The term of the U.S. President is limited to two terms, which is why people often say that the main focus of a president's second term is not "governance," but rather "making money."

On June 23, it was the 154th day of Trump's second term. He used $114 million in cash to pay off the most challenging debt in his business empire just 13 days before the loan was due.

This $114 million is equivalent to the salary of a U.S. president for a full 400 years. According to the most widely circulated calculation—"a carry-on suitcase can hold a maximum of $1 million in $100 bills"—at least 114 carry-on suitcases would be needed to transport this amount of money.

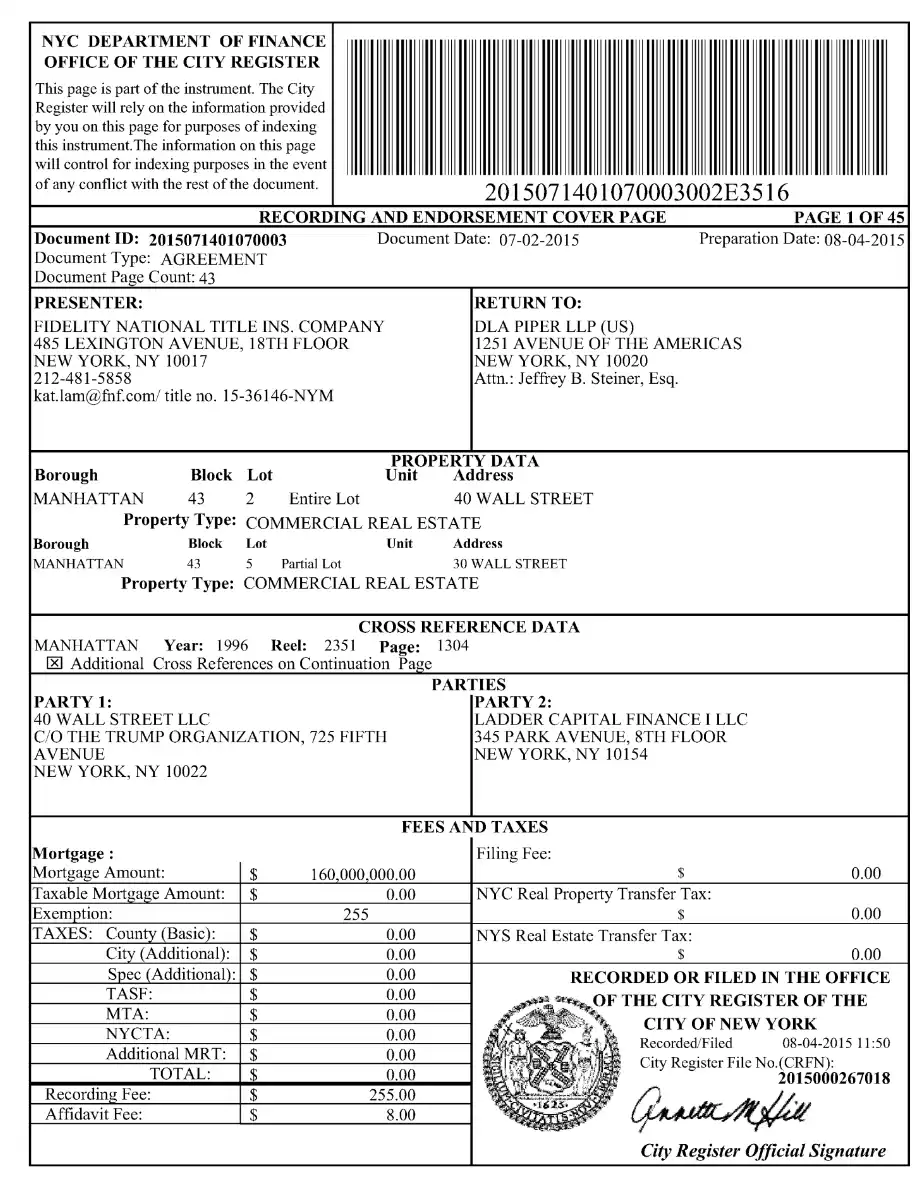

This loan came from his famous Manhattan skyscraper—40 Wall Street, also known as The Trump Building.

