Author: Will Awang, Web3 Lawyer

We have to say that Tether CEO Paolo Ardoino, as a king in the world of stablecoins, is very humble, but he has ambitious plans for the continued development and dominance of Tether. In this digital new era, we have just witnessed the landmark stablecoin bill in the United States passing in the Senate. In the coming months, it will be sent to Trump’s desk for signing.

Amid the Circle IPO frenzy, we have been pondering where the next battleground for stablecoins will be.

In particular, the Genius stablecoin bill's definition of "payment stablecoins" will shift the battleground from the crypto market to real-world payment settlement scenarios.

Bankless has timely launched an interview program with Tether CEO Paolo Ardoino, revealing the understanding of stablecoin king Tether USDT on this matter, which is highly instructive. Here, we find facts overshadowed by the Circle IPO frenzy, as well as the national will for the expansion of on-chain dollars. Paolo's analysis of the stablecoin business model, target market advancement strategies, and Tether's investment logic are blind spots that current stablecoin educational reports fail to cover, and they are also the content that we, as Web3 payment practitioners, need to genuinely care about.

Key Points

Stablecoins have vastly different application scenarios in the U.S. and other parts of the world, and the current stablecoin business model in the U.S. seems difficult to succeed.

The U.S. is one of the most efficient markets for capital flow globally, with financial channel efficiency reaching 90%. The introduction of stablecoins could potentially increase efficiency from 90% to 95%, leaving very limited premium space. In contrast, in other parts of the world, the introduction of stablecoins can provide a 30%-40% increase in financial efficiency. Therefore, the significance of stablecoins is much greater for these countries.

With 3 billion people globally still unbanked, and Tether currently covering 450 million users, the opportunities here are enormous, and there is much work to be done. Thus, Paolo emphasizes the importance of distinguishing between these two different products and application scenarios.

Deepening into Asia, Africa, and Latin America, investing in infrastructure, and innovating distribution channels for deep penetration into emerging markets are key to Tether maintaining its leading position in the stablecoin field. Tether is not only technologically advanced but has also established an unprecedented dollar distribution network globally, which is one of Tether's least known advantages.

Less than 40% of Tether's market capitalization is related to the cryptocurrency market. In other words, over 60% of market cap growth actually comes from the grassroots use of USDT in emerging markets. The next driver of USDT market cap growth may come from commodity trading.

Users are not interested in the blockchain itself. What they care about is one thing—fees need to be low, almost zero.

User: I understand Bitcoin, but I still prefer to use USDT.

1. About the Genius Stablecoin Bill

The U.S. Senate has just passed the Genius stablecoin bill, and President Trump eagerly tweeted: "Get the bill to our desk ASAP, we will gain a comprehensive advantage in the digital asset market!"

1.1 The Stablecoin Bill for Tether

The bill is undoubtedly a great boon for onshore stablecoin issuer Circle, but how does offshore stablecoin issuer Tether view the Genius bill?

Paolo stated that Tether, as a pioneer in the stablecoin industry, has been committed to promoting the development of this field since its inception in 2014. This concept was hardly cared for in the first decade. The process has not been easy. We built a brand new industry from scratch, which naturally created friction with the traditional financial system and encountered many obstacles, especially from the banking system. But our team has never backed down, always believing in providing dollars for those excluded from mainstream finance.

For Paolo personally, this is also the first time he has truly stepped into the U.S.—at the age of 40. In recent years, regulatory actions like "Chokepoint 2.0" have been very unfavorable for Tether, but recently, in communications on Capitol Hill and with executive agencies, he has felt a change in attitude.

Now, seeing the world's most powerful country and government beginning to pay attention to and legislate stablecoin technology, the Tether team feels honored and encouraged. The GENIUS bill is an important step in the right direction, and although the bill still needs to pass the House of Representatives, the momentum looks good. Tether looks forward to seeing its final version to continue advancing potential stablecoin plans in the U.S.

The Genius bill builds a strong framework for U.S. onshore stablecoins and offshore stablecoins like USDT to meet regulatory requirements through corresponding systems. Paolo believes that as an offshore stablecoin issuer, USDT is already in a favorable position regarding compliance.

The GENIUS bill sets a high compliance threshold, which Paolo sees as very fair and commendable, especially in terms of anti-money laundering and compliance. Tether has been actively cooperating with law enforcement agencies around the world, and they have established partnerships with over 250 law enforcement agencies from more than 55 different countries, a number far exceeding that of other financial institutions. At the same time, Tether has built its own monitoring technology, which can effectively identify secondary market activities in the blockchain ecosystem and promptly notify law enforcement.

Bankless previously communicated with Senator Bill Hagerty, a co-drafter of the GENIUS bill, specifically inquiring about Tether. Senator Bill Hagerty stated that if offshore issuers like Tether want to enter the U.S. market, the bill allows the Treasury to conduct comparability tests. If the rules in Tether's country are consistent with those in the U.S., then Tether can continue to operate. Otherwise, Tether needs to establish a subsidiary in the U.S. that must meet the same reserve and disclosure standards as other companies. Senator Bill Hagerty also mentioned that Tether could immediately begin complying with these regulations.

