Original Author: Tiger Research

Original Compilation: AididiaoJP, Foresight News

Abstract

In the first half of 2025, the activity of cryptocurrency users in South Korea expanded from centralized exchanges to on-chain ecosystems. This shift marks the maturation of the market and the diversification of user participation.

South Korean users hold a significant amount of Ethereum assets and maintain stable mainnet participation. Base users gradually increase their engagement through decentralized applications (dApps). Solana attracts the most users, with high user activity. However, due to fatigue from short-term events (such as the meme coin and meme launch platform battles), Solana experiences a high user attrition rate.

South Korean cryptocurrency users exhibit different behavioral characteristics across various blockchains, making it impossible to summarize them with a single trait. Project teams need to develop effective market strategies through systematic user segmentation and analyze using both qualitative and quantitative methods.

1. Overview of On-Chain User Activity in South Korea in the First Half of 2025

South Korean users have begun to gradually expand their activities from exchanges like Upbit and Bithumb to on-chain engagement, indicating a maturation of the market rather than a temporary phenomenon.

The trading volume on South Korean centralized exchanges has always been very high, but on-chain activity is also growing rapidly, leading to a multi-layered market structure in the South Korean crypto market, which is no longer centered around exchanges. Recognizing this will help further develop market strategies.

The IXO 2025 event held from January 24 to 25, 2025, further confirmed this market shift. Co-hosted by TokenPost and CoinReaders, TokenPost CEO Kim Ji-ho stated at the opening ceremony that the number of digital asset investors in South Korea has exceeded 10 million, and the cryptocurrency market has surpassed niche technology communities, establishing connections with mainstream audiences.

International participants are attempting to gain a deeper understanding of South Korean on-chain user engagement, no longer viewing South Korea as a market structure centered around exchanges. However, analyzing the characteristics of South Korean users remains challenging, and systematically obtaining relevant on-chain data is still a significant challenge.

This report collects on-chain activity data from approximately 80,000 wallets, aimed at readers who need a deeper understanding of the South Korean market. The research covers data from the first half of 2025, examining the behavioral patterns of South Korean users in the Ethereum, Base, and Solana ecosystems, providing practical insights for global projects considering entering the South Korean market.

2. Characteristics of South Korean Users: Ethereum, Base, and Solana

2.1. Activity Time

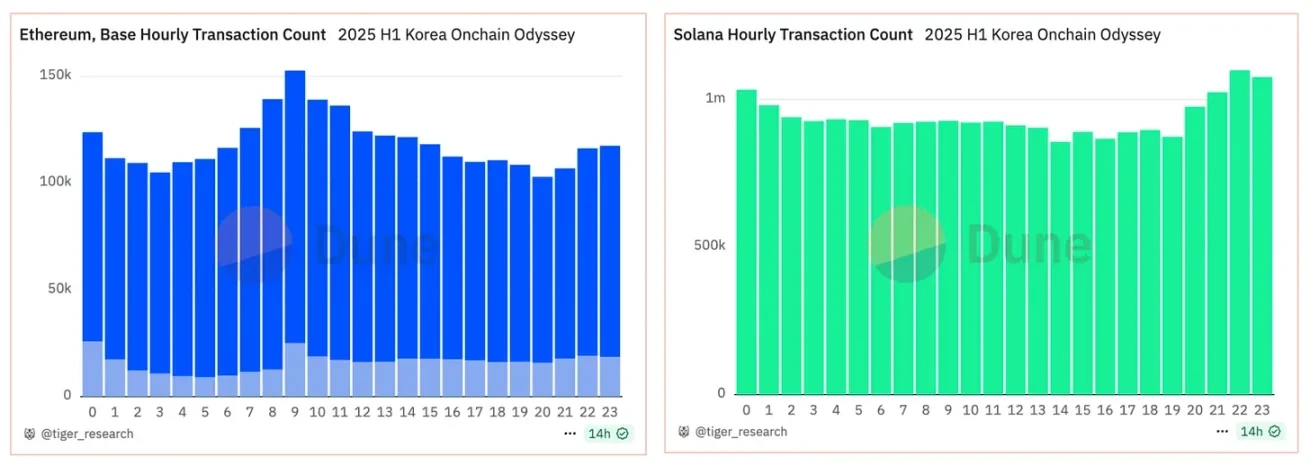

Ethereum, Base: Activity time (9 AM to 11 PM)

Solana: Early morning hours (midnight to 8 AM)

There are significant differences in participation patterns among South Korean users across different blockchains, with notable variations in activity times. Active user transactions on Ethereum and Base are concentrated during the daily activity hours of 9 AM to 11 PM.

