Author: Weilin, PANews

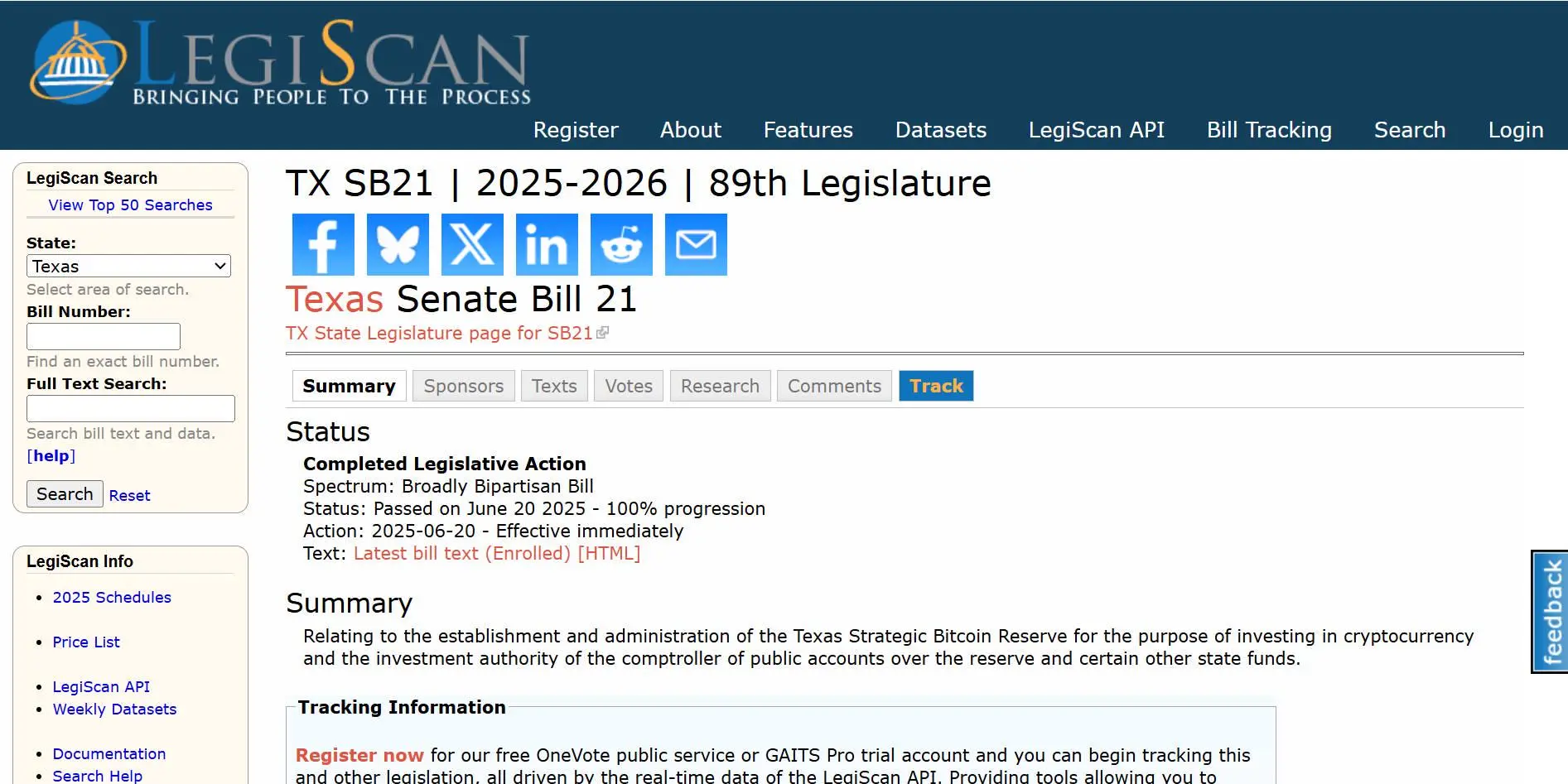

Recently, Texas Governor Greg Abbott signed the SB 21 bill, making Texas the third state in the U.S. to establish a state-level strategic Bitcoin reserve through legislation. While Arizona and New Hampshire took the lead with their bills, Texas is the first state to set up an independent Bitcoin reserve fund supported by public funds, rather than just authorizing it.

The Texas government has allocated $10 million for the purchase of Bitcoin within this fiscal biennium (i.e., a two-year budget). This fund will be managed by the Texas Comptroller and will be established outside the state financial system, rather than being incorporated into the traditional state financial structure.

At the same time, Governor Greg Abbott also signed the HB 4488 bill, ensuring that the Bitcoin reserve fund is legally protected from the state's periodic "fund-sweep" mechanism, meaning it cannot be diverted for general fiscal purposes. The bill also stipulates that even if no Bitcoin is purchased before next summer, the legal status of the reserve fund will continue to exist.

