Author: Gate Research Institute

Abstract

- Diversified revenue models: The revenue sources of yield-bearing stablecoins mainly fall into eight categories, covering different levels from low risk to high risk, such as RWA US Treasury bonds (4%-5.5% APY, low risk), lending (2%-8% APY, medium risk), and market-neutral arbitrage (5%-20%+ APY, high risk).

- USDe (Ethena Labs) revenue strategy: Ethena's sUSDe generates revenue through a Delta hedging mechanism (shorting perpetual contracts to hedge spot longs), with the current sUSDe APY at approximately 7.39% (fluctuation range 5%-25%), plus ENA airdrop rewards (3%-5%), resulting in a combined APY of up to 9%-11%. Users can earn through the Ethena Earn module, participate in cross-chain liquidity pools (up to 18% APY), or wait for airdrops.

- USDS (Sky Protocol) revenue strategy: Sky Protocol's USDS, an upgraded version of DAI, features a native reward mechanism. By depositing USDS into the Sky Savings Rate (SSR) system, users can obtain sUSDS, with the current SSR APY reaching 4.5%. Staking SKY tokens can yield rewards in USDS of up to 14.91%, and combining with Spark Protocol points maximizes strategies to obtain SPK airdrops.

- USDY (Ondo Finance) revenue strategy: USDY is an interest-bearing stablecoin fully backed by short-term US Treasury bonds and bank demand deposits, with a current holding APY of approximately 4.29%. Users can stake it in DeFi protocols (such as Scallop Protocol, NAVI Protocol) to increase total returns to 13% APY, or utilize advanced strategies (such as lending reinvestment in the Sui ecosystem) to achieve APY of up to 12%-17%.

- Other innovative Alpha strategies: Falcon Finance's USDf offers on-chain arbitrage returns based on digital asset collateral, Lista DAO achieves high-yield lending and liquidity staking through the Pendle+Lista combination on BSC, while Hyper EVM provides continuous returns based on stablecoin market-making, enriching the stablecoin Alpha strategy pathways.

- Core logic of stablecoin Alpha: Stablecoin Alpha is not merely a single high yield but refers to excess returns with structural, sustainable, and differentiated advantages. Its core sources include mechanism innovation, leverage structure reuse, off-chain yield stacking, and incentive release mechanisms.

- Risk identification and prevention: Despite the high revenue potential, stablecoin Alpha strategies come with risks such as mechanism volatility, liquidation, liquidity, and project security. Users need to allocate real asset-backed stablecoins, set liquidation protections, pay attention to liquidity depth, and prioritize audited projects with strong endorsements.

Keywords: Gate Research, stablecoins, USDe, USDS, USDY, USDf

1. Introduction: The New Era of Stablecoins at the Intersection of Institutional Change and Revenue Logic

The crypto market is undergoing profound structural reshaping, and stablecoins, as a crucial bridge connecting crypto assets and traditional finance, are entering a dual evolution phase of "institutionalization" and "revenue generation."

On May 19, 2025, the U.S. Senate passed the procedural vote for the "GENIUS Act" with a high majority, marking the imminent establishment of the first nationwide unified regulatory framework for stablecoins at the federal level in the United States. This bill aims to clarify the operational mechanism of the "digital dollar" through legal means and establish systematic standards for the issuance, reserves, compliance, and clearing systems of stablecoins. This move will not only rewrite the power structure of the U.S. stablecoin market but is also expected to trigger profound policy, economic, and geopolitical monetary chain reactions globally, thereby reshaping the future financial landscape. From the refinancing logic of the Treasury market to the fierce competition for stablecoin issuance rights, and even the policy incentives for RWA tokenization, the GENIUS Act sends a clear signal: the dollar is not only to dominate the real-world clearing system but will also lead the value flow on-chain. Stablecoins have become the "on-chain extension tool" of the dollar, and their reserve allocation rights are evolving into a new bargaining chip in the U.S. financial policy game.

Almost simultaneously, USDC issuer Circle Internet Group successfully listed on the NYSE, with the issuance price exceeding expectations. On the day of the IPO, the stock price surged over 160%, with a market capitalization surpassing $18 billion, raising over $1.1 billion, making it the largest public financing event in the stablecoin sector's history. This landmark event not only highlights the capital attraction of stablecoins on Wall Street but also confirms their elevated status in the global financial system—from a marginal technological tool to a strategic extension of sovereign currency and a vehicle for institutionalized financial assets.

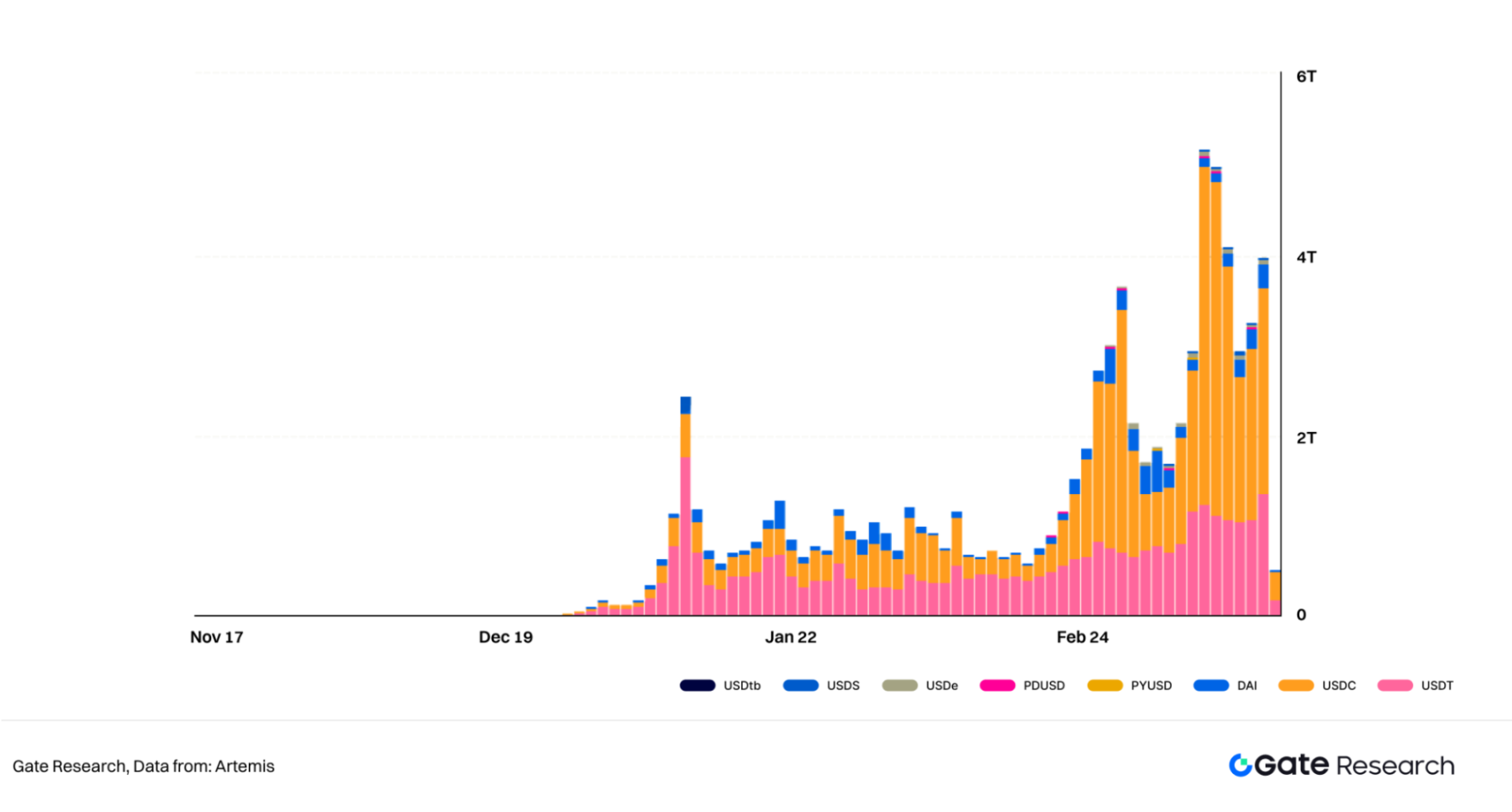

By the end of 2024, Circle had allocated over $60 billion of USDC reserves to short-term U.S. Treasury bonds, generating approximately $1.7 billion in interest income, accounting for 99.1% of its total revenue. According to Artemis data, by early June 2025, the cumulative trading volume of stablecoins for the year had approached $20 trillion, with May alone exceeding $4 trillion, demonstrating their accelerating substitution effect on the traditional dollar system in terms of on-chain liquidity and payment clearing. Currently, the global stablecoin market capitalization has surpassed $250 billion (data from CoinGecko), with USDT accounting for about 60% and USDC in second place.

Figure 1: Global Stablecoin Monthly Trading Volume

Driven by both policy guidance and market demand, stablecoins are rapidly evolving from a single "value anchoring tool" to an efficient capital allocation mechanism on-chain. This transformation has spurred the rapid rise of "yield-bearing stablecoins," becoming a key track in the current development of on-chain finance. This report will systematically outline the definition, mechanism classification, main revenue models, and user operation paths of yield-bearing stablecoins, and through the analysis of typical projects' Alpha strategies, extract the core logic and strategic framework of stablecoin Alpha at this stage, helping investors identify quality opportunities with risk-adjusted revenue potential.

2. What are Yield-Bearing Stablecoins?

2.1 Overview of Stablecoins and the Rise of Yield-Bearing Stablecoins

Stablecoins play an indispensable role in the crypto market due to their value stability. They not only mitigate the risks of extreme price volatility in crypto assets but also serve as multiple vehicles for trading, payment, and hedging. As of June 2025, the total supply of stablecoins has reached $246 billion, with the number of monthly active addresses increasing to 34 million, and institutional adoption rates continuing to rise, accelerating the integration of traditional finance and the crypto market.

