Recently, Kalshi announced the completion of a $185 million Series C funding round led by Paradigm, with its valuation soaring to $2 billion. At the same time, Polymarket is preparing to complete a nearly $200 million funding round, with its valuation surpassing $1 billion.

The frequent financing news in the prediction platform sector inevitably brings to mind the intense competition and underlying tensions between platforms, as a silent showdown over the future pricing power of information unfolds.

The Love-Hate Relationship of Prediction Markets

Kalshi was founded in 2020 and is headquartered in New York. It is currently the only legally approved prediction market platform by the U.S. Commodity Futures Trading Commission (CFTC). Its investors include Y Combinator, former Charles Schwab CEO David Pottruck, and crypto venture capital firm Paradigm, with the latest funding round valuing the company at $1 billion.

Polymarket represents the decentralized prediction market. The platform allows users to trade event predictions using the crypto stablecoin USDC on the blockchain, supporting on-chain settlement and boasting high liquidity. Its investor lineup is equally impressive, including Founders Fund, Polychain Capital, Naval Ravikant, and Balaji Srinivasan. The new funding round is expected to raise $200 million, with a pre-funding valuation close to $1 billion, led by Founders Fund.

In June of this year, Polymarket announced a partnership with the social platform X, led by Musk, combining its prediction market data with the AI tool Grok launched by xAI to create a "real-time prediction information stream." Previously, Kalshi had been the first to negotiate a similar partnership with X and even made an official announcement, but the collaboration was retracted within 24 hours.

The outside world generally believes that this "lightning turn" hides strong political implications—Donald Trump Jr., the son of Trump, is a senior advisor to Kalshi. The social media conflict between Musk and Trump is at its peak, and X's abandonment of Kalshi in favor of the yet-to-be-compliant Polymarket is interpreted as a strategic response to political leanings, reflecting Musk's dissatisfaction with traditional regulation.

Related article: "X Partners with Polymarket, Bringing Musk Closer to the 'Everything App'"

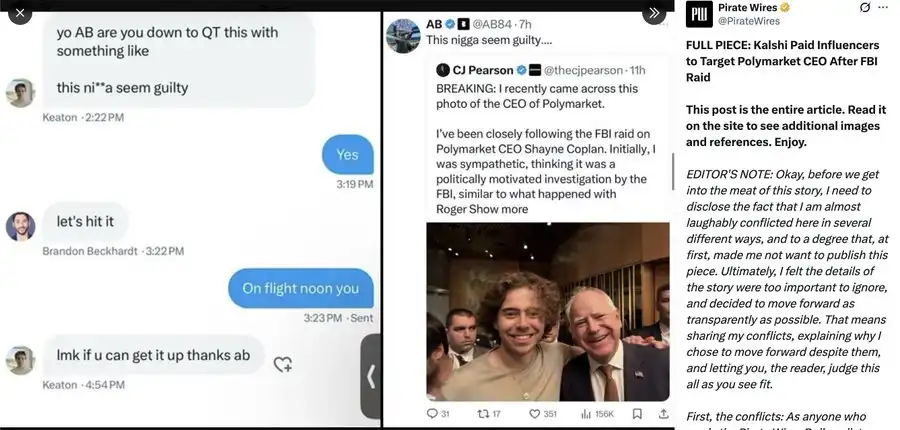

Recently, crypto investor Tom Schmidt revealed that Kalshi may have privately coordinated with former NFL player Antonio Brown (AB) to conduct an organized smear campaign against Polymarket.

In a set of screenshots disclosed by Pirate Wires, Kalshi's growth department employee Keaton was reported to have privately messaged AB, requesting him to retweet with the caption "This guy looks guilty," implying that Polymarket CEO Coplan was involved in criminal activity. Subsequently, AB posted the related tweet as instructed, confirming that Kalshi organized the manipulation of public opinion and launched a smear campaign using social influencers.

In addition to Antonio Brown, Pirate Wires also found that several KOLs with large followings posted negative content after the FBI raided Polymarket's CEO. For example, the meme account Clown World tweeted the day after the FBI raid, mocking Polymarket CEO Coplan as "the illegal gambling version of SBF," and indicated a paid partnership with Kalshi. This account has also frequently posted content related to Kalshi during the election period.

