Selected News

Ark Invest reduced its holdings of Coinbase stock worth $12.5 million yesterday

US electric vehicle company Mullen announces acceptance of Bitcoin and TRUMP Meme coin payments

Bhutan's Bitcoin reserves reach $1.3 billion, accounting for nearly 40% of GDP

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

ARB

Today's discussions about Arbitrum (ARB) on Twitter focus on significant developments within its ecosystem and market sentiment. Key topics include the launch of new projects and collaborations such as Super Lending App and Yapyo, which further solidify Arbitrum's dominant position in the Layer 2 space. The community is actively discussing ARB's DeFi incentive mechanisms and governance dynamics, comparing them with other L2 projects, and exploring the impacts of tokenization and real-world assets (RWA). Overall sentiment is positive, with many optimistic about Arbitrum's growth and influence.

DOG

$DOG (DOGDOG) has sparked widespread attention on Twitter due to its upcoming listing on Kraken. The community views this as a significant milestone for the decentralized Memecoin—$DOG is entirely distributed through airdrops, with no internal reserves or allocations. This listing will significantly enhance accessibility for US users and is seen as an opportunity to attract other major exchanges to follow suit. The $DOG community is known for its high cohesion and activity, currently preparing for the Kraken launch, including encouraging users to deposit and provide liquidity.

UNI

Today's discussions regarding UNI (Uniswap) center on the launch of the Uniswappy feature. This feature allows users to create Uniswap-themed trading cards, generating significant participation and enthusiasm. Additionally, in discussions about the evolution of the DeFi ecosystem, Uniswap is seen as a key player, with the community delving into its governance system and market strategies, as well as its position and influence in the broader crypto market.

XRP

Today's discussions about XRP mainly focus on its collaboration with Wormhole, aimed at enhancing the multi-chain interoperability of the XRP Ledger and its EVM sidechain, which is viewed as a significant breakthrough for the XRPL ecosystem. Meanwhile, the lawsuit between Ripple and the US SEC continues, with Judge Torres rejecting the joint motion for a declaratory judgment proposed by both parties. Despite ongoing legal challenges, Ripple maintains that the legal status of XRP as a non-security has not changed.

Coinbase

Coinbase is in the spotlight today for announcing that it will launch cryptocurrency futures products similar to perpetual contracts in the US on July 21. This move is seen as a significant event for market development, particularly attractive to US traders due to tax incentives. Additionally, Coinbase's stock price has reached an all-time high, reflecting positive market expectations. Discussions also cover its strategic growth path, including being included in the S&P 500 index, serving as the main broker for ETFs, and the launch of the Coinbase Concierge service for high-end users. Furthermore, the company's continued accumulation of Bitcoin has further enhanced its market influence.

Featured Articles

The US presidential term is limited to two terms, so it is often said that the main focus of a president's second term is not "governance," but "making money." June 23 marks the 154th day of Trump's second term. He used $114 million in cash to pay off one of the most challenging debts in his business empire just 13 days before the loan's due date. This $114 million is equivalent to the salary of a US president for 400 years. According to the most widely circulated calculation—"a carry-on suitcase can hold up to $1 million in $100 bills"—at least 114 carry-on suitcases would be needed to pack this amount. This loan came from his famous Manhattan skyscraper—40 Wall Street, also known as The Trump Building.

Beyond the stablecoin craze, equity tokenization is becoming a new market narrative. On June 27, the Web3 startup Jarsy announced the completion of a $5 million pre-seed financing led by Breyer Capital. What truly caught the market's attention was the problem they are trying to solve: why do the early growth dividends of top private companies always belong to institutions and super-rich individuals? Jarsy's answer is to reconstruct the participation model using blockchain technology—"minting" private equity of unlisted companies into asset-backed tokens, allowing ordinary people to bet on the growth of star companies like SpaceX and Stripe with a $10 threshold. Following the financing disclosure, the market immediately focused on the topic of "private equity tokenization"—this alternative asset class, which originally existed only in VC boardrooms and high-net-worth circles, is being packaged as blockchain assets and expanding its territory on-chain.

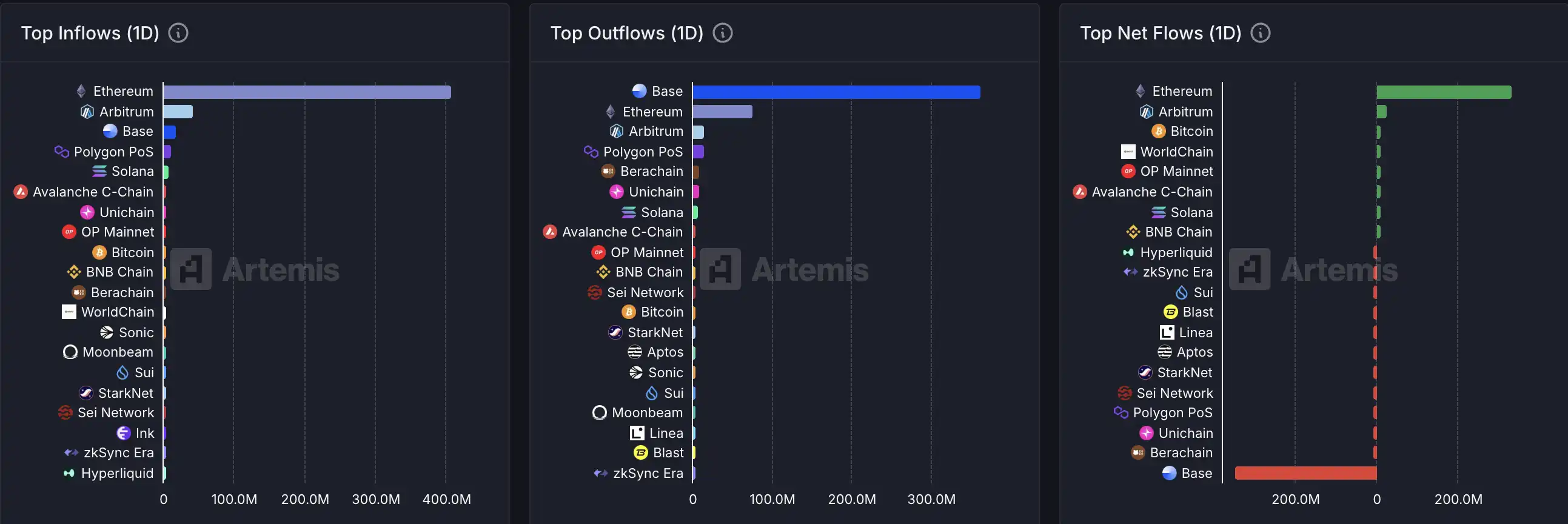

On-chain Data

On-chain capital flow situation for the week of June 27

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。