Paolo believes that Senator Bill Hagerty's viewpoint is correct, as the GENIUS bill provides a pathway for offshore issuers to achieve mutual benefits by establishing similar management systems. He pointed out that countries must establish corresponding systems, and the GENIUS bill will set an example for other countries. Once the U.S. passes the GENIUS bill, other countries will follow suit, paving the way for the development of the global stablecoin industry.

1.2 Tether's Response

Bankless hopes to learn from Paolo about Tether's plans following the passage of the GENIUS bill, as Tether currently seems to face multiple development directions, whether offshore/onshore operations or issuing new stablecoins onshore.

A. Strong Profitability

In this regard, Paolo stated that Tether is confident in meeting the requirements of the GENIUS bill, especially for USDT. He noted that Tether achieved a profit of $13.7 billion last year and is expected to exceed that number this year. He emphasized that even with only $155 billion in assets, Tether can generate about $7.5 billion in revenue at current interest rates. Additionally, Tether is making other investments, including in gold and Bitcoin, which are expected to further increase returns.

B. Huge U.S. Treasury Reserves

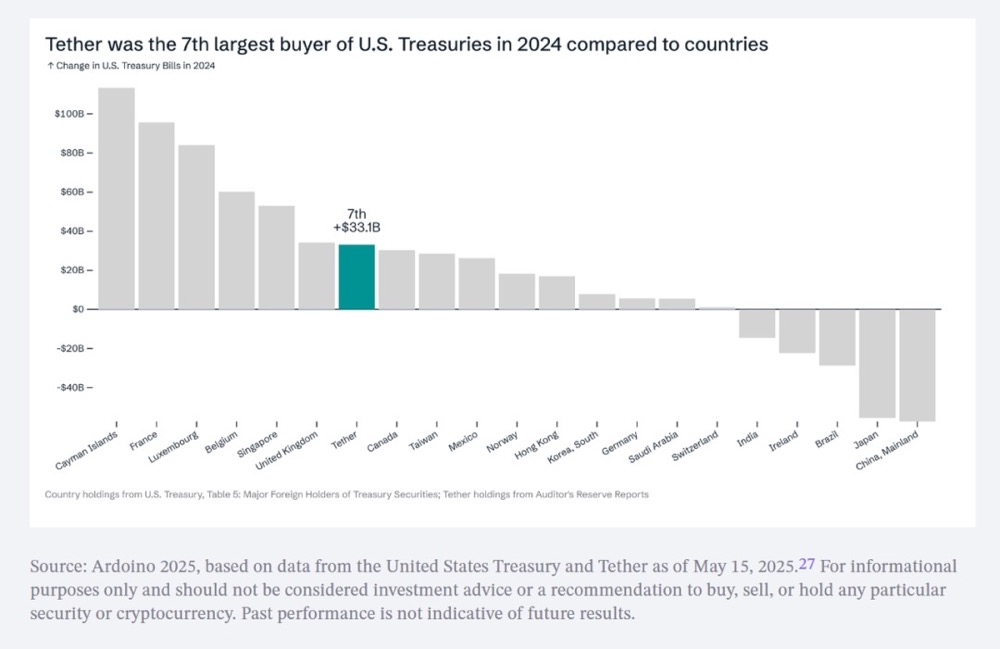

Paolo questioned those who believe Tether cannot meet the bill's requirements. He pointed out that Tether not only has strong profitability but also performs outstandingly in purchasing U.S. Treasury bonds. He revealed that last year, Tether was the fifth-largest buyer of U.S. Treasury bonds, and among all non-state entities, Tether was the 18th largest holder. He believes that the power of stablecoins lies in their support for the U.S. economy, and the president is well aware of this.

Tether's funds are held at "Cantor Fitzgerald" in the U.S., which is a leading financial institution in the country. Tether holds over $120 billion in U.S. Treasury bonds at this institution, indicating that Tether is not hiding its funds but is conducting transparent financial operations in the U.S. Paolo emphasized that this method of fund storage aligns with the spirit of the GENIUS bill. Because these institutions have direct connections with the Federal Reserve, Tether also engages in overnight reverse repos and repurchase agreements. This means that even in the face of tens of billions of dollars in redemptions, Tether can easily cope and meet these demands without any issues.

Paolo believes that the brilliance of this fund storage and operation model lies in its ability to ensure that Tether can operate stably even under immense redemption pressure. He is confident that this government and the GENIUS bill will help solidify the entire industry, providing Tether and other stablecoin issuers with a clearer and safer operating environment.

Furthermore, he emphasized that compared to anything else, the strongest aspect of USDT is that it focuses on the offshore market, meaning that when offshore users purchase USDT, Tether uses those funds to buy U.S. Treasury bonds, thereby diversifying the ownership of U.S. debt and reducing the risk of a single-point sell-off. He believes that it is more ideal for U.S. Treasury bonds to be held by foreign individuals; otherwise, it could lead to catastrophic consequences.

C. Robust Balance Sheet

Tether is confident in meeting the compliance requirements proposed in the GENIUS bill, as they believe they have the capability to perform better in this regard than other institutions. Tether understands the importance of having a strong balance sheet to avoid a repeat of incidents like Terra-Luna. Currently, Tether holds over $125 billion in government bonds, and this number continues to grow to ensure the stability of the stablecoin's value.