40 Wall Street, also known as The Trump Building

Shadow Banking, Trump's Lender

"When Trump needs a loan, he usually calls Ladder Capital," a source once revealed.

In 2015, as a $5 million loan from Capital One was about to mature, Trump decided to refinance 40 Wall Street. This time, he did not turn to traditional banks but instead approached Ladder Capital—a relatively small and lesser-known shadow bank.

After evaluation, Ladder quickly agreed to provide a $160 million commercial mortgage loan for the building, with an interest rate as low as 3.67%. Within weeks, this debt was rapidly packaged and split into four notes, sold to investors along with dozens of other properties, flowing into the subprime financial market.

Ladder Capital's debt notes related to The Trump Building

For Trump, this was a timely loan.

In fact, since the financial crisis of the early 1990s, large banks like Citigroup and JPMorgan Chase have been reluctant to deal with Trump. Back then, Trump was on the brink of bankruptcy due to a series of failed investments, with assets like the Plaza Hotel and Trump Airlines being taken over by banks, resulting in significant losses for several major banks. Deutsche Bank was the last major financial giant willing to support him, but in 2008, due to a repayment dispute over a Chicago project, the two parties ended up in court. Even after Deutsche Bank provided a loan for his Washington project in 2014, their relationship had not fully recovered.

Ladder Capital not only agreed to lend but also offered him an extremely low borrowing rate. Typically, commercial real estate loan rates in the U.S. hover between 5.5% and 10%, with office assets being even higher. For a long time, Ladder Capital and Deutsche Bank were Trump's largest creditors, with Deutsche Bank's interest rates for Trump Organization loans ranging from 5% to 7%, making Ladder Capital's 3.67% rate exceptionally low by comparison.

When things seem unusual, there must be something amiss.

According to reports, the relationship between Ladder Capital and Trump is far more complex than just "lender and borrower." The executive team at Ladder, led by Jack Weisselberg, is the son of Allen Weisselberg, the CFO of the Trump Organization. This connection allowed Trump to secure hundreds of millions in funding at extremely low rates, even as mainstream Wall Street banks collectively avoided him.

As a real estate investment trust (REIT), Ladder's core business is to provide financing for high-risk projects that traditional banks dare not touch. They do not rely on depositor savings but instead quickly package loans through asset securitization to exchange for liquidity and returns. In Trump's 2017 financial disclosures, Ladder Capital held debt claims on at least four of his properties, including Trump Tower on Fifth Avenue, with total debt exceeding $280 million.

As Trump gradually distanced himself from the mainstream financial system, he increasingly relied on shadow banking systems like Ladder. This relationship also reveals the flourishing of New York's shadow banking industry.

Shadow banking refers to a class of financial institutions that are not subject to conventional bank regulations, including hedge funds, private equity, money market funds, and REITs. They issue loans and engage in financing but do not have to meet the same regulatory requirements as commercial banks. The asset size of shadow banking in the U.S. reaches $14 trillion, which is not insignificant compared to the $16 trillion traditional commercial banking system.

However, shadow banking is a weak link in the U.S. financial system. Commercial banks operate on government-backed deposits, while shadow banks rely on short-term financing—meaning that once market liquidity tightens, their funding chains can break instantly, as experienced by Lehman Brothers and Bear Stearns in 2008.

But this is just a small part of Trump's aggressive business style.

Gwendolyn Blair, author of "The Trump Family: Three Generations of Empire Building," points out that Trump was able to smoothly enter the Wall Street banking system early on because his father, Fred Trump, was one of the most respected developers in New York's real estate circle. Banks trusted Fred and were willing to give his son a chance.

However, after Trump's "Donald-style" aggressiveness, patience quickly wore thin. Bankers began to worry that if they continued to lend to him, they might not only fail to recover their money but also face difficulties explaining their decisions to boards and shareholders. Thus, several major banks tacitly expelled this "high-risk client" from the mainstream credit circle.

40 Wall Street, the Skyscraper That Can't Be Rented Out

The Trump Building at 40 Wall Street has always been one of Trump's most celebrated "legendary investments."