In contrast, Solana's transactions are concentrated in the early morning hours from midnight to 8 AM, with users remaining active late at night, forming a stark contrast with other chains. This is because Solana has developed a transaction-centric ecosystem, with major token issuances and activities aligned with North American time zones. Even in the early morning, when the market is active, South Korean users actively participate.

This indicates that South Korean users have a high adaptability to the global market, with active investment tendencies that transcend time zone adjustments, showing a reluctance to miss out on global opportunities. The behavior of South Korean users transcends geographical limitations, keeping pace with the rhythm of the global cryptocurrency market.

2.2. Fund Distribution

There are significant differences in fund distribution across different blockchains. According to the collected wallet data, South Korean users hold a total of approximately $400 million in Ethereum, which is about nine times the total assets on Base and Solana. This difference is primarily due to the presence of whale wallets rather than the number of wallets. Whales (over $1 million) and mid-tier accounts (over $100,000) make up a large proportion. There are 116 whale wallets on Ethereum, with each wallet averaging $2.5 million.

The asset distribution on Solana shows a different pattern. Retail wallets (under $100) account for 99.9% of all wallets, with an average holding amount of only $30. However, a few whale wallets average over $8 million, creating a highly polarized distribution of funds.

These data indicate that South Korean users exhibit different investment tendencies across different chains. Ethereum attracts conservative large investors who prioritize stability, while Solana attracts a large number of retail investors seeking high returns. These retail investors prefer short-term opportunities such as meme coins and meme launch platform tokens. Base attracts medium investors who fall between the two. This indicates that the South Korean market has a diverse user base rather than being concentrated on specific investment tendencies.

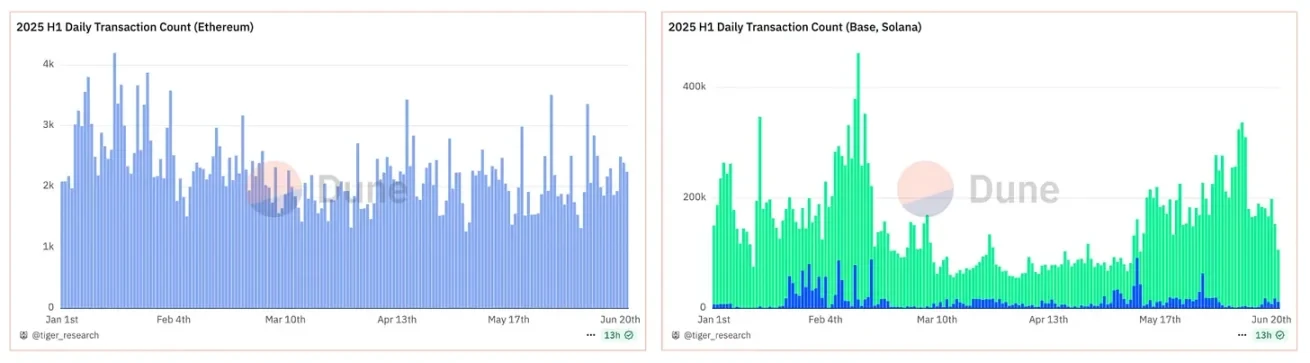

2.3. User Activity Trends

The trading volume on Ethereum is not affected by market fluctuations or external events, maintaining long-term stability. South Korean users in the Ethereum ecosystem focus more on practical activities. They engage more in actual dApp usage, asset custody, and governance activities rather than DeFi-centered trading activities.