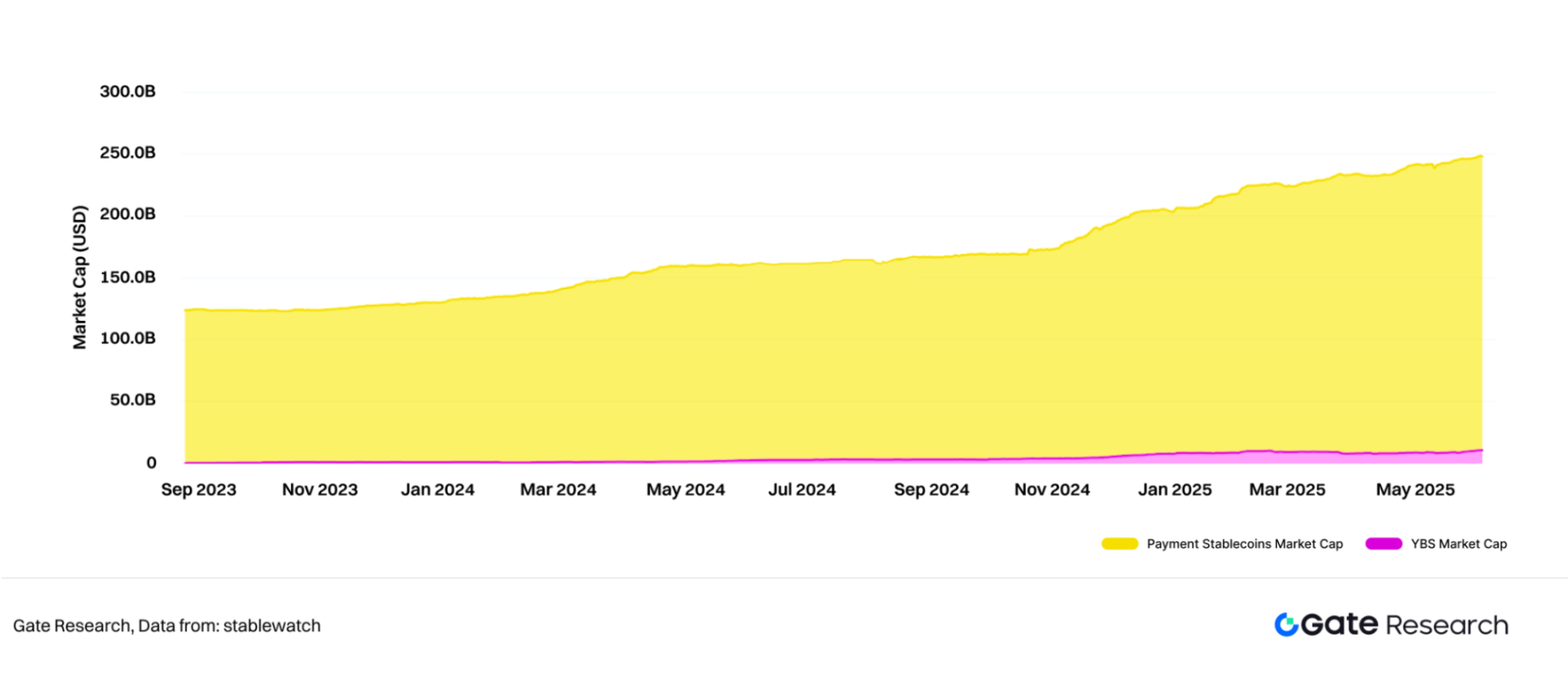

Among them, "yield-bearing stablecoins" are an emerging category that is reshaping the role positioning of stablecoins. According to stablewatch data, as of June 6, 2025, the circulation of yield-bearing stablecoins has grown from $2.74 billion to $11.12 billion, with their market share in the stablecoin market rising to approximately 4.5%.

Figure 2: Payment Stablecoins vs. Yield-Bearing Stablecoins Market Capitalization

These stablecoins are defined as those that can continuously generate revenue while maintaining a stable value (usually pegged to the dollar at a 1:1 ratio). Unlike traditional stablecoins that only provide payment and trading functions, yield-bearing stablecoins introduce mechanisms such as lending, arbitrage, and RWA, allowing holders to achieve sustainable returns while maintaining stability, thus meeting the demand for "stable returns" in the crypto market. Core characteristics include:

- Dual attributes of value anchoring + revenue generation

- Diverse revenue sources: on-chain lending, DeFi arbitrage, RWA, etc.

- Typically combined with yield tokenization and strong composability

- Emphasis on deep integration with DeFi protocols and capital efficiency optimization

This "stable return" logic meets the needs of lower-risk preference investors and promotes the evolution of stablecoins from payment tools to value-bearing assets.

2.2 Revenue Models of Yield-Bearing Stablecoins

Based on incomplete statistics, the current revenue sources of yield-bearing stablecoins can mainly be categorized into eight types:

Figure 3: Classification of Revenue Models for Yield-Bearing Stablecoins

2.2.1 Stablecoin Lending & Borrowing

The most common and fundamental model, stablecoins earn interest through lending platforms, occupying the largest capital volume.

- CeFi platforms: Leading exchanges like Binance, Coinbase, OKX, and Gate offer savings products suitable for ordinary users, but the returns can be quite volatile, typically ranging from 2%-4% during quiet market periods.

- DeFi protocols: Aave, Sky Protocol (the upgraded brand of MakerDAO), Morpho Blue, etc., provide more open and composable lending mechanisms.

- Innovative forms:

○ Fixed-rate lending protocols: The Pendle protocol pushes fixed-rate models to new heights through yield tokenization.

○ Rate tranching and subordination: Introduces more complex risk layering.

○ Leveraged lending: Amplifies returns but also increases risks accordingly.

○ DeFi lending aimed at institutional clients: For example, Maple Finance's Syrup derives its yield from institutional lending.

○ RWA lending: Brings real-world lending business yields on-chain, such as Huma Finance's on-chain supply chain financial products.

Risk considerations: Platform security, borrower default risk, yield stability.

2.2.2 Liquidity Mining (Yield Farming) Returns

Represented by Curve, its returns come from AMM trading fees distributed to LPs and token rewards.

- Leading platforms generally have relatively high security.

- Returns are generally low (0-2%); if not large long-term funds, the returns may not cover transaction gas fees. Other smaller DEXs may offer higher returns but carry the risk of rug pulls.

Risk considerations: Platform security, impermanent loss (for non-stablecoin trading pairs), volatility of token rewards.

2.2.3 Market-Neutral Arbitrage Returns

Achieving arbitrage returns with market risk close to zero by constructing hedged positions.

- Funding Rate Arbitrage: Utilizing the differences in funding rates of perpetual contracts, when the funding rate is positive, buy spot and short perpetual contracts to earn fees. The Ethena protocol is a typical representative, where users deposit stETH to mint USDe and short ETH perpetual contracts on centralized exchanges to earn funding rates, with historical data showing a probability of positive rates exceeding 80%.

- Cash-and-Carry Arbitrage: Taking advantage of price differences between the spot market and expiring futures market to lock in profits through hedged positions.

- Cross-Exchange Arbitrage: Utilizing price differences between different exchanges; currently, the price differences for mainstream trading pairs are very low, making it difficult for retail investors to participate.

Risk considerations: Extremely high professionalism, platform risk, negative returns under extreme market conditions (such as prolonged negative funding rates).

2.2.4 RWA Projects Yielding US Treasury Returns

Tokenizing real-world assets (such as U.S. Treasury bonds) on-chain and distributing returns in stablecoin form.

- Typical projects: Ondo's USDY and Usual's USD0.

- Stable returns (current U.S. dollar interest rates above 4%), high security, and strong compliance.

- Innovation: Usual's USD0++ introduces a liquidity token mechanism, providing on-chain liquidity for locked U.S. Treasury bonds, similar to Lido's role in ETH staking, enhancing flexibility and additional yield opportunities.

Risk considerations: Custodial risks of underlying RWA assets, compliance risks, sustainability of additional token incentives, project governance risks.

2.2.5 Structured Products with Options

Mainly popular on centralized exchanges, utilizing the "sell options to earn premiums" strategies such as Sell Put or Sell Call.

- U-based stablecoins: Primarily using the Sell Put strategy to earn premiums paid by option buyers.

- Characteristics: More suitable for range-bound markets, with limited returns or risks in one-sided markets.

- Innovation: The Shark Fin principal protection strategy from exchanges, which earns premiums within a range through option combinations while protecting the principal outside the range, suitable for users focused on principal safety.

- On-chain options: Still in early development, with Ribbon Finance previously being a leader, but maturity needs improvement.

Risk considerations: Market condition judgments, principal loss risk (if directional judgment is incorrect), limited option premium returns.

2.2.6 Yield Tokenization

Represented by the Pendle protocol, which splits yield-bearing assets into Principal Tokens (PT) and Yield Tokens (YT), allowing users to lock in fixed yields, speculate on future yields, or hedge yield risks.

- PT: Represents the principal of the underlying asset, redeemable 1:1 for the base asset at maturity.

- YT: Represents future yields, decreasing over time, with a zero value at maturity.

- Strategies: Fixed income, yield speculation, risk hedging, providing liquidity.

- Revenue sources: Native yields from underlying assets, speculative yields from YT, LP yields, platform token incentives, etc.

- Shortcomings: High-yield pools have shorter terms, requiring frequent operations.

Risk considerations: Risks of underlying assets, smart contract risks, speculative risks of YT.

2.2.7 A Basket of Stablecoin Yield Products

For example, Ether.Fi's Market-Neutral USD pool, which provides users with a combination of various stablecoin yield strategies (lending, liquidity mining, funding rate arbitrage, yield tokenization) in the form of actively managed funds.

- Advantages: Diversifies risk while balancing high yields, suitable for users with insufficient capital who do not wish to operate frequently.

- Risks: Dependent on the strategies and risk control capabilities of the fund managers, accumulation of risks from underlying strategies.

2.2.8 Alternative Stablecoin Staking Rewards

Some projects accept stablecoin staking to earn additional token rewards, such as the AO Computer network by the Arweave team, which accepts DAI staking to earn AO tokens.

- Characteristics: Small bets for large gains, obtaining additional project token rewards.

- Risks: Price uncertainty of additional tokens, project development risks.

3. Analysis of Alpha Strategies for Mainstream Yield-Bearing Stablecoins

In a stablecoin market with a total market capitalization exceeding $250 billion and annual trading volumes reaching trillions of dollars, yield-bearing stablecoins are becoming a new hotspot for on-chain yields. These stablecoins not only peg to the dollar but can achieve approximately 3% to 15% APY, connecting traditional finance with DeFi and providing ordinary users and professional investors with diversified paths for on-chain asset appreciation, such as market-making, collateralization, reinvestment, and point airdrops, initiating a new growth cycle for on-chain dollar assets.

According to CoinGecko's market capitalization data for yield-bearing stablecoins as of June 6, 2025, the leading projects are mainly divided into two categories: one is incentive-based stablecoins like sUSDe and sUSDS, which are high liquidity and high yield, serving as the core of "programmable cash flow" on-chain; the other is more robust yield-bearing stablecoins like USDY and USDM, which focus on compliance and institutional demand. Representative projects include:

- Ethena's sUSDe (market cap $3.456 billion): Achieves high yields through a short hedging strategy with perpetual contracts, supplemented by incentive rewards to attract user participation;

- Spark's sUSDS (market cap $2.569 billion): Relies on off-chain U.S. Treasury investments, combined with a compound point system to achieve stable returns;

- Ondo's USDY (market cap $586 million): Provides robust bond-type yields aimed at institutional users.