From an equity perspective, the Tether group currently has approximately $176 billion in assets, while the market capitalization of its stablecoin is $155 billion. They strictly maintain a single reserve above the stablecoin, meaning that on top of the 100% reserves for the USDT stablecoin, they have set aside an additional approximately $6 billion. In contrast, traditional banking systems typically adopt a fractional reserve system, retaining only about 10% of liquid assets. Tether, however, has about 105% of liquid assets as reserves for its stablecoin, in addition to $15 billion in group equity as a supplement, making this strong reserve model unprecedented in the industry.

1.3 After the Passage of the Stablecoin Bill

Paolo believes that if the Genius bill passes in its current form, it will bring numerous opportunities for Tether and the entire industry. He pointed out that over the past four years, the industry faced the "Operation Chop Point 2.0" initiative, where government departments like the OCC held an opposing stance towards cryptocurrencies, limiting the development of crypto-friendly banks. This was also one of the reasons for the collapse of Silicon Valley Bank and Silvergate Signature, which nearly stifled Tether's competitor Circle.

However, the Trump administration is now building a framework to support crypto-friendly banks, which will enhance the security of the entire industry, and Tether is looking forward to this. Recently, Federal Reserve Chairman Powell stated: Banks can provide banking services to the cryptocurrency industry and engage in related businesses, provided that the safety and soundness of the financial system are ensured.

Numerous banking consortiums, such as JP Morgan, and companies like Amazon and Walmart have announced intentions to create stablecoins. In Paolo's view, the more intense the competition, the better, as it will drive technological advancement, improve efficiency, and reduce costs.

For markets outside the U.S., Paolo hopes to see more countries adopt legislative frameworks similar to the GENIUS bill. He pointed out that Europe's MICA compliance requires stablecoin issuers to hold at least 60% of their assets in uninsured cash deposits in banks. This sharply contrasts with the U.S. GENIUS bill, which requires stablecoin reserve assets to be in U.S. dollars or U.S. Treasury bonds. Paolo believes this requirement is more robust in the U.S. because the deposit insurance limit is $250,000, while in Europe, it is €100,000. He mentioned that if stablecoin companies have 60% uninsured cash deposits, it poses a significant risk, especially in the event of bank failures.

In addition to the U.S. and Europe, other regions are also actively advancing stablecoin legislation. For example, Hong Kong has passed the Stablecoin Bill. Singapore also released a stablecoin regulatory framework in 2023. These legislative advancements indicate that a global consensus on stablecoin regulation is gradually forming, and the GENIUS bill may serve as a reference template for legislation in other countries.

Paolo believes that the GENIUS bill provides a clear regulatory framework for the stablecoin market, particularly with more robust requirements for reserve assets. He hopes that Europe can learn from the U.S. experience and adjust its legislative requirements to promote the healthy development of stablecoins. At the same time, he also looks forward to other countries adopting similar legislative frameworks to drive the unification and standardization of the global stablecoin market.

1.4 Europe's Attitude Towards Euro Stablecoins and CBDCs

Bankless asked Paolo whether Europe is more inclined to develop a digital currency led by the European Central Bank rather than allowing private enterprises to launch stablecoins like in the U.S. Paolo believes that Europe may fully implement CBDCs, but he is cautious about this.

Paolo pointed out that Europe is concerned about the popularity of dollar stablecoins, fearing that the dollar may replace the euro's international status. He mentioned that if people are randomly asked outside of Europe whether they prefer their local currency or the dollar, most would choose the dollar. In contrast, the euro has lower recognition and acceptance outside of Europe. Therefore, Europe is trying to maintain the status of its currency through protectionist measures.

Paolo expressed concerns about CBDCs, particularly regarding privacy and freedom issues. He noted that currently, in credit and debit card transactions, banks act as intermediaries, providing a layer of separation between individuals and the state, protecting personal privacy. The state cannot track you or geolocate every transaction you make. For example, if you spend digital euros at a bar in Milan, the central bank would know. He believes this is excessive. Sometimes, we see Europe becoming irrational and deciding that freedom of speech is no longer an option and should be curtailed, among other things.

However, with the use of CBDCs, central banks would be able to track every transaction, which could lead to excessive infringement on personal privacy. He emphasized that this excessive monitoring could be used to restrict freedom of speech and other fundamental rights. If you control people's money, you may ultimately use that power to seek compliance from them.

Paolo believes that part of the motivation for Europe to implement CBDCs is to counter the popularity of dollar stablecoins and protect the euro's international status. However, he worries that this approach may sacrifice personal privacy and freedom. He hopes that Europe can be more open to accepting innovations from the private sector rather than overly relying on central bank digital currencies to achieve its goals.

1.5 About Circle IPO

Bankless mentioned Circle's stock performance after its initial public offering (IPO), rising from an issue price of $31 to $300. He saw some analyses on Twitter suggesting that if Tether were to achieve a similar valuation, it would reach approximately $3 trillion. He asked Paolo for his thoughts on Circle's stock performance.