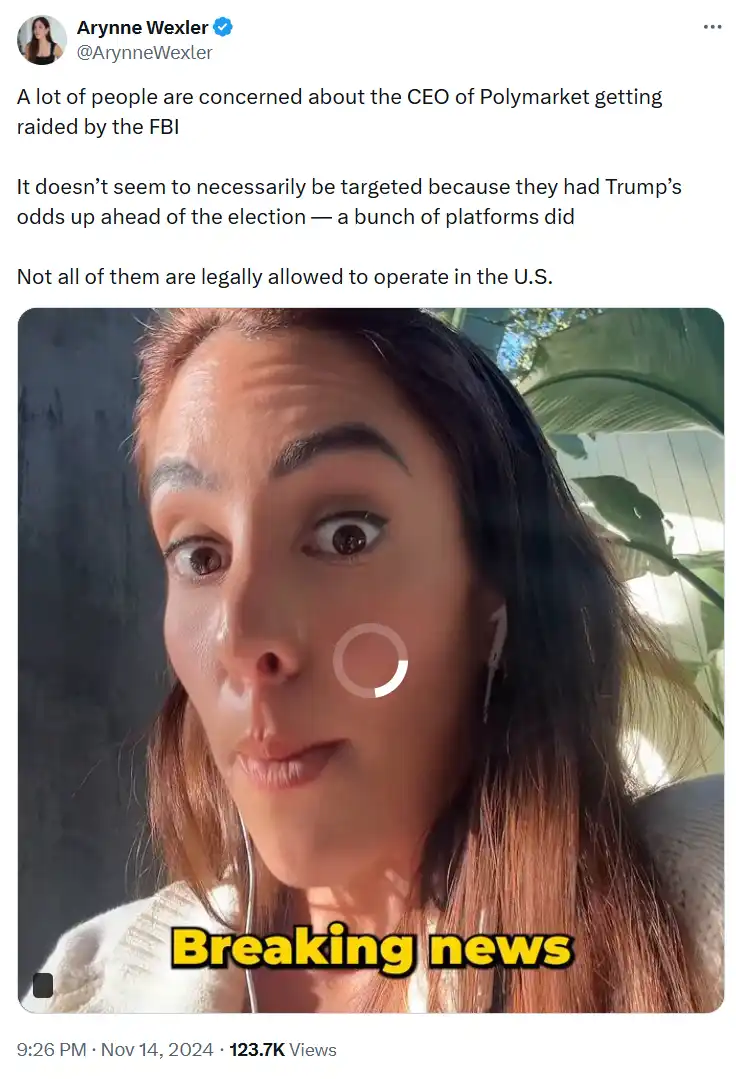

Miami influencer Arynne Wexler posted a video emphasizing that Polymarket is illegal in the U.S., repeatedly recommending Kalshi and advising viewers to "choose compliant platforms." Relevant screenshots show that Arynne Wexler had previously engaged in private cooperation with Kalshi.

Kalshi vs. Polymarket: Who Comes Out on Top?

Funding Background: Top Capital Highly Sought After

Both Kalshi and Polymarket have garnered favor in the capital markets, attracting top VCs and industry figures, indicating that the prediction sector is transitioning from "niche speculation" to "the next infrastructure."

Kalshi started through Y Combinator's winter incubation program in 2019 and completed a $30 million Series A funding round led by Sequoia Capital in February 2021, with the company's valuation soaring to $120 million. Heavyweights like SV Angel, Charles Schwab (Chairman of Charles Schwab), and Henry Kravis (co-founder of KKR) were all involved. In October 2024, Kalshi secured another $50 million in funding, with well-known institutions like Sequoia Capital, Mantis VC, and Neo participating, which will be used to expand event contract categories and enhance platform functionality. On June 26, 2025, Kalshi completed a $185 million Series C funding round led by Paradigm, with a valuation of $2 billion.

