In the midst of strategizing, we decide the outcome from a thousand miles away. Hello everyone, I am Lin Chao, a global financial market observer, focusing on cryptocurrency market analysis, bringing you the most in-depth trading information analysis and technical teaching.

Recently, Lin Chao has received private messages where many people repeatedly mention XRP and SOL, wanting to know which has greater potential and is more worth holding long-term. In the market, both are among the top cryptocurrencies by market capitalization and have a loyal fan base. Today, Lin Chao will provide a detailed breakdown of the prospects for XRP and SOL, as well as my own holding status.

According to a report from Bybit in May 2025: Bitcoin (BTC) is increasingly solidifying its king status, continuously attracting a large amount of investment; meanwhile, XRP shows a clear upward momentum under the expectation of a spot ETF; in contrast, the holdings of Solana (SOL) have significantly declined. The holdings of XRP have notably increased, doubling from 1.29% in November 2024 to 2.42% in May 2025. In comparison, Solana's holdings dropped from 2.72% in November 2024 to 1.76% in May 2025, a decrease of 35% since October 2024. XRP's crypto market cap has become the third largest non-stablecoin after Bitcoin and Ethereum. Some even believe that the approval of the XRP spot ETF may come even earlier than that of the Solana spot ETF, which has led some speculative funds to shift liquidity from SOL to XRP.

Everyone knows about Bitcoin's strong performance, mainly driven by a more favorable regulatory environment for cryptocurrencies in the U.S. and the introduction of a spot Bitcoin ETF, which has led to increased institutional investor adoption. The emergence of the spot ETF provides institutional investors with a more convenient and compliant way to enter the market, significantly lowering the entry barrier. Long-term followers of Lin Chao know that my view has always been that whether we profit by holding a certain cryptocurrency or through short-term contracts, our ultimate goal is to convert the profit portion into Bitcoin holdings.

What has caught Lin Chao's attention is the rise of XRP. Although I hold both XRP and SOL, my position in XRP is not heavily weighted. First, it is important to understand that XRP is essentially a bridging currency that enables efficient and low-cost exchanges between different fiat currencies, providing a smoother path for global payments and cross-border settlements. Its vision is to create a decentralized, global financial network that connects banks, payment service providers, and financial institutions worldwide through its nodes, achieving faster, cheaper, and more efficient payments and transactions. Currently, XRP's processing speed can reach 1,500 transactions per second, so it can be understood that XRP's key focus is on decentralized finance (DeFi), stablecoins, and asset tokenization in the Web3 space.

However, it is important to note that XRP is an established cryptocurrency launched in 2012. After so many years of accumulation, it is normal for it to have more holders than SOL, but this does not necessarily indicate that more people are optimistic about XRP's growth prospects; it simply reflects that it has existed long enough. Additionally, the issuing company of XRP has not publicly disclosed the profitability of its cross-border payment business, and the actual usage frequency of XRP in global financial services has not met expectations, relying more on the sale of XRP tokens to maintain operations. It is worth noting that the vast majority of XRP tokens are still held by the issuing company Ripple, which sells a certain amount of XRP every quarter.

In contrast, SOL, established in 2017, is a younger public chain compared to XRP. It can support more practical applications, with its ecosystem backing billions of DeFi assets and tens of thousands of daily active users, attracting partnerships with companies like Google Cloud, Mastercard, and Shopify. Solana's hardware technology advantages are quite evident; after the Firedancer upgrade, its TPS exceeded one million, processing 1.2 million transactions per second, compared to XRP's 1,500 transactions per second, showcasing a significant core hardware advantage.