Paolo responded that Tether currently has no plans to go public. He explained that companies typically choose to go public for two main reasons: one is the need for capital, but Tether is highly profitable and does not require external funding; the second is to provide an exit mechanism for shareholders, but Tether currently does not need to consider shareholder exits. He emphasized that Tether's profitability not only supports the company's operations but also enables them to make large-scale investments. Over the past two years, Tether has invested over $5 billion in the U.S., a fact that is often overlooked but is crucial for the company. They are committed to giving back to the U.S.—the country that created the great currency of the dollar.

Paolo also mentioned that going public is usually aimed at obtaining cheap capital or meeting shareholder exit demands, neither of which Tether needs. He himself has no intention of leaving the company, as there is still much development potential and many areas to prove. Under the concept of USDT, there are many different verticals and industries to explore, and they are committed to serving the interests of the people in a disruptive way, rather than just for the benefit of a few enterprises.

Although Tether currently has no plans to go public, Paolo acknowledged that from a valuation perspective, Circle's stock performance is indeed impressive. He believes that if Tether's valuation could reach a similar level, it would be a very good outcome. However, he also stated that they will focus on the sustainability of this valuation level, but in any case, this is a positive signal for Tether.

II. Stablecoin Business Models

Despite the visible excitement surrounding the Circle IPO and many large companies preparing to issue their own stablecoins, Paolo believes that stablecoins have vastly different application scenarios in the U.S. and other parts of the world, which may be a somewhat controversial viewpoint.

2.1 Business Models in Different Scenarios

He pointed out that the current stablecoin business model in the U.S. seems difficult to succeed. Although Circle's IPO has garnered widespread attention in the U.S., in fact, it is nearly impossible to profit from stablecoins in the U.S. All these competitors will focus on the U.S. market, where profits are easier to obtain, as it is readily available to them. However, in his view, the U.S. stablecoin market is caught in a race to the bottom.

A. Rate Competition Compresses Profitability

Paolo reviewed the development history of cryptocurrency exchanges. Around 2010, exchanges began to rise, and at that time, Bitfinex charged a fee of 20 basis points per transaction. However, today, as a taker, the trading fee is only one basis point, a significant decrease compared to ten or twelve years ago, reflecting the intense competition in the market and leading to a decline in profitability.

B. Capital Efficiency Improvement

The U.S. is one of the most efficient markets for capital flow globally, with financial channel efficiency reaching 90%. If stablecoins are introduced in the U.S., efficiency could potentially increase from 90% to 95%, but the premium space brought by this improvement is very limited. In contrast, in other parts of the world, such as countries like Nigeria, Argentina, or Turkey, the efficiency of financial channels may only be around 10%-20%. The introduction of stablecoins could improve efficiency to 50%, meaning an increase of 30%-40%. Therefore, stablecoins are of greater significance for these countries. In emerging markets, people are more willing to accept lower interest rates because the daily volatility of their local currency is much higher than the 4% yield that Tether can provide annually.

To some extent, the red ocean competition in the global north may be beneficial for Tether's profitability, but from the perspective of industry development and end users, this is not a good thing. Because theoretically, the market should have more competitors emerging to further enhance efficiency and reduce costs. At the same time, Paolo also pointed out that there are numerous opportunities globally, as there are still 3 billion people without bank accounts, while Tether currently covers 450 million users, presenting enormous opportunities and much work to be done.

Regulatory frameworks should also take this into account and provide appropriate protections for offshore issuers like USDT. USDT is a foreign stablecoin for the U.S., but its importance remains undiminished, and it is even more crucial for maintaining the global status of the dollar and purchasing U.S. Treasury bonds.

Therefore, Paolo emphasizes the importance of distinguishing between these two different products and application scenarios. In the U.S., stablecoins may evolve into tokenized money market funds, similar to what he mentioned with JPMD. Other stablecoins will also develop in this direction, with returns primarily going back to users.

For Tether, the onshore US dollar stablecoin they plan to create needs to compete on different levels, particularly in programmability and services, rather than competing with the business model of USDT, which is designed specifically for foreign markets.

2.2 Tether's Competitive Advantages

Bankless stated that the competition in the domestic stablecoin market in the U.S. will be very intense in the future. There is increasing discussion about U.S. stablecoin issuers, with companies like Amazon, Walmart, and even Meta and Twitter rumored to be launching stablecoins. Additionally, large banks such as JPMorgan, Citigroup, and Wells Fargo are exploring alliance stablecoins. If large banks in the U.S. can mint tokenized deposits and settle with the Federal Reserve's assets, he wonders what competitive advantages (moats) Tether will have left in five years after this situation becomes common domestically.

Paolo responded that Tether's distribution partners and its own distribution network still have tremendous potential. He also pointed out that banks typically only sell their stablecoins to their own customers and do not actively promote stablecoins on the streets like Tether does, educating ordinary people, especially those with low to middle incomes.

He emphasized that when Tether enters a new country, they do not directly seek partnerships with the largest local banks like their competitors. Instead, they go deep into the streets for grassroots education and promotion. They visit households to find local partners who share their vision, starting from the grassroots to promote their products. This bottom-up promotion approach has always been their method.