He has repeatedly mentioned this deal in public speeches and writings: "I acquired this building for just $1 million in 1995." In his autobiography "Never Give Up," he wrote, "Sometimes people ask me what my proudest investment is, and I always think of 40 Wall Street—this building has a special magic that sets me apart forever."

Indeed, this skyscraper, which began construction in 1930, briefly became the tallest building in the world before the Chrysler Building was completed. Standing 70 stories tall at 282.5 meters, located in the financial heart of Manhattan, it was designated a New York City landmark in 1998. It has witnessed the rise and fall of Wall Street and Trump's journey from developer to president.

Many people do not know that Trump does not own the land beneath this building. He only has long-term lease rights, which can last up to 200 years. The actual owners of the land are a group of low-profile German billionaires and industrial tycoons. In 1995, Trump took over the lease and restructured it, requiring him to pay a fixed ground rent to these Germans each year.

It was against this backdrop that Trump decided to refinance the building in 2015. He obtained a $160 million loan from Ladder Capital to replace the $5 million debt he had borrowed from Capital One, which was about to mature.

The Trump Building, source: The New York Times

At that time, Ladder Capital was confident about the building's cash flow. Data showed that in 2015, the building's occupancy rate was as high as 94.5%, exceeding similar office buildings by 1 percentage point. According to their predictions, the building could generate $43.1 million annually, with total operating costs not exceeding $20.6 million, resulting in a net income of over $11 million.

However, the operational status of the building did not go as smoothly as anticipated in 2015, leading some financial institutions to worry that Trump might default on the loan like before.

Starting in 2019, with the onset of the pandemic and a sharp decline in office demand, the building's occupancy rate fell from 89.1% to 74.2% in 2023. Rental income also dropped from $41.7 million in 2019 to $30.9 million in 2022, and although it slightly rebounded to $33 million in 2023, it still failed to approach the initial forecast.

Meanwhile, operating costs remained high. They rose from $20.9 million in 2017 to $23.2 million in 2023, with maintenance and repair costs nearly double the original estimate. Ultimately, the building's net operating income in 2023 was only $12.8 million. In August 2023, the rating agency Fitch directly downgraded the credit rating of this loan from investment grade BBB- to junk grade BB.

This was not the worst of it.

Trump's annual ground rent to the Germans was $1.6 million in 2015, but it has now risen to $2.3 million. More troubling is that after 2033, according to the lease reset terms, this ground rent will skyrocket to $16 million, which would almost consume all profits.

After paying $9.8 million in annual loan interest and deducting renovation and leasing expenses, Trump only truly earned $1.2 million from this building.

The major tenant Duane Reade has already terminated its lease four and a half years early, and other tenants are either delaying their move-in or postponing lease renewals. By the first quarter of 2025, the building might "barely break even." However, against the backdrop of rising interest rates and high operating costs, this "balance" appears to be a fragile illusion.

From Casinos to Skyscrapers, Trump's Six Bankruptcies

How to repay this money has become one of the key indicators for observing Trump's financial situation and political leverage. Even more concerning is that just last year, the New York State Attorney General explicitly stated that if Trump fails to pay the damages in a civil fraud case, this building could face legal seizure.

Using personal funds to repay part of the principal and then borrowing new debt to pay the remaining amount remains a possible solution. However, multiple financial institutions have already expressed concerns—will Trump, as in the past, be unable to repay again? He might even declare bankruptcy for 40 Wall Street.

If that happens, it would be his seventh bankruptcy filing. Amitosh Purnanandam, a finance professor at the University of Michigan, pointed out that unless Ladder Capital still holds a portion of this loan, the company would have no recourse. "The real victims would be the investors who bought these bonds," he said, "they could be banks, insurance companies, or hedge funds."

Since the 1990s, Trump has been known for his aggressive style of "high leverage, heavy betting, and gambling on the future." He has declared bankruptcy for his businesses six times.