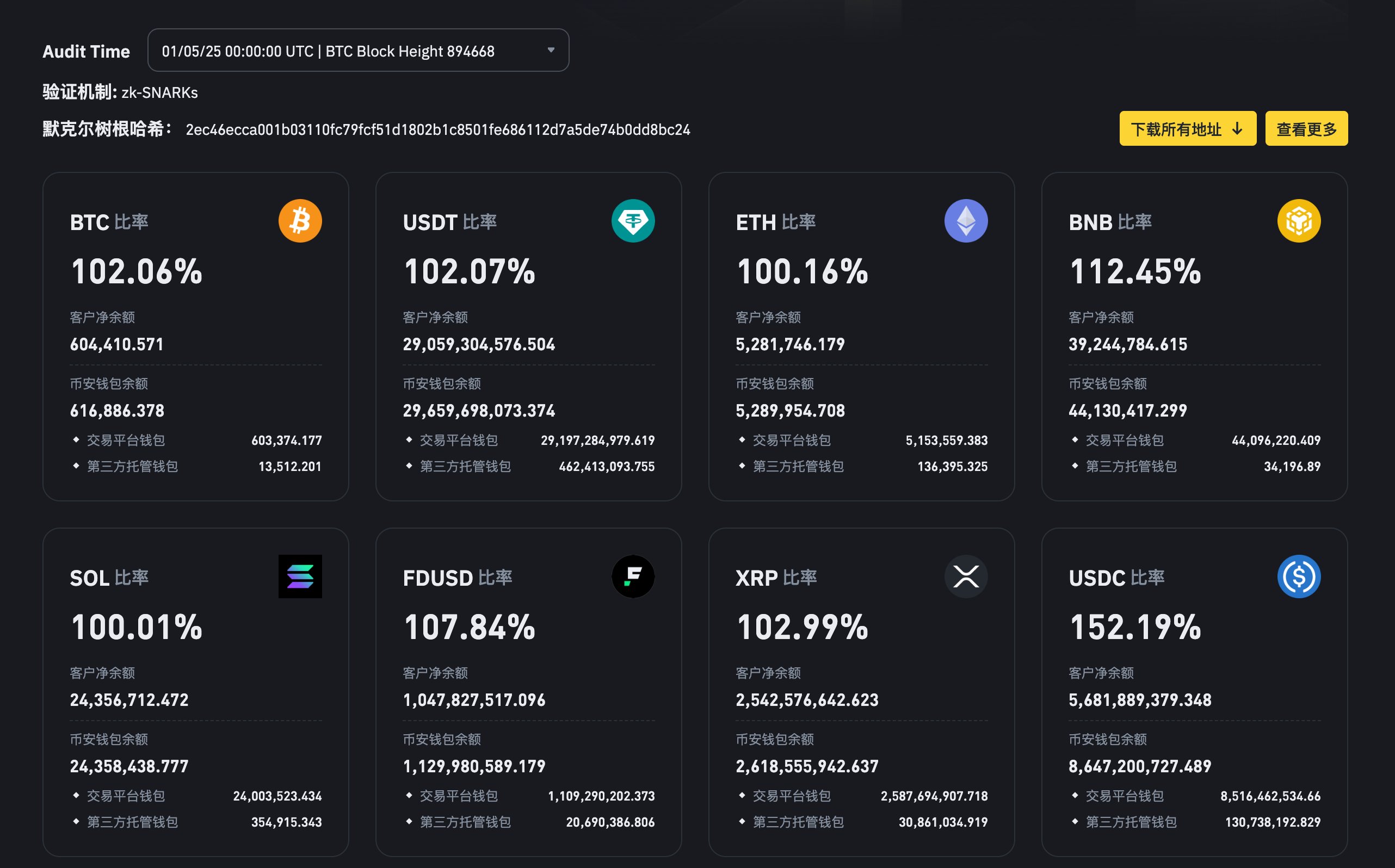

From the latest mid-year reserve data from Binance in 2025, we can also see that BTC increased by 9,729 coins ≈ $963 million, ETH increased by 8,033 coins ≈ $15.26 million, USDT increased by $325 million, USDC increased by $1.697 billion, and BNB increased by 15,913 coins ≈ $9.7 million. Meanwhile, XRP decreased by 14.5 million coins ≈ -$31.6 million, and SOL decreased by 2,453 coins ≈ -$360,000. In comparison, Binance's action goal is to settle profits and transfer them to low-risk assets, which aligns with Lin Chao's consistent approach. Comparing the holdings of XRP and SOL, although both are in the high-risk reduction category, the reduction in XRP is ten times that of SOL.