Despite the advanced financial infrastructure in the U.S., Paolo mentioned that he has seen reports indicating that many people struggle to maintain bank accounts. Therefore, he believes that more and more people in the U.S. will benefit from Tether's products, as Tether's offerings communicate in a more direct and relatable way with people, rather than from a high and mighty perspective, thinking the world is the same as it was 20 years ago.

III. How to Win the Next Phase of Stablecoins

As we discussed in the previous article, Arthur Hayes told us about Bitfinex and Tether's joint creation of the USDT product, — people need to bypass the banking system to create a digital dollar that is free, accessible, and liquid 24/7.

In this crypto-native world, Tether has already achieved victory in the first phase of stablecoins.

With the advancement of the GENIUS bill, the stablecoin industry is about to enter its second phase, where the key to stablecoins lies in distribution. As a pioneer in the industry, Tether has established a strong crypto-native distribution channel. Bankless asked Paolo how Tether will continue to win in the second phase of stablecoins in the face of these new competitors.

3.1 Distribution Network from an Investment Perspective

Paolo responded that, first, based on his understanding of the GENIUS bill, large tech companies like Meta may find it difficult to launch their own stablecoins, as there seems to be some prohibition in the bill restricting non-financial companies from issuing stablecoins. He believes these large tech companies may need to collaborate with existing stablecoin providers or small banks to support other stablecoins and gain revenue sharing. Paolo emphasized that although companies like Meta have a large user base, they may face restrictions in stablecoin issuance.

Secondly, regarding distribution channels, Paolo pointed out that Tether has invested in over 100 companies using its own funds rather than reserve funds, which has brought profitability to Tether and established a wide distribution network. Tether has built strong physical touchpoints in regions like Africa, Central America, and South America, covering millions of entities, which is one of the key factors for their success.

Paolo elaborated on Tether's innovative projects in Africa, where they are building information kiosks equipped with solar panels and charging batteries to address local power shortages. These kiosks offer subscription services at a price of 3 USDT per month, with approximately 500,000 users and 10 million battery replacements to date. By the end of 2026, Tether plans to have 10,000 kiosks, increasing to 100,000 by the end of 2030, covering about 30 million households and averaging coverage for 120 million people in Africa. This initiative not only provides electricity to local residents but also enables them to use USDT for daily transactions.

Paolo believes that this innovative distribution channel and deep penetration into emerging markets are key to Tether maintaining its leading position in the stablecoin space.

He emphasized that Tether is not only technologically advanced but has also established an unprecedented dollar distribution network globally, which is one of Tether's least recognized advantages.

3.2 The Pandemic as a Catalyst

Bankless found that Tether's estimated total user base has reached 440 million, with these users actually transacting in dollars. They believe the entire U.S. has overlooked this use case. They curiously asked Paolo how the market expansion and distribution in the first phase occurred, as it cannot solely rely on the narrative of emerging markets.

Paolo responded that, unfortunately, the success of USDT is not because we did particularly well, but because many countries' economies are in terrible shape. Taking Turkey as an example, with an annual inflation rate of 50% and an 80% depreciation of the local currency against the dollar over the past few years; Argentina is even worse, with its currency depreciating by over 90% and multiple defaults. USDT provides a hedge for these countries.

It was the global pandemic that significantly changed Tether's user growth trajectory. He mentioned that in 2020, Tether's market capitalization was only $4.7 billion, and it wasn't until 2022 that Tether truly formed a marketing team. Therefore, the growth during the period from 2020 to 2022 was bottom-up, resulting from natural user growth.

Paolo explained that emerging markets in developing countries share three common characteristics:

These countries are relatively poor;

They have high inflation rates, far exceeding those of wealthy countries;

These countries have high smartphone penetration, a high level of digitization, and a young demographic.

From 2017 to 2020, it was these young people who first encountered and understood cryptocurrencies. When the pandemic broke out in 2020, the situation changed. The pandemic accelerated the rise in global unemployment rates, especially in emerging markets, where rising unemployment exacerbated inflation.

During the pandemic, people became increasingly fearful and rushed to the streets to buy cash in dollars. For example, in Argentina, when the pandemic began, the Argentine peso started to depreciate, and people feared unemployment and being unable to work, so they went out to buy cash in dollars on the black market. However, in 2020, these young people saw their parents risking going out to buy dollars during the pandemic. The children would ask their parents why they were risking going to the black market to buy dollars when they already had dollars in their cryptocurrency wallets. This phenomenon became particularly evident during the pandemic.

Paolo emphasized that this phenomenon is particularly pronounced in emerging markets because the economic conditions in these countries are relatively fragile. In Europe and the U.S., while there are also issues, the overall situation is still better than in emerging markets. When people face economic difficulties and families are at risk, they will do everything possible to protect their loved ones. This is why people found ways to hold and acquire dollars through local exchanges, Binance, and other platforms.

And these young people, who are familiar with cryptocurrencies and willing to try new things, became the key driving force behind this trend. Through word of mouth, one parent tells another parent that they bought dollars on this app, and this phenomenon gradually spreads.