The following sections will provide a detailed analysis of the yield mechanisms and user strategies for sUSDe, sUSDS, and USDY.

3.1 USDe – Synthetic Yield Provided by Ethena Labs

In the context of yield-bearing stablecoins increasingly becoming the main line of DeFi investment, Ethena Labs' USDe and its derived yield product sUSDe offer a "internet bond" solution that combines stability and yield. The protocol is based on the Ethereum ecosystem, using a Delta hedging mechanism to convert Ethereum collateral assets into the dollar-pegged stablecoin USDe, and further transforming the yields generated from staking rewards and hedging funding rates into sUSDe, providing users with a stable and sustainable source of on-chain interest rates.

3.1.1 Core Products: USDe and ENA Token

USDe: Ethena's synthetic dollar

USDe is a synthetic dollar issued by Ethena, designed to provide a stable, scalable digital currency that does not rely on traditional financial infrastructure. It maintains value stability through a 1:1 peg to the dollar, utilizing Delta hedging and minting-redeeming arbitrage mechanisms, thus serving as a reliable medium of exchange and store of value in the volatile crypto market.

ENA: The native token of the Ethena protocol

ENA is the native utility token of the Ethena protocol, playing a crucial role in the ecosystem. ENA holders can participate in protocol governance, voting on key decisions regarding risk management frameworks, the composition of USDe's supporting assets, partnerships, and integration plans. Additionally, ENA maintains the stability and functionality of USDe through various incentive mechanisms, serving as a key link in the operation of the entire ecosystem.

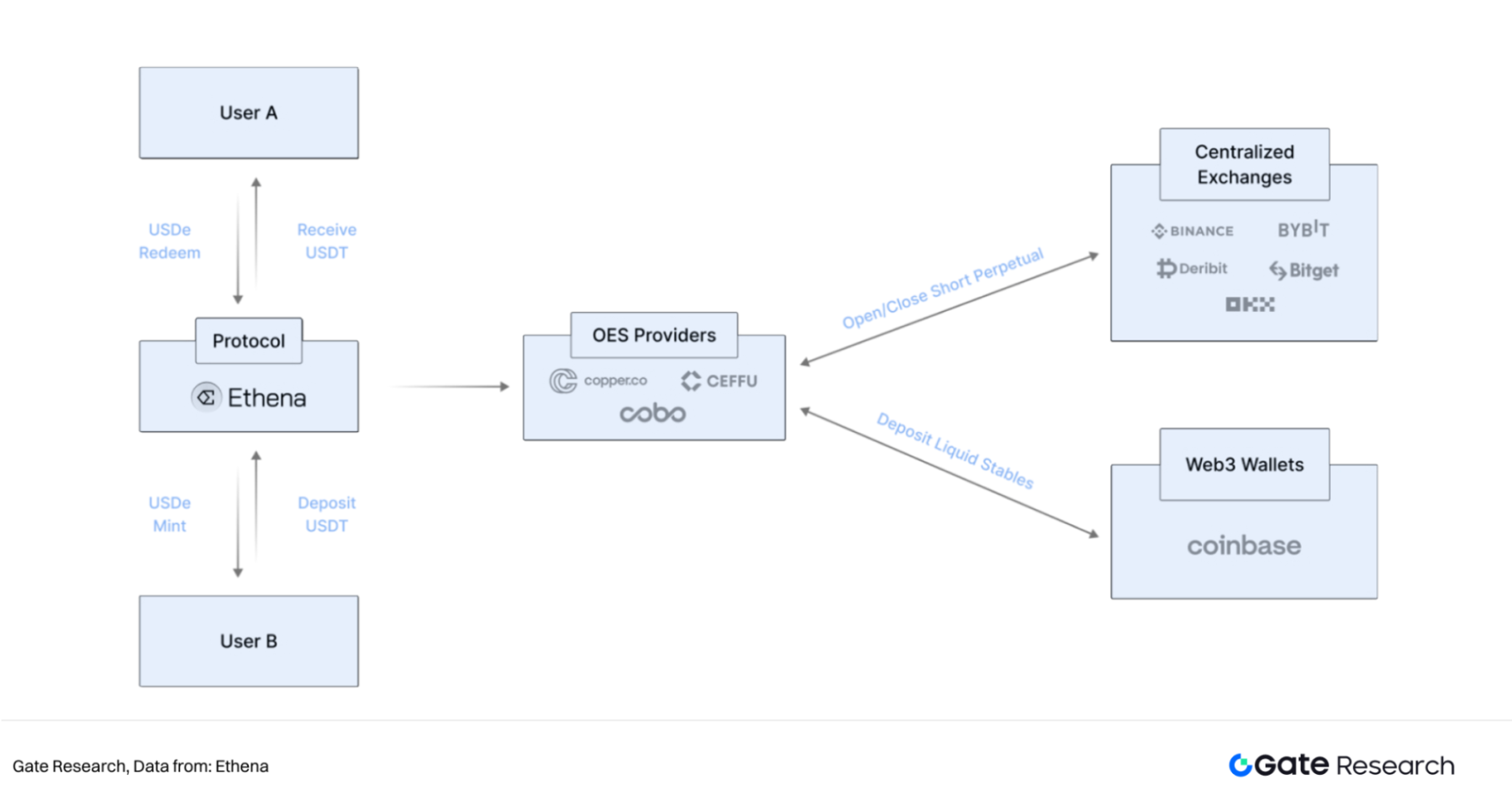

3.1.2 Operation Mechanism of the Ethena Protocol

The core mechanism built by Ethena ensures the stability of USDe through Delta hedging strategies and returns its naturally generated yields (such as funding rates and staking rewards) to users via sUSDe, forming a stable return mechanism.

(1) USDe Minting Logic and Delta Hedging

Users can mint USDe using assets like ETH or stETH, and the platform will:

- Automatically open short positions in the derivatives market (such as perpetual contracts);

- Achieve Delta-neutral position management to hedge against price risks from ETH volatility;

- The staking rewards + funding rate differentials from the derivatives market form the real sources of yield.

Figure 4: How USDe Works

(2) sUSDe Reward Mechanism

sUSDe is the reward accumulation version of USDe. To earn rewards, users must stake their USDe to receive sUSDe. Its core features include:

- Timely compounding: Yields are automatically reinvested per block;

- Strong on-chain composability: sUSDe can be used as collateral in other protocols;

- Visible APY fluctuations: Yield rates fluctuate based on on-chain staking rewards and the funding rate differentials in the perpetual market.

(3) User Participation Pathways and Yield Sources

Ethena currently obtains protocol rewards through three different channels, with the main source being its short perpetual contract positions opened on exchanges, which can collect positive funding rates. Additionally, there are two types of extra yield sources: one is consensus and execution layer rewards from staked assets (such as ETH/stETH), and the other comes from funding rates and basis yields generated by Delta hedged derivative positions, as well as fixed rewards provided by Liquid Stables.

Ethena's user participation threshold is relatively low, and the complete participation pathway is as follows:

Figure 5: User Participation Pathways and Yield Sources for USDe

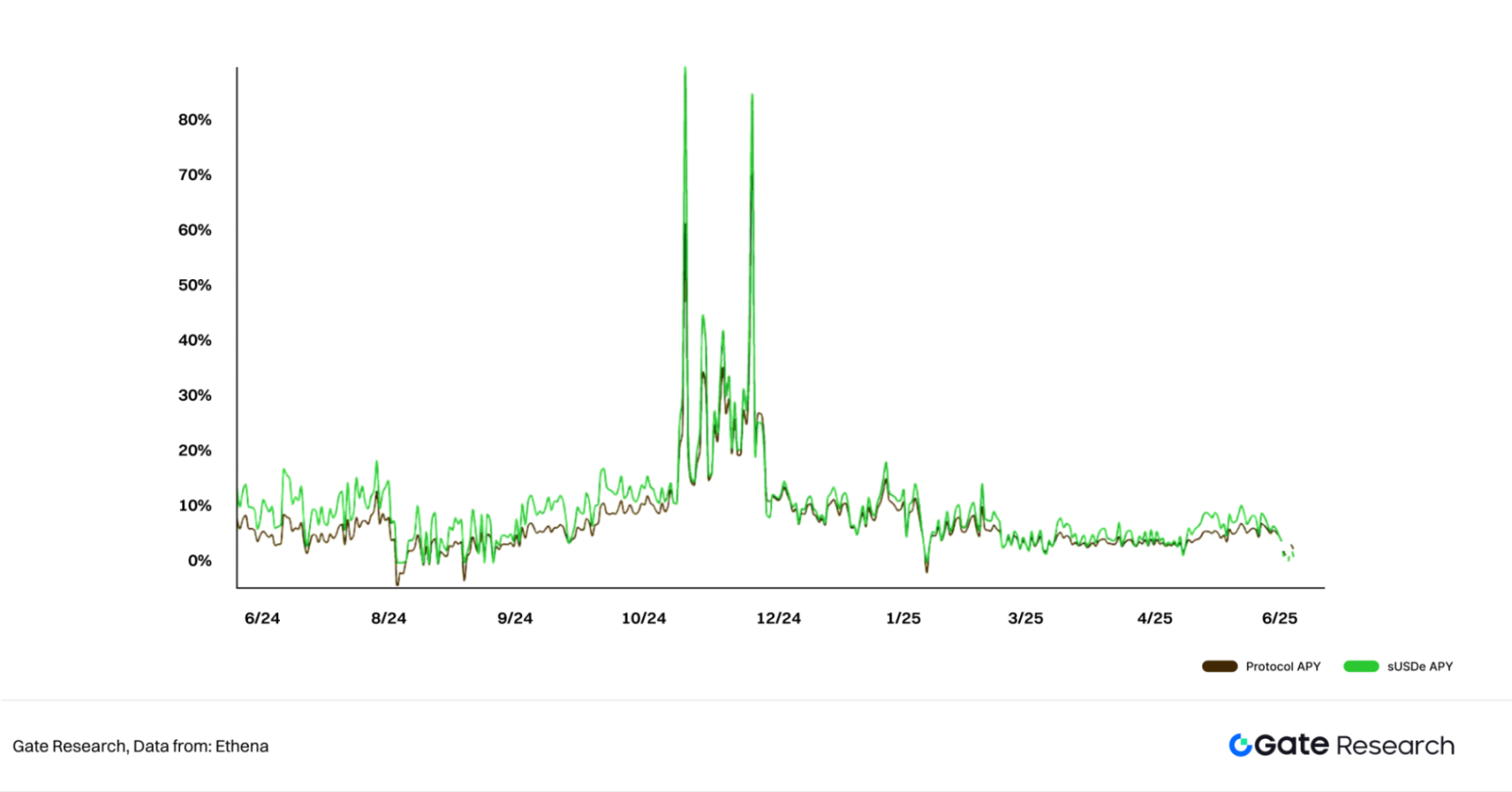

sUSDe has performed impressively over the past year, with APY fluctuating between 5% and 25% (depending on market funding rates and staking returns), currently around 7.39%, significantly higher than traditional stablecoin financial products, making it one of the representative projects of current yield-bearing stablecoins on-chain. Ethena's total value locked (TVL) has reached $5.94 billion, rapidly growing since the project's launch, ranking 7th among DeFi protocols. Currently, Ethena's total staked assets amount to $5.87 billion, primarily composed of stablecoins (50%), BTC (32%), ETH (12%), ETHLSTs (5%), and SOL (1%).