Trump's first bankruptcy occurred in 1991 with the Atlantic City casino, which he once called the "Eighth Wonder of the World." The casino cost a staggering $1.1 billion and was primarily financed through junk bonds with an annual interest rate of 14%. When the economic recession hit in 1990, the cash flow in the gambling city collapsed, and the casino's operations quickly deteriorated, bringing it to the brink of bankruptcy. Trump filed for Chapter 11 bankruptcy protection, shedding some assets and converting creditors into shareholders, which allowed him to retain control of the business.

The second to fourth bankruptcies occurred in 1992 when Trump Castle, Trump Plaza, and the Plaza Hotel all faced financial distress, nearly simultaneously falling under the weight of debt. The Plaza Hotel had liabilities exceeding $550 million and was out of cash. Trump once again filed for bankruptcy reorganization, salvaging operations through stock reductions and debt-to-equity swaps while retaining management control, allowing the "Trump" brand to continue to thrive.

During this time, in 1999, Trump's father, Fred, passed away, and the real estate empire was passed down, marking the official beginning of the "Trump era." However, Trump soon faced his fifth bankruptcy. In 2004, Trump Hotels & Casino Resorts announced bankruptcy, burdened with $1.8 billion in debt and nearly $50 million in losses in the first quarter. Another round of Chapter 11 followed. Trump avoided entrapment by injecting capital and reducing his stake while continuing to collect management fees.

That year, Trump began to frequently appear on television: cameo roles in movies and the reality show "The Apprentice" brought him back into the public eye. Media exposure skyrocketed, but unfortunately, the global financial crisis struck. In 2008, the collapse of Lehman Brothers triggered a rapid contraction in the real estate market, dragging down all of Trump's real estate projects.

In 2009, unable to repay $53.1 million in debt, Trump Entertainment Resorts filed for bankruptcy protection again. In 2014, amid continued deterioration of asset management, he filed for bankruptcy once more, ultimately choosing to relinquish management control and sell the casino to billionaire Carl Icahn and other hedge funds.

It is noteworthy that all six bankruptcies occurred at the corporate level, and Trump himself has never filed for personal bankruptcy. By leveraging legal isolation, he successfully protected his personal assets. More importantly, in each reorganization, he made efforts to retain management rights or brand licensing rights, ensuring that the name "Trump" could continue to generate cash flow.

From past practices, it is clear that Trump excels in three areas: using bankruptcy protection to resolve crises, employing public relations and media to repair his image, and monetizing through brand licensing. But this time, Trump used $114 million in cash to pay off all his loans at once.

However, this "paying off everything in cash" approach raised new questions: how much money does Trump really have? Where did this money come from?

Paying off loans with cash, where does Trump's money come from?