3.3 The Next Driving Force for Growth

Bankless asked Paolo whether there is a correlation between Tether's market capitalization and the total market capitalization of the entire cryptocurrency market. He pointed out that before 2022, Tether's market capitalization experienced massive accelerated growth, followed by a market downturn.

Paolo responded that according to their statistical analysis, less than 40% of Tether's market capitalization is related to the cryptocurrency market. In other words, over 60% of the market capitalization growth actually comes from the grassroots use of USDT in emerging markets. He emphasized that the application of USDT in these markets occurs naturally, rather than through Tether's direct promotion.

Paolo further pointed out that the next driving force for USDT's market capitalization growth may come from commodity trading. He mentioned that almost all the largest commodity traders are contacting Tether because USDT is a very attractive solution for them. In international trade, relying on the slow processes of banks leads to inefficient capital use, while USDT can significantly improve transaction efficiency.

For commodity traders, USDT provides a fast and efficient payment method. Since commodities often come from emerging markets, traders need to ensure that sellers receive payments as quickly as possible so they can continue with the next transaction. Therefore, USDT is an ideal choice for both buyers and sellers.

Paolo also mentioned a specific example where stores in Santa Cruz, Bolivia, and other towns have started labeling prices in USDT. He emphasized that all of this is happening naturally, and Tether has not conducted any promotional activities in Bolivia. This indicates that the acceptance and usage of USDT in emerging markets are naturally growing, which will provide sustained momentum for Tether's market capitalization growth.

3.4 Dollar Expansion Under Geopolitics

So how should we understand Tether's role in the current geopolitical landscape, especially regarding the expansion of "Western values"?

Paolo: In my view, money is the ultimate social network, and the changes driven by Tether have a threefold impact.

First, what Tether is doing in financial inclusion is more effective than many international organizations, NGOs, and even charitable institutions. This shocks me—if a small company can do what they have failed to achieve for decades, then they really need to reflect. We are genuinely bringing financial services to billions of people who are still excluded globally.

Second, Tether is expanding the global use of the dollar, promoting dollar hegemony. This is not an exaggeration; we have established millions of offline touchpoints in emerging markets, from convenience store networks in Central America, phone recharge points, and newsstands to rural markets in Africa, where we have direct contact with them. These distribution channels can also be used for financial education and even selling other products.

Third, Tether is building its own energy and financial infrastructure in Africa. In this continent with extremely low electricity coverage—where 600 million out of 1.4 billion people have no electricity at home—we are creating solar-powered financial service kiosks. In these small villages, Tether's kiosks provide rechargeable batteries for just 3 USDT per month. Residents learn how to set up USDT and Bitcoin wallets through these kiosks, enabling savings and transfers. We have deployed 500 such kiosks in Africa, with 500,000 users and 10 million battery replacement records. By 2026, we expect to expand to 10,000 kiosks, and by 2030, to 100,000, covering approximately 30 million African households. This is not just financial distribution; it is the distribution of light. We aim to illuminate the heart of the African continent, creating a network that can be seen from space.

3.5 What Do Users Really Care About?

Paolo: Users are not interested in blockchain itself. What they care about is one thing—low fees, almost zero.

We once recommended some digital wallets from our partners to users and encouraged them to deposit USDT into these wallets. However, we noticed a phenomenon: many wallets were marketing various flashy features to users, such as investing USDT in other cryptocurrencies, participating in staking, or purchasing NFTs. While these features may seem rich, they could expose users to unnecessary risks, which is extremely detrimental to household savings.

In light of this, Tether decided to step in and create a wallet that truly centers on the savings experience, tailored for these markets. We are developing an open-source SDK called the Wallet Development Kit (WDK), which will allow anyone to develop wallets based on it. The wallet's interface is designed to be extremely simple, containing only two accounts: one is a USDT daily account for users' everyday payment needs; the other is a savings account where users can deposit Bitcoin and connect to decentralized yield protocols to earn returns. While we provide developers with the flexibility to add new features, the default version will be a minimalist design for African users, aimed at providing the most basic and practical functions.

In terms of collaboration, we are closely working with Opera's MiniPay team and are actively seeking more partners to jointly promote the development of this project.

Tether has been actively engaged in Bitcoin education globally. However, in these markets, we often hear feedback like: “I understand Bitcoin, but I still prefer to use USDT.” This is not because people are ignorant, but because they do not have enough time or resources to deeply understand Bitcoin. Many "Bitcoin extremists" often overlook this point, mistakenly believing that everyone in the world has the time and ability to study cryptocurrencies, but that is not the case.

Therefore, we decided to start with USDT, which users are familiar with and trust, to establish a relationship of trust first, and then gradually guide them to engage with Bitcoin. Education is a long-term battle that cannot rely solely on verbal promotion but must be realized through practical actions. Tether is investing significant funds and resources on the ground to actively advance this educational process, aiming to enable more people to safely and stably use digital assets for savings.

IV. Tether Ventures Investment Logic

Tether has earned about $20 billion in the past two to three years. Less than 5% of that is distributed to shareholders. Our idea is to keep most of the funds within Tether's investment department. As you mentioned, part of the excess reserves is used for over-collateralization of stablecoins, but the remaining approximately $14 billion or more is now being invested in various ways.