Figure 6: Ethena Protocol APY and sUSDe APY

3.1.3 USDe Yield Strategies and Operation Guide

As USDe and the Ethena protocol continue to gain popularity, more users are focusing on how to efficiently participate in this "stable yield system." Currently, the mainstream participation methods can be divided into four paths, corresponding to different risk preferences and operational proficiency, suitable for conservative investors while also providing arbitrage opportunities for advanced users. The following is a detailed analysis of these four paths.

Path One: Ethena Earn Module (Core Strategy)

The most direct and currently the most mainstream participation method is to earn yields through Ethena's official Earn module. Specific operations:

- Visit the official website app.ethena.fi;

- On the Swap page, exchange USDT or USDC for USDe;

- On the Earn page, deposit USDe to generate sUSDe and start earning yields.

The yield structure of this strategy mainly consists of two parts:

- Base Yield: Comes from the short funding rate in the perpetual market + stETH staking rewards, with an APY of about 4.5%;

- Additional Incentives: Ethena distributes 3-5% of $ENA airdrop rewards to stakers every quarter.

Overall, the comprehensive APY for participating in the Earn module is between 9-11%, calculated with daily compounding, suitable for ordinary users looking for stable passive income.

Path Two: Participate in Liquidity Pools (Cross-Chain Strategy)

For users looking to obtain higher yields and willing to take on some risk, participating in cross-chain liquidity pools for market-making is an option. Currently, USDe and tsUSDe have been listed on mainstream DEXs on the TON network, forming trading pairs with USDT/USDC, allowing users to provide LP (liquidity) for market-making. Participation method:

- Add tsUSDe-stablecoin liquidity in the TON wallet or DEX;

- Obtain tsUSDe holdings and enjoy liquidity mining rewards + $ENA airdrops.

The expected APY for this path is as high as 18%, but attention must be paid to IL (impermanent loss) risks. This method is particularly suitable for users with some experience and the ability to operate cross-chain and market-making.

Path Three: Arbitrage through Centralized Exchanges (Advanced Play)

For advanced users, there is another arbitrage path. Some centralized exchanges have regarded $sUSDe as a bond-like product with stable yields. This also brings potential arbitrage opportunities for users:

- Within the price fluctuation range, users can pre-sell the future yields of sUSDe;

- Or utilize price differences between different platforms for arbitrage operations.

Such strategies are complex and require high market judgment, making them more suitable for experienced users; ordinary users are not advised to frequently attempt this path.

Path Four: Hold sUSDe and Wait for ENA Airdrops

Finally, the path with the lowest barrier to entry: long-term holding of sUSDe while waiting for airdrops. Currently, it is during the fourth quarter "Sats Campaign" event launched by Ethena, expected to last until September 24, 2025. During this period, simply holding sUSDe will grant quarterly distribution rights for $ENA without any additional operations. This strategy is simple to execute and provides stable returns, suitable for new users or participants looking for "low involvement + stable airdrops."

In summary, from Ethena Earn to cross-chain liquidity pools, to centralized arbitrage and passive airdrops, the USDe ecosystem provides clear and diverse yield paths for different types of users. Users can choose suitable strategies based on their risk tolerance and operational preferences; conservative users can focus on the Earn module and airdrop holdings, while aggressive users can try cross-chain market-making or arbitrage plays.

3.2 USDS – Upgraded from Dai (DAI)

The Sky protocol (formerly MakerDAO) has launched a new generation of stablecoin USDS and governance token SKY through brand upgrades and product iterations, with SparkFi as the core sub-project, providing users with diverse high-yield opportunities.

3.2.1 Sky's New Generation Yield-Bearing Stablecoin: USDS and sUSDS

USDS (United States Dollar Sky) is a 1:1 upgraded version of the decentralized stablecoin Dai (DAI). Similar to DAI, USDS remains a decentralized, over-collateralized stablecoin aimed at maintaining a 1:1 peg to the U.S. dollar. However, its significant distinction lies in the embedded native reward mechanism, allowing users to earn yields through SKY tokens and Sky Savings Rate (SSR), making USDS a "yield-bearing stablecoin."

sUSDS (Savings USDS) is the equity token generated when users deposit USDS into the SSR system, which can be seen as an upgraded version of sDAI, offering higher yields. It complies with the ERC-4626 standard, featuring automatic yield accumulation and high flexibility (transferable, stakable, and lendable), and supports multi-chain networks like Ethereum and Base.

The SKY token is a 1:24,000 upgraded version of the original Maker governance token MKR, becoming the governance core of the Sky ecosystem. Holders can deeply participate in governance, voting on key ecological decisions, and can stake SKY to generate and borrow USDS, receiving staking rewards distributed in USDS.

3.2.2 Operational Mechanism: How to Achieve Value and Yield

(1) Minting and Pegging of USDS

- Minting: Users can mint USDS by depositing eligible crypto assets (such as ETH, wstETH, WBTC) and real-world assets (RWAs) as collateral into the Sky Protocol, ensuring over-collateralization and stability.

- Dollar Peg: USDS maintains its 1:1 peg to the U.S. dollar through an automated system of smart contracts and collateral.

(2) Sky Savings Rate (SSR) Mechanism

- USDS Deposit and sUSDS Generation: Users deposit USDS into the Sky Savings Rate system (SSR) to obtain sUSDS.

- Yield Accumulation: Sky uses a dynamic model to add USDS to the SSR pool every few seconds. Over time, the value of sUSDS in specific funding pools will continuously increase.

- Yield Withdrawal: Users can choose to redeem sUSDS back to USDS, receiving accumulated yields in addition to the initially deposited USDS.

- Goal: The design of SSR aims to provide passive yields for USDS holders while incentivizing users to hold USDS, supporting the health and stability of the Sky ecosystem.

(3) Core Sources of Yield

- Borrowing Governance Fees: Users borrowing USDS pay stability fees, part of which is returned to sUSDS holders.

- Liquidation Fee Revenue: Fees generated when the system liquidates low collateral positions will also be distributed.

- RWA Investment Returns: The protocol generates yields by investing in real assets, including U.S. Treasury bonds, enhancing stability.

- SKY Token Incentives: sUSDS users can participate in governance and receive SKY token rewards based on their contributions.

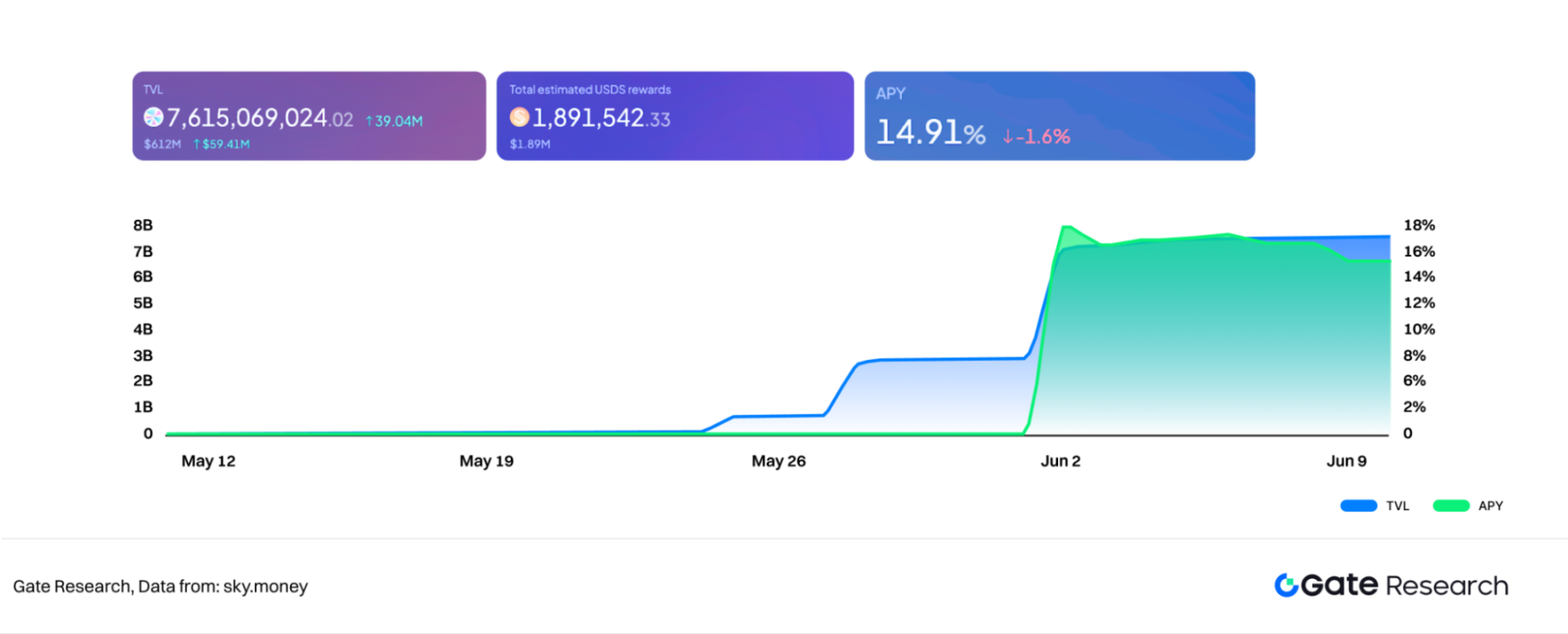

The Sky protocol currently provides stablecoin incentives for SKY staking, with rewards distributed in USDS, and the current APY is approximately 14.91%. The total rewards for USDS are about $1.89 million, with a total TVL of $7.6 billion. According to official data, as of the end of May, the annual profit for Sky Protocol's USDS is expected to exceed $90 million (excluding SKY token incentives), with total collateral value maintained above $10.5 billion, and the overall collateralization rate of the system is 129%, with USDS supply stabilized above $7 billion. The total locked amount in Sky Savings exceeds $3 billion, with an APY of 4.5%, and rewards of approximately $8.6 million have been distributed in May, with total monthly rewards for Sky Token Rewards exceeding $460 million.