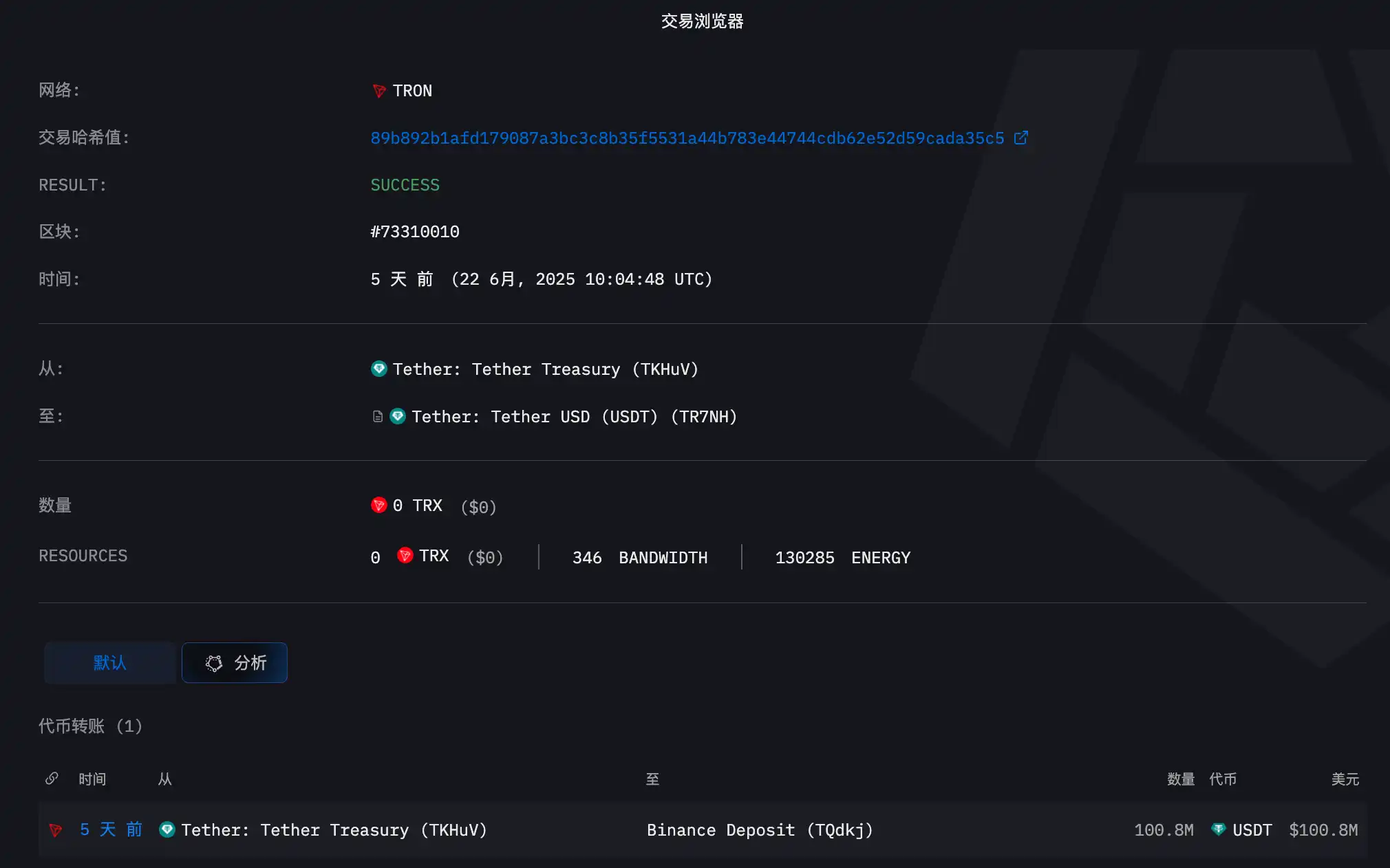

Just after the news of Trump's loan repayment broke, some netizens keenly noticed that on June 22, a staggering $112 million in USDT was destroyed on the TRON blockchain, and this fund could very likely be the source of his repayment.

(Note from Rhythm BlockBeats: USDT being "destroyed" or transferred to an exchange usually means it has been redeemed for dollars—essentially removed from circulation on the blockchain and returned to a real-world bank account.)

Moreover, Rhythm BlockBeats also discovered that ARKHAM data showed that on June 22 at 10:00 UTC, there was indeed a transfer of $100 million in USDT from the TRON network to a Binance deposit address starting with TQdkj. The path and timing of the funds almost mirrored some netizens' speculations.