Tether Ventures has made many investments across different fields, including Layer 1 chains designed specifically for Tether (such as Plasma and Stable), mobile networks, telecom networks, energy startups, media tech companies, and even an Italian football team. Bankless asked Paolo about Tether Ventures' investment strategy.

4.1 Tether's Investment Layout

Paolo responded that Tether's portfolio is very broad, covering different verticals. He explained that a good portfolio should include conservative and stable assets, and Tether is no exception. In addition to purchasing traditional assets like Bitcoin (Tether Group currently holds over 100,000 Bitcoins) and gold (Tether Group currently holds 80 tons of gold), Tether has also started investing in land and agricultural companies. For example, Tether invested in Adecoagro, a company with a large amount of land in South America, primarily engaged in dairy products, bioethanol, rice, and livestock products. Paolo pointed out that land is a scarce and safe asset that historically appreciates slowly. Additionally, agriculture is closely related to commodity trading, and Tether's stablecoin USDT has potential application value in commodity trading.

What I said about commodity trading and USDT can also apply to agricultural products. Therefore, USDT and stablecoins, in general, will also accelerate the efficiency of agricultural companies in obtaining capital, while also speeding up the payment for the goods they produce. So this is a very interesting combination between the two. Then Tether has another area, which is new technology. Artificial intelligence is one of them.

Paolo also mentioned Tether's investments in new technologies, particularly artificial intelligence. Tether is building its own peer-to-peer AI platform, QVAC, aimed at making AI more accessible to people and capable of running on various devices, from low-end smartphones to high-end servers. Additionally, Tether has invested in brain-computer interface technology company Blackrock Neurotech, which Paolo believes is crucial for humanity to maintain an edge in competition with AI and robots.

Tether has also invested in Northern Data, a leading AI infrastructure company with over 24,000 H100 GPUs and its own AI R&D team. We are also developing a P2P inference and federated learning platform called "CUAC," inspired by Isaac Asimov's short story "The Last Question," which poses an ultimate question: "Can entropy be reversed?" The philosophy behind this is that if one day we want AI to answer this question, it must become part of the structure of the universe, rather than a data center system controlled by a centralized company.

Regarding Tether's investment in the Italian football team Juventus, Paolo stated that while this investment represents a small portion of Tether's portfolio, as fans of Juventus, they see the potential for global promotion through the football club. Juventus has fans all over the world, providing Tether with a unique distribution channel. Tether can also help Juventus achieve its football goals. We have a global digital and physical distribution network that can promote Juventus' brand worldwide. Additionally, many of the technology companies we invest in can also support Juventus.

Overall, Tether Ventures' investment strategy is diversified, aiming for long-term growth and stability through different verticals. These investments include not only traditional financial assets but also opportunities in emerging technologies and global market promotion.

4.2 Core Logic of Investment

Bankless: When evaluating potential investments, is distribution a primary consideration, and is every investment centered around distribution?

Paolo answered affirmatively, stating that distribution is indeed a key factor in their investment evaluation.

For example, Tether invests in digital distribution networks, such as Rumble, which is a video platform with 70 million users. An interesting fact is that Rumble's creators sold $850 million worth of gold between 2023 and 2024. Imagine the opportunity if Rumble launched a wallet supporting Bitcoin and Tether Gold! So we hope to combine this digital infrastructure with asset distribution.

He further explained that even in the field of artificial intelligence (AI), they see tremendous potential. He predicts that in the next 15 years, there could be a trillion AI agents, and each AI agent should have a non-custodial wallet. He doubts that these AI agents will open accounts at traditional financial institutions like the Federal Reserve or JPMorgan, which is why Tether is developing a wallet development toolkit called WDK. This toolkit will be completely open-source, allowing anyone to build a complete non-custodial wallet, with Tether not holding any keys, enabling users to freely create any model they want, and Tether will support all different blockchains.

Paolo continued to elaborate on their vision, hoping to create a seamless user experience by integrating their AI platform. He used a smart refrigerator as an example, which could display a QR code connected to a non-custodial wallet. Users could load the refrigerator with, say, $50, and the refrigerator would automatically purchase groceries. He emphasized that he does not want the money in the refrigerator to exist on a third-party payment platform like PayPal, as that is not the user experience he envisions.

He also looked to the future, imagining that even devices like light bulbs could be equipped with very small AI capable of automatically adjusting optimal power and lighting based on the environment. He believes achieving such future goals requires support from local AI, rather than connecting every device to a centralized server like ChatGPT, as that would lead to server overload and high latency. Therefore, providing wallet support for local AI is very important, and if this wallet includes stablecoins, that would be even better.

V. On Blockchain, Wallets, and Bitcoin

Bankless: Some of Tether's investments have coincided with trends in the cryptocurrency space, particularly Layer 1 blockchains like Plasma and Stable, which are trying to become fully Tether-based Layer 1s. They asked Paolo whether any of these Tether-specific high-throughput blockchains would become a "Tether chain," and how Tether views investments in these blockchains.