Figure 7: Sky Protocol TVL and APY

3.2.3 USDS Yield Strategies and Operation Guide

The Sky protocol, through USDS and the core sub-project SparkFi, provides users with flexible and high-yield DeFi participation paths. Below are various yield strategies and operational suggestions:

Path One: Directly Stake USDS to Obtain sUSDS (Stability Strategy)

Automatically earn yields through the SSR mechanism, suitable for conservative users and "deposit-oriented" on-chain participants. Participation method:

- Mint USDS by depositing eligible crypto assets through the Sky Protocol.

- Deposit USDS into the Sky Savings Rate (SSR) system to automatically obtain sUSDS. Currently, the APY for SSR can reach 4.5%.

- sUSDS will automatically accumulate value over time, equivalent to passive appreciation. It is recommended to pay attention to yield trends and choose high-yield periods for deposits.

Path Two: Stake SKY Tokens to Obtain Stablecoin Incentives

- Operation: Stake SKY tokens in the Staking Engine of the Sky Protocol.

- Yield: By staking SKY, users can generate and borrow USDS based on the amount of SKY provided, while also receiving staking rewards in USDS of up to 14.91%.

- Staking SKY not only generates yields but also allows voting rights to be transferred to representatives or contracts, participating in Sky ecosystem governance.

Path Three: Spark Protocol Airdrop and Points Maximization Strategy

Base Yield: On the Savings page of the SparkFi official website, exchange USDC for USDS, then deposit USDS, currently with an APY of about 4.5%, and each 1 USDS YT or LP can earn 25 points daily.

SPK Airdrop Maximization Strategy:

- Effective Method: It is recommended to borrow USDS by collateralizing assets like ETH on lending platforms (such as the Spark official lending interface) or deposit borrowed USDS into Pendle to earn points. Other effective methods include providing wstETH/rETH/ETH/GNO to borrow USDS/DAI or providing ETH to borrow wstETH, etc.

- Ineffective Method: Directly supplying sUSDS/sDAI to borrow stablecoins or depositing USDS/DAI into sUSDS/sDAI as collateral will result in the loss of airdrop eligibility.

- Increase Points:

○ Content Creation: Create high-quality content related to #SparkFi (data analysis, memes, etc.), publish it on the X platform, and tag @sparkdotfi, @cookiedotfun.

○ Task Participation: Actively participate in tasks on Galxe and other platforms.

○ Community Engagement: Engage actively in Discord (discord.gg/tkAahUm5) to earn XP and gather task inspiration.

○ Invitation Mechanism: Accumulate 10 Snaps as soon as possible to unlock the invitation feature, invite active users, and receive a 10% additional contribution reward.

Path Four: Combined Yield Strategy (Advanced Yield)

- Utilize sUSDS/sUSDC for "productive" leverage: sUSDC/sUSDS, as yield-bearing stablecoins, can generate yields while also serving as collateral. On lending platforms like Euler, use sUSDC/sUSDS as collateral for borrowing, and then invest the borrowed assets, forming a "deposit earning interest + borrowing investment" combined yield strategy, significantly enhancing capital efficiency.

- Cross-Chain Yield Exploration: Focus on high-yield opportunities for USDS across different chains, such as Base (approximately 7.5%), Ethereum (approximately 5.5% APY), Arbitrum (approximately 5.1% APY), Solana (approximately 4.8% APY), and Optimism (approximately 4.5% APY).

Although the Sky protocol and SparkFi show strong growth potential, users should remain aware of potential risks, including protocol security, the stability of asset exchange mechanisms, the sustainability of interest rate models, and the long-term execution of incentive programs. Overall, the Sky ecosystem is reshaping the new paradigm of "stablecoin = capital efficiency + optimized experience + cross-chain interoperability" through the innovative mechanisms of USDS and sUSDS, with the potential to become a core component of DeFi. Through the above strategies, users can not only achieve low-risk asset appreciation but also actively participate in SPK airdrops, maximizing overall returns.

3.3 USDY – Yield-Bearing Stablecoin from Ondo Finance

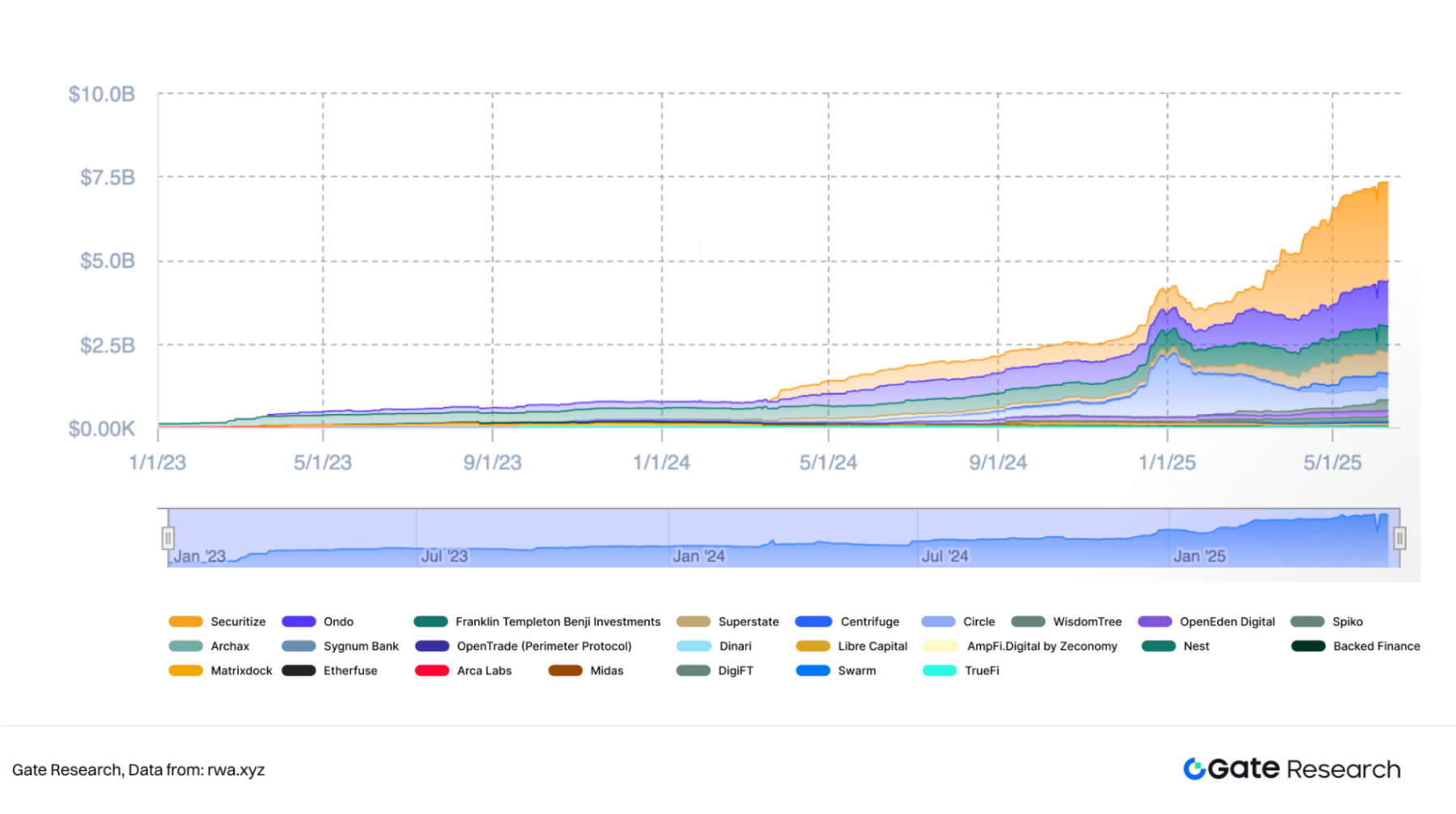

Ondo Finance is a decentralized finance protocol aimed at institutions, dedicated to bringing low-risk, stable-yield real-world assets (RWA) such as U.S. Treasury bonds and money market funds onto the blockchain. One of its core products, USDY, is a yield-bearing stablecoin designed for global non-U.S. residents and institutional investors, providing a dollar-denominated stablecoin alternative that generates yields. According to RWA.XYZ data, in the niche market of Treasury yield tokens, Securitize and Ondo are leading; among them, Ondo has reached a scale of $1.375 billion in the U.S. Treasury RWA market, growing 16.86% in the past month, with a market share of 18.74%, ranking second, only behind the Securitize platform supported by BlackRock.

Figure 8: U.S. Treasury RWA Market Size

3.3.1 Asset Products: USDY and OUSG

Yield-Bearing Stablecoin USDY

USDY is a yield-bearing dollar stablecoin launched by Ondo Finance, pegged to the U.S. dollar. The coin is fully backed by short-term U.S. Treasury bonds and bank demand deposits at a 1:1 ratio, issued through a bankruptcy-remote independent SPV (Ondo USDY LLC) to ensure the separation of reserve assets from the issuing entity, enhancing asset security. Its partner institutions include Morgan Stanley, StoneX (responsible for holding U.S. Treasury bonds), and First Citizens and Coinbase Prime (providing banking deposit services).

Its main feature is the daily automatic accumulation of yields, combining dollar stability with interest returns. The annual yield references the SOFR rate, with a current APY of approximately 4.29% after deducting about 0.5% management fees.

Tokenized U.S. Treasury Fund OUSG

OUSG is a tokenized U.S. Treasury product launched for qualified institutional investors globally, with the underlying asset being BlackRock's iShares Short Treasury Bond ETF. Users must participate through KYC verification. Its reserve assets also include shares of U.S. Treasury funds issued by Franklin Templeton (FOBXX), Wellington, WisdomTree, Fidelity, and others. Yields will be automatically reinvested for compound growth. OUSG charges institutional clients a management fee of 0.15% and related fund fees.

3.3.2 Operational Mechanism: How Does USDY Generate and Distribute Yields?

(1) Asset Collateralization and Issuance

USDY is issued by Ondo USDY LLC (an independent, bankruptcy-remote special purpose vehicle), with the SPV's assets/equity serving as collateral, and USDY holders designated as the ultimate beneficiaries through a trust arrangement. The reserve assets (short-term U.S. Treasury bonds and bank demand deposits) are held by regulated custodians, ensuring 1:1 full backing.