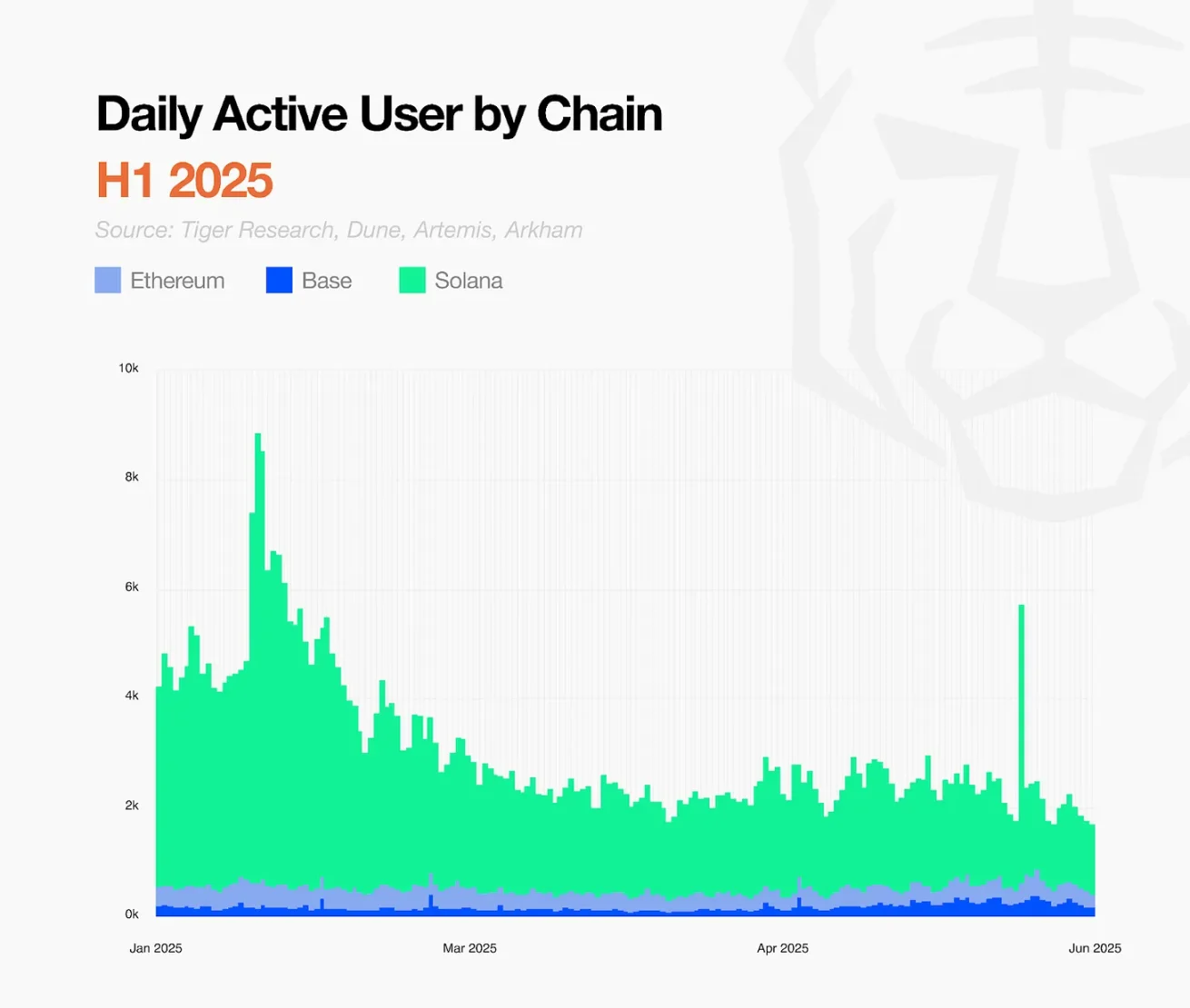

In contrast to Ethereum, the trading on Base and Solana is sensitive to overall cryptocurrency market sentiment and short-term events. When cryptocurrency prices surged at the beginning of the year, trading volumes spiked; they then briefly declined, and rose again in May when Bitcoin broke $100,000.

The trading trends on Base and Solana are similar, but there are differences in daily active user numbers. Solana experiences a higher user attrition rate due to the meme coin launch platform and short-term event structures. Thanks to the adoption of diverse dApps and consumer services, although Base has fewer loyal users, the number of active users is steadily increasing.