Paolo responded that he does not believe there will be a "Tether chain," nor does he think there will be one in the future. He emphasized that, nevertheless, there are good opportunities within these blockchain projects, and there are excellent teams capable of building great ecosystems. He anticipates that the transaction fees of certain blockchains will vary over time, sometimes high and sometimes low.

Tether may launch a wallet that supports all networks by the end of the year, which will be built using the WDK (Wallet Development Kit) to enable everyone to create similar wallets. Paolo emphasized that Tether does not want to make money through the wallet but hopes to ensure that there is a good product in the market.

He envisions a future where users' wallets can automatically transfer USDT to chains with lower fees based on cross-chain exchange tools, thereby incentivizing blockchains to maintain low fees. He believes this user experience is best for end users, as it allows for fair competition between different chains and lets users decide which chain suits them best.

Bankless further asked Paolo how to describe Tether's relationship with Bitcoin, and whether Tether considers Bitcoin to be special or just another chain. They mentioned that Tether was initially issued on the Omni Network (a Bitcoin sidechain), later exploded in growth on Ethereum, and now Tether is investing in and incubating blockchains that support Tether, including the Bitcoin sidechain Plasma. They wanted to know Paolo's views on Bitcoin.

Paolo expressed his fondness for Bitcoin, mentioning that the way Bitcoin was born is poetic, and it is a simple chain that has fulfilled its mission. He particularly likes Bitcoin because it works even in the worst situations. Although Bitcoin's 10-minute block time is considered slow, Paolo believes there is a rationale behind it. He mentioned Layer 2 solutions like Lightning Network, Light Spark, and Plasma, which provide more opportunities.

He believes that Layer 1 should not be used for payments, and even Ethereum realizes that making payments on Layer 1 will encounter bottlenecks. Therefore, there needs to be a scalability layer, which is the right approach. Paolo also noted that Bitcoin's block size and block time allow people in remote villages in Africa to download the Bitcoin blockchain. If the block time were faster, like Solana's, then in underdeveloped countries, almost no one would be able to run a node. Therefore, Bitcoin is very special to him because it has ultimate inclusivity, working even in the worst situations, even during a third world war. He emphasized that other blockchains have different use cases, but it is important to distinguish between them. For example, Plasma is EVM-compatible, and Blockstream Liquid is another great Bitcoin sidechain that is exploring a Turing-complete contract system. Paolo stated that he appreciates innovations outside of Bitcoin, but Bitcoin is their beloved one, aligning closely with their philosophy.

He also mentioned that as Bitcoin block rewards gradually decrease, fees on the chain may rise significantly. He believes that the Bitcoin main chain will become a settlement layer for Lightning Network-style channels or the underlying layer for some very important contracts. In this scenario, users might open a Bitcoin transaction on the first layer and then conduct countless transactions on the second layer, ultimately returning to the first layer for settlement. If the fee for each settlement is $500, but it actually represents a total of 1 billion transactions, then the average cost per transaction becomes very low. Paolo believes this dynamic is one of the most beautiful parts of the Bitcoin network, as new layers or applications emerging on Bitcoin will all anchor to Bitcoin, making it a secure layer that anchors everything.

VI. Tether's Benefits to the U.S. and Cryptocurrency

There has been a lot of negative news about Tether in the past, and Tether has experienced many ups and downs with the U.S. government, but Bankless feels that 2025 is almost a year of redemption for Tether. Now, those negative stories are gone, and even U.S. lawmakers recognize what Tether is, how big it is, and the value it brings to the U.S. Treasury market.

Paolo believes that Tether has many benefits for the U.S.

First, Tether is bringing financial inclusion to hundreds of millions of people through the dollar. There have been some charities and NGOs that raised large amounts of money from around the world trying to solve the issue of financial inclusion. Companies like Tether are able to bring financial inclusion to nearly 500 million people, and Tether is doing this with the dollar.

Second, Tether is promoting the dollar. While other BRICS countries are trying to replace the dollar's international status, Tether is providing assistance. In fact, Tether is one of the companies that helps the U.S. the most. When Tether is in Africa and Central and South America, you won't see the U.S. presence, but you will see the presence of BRICS countries. They are trying to replace the dollar's status, and Tether's existence is associated with millions of touchpoints. Tether is working hard to push back, making the dollar the preferred currency and the most commonly used currency in these countries.

Third, Tether is one of the largest purchasers of U.S. Treasury bonds and U.S. debt. Three years ago, China held $2 trillion in U.S. debt, and now it is less than $700 billion. This could be used as a weapon against the U.S. As I said, you want to diversify the ownership of U.S. debt, and Tether is helping the U.S. achieve that.

Fourth, Tether invests in the U.S. Tether reinvests most of its profits in the U.S., supporting very excellent American companies. Everything Tether does is closely related to the U.S. Tether stores Treasury bonds in the U.S., not in just any European bank.

When it comes to cryptocurrency, it's interesting because there is indeed a lot of FUD (Fear, Uncertainty, and Doubt), but if you pull up the charts, you can see that FUD is one thing, but FUC (Fundamental Underlying Conditions) is another. The chart has been almost consistently growing. Tether's stability and transparency provide a solid foundation for the cryptocurrency market, helping to drive the development of the entire industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。