Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $3.31 trillion, with BTC accounting for 64.8%, which is $2.14 trillion. The market cap of stablecoins is $252.7 billion, with a recent 7-day increase of 0.36%, of which USDT accounts for 62.47%.

This week, BTC's price has shown a fluctuating upward trend, currently priced at $108,000; ETH has shown range fluctuations, currently priced at $2,494.

Among the top 200 projects on CoinMarketCap, a small number have risen while most have fallen, including: SEI with a 7-day increase of 31.68%, PENGU with a 7-day increase of 19.47%, MOVE with a 7-day increase of 39.06%, and DOG with a 7-day increase of 22.29%.

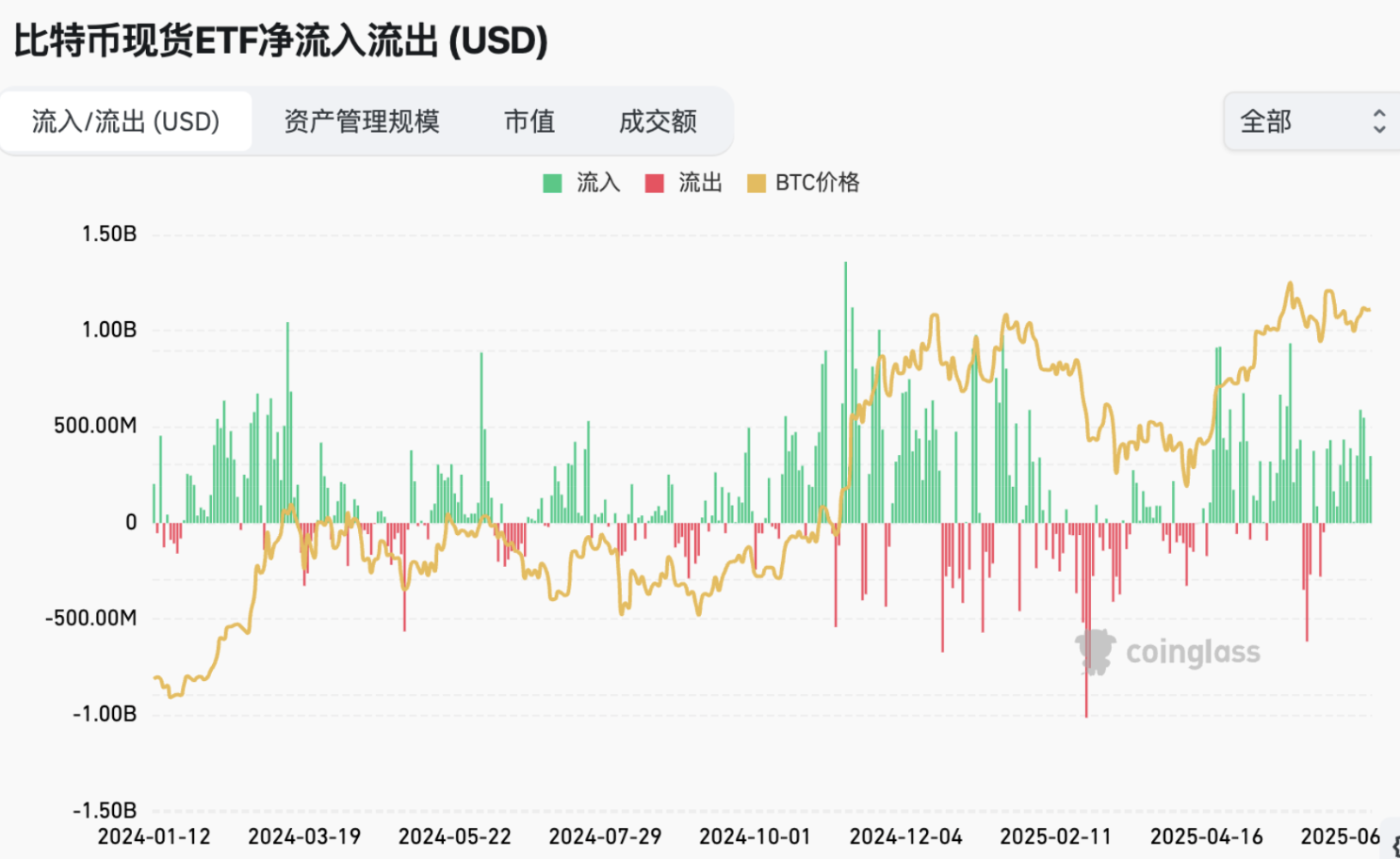

This week, the net inflow for the U.S. Bitcoin spot ETF was $2.216 billion; the net inflow for the U.S. Ethereum spot ETF was $283.8 million.

On June 27, the "Fear & Greed Index" was at 49 (higher than last week), with this week's sentiment being: 5 days neutral, 2 days fear.