Polymarket's funding path has a more Web3 flavor: founded in 2020, it secured a $4 million seed round led by Polychain, with angel investors including Balaji (former a16z partner, Coinbase CTO), Jack Herrick (founder of wikiHow), and Robert Leshner (founder of Compound). In 2022, it raised a $25 million Series A round led by General Catalyst, with Airbnb co-founder Joe Gebbia and Polychain investing again. In May 2024, Polymarket completed a $45 million Series B funding round led by Founders Fund, founded by Peter Thiel (co-founder of PayPal and Palantir), with Ethereum founder Vitalik also personally investing. It is currently preparing for a new $200 million funding round, with a valuation expected to exceed $1 billion.

Notably, Polymarket not only has deep backing from traditional crypto capital but also has the endorsement of Silicon Valley legend Peter Thiel. Thiel led Polymarket's Series B funding through his Founders Fund, which was also an early supporter of Musk's X. Kalshi, on the other hand, has received backing from members of the Trump family. Amid regulatory controversies in the election market, the indirect support from Trump's camp for Kalshi has often been interpreted by the market as a "policy signal." In this highly politicized sector, the game of capital and power has long transcended the prediction sector itself.

Operational Mechanism: Centralized vs. Decentralized

The core difference in the operational methods of Polymarket and Kalshi mainly lies in "decentralization vs. centralization."

Kalshi adheres to a centralized approach, employing a traditional centralized order book structure—the platform acts as both the matchmaker and the fund custodian, with all trade matching, result sourcing, and settlement paths completed within its platform, providing a trading experience closer to the U.S. stock options market, making the entire logic more conducive to institutional participation and regulatory access.

In contrast, Polymarket fully embraces the decentralized narrative—AMM market-making mechanism, smart contract full-chain settlement, and oracle determining result sourcing, requiring no trust center, no real-name registration, and wallet as the transaction. The platform has embedded the characteristics of "freedom, fairness, and anti-censorship" into its code logic, aligning more closely with the "decentralization" ethos of the crypto community.

Regulation: Compliance First vs. Regulatory Red Lines

The regulatory gray area of prediction markets is no longer a secret, and the differing fates of Kalshi and Polymarket in this gray area further reveal the advantages and disadvantages of centralized and decentralized routes.

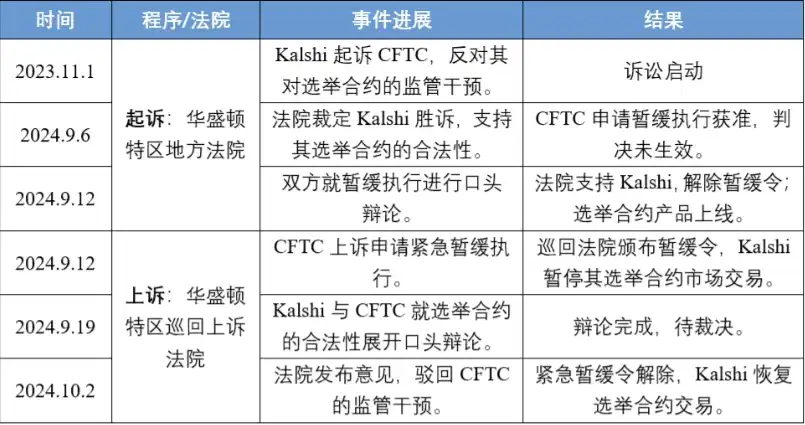

Kalshi broke through regulatory barriers to become an officially recognized prediction market: in June 2023, it attracted the attention of the U.S. Commodity Futures Trading Commission (CFTC) due to election contracts. On June 12, Kalshi self-certified to the regulators, and on June 23, the CFTC initiated a formal review, ultimately denying it on September 22, citing "involvement in illegal gambling." However, Kalshi did not give up and subsequently engaged in a protracted tug-of-war with the CFTC in the Washington Circuit Court, ultimately winning in October 2024, becoming the first prediction platform in the U.S. to obtain legalization for election contracts.

In stark contrast, Polymarket has faced regulatory crackdowns: as early as 2022, it was sued by the CFTC for offering unregistered over-the-counter binary options contracts, paying a $1.4 million fine and "promising" to exit the U.S. market. However, according to on-chain access data, about 25% of the traffic still comes from U.S. users, with VPNs being commonly used to bypass restrictions. In November 2024, after the U.S. elections, Polymarket reignited the regulatory powder keg: the U.S. Department of Justice launched an investigation, and the FBI raided its founder Shayne Coplan's residence, seizing his electronic devices, accusing him of potentially manipulating platform results to influence election opinions and guiding U.S. users to participate in trading. To this day, Polymarket remains classified as an "illegal platform" by the CFTC, with the shadow of regulation looming large.