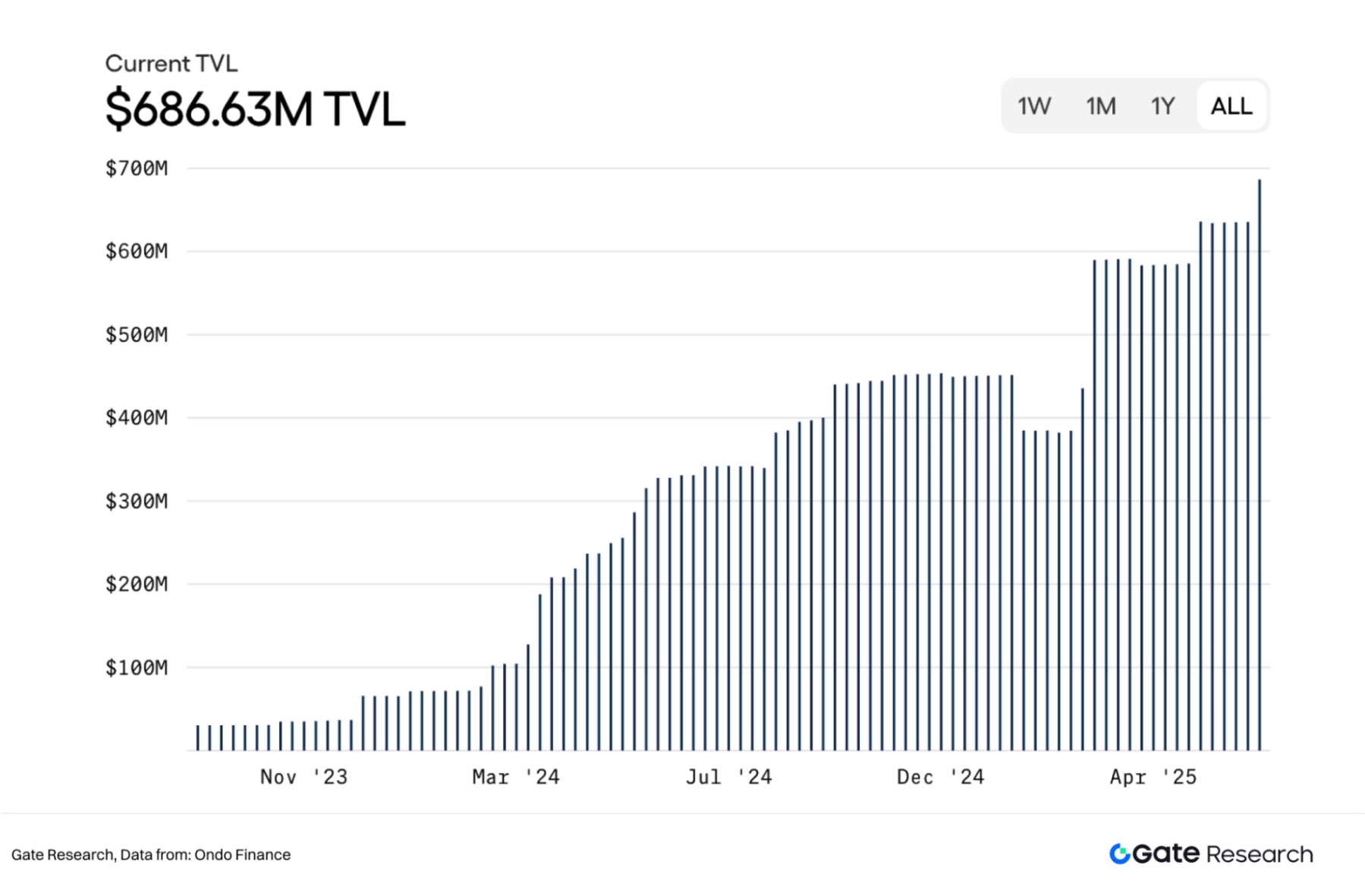

According to official data, USDY's total locked value (TVL) exceeds $680 million and is currently available on eight blockchain networks, including Ethereum and Solana.

Figure 9: Total Locked Value (TVL) of USDY

(2) Yield Accumulation and Distribution

- Daily Settlement: The interest on USDY is calculated daily, meaning holders can see their USDY quantity or intrinsic value automatically increase each day without manual claiming.

- Sources of Yield: Primarily from the interest earned on the underlying short-term U.S. Treasury bonds and bank demand deposits. Ondo sets the annual yield for USDY each month (e.g., 4.25%) and distributes most of the base yield to holders, retaining about 0.5% as a management fee.

- Rebase Function (rUSDY): USDY can be converted into a stable value token with rebase functionality, rUSDY. Users holding rUSDY will see their token quantity automatically increase with yield growth, similar to Lido's stETH mechanism, providing a more intuitive representation of yield growth.

(3) Regulation and Compliance

USDY is offered under D/S regulations, meaning it is currently primarily open to qualified investors or non-U.S. investors. To enable permissionless participation on the protocol's backend, Ondo has also partnered with DeFi protocols like Flux Finance to provide stablecoin collateral lending services for tokens like OUSG that require permissioned investment.

3.3.3 USDY Yield Strategies and Operation Guide

USDY offers various strategies for on-chain investors seeking stable dollar yields. Below are common paths to acquire USDY and enhance overall yields through DeFi projects:

Path One: Basic Holding and Exchange (4.29% Base Yield)

The most basic strategy is to directly hold USDY to automatically earn yields daily (current APY approximately 4.29%). Acquisition methods:

- Institutional Investors: Can directly contact Ondo Finance for purchase;

- Ordinary Users (suitable for small operations): Exchange USDY using USDC or USDT through DEX, recommended to check exchange pool depth, set slippage (0.1%), and enable MEV protection;

- Investment Support: USDY supports investments in USDC/USDT, and amounts over $100,000 also support wire transfers in U.S. dollars.

Path Two: Stake USDY in DeFi Protocols (Multiple Yield Stacking)

Operation: Deposit held USDY into DeFi protocols (such as Scallop Protocol, NAVI Protocol) to earn both their native yields and lending/incentive yields.

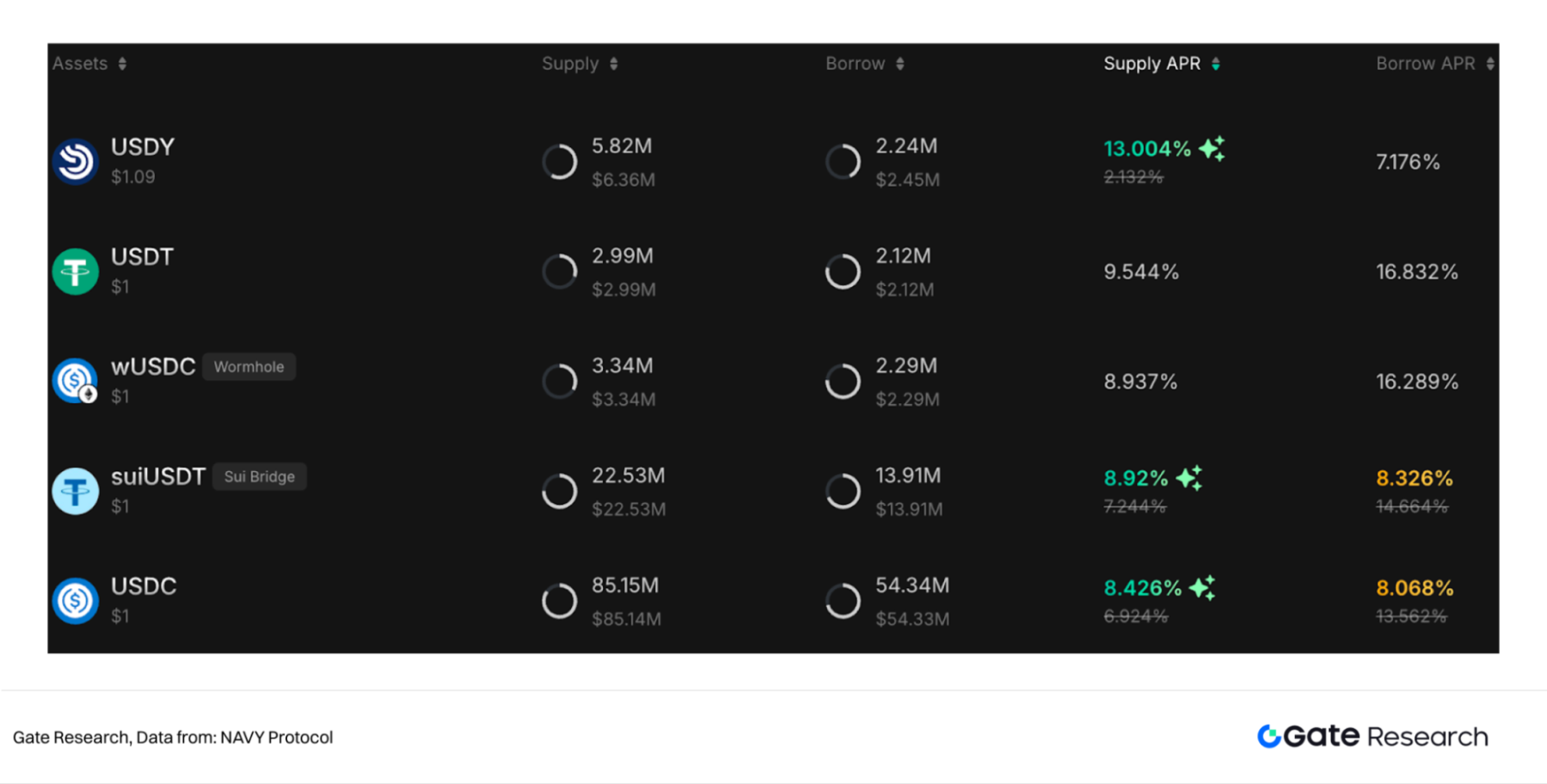

Yield: Staking USDY will earn the native yield of USDY itself (approximately 4.25% APY), plus lending yields and ecological incentives (such as fees, token rewards). NAVY Protocol will directly display the total yield rate, currently with an APY of 13%, while Scallop requires adding lending yields to USDY's own yield.