Market Forecast:

This week, stablecoins continue to be issued, with significant net inflows into the U.S. Bitcoin spot ETF and net inflows into the Ethereum spot ETF. Both BTC and ETH maintain a fluctuating upward trend. The RSI index is at 47.9, indicating neutrality. The Fear & Greed Index is mainly neutral. This week, Federal Reserve Chairman Powell hinted in Congress that if data remains stable, a rate cut could be considered in the future, which boosted the market, bringing BTC prices back above $107,000.

This week, South Korea initiated a compliance amendment for digital assets, and more listed companies are beginning to follow Strategy in establishing BTC strategic reserves. The likelihood of a rate cut by the Federal Reserve in July is only 20.7%, but if PCE and other data remain stable, a rate cut may begin in September. Next week, BTC's price range is expected to be $103,000-$109,000, and it is currently recommended to accumulate small amounts on dips. In July, if there are no major macro policy impacts, the market will maintain a range-bound fluctuation until the U.S. stablecoin bill is officially issued in August or the Federal Reserve cuts rates, at which point the market may see significant increases. Next week, attention should be focused on U.S. tariff agreement policies.

Understanding Now

Review of Major Events of the Week

On June 23, Circle's total market capitalization has now surpassed the total market capitalization of its issued stablecoin USDC;

On June 24, U.S. President Trump stated that the announced ceasefire between Iran and Israel is "a wonderful day for the world." When asked how long the ceasefire would last, Trump said: "I believe the ceasefire is indefinite. It will continue indefinitely;"

On June 24, Binance founder CZ responded to a plan by a team of executives from a crypto hedge fund to raise $100 million through a publicly traded company they control to invest in BNB to establish a BNB version of MicroStrategy, stating that multiple companies are already making related attempts;

On June 23, Eyenovia, Inc. (NASDAQ: EYEN) announced today that it has signed a securities purchase agreement (SPA) with qualified institutional investors for a total of $50 million in a public equity private placement (PIPE);

On June 23, cryptocurrency trading platform OKX is considering an initial public offering (IPO) in the U.S. after returning to the U.S. market in April this year;

On June 24, Guotai Junan International announced that Guotai Haitong Group's subsidiary Guotai Junan International Holdings Limited (stock code: 1788.HK) has officially received approval from the Hong Kong Securities and Futures Commission on June 24 to upgrade its existing securities trading license to provide virtual asset trading services, as well as to provide advice based on virtual asset trading services. After the upgrade, customers can directly trade cryptocurrencies such as Bitcoin and Ethereum, as well as stablecoins like USDT on its platform;

On June 25, "SOL version MicroStrategy" DeFi Development Corp (formerly Janover) launched WIF validation nodes, planning to share WIF staking income and other validation node rewards with the community;

On June 26, Coinbase announced that it will soon launch American-style perpetual contracts (US Perpetual-Style Futures) on the Coinbase derivatives trading platform, which retains the core functions of global perpetual contracts while fully complying with U.S. regulatory standards;

On June 26, White House digital asset policy advisor Bo Hines confirmed that the U.S. is working on building the infrastructure for a strategic Bitcoin reserve;

On June 27, the startup Dinari, which provides blockchain-based U.S. stock trading services, has obtained broker-dealer registration for its subsidiary. The company stated that this makes it the first tokenized stock platform in the U.S. to receive such approval.

Macroeconomics

On June 25, Federal Reserve Chairman Powell stated that future trade agreements may allow the Federal Reserve to consider rate cuts. On June 25, the Mayor of New York City announced a cryptocurrency plan to adopt cryptocurrency for municipal service fee payments;

On June 26, Cboe BZX Exchange submitted a 19b-4 application to the U.S. Securities and Exchange Commission (SEC) for the Canary PENGU ETF;

On June 27, according to CME's "FedWatch": The probability of the Federal Reserve maintaining interest rates in July is 79.3%, while the probability of a 25 basis point rate cut is 20.7%. The probability of the Federal Reserve maintaining interest rates in September is 8.2%, while the cumulative probability of a 25 basis point rate cut is 73.3%, and the cumulative probability of a 50 basis point rate cut is 18.5%;

On June 27, South Korean Democratic Party member Min Byeong-deok today initiated an amendment to the "Capital Markets and Financial Investment Business Act," aiming to include digital assets (virtual assets) within the scope of financial investment products' underlying assets and trust property. This amendment will allow digital assets such as Bitcoin to serve as underlying assets for financial products like exchange-traded funds (ETFs), while also providing legal basis for trust companies to custody and manage digital assets. This move is one of President Yoon Suk-yeol's core campaign promises;

On June 26, Australian ASX-listed AI biotech company Opyl announced the launch of a Bitcoin treasury strategy to rescue its financial crisis. The company purchased approximately 2 BTC, valued at about $214,500, through the DigitalX Bitcoin ETF listed on ASX, supported by a non-dilutive loan from blockchain company SOL Strategies' chairman Tony G, with a maximum amount of $1.3 million and an annual interest rate of 6.5%. Opyl had only $64,000 in cash at the end of the first quarter;

On June 27, the UK-listed company Vinanz increased its holdings by 5.85 BTC, bringing its total holdings to 65.03 BTC, with an average purchase price slightly above $98,200;

On June 28, U.S. President Trump stated, "We can extend or shorten the July 9 deadline for the tariff agreement."

