U.S. Stock Futures Hit All-Time Highs! PCE Data About to Be Released, Will BTC Be Affected by the Correlation?

Macro Interpretation: Tonight at 20:30, the global financial markets hold their breath— the U.S. core PCE price index for May is about to be revealed. Economists generally expect the year-on-year growth rate to reach 2.6%. If the actual data is lower than expected, as predicted by Wall Street Journal reporter Nick Timiraos, the path for the Federal Reserve to cut interest rates will become clear. Coincidentally, just before the data release, the three major U.S. stock index futures collectively set new historical peaks: S&P 500 futures broke through 6,145 points, and Nasdaq futures reached a high of 20,180 points. Generally speaking, this kind of correlation effect is becoming a key driver for Bitcoin to break through—if the Federal Reserve turns to easing as expected, continued inflow of institutional funds may push Bitcoin past the strong resistance zone of $109,000.

The market's optimism is not unfounded. Institutional reports reveal subtle signals of a policy shift: although Powell's stance was hawkish at the June FOMC meeting, several Federal Reserve governors quickly shifted to a dovish position within a week, and even Powell himself softened his tone during a congressional hearing. This rare and rapid shift is not to be overlooked, as political pressure has been significant—after President Trump publicly criticized the Federal Reserve's policies, the Fed's communication strategy underwent dramatic adjustments. Meanwhile, U.S. inflation has fallen to 2.38%, and the unemployment rate has remained stable at 4.2% for 12 consecutive months, continuously undermining the rationale for maintaining high interest rates.

Even more exciting is the deepening integration of traditional finance and the crypto world. Guotai Junan International has received approval from the Hong Kong Securities and Futures Commission to upgrade its license, becoming the first Chinese brokerage to offer virtual asset trading services. This news caused its stock price to surge nearly 200% in a single day. This is not only a milestone event for institutional entry but also marks a substantial breakthrough in the compliance process of crypto assets within the mainstream financial system. Additionally, the U.S. Federal Housing Finance Agency (FHFA) is considering requiring Fannie Mae and Freddie Mac to evaluate the inclusion of cryptocurrencies as collateral for housing loans, potentially opening the door to a multi-trillion-dollar mortgage market. Although there are concerns within the industry that this move may sow the seeds of systemic financial risk, it is undeniable that the asset attributes of cryptocurrencies are receiving unprecedented official endorsement.

Capital flow data reveals the current market's delicate balance. Currently, the average monthly trading volume of altcoins is only about $1.7 billion, significantly lower than the annual average level of $2.5 billion. This moderate trend suggests that investors are shifting from speculative assets to mainstream coins, forming a typical characteristic of mid-cycle accumulation in a bull market. Although the cryptocurrency market is still driven by sentiment, a complete collapse would require a black swan event on the scale of Terra or FTX. Against the backdrop of an increasingly完善 regulatory framework and continuous inflow of institutional capital, the crypto market is more likely to enter a long-cycle slow bull phase.

Of course, concerns remain. Some market warnings indicate that the U.S. fiscal deficit rate may remain at a high level of 7% of GDP, with debt concerns hanging like a sword of Damocles. The Trump administration lacks substantial plans for tax increases or spending cuts, and the only way to alleviate the situation is through a significant decrease in borrowing costs—this creates a subtle game with Federal Reserve policy. Technically, Bitcoin was impacted by the situation in the Middle East earlier this week, dipping to the key support level of the 21-week moving average at $98,532. This level is seen as a dividing line between bulls and bears; if geopolitical risks escalate again or if PCE data unexpectedly comes in high, the risk of short-term adjustments cannot be ignored.

As traditional stock indices soar, the crypto market is undergoing a historic transformation. From the macro tailwind of the Fed's policy shift to the institutional breakthrough of licensed Chinese brokerages, and the potential connection to the trillion-dollar mortgage market, the energy for Bitcoin to break through previous highs is quietly accumulating across multiple dimensions. Although the shadows of debt and geopolitical risks still swirl like undercurrents, the train of integration between the crypto world and traditional finance has already sounded its horn—this time, its destination may be the true mainstream financial landscape.

BTC* Data* Analysis:

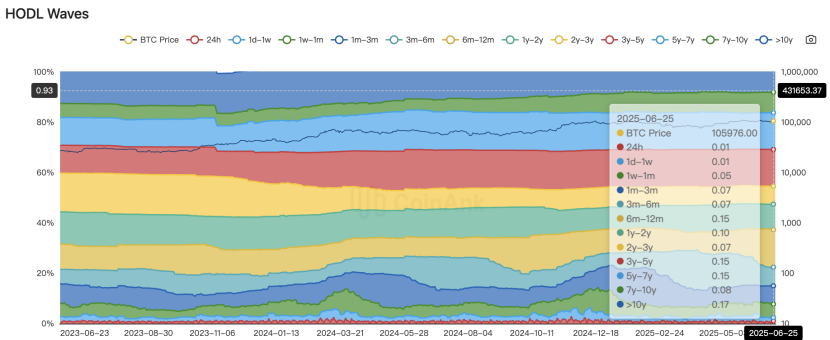

According to CoinAnk data, based on the latest on-chain data, Bitcoin long-term holders have achieved a record net increase of 800,000 BTC in the past 30 days, a scale far exceeding the historical average. Similar scales of monthly accumulation have only occurred six times before, including mid-2021 and late 2024, and were accompanied by significant subsequent price uptrends. Currently, the cost range for long-term holders is concentrated between $95,000 and $107,000, while the average cost for short-term holders is about $93,000. At the same time, the proportion of long-term holders has risen to 68% of the total circulating supply, with early miners showing a strong reluctance to sell, having sold only a minimal amount of BTC this year, highlighting the tightening supply side of the market.

This accumulation behavior reflects the strong confidence of long-term investors in BTC as a value storage asset. Historical patterns show that similar scales of accumulation often indicate turning points in price cycles, likely stemming from an imbalance in market supply and demand and the strengthening of investor psychological expectations. The holding cost range can serve as a key support level; when prices approach this level, reduced selling pressure may help propel an upward trend. In terms of impact on the crypto market, especially BTC, the accumulation reduces circulating supply, combined with the reluctance to sell, which may exacerbate scarcity and drive prices to break historical highs; however, if the macro environment deteriorates or short-term holders face increased cost pressure, the market may experience volatility. Overall, the structure dominated by long-term holders is conducive to stabilizing the market and supporting the continuation of the bull market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。