Figure 10: NAVY Protocol Stablecoin APR Rankings

Path Three: Advanced Strategy: Borrow High APR Stablecoins for Reinvestment

The Scallop protocol in the Sui ecosystem offers a unique yield cycling strategy that can significantly amplify USDY yields:

- Deposit USDY into the "Lender Financial Pool" under the "Deposit Pool" to continue earning its native Treasury APR;

- Borrow higher APR stablecoins (such as USDC, sbUSDT, FDUSD) from the "Borrower Debt Pool";

- The borrowing ratio is related to the amount of locked SCA (Scallop protocol token), enhancing the incentive multiplier (up to 3.5-4 times);

- Invest the borrowed stablecoins into other high-yield protocols to further amplify yields:

○ Bucket Protocol (@bucket_protocol): APY approximately 12%, interest paid in SUI;

○ Moledefi (@Moledefi): APY approximately 17%, part of the interest paid in SUI;

○ Suilend (@suilendprotocol): APY 5%-8%, allows for cyclical loans and earns SEND points;

○ Scallop Borrowed Asset Pool: Earn Scoin (such as sSUI, sUSDC), which can be further invested in other protocols for additional yields.

- Yield Harvesting and Reinvestment: Regularly harvest SUI (which can be staked as haSUI for an additional 3% yield and reused in other protocols) and SCA (which can be locked as veSCA or placed in the lender pool to continue earning 12% APR).

Additionally, high-risk assets (such as WAL, DEEP) can be borrowed to achieve APYs of up to 100%-200%, but strict risk management is required. Through combined strategies in DeFi protocols like Scallop, capital efficiency and overall returns can be significantly amplified, but it is essential to fully assess the risks of DeFi operations and market volatility.

3.4 Other Stablecoin Alpha Strategy Opportunities

3.4.1 Falcon Finance: A Rising Star Supported by DWF Labs

Falcon Finance is a stablecoin protocol supported by cryptocurrency market maker DWF Labs, aiming to issue a dollar-pegged stablecoin USDf. It generates on-chain arbitrage yields by collateralizing stablecoins and mainstream assets (such as USDC, ETH, etc.), with a mechanism similar to Ethena Labs and Resolv Labs, where the underlying yield primarily comes from funding cost arbitrage. Currently, its yield-bearing asset sUSDf has an APY of approximately 14.3%.

Participation Methods:

Acquire USDf: Users can exchange USDf through platforms like Uniswap, Curve, and Balancer, paying attention to liquidity and slippage; they can also exchange assets like USDC, USDT, and ETH for USDf after completing KYC on the official website.

Stake USDf to obtain sUSDf (yield-bearing asset):

- Classic Yield Model: Flexible staking, can be unstaked at any time, with an APY of approximately 14%.

- Boosted Yield Model: Lock for 3, 6, or 12 months, increasing yields to 1.05x, 1.25x, and 1.5x respectively, with no redemption during the lock-up period.

- Note: sUSDf is a self-growing asset (not 1:1 pegged), and its unit value increases with yield accumulation; staking and exchanging is not an equivalent conversion.

Exit Mechanism: Users can choose to exchange directly through DEX (which may incur losses) or redeem back to USDC/USDT at a 1:1 ratio through the official redeem function, but there is a 7-day exit window.

Advanced Play: Users can perform circular lending operations through the sUSDf/USDC lending pool on Morpho to expand principal for higher yields, but this also involves interest rate fluctuations and liquidation risks, not recommended for beginners.

3.4.2 Lista DAO: A Yield Lending Hub on BSC

Lista DAO is a leading lending and stablecoin protocol on the BNB Chain, with its core stablecoin being USD1. Due to its collaboration with the Trump family on USD1 and its listing on Binance, its market share has rapidly risen to the top five stablecoins, becoming one of the most important yield-generating DeFi platforms on BSC.

High Yield Strategy: Pendle + Lista Arbitrage Play (with reasonable interest rate spreads and good LTV control, can reach 20%-22%+, which is double the yield of a single PT-sUSDE)

Operation Path:

Purchase PT-sUSDE on Pendle (can lock in about 10% fixed yield).

Collateralize PT-sUSDE in Lista Lending to borrow USD1.

Use the borrowed USD1 to execute the following operations:

○ Basic Play: Engage in interactions or lending (4%-8% APY), with almost no loss.

○ Advanced Play: Deposit USD1 into the USD1/BNB lending pool (borrowing rate only 0.07%), borrow BNB and participate in Lista liquidity staking, with an overall APY of up to 16.5%.

○ Circular Lending Play: Exchange the borrowed USD1 for USDT, continue to purchase PT-sUSDE in a circular operation, achieving up to 3x leverage, further amplifying yields.

3.4.3 Other Stablecoin-Based Alpha Yields

In addition to the aforementioned stablecoin protocols, Hyperliquid's modular EVM network Hyper EVM has also opened up yield paths based on stablecoin market making for users. Users can deposit stablecoins like USDC and USDT into its HLP (Hyper Liquidity Provider) market-making treasury, participating as liquidity providers in the protocol's market making, earning approximately 19%+ annualized yield generated from trade matching. This mechanism relies less on incentive subsidies, making it more sustainable and suitable for medium to long-term holding and yield reinvestment strategies.

3.5 Summary

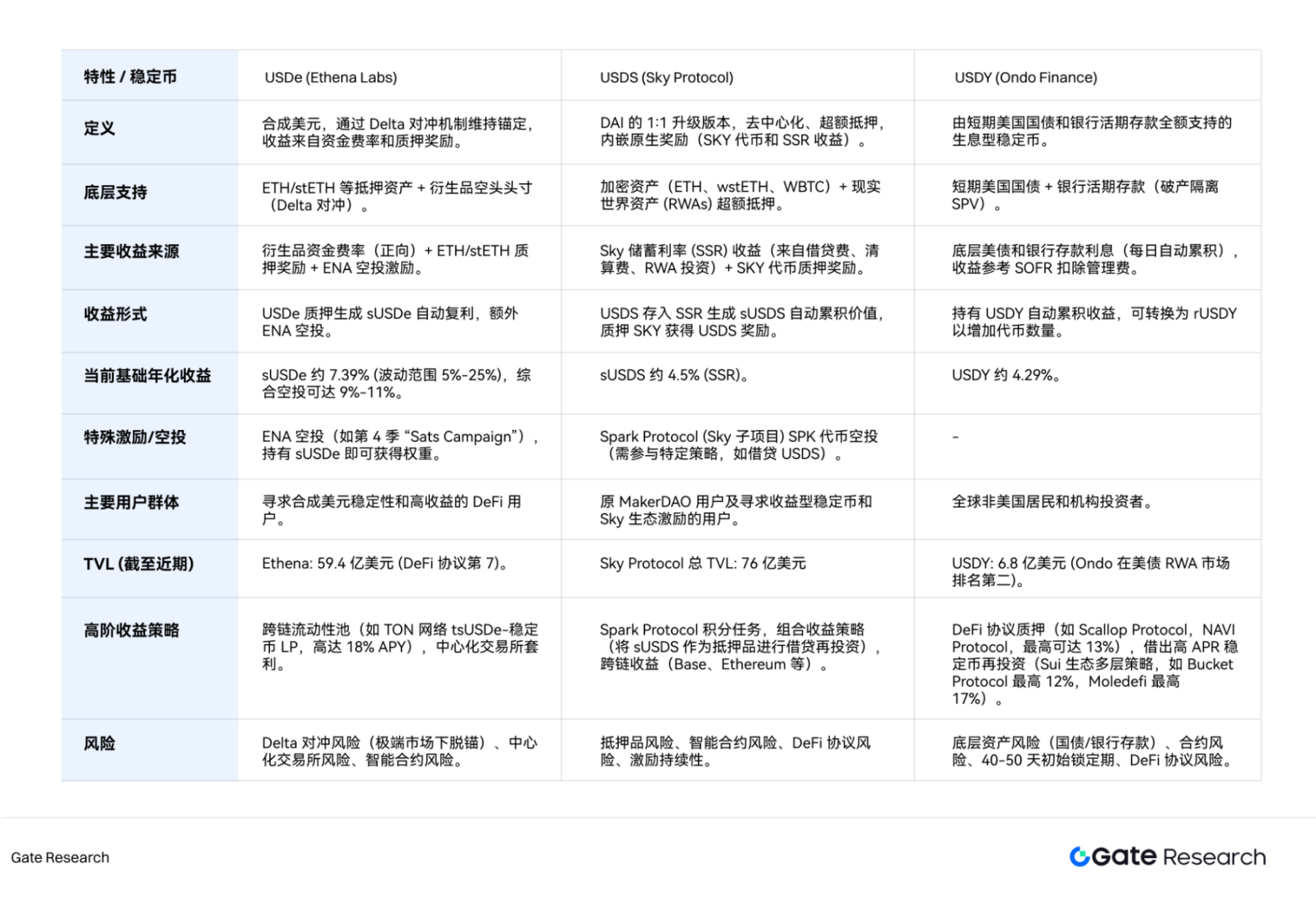

In the context of increasingly diversified DeFi yields, USDe, USDS, and USDY, as the current mainstream yield-bearing stablecoins, have constructed their unique value propositions and yield paths from three directions: derivative mechanisms, on-chain governance, and real-world asset anchoring. Although their common goal is to provide dollar exposure with return capabilities, there are significant differences in underlying mechanisms, sources of yield, user preferences, and ecological synergy.

Represented by synthetic dollars, Ethena (USDe) focuses on providing high yields and stability in volatile markets through a Delta hedging mechanism, supplemented by ENA airdrop incentives. Sky Protocol's USDS serves as an upgraded version of DAI, offering users multi-layered yield stacking and governance participation opportunities through its SSR mechanism and SparkFi ecosystem. Ondo Finance's USDY, directly anchored by real-world assets (such as U.S. Treasury bonds and bank deposits), automatically accumulates yields daily, providing compliant and transparent on-chain U.S. Treasury alternatives for non-U.S. residents and institutional investors.

Figure 11: USDe vs USDS vs USDY

In addition to the aforementioned mainstream stablecoins, the DeFi ecosystem is rapidly generating a batch of innovative Alpha strategy solutions: Falcon Finance's USDf, as a rising star supported by DWF Labs, obtains on-chain arbitrage yields through collateralizing stablecoins and mainstream assets, with flexible and lock-up models catering to different risk preferences and supporting advanced operations like circular lending. Lista DAO has built a strong yield lending hub on the BNB Chain, and its USD1 stablecoin, combined with protocols like Pendle, can achieve high compound annualized yields through composite strategies. Meanwhile, Hyper EVM provides a yield path based on stablecoin market-making mechanisms, allowing users to earn sustainable annualized yields by depositing stablecoins into its HLP market-making treasury.

In summary, from the stablecoin anchoring logic to yield realization paths, yield-bearing stablecoins in DeFi are gradually evolving into a multi-layered, multi-mechanism, and multi-ecological synergy value capture system. Investors can flexibly layout in synthetic mechanisms, on-chain governance, RWA yields, or advanced arbitrage strategies based on their own demands, systematically capturing a new round of Alpha opportunities in the stablecoin market.