Data source: ARKHAM

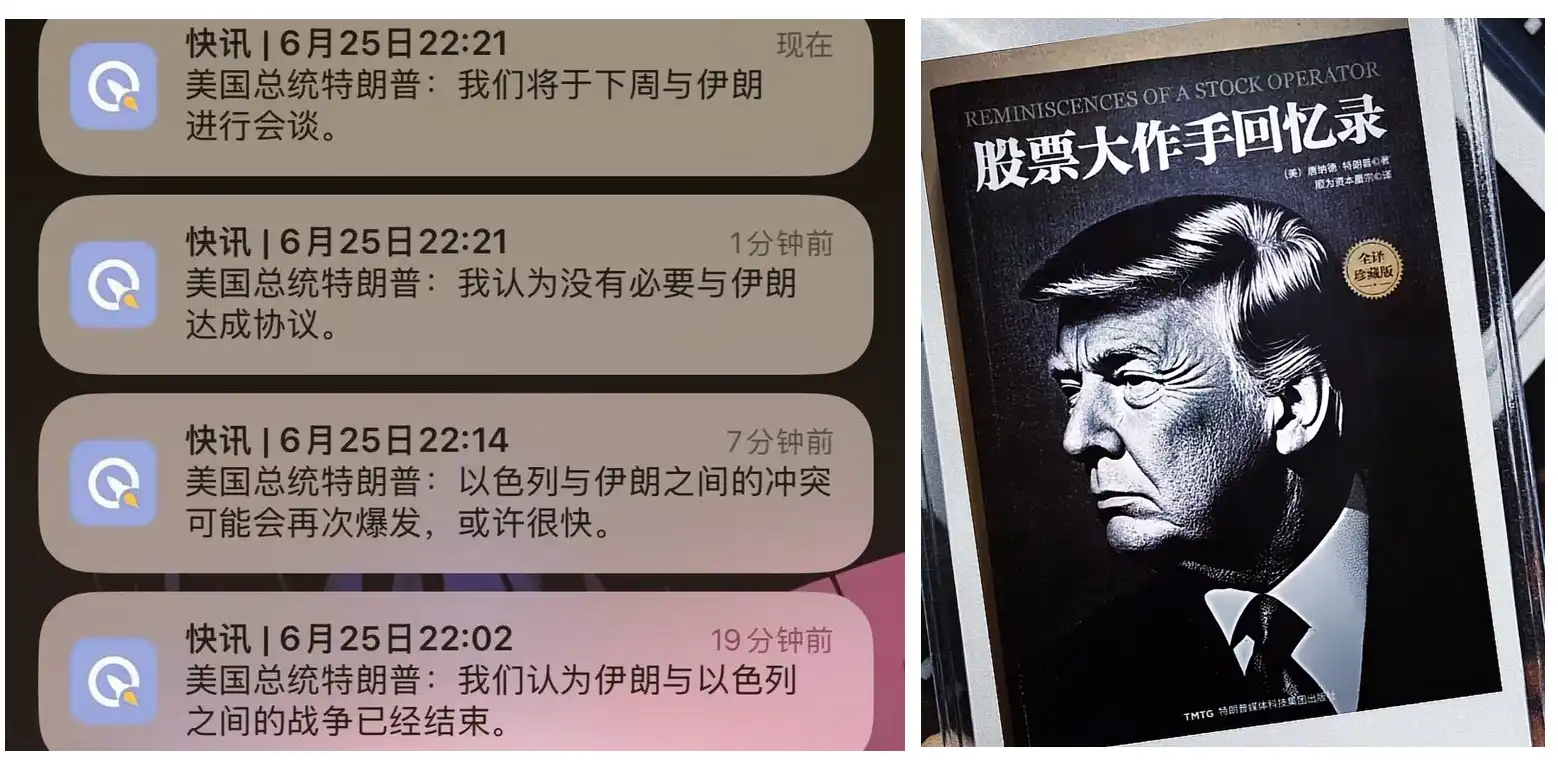

What has drawn even more market attention is another layer of speculation: Trump's recent statements on the Israel-Iran issue—are they merely diplomatic strategies, or is he intentionally trying to influence market sentiment for profit?

Source: Twitter

On June 20, Trump hinted at a "pause" in actions against Iran, which immediately caused U.S. stocks to drop and oil prices to plummet by 2%. During the same period, Bitcoin surged by about 2%, rising back to $106,000. This market movement closely aligned with Trump's statements regarding the Israel-Iran conflict, causing market sentiment to shift, and risk assets rebounded.

On the 23rd, he further claimed that "Israel and Iran have agreed to a ceasefire," leading Bitcoin to spike 5% during trading, breaking through the $105,000 mark. With Cryptostocks like Coinbase rising 12% and MicroStrategy increasing by over 1%, the entire crypto sector strengthened simultaneously. This "statement–market reaction–cash out" rhythm is extremely subtle.