Influence: Polymarket Breaks Through and Leads

If Kalshi wins within the framework of rules, then Polymarket wins by breaking through the noise outside of it.

In the 2024 U.S. elections, Polymarket accurately predicted Trump's victory in advance, becoming a representative platform for "slapping polls in the face." Bloomberg Terminal integrated its odds data into their system, and mainstream media such as The New York Times, The Economist, and The Wall Street Journal collectively cited on-chain prediction data for the first time, breaking the Web2 opinion barrier. Even Trump himself mentioned Polymarket at a rally, allowing its influence to permeate from the blockchain into public opinion across the U.S.

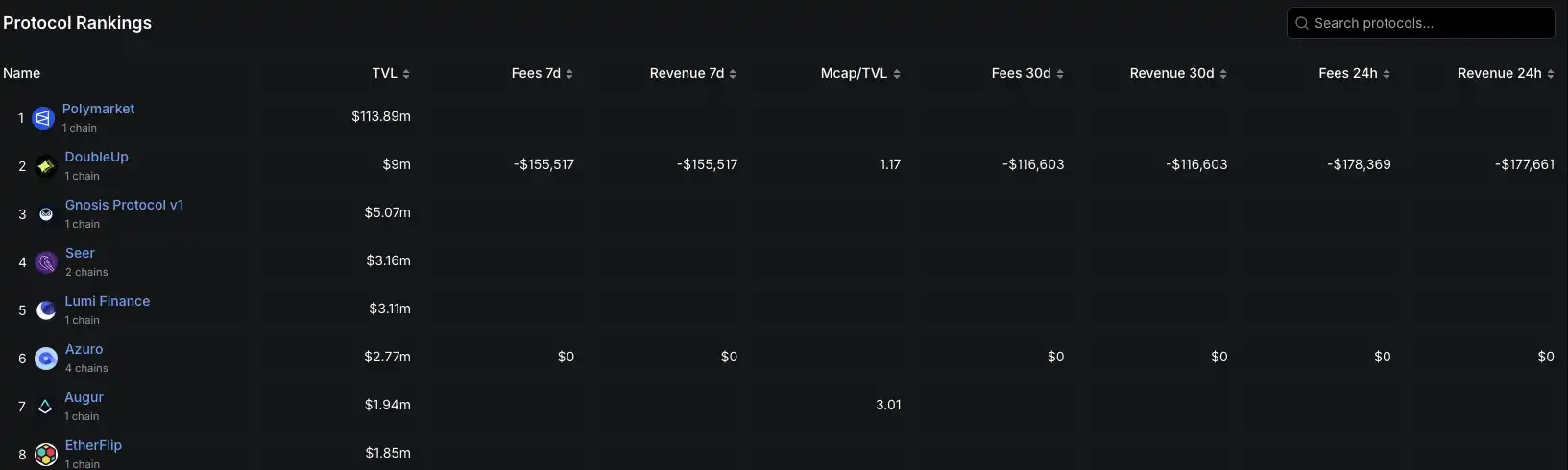

In terms of scale, Polymarket is already far ahead. The platform's current Total Value Locked (TVL) has reached $113 million, surpassing the combined total of the top ten platforms in the sector; the cumulative trading volume in the U.S. election market for 2024 has exceeded $3 billion, with betting amounts over $4 billion. In contrast, Kalshi's total trading volume in the election market during the same period was $875 million, with betting amounts around $230 million. Whether in user participation, trading depth, or market feedback enthusiasm, Polymarket is undoubtedly the "phenomenal platform" in the current prediction sector.

Conclusion

Whether following the centralized compliance path of Kalshi or adhering to the decentralized autonomous spirit of Polymarket, both represent different answers to the "future pricing power" in the information age. Whether these two paths ultimately converge remains to be seen over time. However, it is certain that prediction markets are moving from the margins to the center; they are no longer just a speculative game for a few but are becoming a new way to explain the world. Who will rise and fall is worth betting on.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。