2.4. dApp Usage

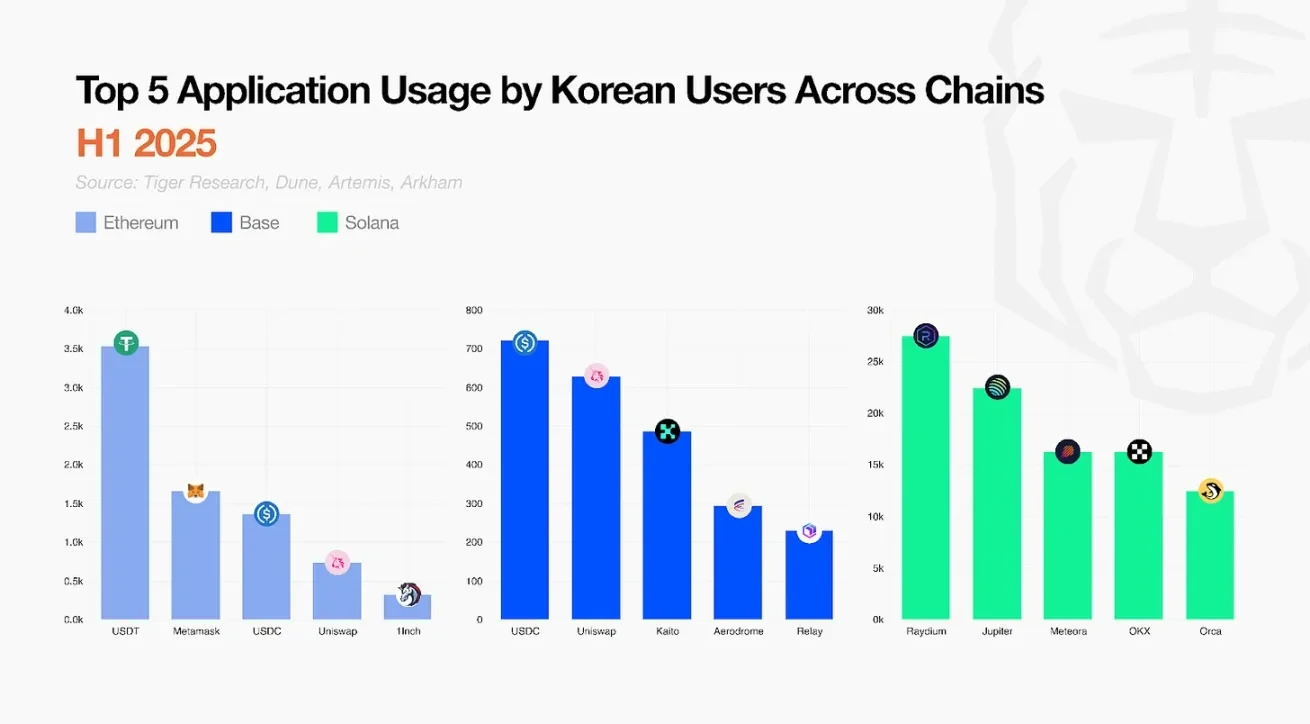

The dApp usage of South Korean users across different chains further reveals their differences.

On Solana, activity is centered around trading. South Korean users primarily focus on DeFi trading, with low stablecoin usage, and SOL trading pairs dominate.

On Ethereum and Base, users are more actively engaged in remittance and deposit activities, using USDT or USDC for transactions. There are diverse practical use cases on these chains. The Kaito InfoFi service on Base is one of the main drivers attracting users, currently ranking third on Base. South Korean users respond positively to reward structures, preferring to earn through token staking and incentive claims.

3. Conclusion

This report analyzes the on-chain activity of approximately 80,000 South Korean cryptocurrency users, which aids in developing more effective market entry strategies.

Most importantly, South Korean users should not be viewed as a homogeneous group. Compared to other markets, South Korean users have a deeper engagement with the cryptocurrency market. The characteristics of South Korean users are primarily reflected in three aspects:

First, South Korean users demonstrate strong adaptability to the global market. The early morning activity on Solana indicates that their participation transcends time zones, as users are unwilling to miss out on global cryptocurrency market opportunities, with behavior not limited by geography, keeping pace with the rhythm of the global cryptocurrency ecosystem.

Second, there is a clear differentiation in strategies and investment tendencies across different chains. The same group of South Korean users acts as conservative investors focused on stability on Ethereum; as speculative investors seeking high returns on Solana; and as moderate investors on Base. This strategic differentiation forms a hierarchy based on investment objectives and risk preferences. Users optimize their participation strategies according to the characteristics and culture of each ecosystem, indicating that South Korean users are a complex group.

Third, users show a high interest in incentive-based services. They actively participate in these services, with the rapid rise of Kaito on Base being a prime example. South Korean users engage actively in yield activities through token staking and reward systems. On-chain data confirms this trend, with Kaito listing South Korean users separately on the leaderboard, and some projects expanding their reward pools specifically for South Korean users, validating this observation.

Global projects considering entering the South Korean market need to develop customized strategies that align with user characteristics. South Korea is a balanced market, with no bias towards specific stages or types.

Strategy development should prioritize selecting blockchains that suit the layered expectations and behaviors of target users. There are significant differences in expectations and behaviors of South Korean users across different chains.

On the operational level, providing services based on North American time zones will not pose significant issues, and a global operational system can be incorporated into long-term expansion plans.

User acquisition and retention require clear and sustainable incentive structures. South Korean users are highly sensitive to token staking and reward systems, responding more positively to long-term participation structures, while short-term activities yield poorer results.

Most importantly, these users should be viewed as partners in the development of the ecosystem rather than mere users. This report aims to provide practical assistance for relevant strategy development.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。