How to do business in a compliant exchange?

According to data, in 2024 Coinbase:

The total number of users is 105 million, with about 55% from the United States.

Institutional clients contribute 82.05% of the total trading volume, while retail users account for only 17.95%.

By cryptocurrency type, Bitcoin and Ethereum account for 44% of the trading volume.

Summary: Primarily serves U.S. users, with institutions dominating the trading volume, and mainstream coins remain the main trading assets on the platform.

In contrast, HashKey, another compliant exchange with a strong background, has encountered several difficulties, including:

Market limitations: HashKey primarily serves local users in Hong Kong, with limited market capacity.

Globalization attempts: In 2024, HashKey Global was launched to expand into international markets, but it started late and faces fierce competition from established platforms like Coinbase and Binance.

Limited service scope: Due to strict compliance requirements, HashKey's products and services are highly targeted but have a narrow coverage.

Highlight: OTC Business

HashKey's over-the-counter (OTC) business has performed outstandingly, supporting seamless trading of over 10 fiat currencies and more than 60 cryptocurrencies, with trading volume exceeding $5 billion in 2024, becoming its pillar revenue source.

The risk of a single business line lies in an unbalanced revenue structure. Can HashKey explore diversified business models to achieve long-term growth? Currently, there is indeed potential.

On May 7, 2025, Futu Securities International officially launched Bitcoin, Ethereum, and USDT deposit services, supporting cryptocurrency trading services for compliant investors;

On June 24, 2025, Guotai Junan International officially received approval from the Hong Kong Securities and Futures Commission to provide virtual asset trading services.

According to reports, both Guotai Junan and Futu are adopting a broker intermediary model to enter the cryptocurrency market, with underlying technology supported by HashKey. This means that the two platforms do not directly develop cryptocurrency trading platforms but act as intermediaries, relying on existing platforms and interfaces to provide cryptocurrency trading services to clients.

In fact, the two brokerages have become "distributors" for HashKey, as both Guotai Junan and Futu hold VASP licenses, while only HashKey holds a VATP license. The underlying liquidity of VASP relies on VATP support, so the trades of users on their platforms will ultimately be routed to HashKey.

The explosive point is:

Currently, several brokerages are working hard to complete license upgrades to enter the cryptocurrency trading market. Their operational model is also a non-proprietary "distribution-style" exchange, while HashKey is far ahead in this market in terms of technical strength, compliance, and brand power, possessing sufficient core competitiveness in the B-end, making it entirely possible to become the underlying platform for institutions entering the cryptocurrency market in the future.

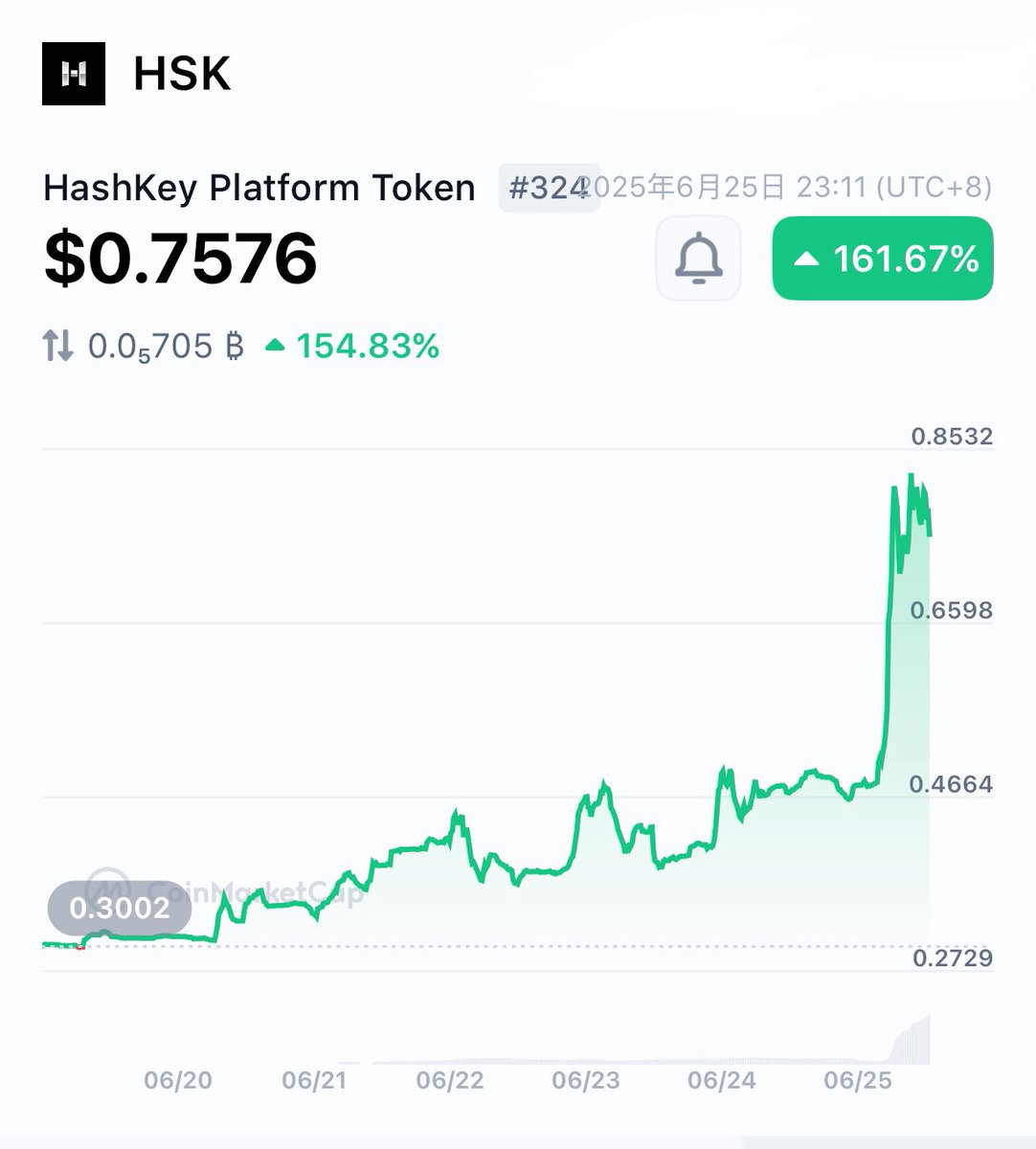

In the future, domestic brokerages and institutions entering the cryptocurrency market will, in fact, become distribution platforms for HashKey. Coupled with the official launch of the "Cross-Border Payment Link" from Hong Kong to the mainland, this releases positive signals from the policy level. No wonder $HSK rose 160% in a week.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。