4. Stablecoin Alpha Practical Guide: Strategy Logic and Tool Methods

The "Alpha" in the stablecoin field does not refer to a single high yield but rather to excess returns that are structural, sustainable, and have differentiated advantages. Through an in-depth analysis of the mechanisms of mainstream yield-bearing stablecoins, the core sources of its Alpha can be summarized into four main paths: mechanism innovation (such as synthetic assets or new staking models), leverage structure reuse (such as circular collateralization and enhanced capital efficiency), off-chain yield stacking (such as U.S. Treasury support or interest rate arbitrage), and incentive release mechanisms (such as airdrop points, protocol rewards, etc.). This chapter will systematically summarize specific Alpha capture strategy logic and operational tools around these four dimensions, providing investors with a structured Alpha practical guide.

4.1 Stablecoin Alpha Capture Strategy Logic

Strategy One: Discover Early Yield-Bearing Stablecoin Projects

Finding early yield-bearing stablecoin projects is one of the core ways to obtain Alpha. First, focus on the innovation of the project mechanism, especially whether it has a compounding structure and whether it embeds on-chain/off-chain yield assets. For example, the sUSDe stablecoin launched by Ethena generates sustainable yield returns and returns to users by shorting perpetual contracts on-chain to hedge spot longs; while the sUSDS issued by Spark Protocol constructs an automatic compounding yield model based on U.S. Treasury-backed assets, adding SPK point incentives to enhance both on-chain cash flow and incentive expectations.

Secondly, pay attention to the multi-chain deployment and liquidity layout of such projects. Multi-chain deployment (such as Ethereum, Base, Blast, etc.) usually means broader user coverage and richer incentive resources. Users can track project TVL changes, liquidity pool yield changes, and other indicators through on-chain data platforms like DefiLlama, DeBank, and Token Terminal to assess whether the Alpha is sustainable.

Finally, high-quality Alpha yields often appear during the window period when tokens are not yet launched and are in the point incentive stage. During this phase, accumulating airdrop points through bridging assets, providing liquidity, or participating in task activities is an important path to obtaining implicit annualized returns (5%-15%). Typical Alpha signals include: the launch of points pages, ecological cooperation incentives, and the initiation of LP mining activities.

Strategy Two: Build a Stablecoin Compound Yield Circular Path

Structured stablecoin circular arbitrage paths are currently the most yield-stacking strategy type. Taking sUSDe as an example, users can collateralize sUSDe to obtain USDC, then use it to buy sUSDe again, forming up to three rounds of compounding operations. In this process, users can continuously earn the annual yield provided by sUSDe itself (approximately 10%) while also enhancing the principal scale through leverage structures.

Furthermore, users can participate in LP market making on Uniswap, Curve, or Ethena's native AMM, thereby earning additional ENA Points or platform point incentives. Additionally, such paths often come with high expected airdrops (such as the initial ENA airdrop from Ethena being distributed through points), with implicit returns reaching 8-12% APY. When constructing such paths, the following on-chain tool platforms can be used for operations: Morpho Blue, Aave, Spark, Kelp (lending module), as well as combination tool platforms like Instadapp, Summer.fi, Rage Trade.

Strategy Three: Low-Risk Alpha — RWA Yield Stacking Strategy

For users seeking stability and low volatility, yield strategies built around real-world assets (RWAs) are the preferred direction. The core logic is to hold stablecoins supported by real assets (such as U.S. Treasury bonds, repurchase agreements) (like USDY, USDM), obtaining off-chain fixed yields while further stacking on-chain liquidity yields through LP market making, and leveraging ecological bridging and incentives to obtain additional point returns.

Taking Ondo Finance's USDY as an example, its basic yield comes from off-chain U.S. short-term Treasury bonds, with a current annual yield of 5.3%. If users participate in USDY/USDC LP market making on Uniswap, they can earn an additional 2-4% liquidity incentives. At the same time, USDY also provides the Ondo Points ecological incentive mechanism, which is expected to bring 3-5% point-based returns. The overall path yields are stable, with low risk, suitable for investors aiming for stable returns.

Strategy Four: Incentive-Based Alpha — Airdrop and Point Farming Paths

Airdrop and point incentive strategies are one of the important paths for on-chain users to achieve "invisible Alpha." Key judgment signals for Alpha include whether the project has launched a points system (such as Spark Points, ENA Points), whether the community has strong airdrop expectations, and whether the investment institution background is of high quality (such as support from a16z, Paradigm, etc.). Additionally, whether the project has not yet issued tokens is also a key factor in assessing the early potential of the incentive phase.

In such paths, the core operational logic for users is not high-frequency trading or complex leverage, but rather continuously completing specified interactive behaviors of the project, such as depositing funds, bridging assets, providing LP market making, participating in tasks, etc., to accumulate convertible point assets. For example, Ethena's ENA Points can be obtained by holding sUSDe and participating in liquidity mining, ultimately converting into ENA airdrops; SparkFi's Spark Points are similarly distributed based on sUSDS holdings and LP interaction behaviors, which may further bind with the Maker ecosystem in the future, releasing MKR-related incentive value.

4.2 Recommended Tools and Information Sources for Finding Alpha

Figure 12: Practical Tools for Obtaining Yield-Bearing Stablecoin Alpha

4.3 Risk Identification and Prevention Suggestions

Although stablecoin Alpha strategies have structured yield potential, they also come with specific on-chain risks that require users to consciously identify and avoid in practice. Below are four common types of risks in current mainstream yield strategies and their corresponding suggestions:

First is the risk of mechanism volatility. Some high-yield strategies (such as hedging yields based on short perpetual contracts) rely on specific market conditions, and if the foundational strategy fails, it will directly impact the sustainability of yields. It is recommended that users allocate a portion of stablecoins supported by real assets (such as U.S. Treasury bonds, repurchase agreements) (like USDY, USDM, sUSDS) to build a robust underlying yield source.

Second is the risk of liquidation. When using leveraged circular strategies, significant market fluctuations may trigger the liquidation mechanisms of lending platforms, leading to principal losses. To mitigate this, users should set up automatic liquidation protection (such as Flash Repay), maintain a moderate health ratio (LTV 70%), and prefer lending platforms that support real-time health ratio monitoring (such as Morpho Blue, Spark).

The third type is liquidity risk. Some emerging stablecoin projects may have limited liquidity pool depth in the early stages, and large buy or sell orders or exits may face issues such as significant slippage and asset depreciation. It is advisable for users to check the corresponding pool's TVL and trading depth through mainstream DEXs like Curve and Uniswap before executing operations, avoiding heavy operations during periods of weak liquidity.

Finally, there is the risk of project security. Many early projects may not have undergone a complete audit process or may have excessive centralized authority (such as funds controlled by multi-signature wallets, which cannot be tracked on-chain). When choosing to participate in a project, priority should be given to protocols that have completed audits and have strong endorsements (such as support from a16z, Paradigm, Framework) to reduce compliance and security risks.

5. Conclusion

Yield-bearing stablecoins represent a new stage in the development of stablecoins—transitioning from "static anchoring" to "dynamic appreciation." They provide crypto users with seemingly "risk-free" on-chain yield opportunities based on short-term U.S. Treasury bonds, on-chain derivative strategies, or real asset yields. However, this innovation hides risks and challenges that cannot be ignored:

- On the technical level, smart contract vulnerabilities, cross-protocol risks, and insufficient transparency in fund management may lead to asset losses for users;

- On the institutional level, regulatory uncertainties, centralized custody risks, and yield volatility make it difficult to equate them with traditional safe yield tools;

- On the market level, limited liquidity, insufficient acceptance, and strong platform dependency restrict the widespread adoption of such products.

Moreover, the current core source of yield—the natural returns of short-term U.S. Treasury bonds in a high-interest-rate environment—is essentially temporary. Once the Federal Reserve enters a rate-cutting cycle, the decline in T-Bill yields will directly weaken the yield-generating capacity of stablecoins. How to construct a sustainable, compounding on-chain yield structure that can traverse interest rate cycles becomes key to future development. Therefore, future yield-bearing stablecoins will no longer rely on a single asset or static yield model but will shift towards:

- Introducing diverse RWAs, such as corporate bonds, real estate, carbon credits, etc., to achieve a mapping of real-world yields on-chain;

- Adding long-term U.S. Treasury (20-30 years) coupon locking mechanisms to build a stable yield curve across cycles;

- Implementing structured allocation and programmable cash flows through smart contracts to enhance capital efficiency and strategy flexibility.

Within this framework, stablecoin Alpha is no longer simply about "earning interest," but rather a structured arbitrage system encompassing real yields, mechanism design, airdrop points, and on-chain strategy combinations. Its long-term value will reflect how to build a stable yield platform that combines liquidity, security, yield, and portfolio flexibility.

For ordinary users, the key lies in identifying opportunities, controlling risks, and seizing early incentive windows; for institutions and professional investors, the true value of yield-bearing stablecoins is as foundational units of "on-chain programmable cash flows," serving as a critical bridge connecting off-chain yields with on-chain finance.

6. References

1. https://www.coingecko.com/en/categories/yield-bearing-stablecoins

2. https://app.artemis.xyz/stablecoins

3. https://www.stablewatch.io/

4. https://mirror.xyz/zhaotaobo.eth/GkbXo-qsNfYOcKiKscXc8f0XNP6Op2GDo7xJ1Cy-lg_

5. https://cn.cointelegraph.com/learn/articles/yield-bearing-vs-traditional-stablecoins

6. https://wallstreetcn.com/articles/3748334

7. https://docs.ethena.fi/how-usde-works

8. https://app.ethena.fi/dashboards/market-data

9. https://info.sky.money/rewards/0x38e4254bd82ed5ee97cd1c4278faae748d998865

10. https://foresightnews.pro/article/detail/67349

11. https://x.com/SkyEcosystem/status/1930373528060113063

12. https://ipfs.io/ipfs/Qmex5coqQPXqo4FvCkPqvKfH2ibBgACTsUV3YrTGaC86LQ

13. https://app.rwa.xyz/treasuries

14. https://ondo.finance/

15. https://foresightnews.pro/article/detail/51902

16. https://docs.ondo.finance/general-access-products/usdy

17. https://app.scallop.io/

18. https://app.naviprotocol.io/

19. https://lista.org/lending/market/0xd6df9bb9ed780d18239e6ddd7c6d17f3c9bee4443149a10ec70bf8ef2a93052f

20. https://x.com/taolige666/status/1926912344216523022

21. https://x.com/Nickpxxx/status/1922640215539343802_

22. https://x.com/DtDt666/status/1919024898577764451

23. https://x.com/CryptoLabsCN/status/1927329540696641553_

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。