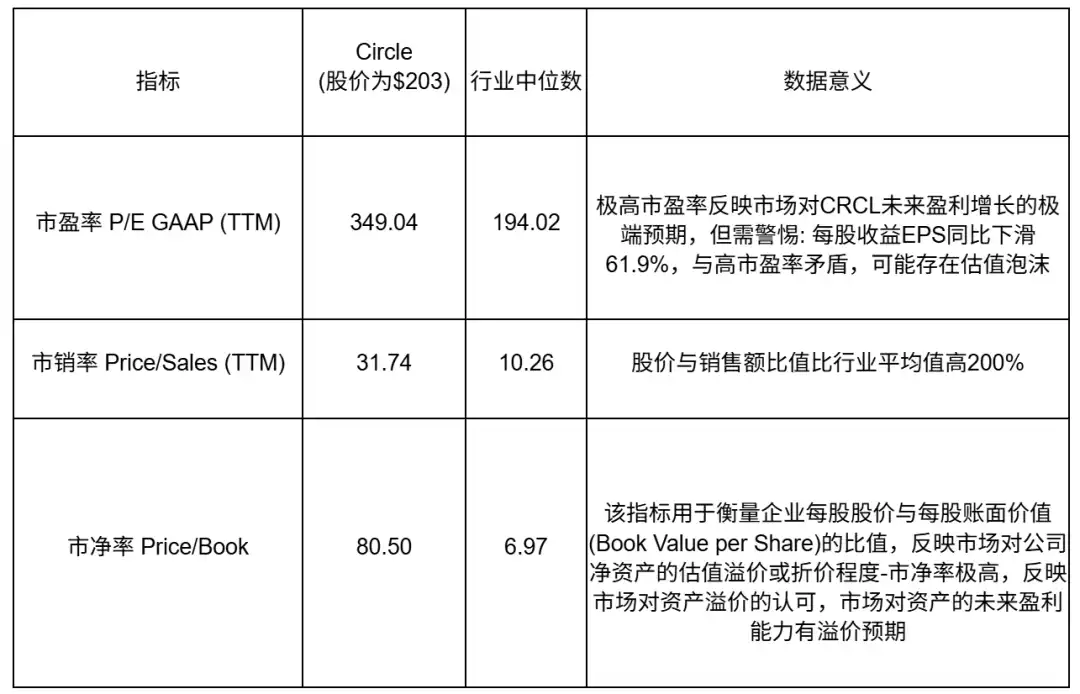

Circle's price-to-earnings ratio, price-to-sales ratio, price-to-cash flow ratio, and price-to-book ratio are all higher than the industry median, reflecting investors' high expectations for the company's future operational performance. To support these high expectations, Circle needs to achieve strong growth in profitability, sales, and discretionary cash flow to absorb the current high valuation. Notably, Circle's future growth momentum may primarily come from product diversification, particularly the rapid expansion of the EURC euro stablecoin in the European market and breakthroughs in the digitalization of physical assets through the RWA tokenized product USYC.

Equity Structure Analysis

Circle's equity structure is not healthy. Institutional investors hold only 10% of the shares, while Coinbase's institutional investors account for 30%. The shareholding ratio of the company's senior management is 7.4%, which is relatively low. Retail and other investors hold 37% of the shares, more than both institutional and executive holdings. The IPO pricing range given by JPMorgan, Citigroup, and Goldman Sachs was $27-28, reflecting a lack of confidence from institutions in Circle.

Investment Logic Analysis

Bullish Logic:

- Stablecoins address the inherent pain points of traditional fiat currency trading systems, and the market is in an expansion phase.

- USDC has a significant compliance first-mover advantage in the stablecoin market.

- The company is gradually reducing its reliance on Coinbase for distribution, which may lead to a larger share of investment dividends in the future.

- The GENIUS Act may force major competitor USDT to exit the U.S. market.

Bearish Logic:

- Valuation is disconnected from fundamentals, with a significant contradiction between declining profits and high valuation.

- Low asset return rates make it difficult to support long-term value growth.

- Over 60% of USDC investment income belongs to Coinbase, and Circle cannot obtain the full income (based on 2024 financial data).

- The proportion of institutional investors is too low, resulting in an unhealthy equity structure.

05 Conclusion and Outlook

Circle exhibits characteristics of "high market expectations, rapid growth, and high valuation." On one hand, the company's stock price has increased by over 540% since its IPO, reflecting market recognition of its advantages in regulatory compliance and market share expansion. As the most transparent stablecoin, USDC enjoys a high reputation among institutional investors, laying a solid competitive foundation for the company. On the other hand, the company faces challenges such as limited profitability, low asset utilization, and the need to digest a high valuation.

In the short term, the significant rise in Circle's stock price has fully reflected the market's optimistic expectations, and investors need to pay attention to the alignment between valuation and fundamentals. In the long term, whether Circle can achieve breakthroughs through product diversification will be key. The expansion of the EURC euro stablecoin in the European market, the innovative application of the RWA tokenized product USYC, and the gradual reduction of reliance on Coinbase for revenue sharing are all expected to bring new growth momentum to the company.

With the advancement of regulatory policies such as the GENIUS Act and the continued development of the stablecoin market, USDC's compliance first-mover advantage may translate into a larger market share and profitability. When evaluating Circle, investors need to balance its innovative potential with the current valuation level, focusing on whether the company can prove that the high expectations set by the market are reasonable through diversification strategies and improved operational efficiency.

Original Link

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。