ETF

According to statistics, from June 23 to June 27, the net inflow of the U.S. Bitcoin spot ETF was $2.216 billion; as of June 27, GBTC (Grayscale) had a total outflow of $23.203 billion, currently holding $19.786 billion, while IBIT (BlackRock) currently holds $74.066 billion. The total market capitalization of U.S. Bitcoin spot ETFs is $135.266 billion.

The net inflow of the U.S. Ethereum spot ETF was $283.8 million.

Envisioning the Future

Event Preview

EthCC 8 will be held from June 30 to July 3, 2025, in Cannes, France;

IVS2025 KYOTO will be held from July 2 to 4, 2025, in Kyoto, Japan.

Project Progress

The fees for the Circle Paymaster function will be waived before June 30, which supports users in paying Gas fees using USDC on the Arbitrum and Base networks, charging users 10% of the Gas fee for each transaction;

The Ethereum Foundation's Devconnect scholar program application deadline is June 30, 2025, with the types of scholars including: Ethereum community organizers, legal and public sector professionals, journalists, artists, and developers and other builders, totaling 100;

After approval at the shareholders' meeting on June 30, Hokuriku Spinning plans to launch its cryptocurrency business in early July, intending to hold Bitcoin and issue independent tokens;

The decentralized AI market Lightchain AI mainnet will launch in July;

The Web3 social platform Noice announced the distribution plan for 20 billion noice community pool tokens, with the first airdrop starting on July 4, distributing 10% (2 billion tokens) of the community pool, followed by four more airdrops each month until November.

Important Events

Nigeria's SEC new crypto marketing rules will take effect on June 30, requiring VASPs and KOLs to obtain approval for promotions, and cryptocurrency influencers must obtain "no objection authorization" from the Nigerian Securities and Exchange Commission before publishing digital asset advertisements. Non-compliance may result in penalties, such as a minimum fine of 10 million Nigerian Naira (approximately $6,400) or a maximum of three years in prison;

California's "Digital Financial Assets Act" imposes stricter regulations on businesses engaging in cryptocurrency activities, requiring individuals and companies to obtain a license from the Department of Financial Protection and Innovation (DFPI) to conduct digital financial asset business. The act requires licensees to retain records for five years, including at least a monthly maintained general ledger listing all assets, liabilities, capital, income, and expenses;

July 4, 2026, marks the 250th anniversary of the signing of the U.S. Declaration of Independence.

Token Unlocking

Optimism (OP) will unlock 31.34 million tokens on June 30, valued at approximately $16.85 million, accounting for 1.79% of the circulating supply;

Sui (SUI) will unlock 44 million tokens on July 1, valued at approximately $117 million, accounting for 1.39% of the circulating supply;

dYdX (DYDX) will unlock 4.16 million tokens on July 1, valued at approximately $2.02 million, accounting for 0.56% of the circulating supply;

EigenLayer (EIGEN) will unlock 1.29 million tokens on July 2, valued at approximately $1.43 million, accounting for 0.41% of the circulating supply;

Ethena (ENA) will unlock 40.63 million tokens on July 2, valued at approximately $10.53 million, accounting for 0.67% of the circulating supply;

IOTA (IOTA) will unlock 8.63 million tokens on July 4, valued at approximately $1.35 million, accounting for 0.22%.

About Us

Hotcoin Research, as the core investment research hub of the Hotcoin ecosystem, focuses on providing professional in-depth analysis and forward-looking insights for global cryptocurrency investors. We have built a "trend analysis + value discovery + real-time tracking" integrated service system, offering in-depth analysis of cryptocurrency industry trends, multi-dimensional assessments of potential projects, and round-the-clock market volatility monitoring. Combined with our weekly dual updates of the "Hotcoin Selected" strategy live broadcast and the "Blockchain Today" daily news brief, we provide precise market interpretations and practical strategies for investors at different levels. Leveraging cutting-edge data analysis models and industry resource networks, we continuously empower novice investors to establish cognitive frameworks and assist professional institutions in capturing alpha returns, collectively seizing value growth opportunities in the Web3 era.

Risk Warning

The cryptocurrency market is highly volatile, and investment carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。