Solana is expected to receive approval for a spot ETF by October this year, and it is certain to pass, as both the White House and the new SEC are very pro-crypto. Moreover, this month, the SEC also asked the Solana ETF application institutions to submit supplementary materials, which is often a precursor to approval. In contrast to XRP's "expected approval," SOL's approval can be considered a done deal. Lin Chao has always emphasized that one should not have too many expectations regarding the "expected" fundamentals in the market. Retail investors often cannot access specific substantial fundamentals, so they are often misled by "uncertain positive news" in the market, leading to investment failures. If you really cannot confirm the credibility of the information, the simplest way to verify is to compare the actions of large institutions.

If SOL passes the ETF, what is the potential upside? Based on historical data, Lin Chao estimates that if the fund inflow for the SOL ETF is 5% of that for the BTC ETF, its price could rise by 3.4 times, reaching $500, potentially hitting the $400–$500 range; in a more optimistic scenario, if the fund inflow reaches 14%, the price could exceed $800.

However, it is important to be cautious about the selling pressure risk for SOL. Early investors in SOL have very low costs, and the ETF launch could become a point for unlocking and exiting. Earlier this year, as the altcoin season entered a cold period, SOL's price fell from a high of $295.6 to a low of $96.07, with a maximum drop of two-thirds, which also reflects that SOL's holders have relatively dispersed holdings. Additionally, SOL's supply structure differs from that of BTC and ETH: the staking ratio has exceeded 65%, and whether the ETF allows staking of shares remains uncertain. If staking rewards are not included in the ETF structure, the attractiveness of SOL in the spot ETF will decline due to not participating in on-chain returns. In simple terms, if the ETF approval does not include the staking portion, the returns for early SOL holders will be significantly reduced, affecting market confidence.

Before the ETF news is officially confirmed, in the short term, SOL's price may be further driven by capital expectations, with a possibility of hitting the $200–$300 range; however, whether SOL can replicate the explosive growth of BTC in the medium term depends on two variables: whether the ETF structure can address the staking issue and truly achieve the dual goals of "on-chain returns + regulatory transparency"; and whether the on-chain ecosystem can accommodate new traffic and trading demands, building a solid "capital + application" closed loop.

From the recent price trends and technical aspects of SOL, we can see that it aligns with my previous market predictions. The cryptocurrency market is in a period of oscillation and correction from June to September (specific details can be found in Lin Chao's earlier articles). During this period, there will be continuous adjustments to platform levels, and after each decline, it will enter another new oscillation phase to seek support. Therefore, spot users need not FOMO; let the bullets fly for a while, and there will definitely be better entry opportunities. However, for those who do not have much time to monitor the market, entering around 140 would not be too far off. I will also be allocating positions around 140 and 120, and if this round of oscillation lasts long enough, I will also make long-term investments below 130.

Contract users can consider using this oscillation period to hone their skills and develop their trading systems. The likelihood of extreme one-sided market conditions in the short term is low, and even if mistakes are made, they won't be too far off. Compared to medium to long-term spot trading, short-term trading does not require as much patience and belief, and one does not have to suffer more psychological pressure due to prolonged sideways movement. Trading itself is for profit, and everyone should make good use of all tools that can be utilized for profit. In this boring trading cycle of sideways movement, find a bit of fun. If users have questions about entry points and position management, they can also message Lin Chao for reference while building their trading systems.

The Buddha said, "Those without faith do not cross." Many people spend their lives doubting everything, and in the end, they do nothing, remaining stagnant while watching others succeed. The cost of being deceived is actually not high, but the cost of doubt is much higher. If your execution cannot keep up with your understanding, then all your understanding is just internal friction.

The global market is ever-changing, the world is a whole, follow Lin Chao to gain a top-tier global financial perspective

For real-time consultation, please follow the public account: Lin Chao on Cryptocurrency.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。