Looking back at his past market behaviors, this is not the first time he has raised suspicions of manipulation:

On April 9, just before the suspension of tariffs, Trump posted on Truth Social, "Now is a good time to buy, DJT!" Hours later, he suddenly announced the suspension of tariffs for most countries, resulting in a 9.5% rise in U.S. stocks and an 8% increase in the Dow. Trump typically does not add his initials at the end of posts. These initials happen to match the stock code of Trump Media Technology Group, which controls Truth Social, and on that day, Truth Social's stock price soared by 22%. This quickly attracted public scrutiny over "insider trading" and "market manipulation," as well as congressional attention.

During the peak of crypto in March this year, analysts like Peter Schiff labeled Trump's actions to boost crypto assets as "pump-and-dump," calling for Congress to investigate whether he was manipulating the virtual currency market through policy declarations. Additionally, as early as 2019, JPMorgan created the "Volfefe Index" based on Trump's tweets to measure their immediate impact on the U.S. Treasury market.

Meanwhile, discussions surrounding the sources of Trump's wealth and market motivations have reached a new peak.

Last Friday, Trump's team submitted a financial disclosure report spanning over 230 pages, marking the first formal release of his balance sheet since the beginning of his second term. The data in this document is current as of early 2025 and covers the entire funding flow and new assets during the 2024 campaign period.

One of the most notable items is the $57 million income he obtained from selling cryptocurrency tokens through WLFI. WLF is a cryptocurrency company controlled by his family, and Trump's three sons are listed as co-founders on the company's website.

Aside from the direct income from WLFI token sales, Trump also holds 15.75 billion governance tokens through an ETH wallet. The financial documents estimate their value to be around $1,000 to $15,000, with income recorded as less than $201. However, it is worth noting that the first round of WLFI sales had a unit price of $0.015, and the second round was priced at $0.05. If calculated at the current over-the-counter price of $0.1, the tokens held by Trump would be valued at $1.57 billion.

In addition to WLFI, the Trump family also controls another more secretive cash-out channel—Meme coins.

His personal meme coin "$TRUMP," although not included in the financial report due to its issuance in January 2025, can be partially understood through the "$MELANIA" coin under his wife Melania's name: according to Lookonchain monitoring, over the past four months, Melania's team has sold a total of 821,800 MELANIA coins through 44 wallets, accounting for 8.22% of the total supply, cashing out approximately $35.76 million.

The market value and liquidity of $TRUMP are far higher than those of $MELANIA. Based on this, it is estimated that the Trump couple's cumulative cash-out amount through these two coins from the second half of 2024 to now may have exceeded $100 million.

Additionally, he holds Ethereum valued between $1 million and $5 million, further solidifying his image as "the most crypto-friendly president." He even publicly stated during his campaign that he would adopt a "more lenient and non-interfering" regulatory stance compared to previous administrations.

If crypto assets are Trump's hidden wealth, then brand licensing income is his cash cow.

He has licensed dozens of products bearing his name and likeness: from "God Bless America" Bibles, limited edition Trump sneakers, perfumes, to Swiss-made "Trump watches" and a signed guitar engraved with "45."

These products brought him millions of dollars in royalty income in 2024 alone, with three golf courses in Florida and Mar-a-Lago contributing $21.77 million in annual cash flow.

Moreover, he is the largest shareholder of Trump Media Technology Group (DJT.US), holding over 53% of the shares. The company is publicly listed on NASDAQ, and Trump's shares are valued in the billions, held in a revocable trust controlled by his eldest son.

According to the latest estimates, Trump's current net worth is approximately $4.8 billion, with cash and liquid assets accounting for about $400 million. However, he also carries over $600 million in debt, a significant portion of which is directly related to unresolved litigation judgments.

For instance, he owes $454 million in civil fraud damages to the New York Attorney General; in the civil defamation case against writer E. Jean Carroll, he was ordered to pay $5 million and $83 million, respectively; these judgments are all under appeal and have not yet been finalized.

Having gone through six bankruptcy episodes, countless lawsuits and trials, and even stepping onto the presidential campaign stage as the first candidate in U.S. history to be "convicted." But now, Trump has not only repaid a 10-year loan but has also built a new wealth empire that spans both reality and the virtual world through cryptocurrency, personal branding, and media platforms.

Perhaps after dodging that bullet, Trump truly believes he is destined to be a winner.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。