Written by: Jessy, Golden Finance

On June 26, Hong Kong released the "Hong Kong Digital Asset Development Policy Declaration 2.0," proposing the "LEAP" framework, dedicated to building Hong Kong into a global leading digital asset center.

As a result, on the Hong Kong stock market, Guotai Junan International, as the first Chinese-funded brokerage in Hong Kong to provide comprehensive virtual asset-related trading services, saw its stock price rise from HKD 1.24 to a high of HKD 7.02 over the two trading days of June 25 and 26, ultimately closing at HKD 3.54. Driven by Guotai Junan International, the Hong Kong Chinese-funded brokerage index surged by 11.75% in a single day. Tianfeng Securities' subsidiary Tianfeng International obtained a virtual asset trading license, which also led to its A-share stock price hitting the daily limit, while Victory Securities, as the first brokerage to achieve coin-to-coin transactions, saw its stock rise by 160% in a single day on the 26th. The unusual movements in the capital market reflect the expectations for brokerages' business development in the virtual asset field.

On the day following the declaration's release, Hong Kong's first daily redeemable tokenized security was officially launched. It is reported that GF Securities (Hong Kong), as the first brokerage to issue tokenized securities in Hong Kong, has now launched the first daily redeemable tokenized security "GF Token." However, this product is a privately issued tokenized money market fund, aimed only at qualified institutional investors.

Trading virtual assets on brokerage platforms and tokenized securities may just be a starting point; in the future, more traditional brokerages may bring further innovations in the crypto field.

New Opportunities for Brokerages under the LEAP Framework

The "LEAP" framework proposed in the "Declaration 2.0" outlines a clear development path for Hong Kong's digital asset market and opens up unprecedented business growth opportunities for traditional brokerages. The impact of this declaration on brokerages lies primarily in providing clear policy backing, lowering compliance thresholds, and indicating directions for business innovation.

Specifically, "L" (Legal) emphasizes the improvement of the regulatory framework. For brokerages, this means clearer rules to follow when engaging in virtual asset trading, custody, issuance, and other businesses.

"E" (Ecosystem) aims to build an ecosystem that integrates Web3 and traditional finance. Brokerages, as important hubs in the traditional financial market, will be deeply integrated into this ecosystem. This not only adds a "crypto trading" segment but also means that brokerages can participate in a broader digital asset lifecycle, including but not limited to connecting traditional investors with digital assets, providing comprehensive wealth management based on tokenized assets, offering investment banking services for digital asset projects, and developing innovative financial products.

"A" (Assets) focuses on the development of new types of assets such as tokenization. The declaration views RWA tokenization as a key industry, with physical assets like precious metals, green energy, and warehouse receipts potentially being mapped onto the blockchain in future Hong Kong. In the RWA sector, brokerages can participate in RWA issuance and management, such as acting as underwriters and providing related consulting services, which helps optimize their revenue structure and explore new profit growth points. The rapid launch of "GF Token" by GF Securities (Hong Kong) is an example. In the future, we should see more tokenized bonds, fund shares, private equity, and even complex derivative structures led by brokerages, greatly enriching their product lines and service ranges.

"P" (Partnership) emphasizes regional and international cooperation. Hong Kong brokerages may seize this opportunity to establish partnerships with leading international digital asset service providers, technology providers, and global projects seeking compliant pathways, enhancing their competitiveness and influence in the global digital asset market.

From Losses to New Opportunities Brought by Crypto

In recent years, Hong Kong brokerages have generally faced growth pressures in traditional brokerage and underwriting businesses due to global economic fluctuations, geopolitical factors, and a decline in the activity of the Hong Kong stock market.

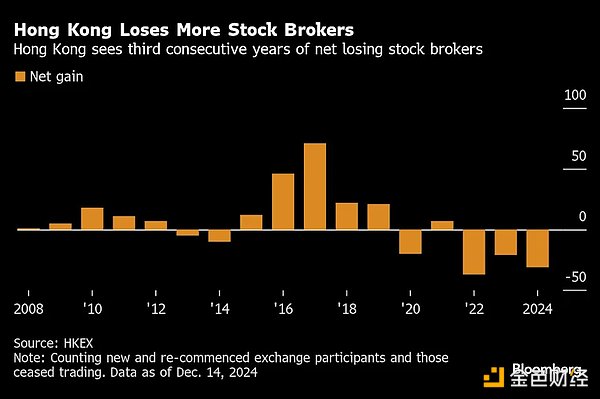

According to data from Hong Kong Exchanges and Clearing Limited, about 37 brokerages ceased trading in 2024. Data from the past three years shows a yearly decrease in the number of brokerages in Hong Kong. The entry threshold for financial licenses in Hong Kong is relatively low, leading to a large number of small and medium-sized brokerages and intense homogeneous competition. In recent years, the weak performance of the Hong Kong stock market has further exacerbated the operational pressures on brokerages. Some small and medium-sized brokerages are struggling and facing significant survival pressures.

However, the "Hong Kong Digital Asset Development Policy Declaration 2.0" may bring new opportunities for brokerage development. The Hong Kong Securities and Futures Commission's official website shows that as of June 26, a total of 41 institutions have completed the upgrade of License No. 1, which allows them to provide virtual asset trading services, with the majority being brokerages, including Victory Securities, Tiger Brokers, Futu Securities, Tianfeng International under Tianfeng Securities, and Haifu Securities under Eastmoney.

Recently, 37 institutions have also been approved to upgrade to License No. 4, which pertains to virtual asset investment consulting—providing professional advice on digital assets, including Zhongtai International Securities and Ping An Securities Hong Kong; 40 asset management institutions have been approved to upgrade to License No. 9, which pertains to virtual asset management—managing funds with over 10% of virtual assets.

With the implementation of the "LEAP" framework and the deepening of brokerage practices, the Hong Kong market is expected to welcome a wave of financial innovation led by brokerages, with "GF Token" perhaps just being the beginning. More types of tokenized bonds, funds, REITs, and even IPOs will emerge. Brokerages will leverage their structuring capabilities and distribution networks to become core issuers and market makers.

Looking ahead, brokerages may combine smart contracts to develop more complex structured yield certificates, derivatives linked to digital asset performance, automated investment strategy products, and more. A seamless experience for exchanging and trading "fiat currency-stablecoins-cryptocurrencies-traditional securities" will also be realized. Brokerages can provide leveraged services such as margin trading based on clients' held digital assets as collateral, integrating comprehensive wealth management and asset allocation solutions for digital assets, and more.

However, the arrival of "spring" is not instantaneous. The declaration provides fertile ground and clear direction, but true harvest requires brokerages to continuously delve into technological innovation, compliance risk control, client education, product design, and other areas. Challenges are ever-present, and competition is fierce; for brokerages in the crypto asset sector, they face not only competition among themselves but also competition from compliant exchanges in the same industry.

For the crypto industry, the active entry of brokerages undoubtedly builds a bridge between crypto and traditional finance, facilitating smoother capital flows between traditional financial products and virtual currencies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。