After more than four years of legal tug-of-war, Ripple is finally ready to "turn the page."

On June 27, Eastern Time, Ripple CEO Brad Garlinghouse announced on the X platform that the company would withdraw its cross-appeal against the U.S. Securities and Exchange Commission (SEC), which is also expected to withdraw its remaining appeal requests. This lawsuit, which began at the end of 2020 and has been at the core of regulatory controversies in the cryptocurrency industry, has finally come to a close.

Garlinghouse stated directly: "We are putting an end to this chapter and focusing on what truly matters—building the 'value internet.'"

Why was this lawsuit so important? How has Ripple managed to "fight hard" while also "building" over the past five years? How has the XRP ecosystem developed to this point? This article will address these questions one by one.

Long Legal Journey: A Timeline Review

The legal dispute between Ripple and the SEC began in December 2020, when the SEC accused Ripple and its executives of illegally raising over $1.3 billion through unregistered XRP sales. This lawsuit had a direct impact on the price movement of XRP.

December 21, 2020: The SEC filed a lawsuit against Ripple Labs and its executives.

2021-2022: Both parties entered the legal discovery phase, with Ripple questioning the basis of the SEC's allegations. The court allowed Ripple to obtain internal SEC documents (such as the "Hinman emails").

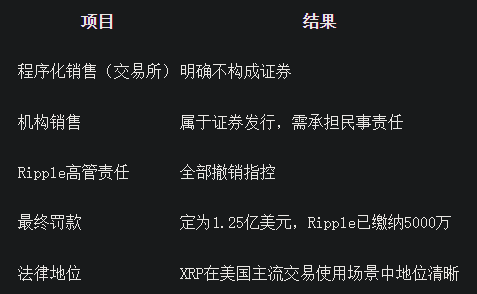

July 13, 2023: Judge Analisa Torres of the Southern District of New York made a landmark ruling:

XRP's programmatic sales (such as through exchanges) are not considered securities.

Institutional sales of XRP were deemed to be unregistered securities offerings.

October 3, 2023: The SEC's request to appeal the ruling on programmatic sales was denied.

October 19, 2023: The SEC dropped its charges against Ripple executives Brad Garlinghouse and Chris Larsen.

March 2024: The SEC sought nearly $2 billion in fines.

August 7, 2024: After months of negotiations, the court ruled in August 2024 that Ripple must pay a civil fine of $125 million, XRP is not considered a security in most transactions, and Ripple is allowed to continue operations under clear legal conditions.

March 2025: Ripple and the SEC began final negotiations, proposing to reduce the fine to $50 million and lift restrictions on Ripple's sale of XRP, but the judge officially denied this request on June 26.

June 26, 2025: Brad Garlinghouse confirmed that Ripple would withdraw its cross-appeal, and the SEC is expected to dismiss its case, signaling the end of a years-long legal battle.

What Did Ripple Win?

This lawsuit has profound implications for Ripple, XRP, and the entire cryptocurrency industry. We can summarize it simply as:

The SEC won the classification of institutional sales, but lost on retail sales through exchanges. This is crucial for the liquidity and market acceptance of XRP.

Garlinghouse commented very accurately: "The legal status of XRP has not changed—it is not a security."

Outside of the lawsuit, Ripple's ecosystem has not stopped progressing.

While dealing with the lawsuit, Ripple's ecosystem expansion has never ceased:

- Integration with Wormhole for cross-chain interoperability

Ripple partnered with Wormhole to serve as a cross-chain bridge for XRPL and its EVM sidechain, allowing users to freely transfer assets between XRPL, Ethereum, Solana, and other chains. This is a significant boon for DeFi, RWA, and other applications.

- Launch of a compliant DEX

In the latest XRPL 2.5.0 upgrade, Ripple introduced the "Permissioned DEX" feature, which only allows KYC-verified users to trade, laying a compliance foundation for future MiCA regulations, stablecoin circulation, and enterprise-level trading.

- Introduction of Permission Delegation

Developers can delegate account operation permissions to other accounts, enabling more complex automated operation scenarios, such as enterprise asset management, compliant stablecoin issuance, and MiCA regulatory adaptation. This further enhances XRPL's enterprise-level adaptability.

- Expansion of stablecoins and RWA

Circle's USDC has been integrated into XRPL, and Ripple has partnered with Guggenheim to issue the first digital commercial paper. Additionally, Ondo Finance has launched a tokenized U.S. Treasury product, OUSD, based on XRPL, expanding the application of real-world assets (RWA) on XRPL.

Moreover, the European Central Bank is testing a private chain trading system called Axiology built on XRPL's source code. Although it does not operate on the public XRPL mainnet, this represents recognition of XRPL technology by sovereign-level institutions.

How will the market price XRP post-lawsuit?

Despite recent positive fundamentals in the market, XRP's price has been fluctuating between $2.00 and $2.60 since early March, without a clear directional bias.

Cryptocurrency analyst XForceGlobal pointed out that XRP recently retraced to $1.90 and tested the key 0.618 Fibonacci level near $2.00 again. Their Elliott Wave analysis predicts that XRP could break through to $5. In earlier posts, XForceGlobal even set the target for this cycle between $20 and $30.

From a technical chart perspective, if XRP's price can effectively break through the upper limit of the current consolidation range at $2.65, it will open the way for its next phase of growth, potentially first targeting $3 and above, and possibly reaching $14 based on the measurement of the breakout flag pattern.

As the shadow of the SEC lawsuit gradually dissipates, Ripple can shed its burdens and fully invest in its vision of "building the value internet." The advancement of strategic acquisitions, continuous upgrades of XRPL technology, and the growing interest of institutional markets in XRP together form a strong fundamental basis for XRP's future rise. Whether Ripple can seize this opportunity to reshape its value remains to be seen.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。