Contents of SB21: How will the Bitcoin reserve be executed from procurement to custody standards?

The SB21 bill considers that Bitcoin and other cryptocurrencies have strategic potential to enhance Texas's financial resilience, serving as tools to combat inflation and economic fluctuations. Establishing a strategic Bitcoin reserve has public benefits in enhancing financial security for residents of the state.

According to the bill, the Texas strategic Bitcoin reserve will be established as a dedicated fund outside the state treasury, managed and operated by the Comptroller. The reserve includes: funds transferred or deposited by legislative appropriations; revenues allocated to the reserve under general law; Bitcoin and other cryptocurrencies (including those derived from blockchain forks and airdrops) purchased or acquired by the reserve based on asset market value requirements; and investment income, interest, or rewards generated from reserve assets.

The bill stipulates:

- Flexible asset management: The Comptroller may invest, exchange, sell, manage, or hold assets based on the standards of a prudent investor, considering the current purposes, terms, and allocation requirements of the reserve. The legislature may allocate funds for investing in cryptocurrencies and managing the reserve. The Comptroller may use Bitcoin or other cryptocurrencies from the reserve, or the net proceeds from their sale, to pay reasonable management fees.

- Reserve funds may co-invest with state treasury funds.

- Unless authorized by the General Appropriations Act or other laws, the Comptroller may not transfer reserve funds to the state treasury.

- Investable asset range: Bitcoin or other cryptocurrencies purchased with reserve funds must have an average market value of no less than $500 billion over the past 24 months. (Currently, only Bitcoin meets this standard)

On the execution level, the Comptroller may contract with one or more third-party entities, including qualified custodians with cold wallet security custody technology and qualified liquidity providers to assist in asset purchase and management.

However, qualified liquidity providers must ensure: they have federal or state legal permission; audited financial statements issued by regulatory auditing agencies; at least five years of experience in cryptocurrency trading; an office in Texas and registration of key personnel; and certification to the Comptroller that they meet the above conditions.

Additionally, the bill proposes that the Comptroller may use derivatives if beneficial to the reserve. SB21 establishes a five-member Strategic Bitcoin Reserve Advisory Committee, composed of the Comptroller, one designated investment expert, and three cryptocurrency asset experts, responsible for asset valuation advice and investment policy design.

From Precious Metals to Bitcoin: Exploring Financial Sovereignty Under Policy Continuity

In an X Space event, Representative Giovanni Capriglione, who participated in drafting the bill, stated that in his view, the right of the public to own, hold, and use any medium of exchange recognized by each other is indisputable. "Whether it is cash, coins, or precious metals like gold and silver, it is the same. About eight years ago, I helped promote and pass the bill to establish the first state-level precious metals depository in the U.S., the Texas Bullion Depository, which currently holds gold and silver.

"About ten years ago, I bought my first Bitcoin, and since then, I have been paying attention to the Bitcoin space. This is mainly because Bitcoin allows individuals to control their financial power without federal regulatory interference," he said.

When asked about the relationship between Bitcoin and precious metals, given that many Bitcoin supporters also recognize the value of gold, he stated that the strategic Bitcoin reserve is not meant to compete with our gold depository; they are functionally complementary. Both can provide a scarce, valuable resource that can be transferred between individuals and are effective means to combat inflation.

Bitcoin Strategic Reserve "Local Laboratory," Custodians to Be Publicly Tendered

In response to Trump's federal policy on Bitcoin strategic reserves, various state-level BTC reserve bills are spreading and undergoing expedited review. On June 25, Arizona passed the "Bitcoin Reserve" bill HB2324. This bill establishes a reserve fund for assets obtained through criminal asset forfeiture. If signed by Governor Hobbs, this will be the second reserve bill passed in the state.

Representative Giovanni mentioned that the White House has issued an executive order regarding Bitcoin strategic reserves, but state governments seem to be ahead, believing that state governments should lead as he has served as a state legislator for 13 years. The federal system in the U.S. allows states to be "policy laboratories," enabling them to test new policies more quickly and in closer alignment with public opinion. According to him, Congress has passed about 18 laws from the beginning of the year until now, while Texas has passed about 1,200 in the same period. Local efficiency is clearly higher and more responsive.

Zack Shapiro, a lawyer at the Bitcoin Policy Institute, stated that they have conducted in-depth research on the definition, role, and necessity of "Strategic Bitcoin Reserves (SBR)." Compared to the federal government, states face more fiscal constraints: the federal government can issue national debt, has the global reserve currency (the U.S. dollar), and can print money, but states do not have these powers. However, states also bear long-term responsibilities such as pensions and infrastructure while enduring the pressure of currency devaluation. Therefore, the core significance of SBR lies in preserving public funds, combating inflation, and ensuring that state governments can fulfill their obligations in the future.

Additionally, he believes that there are significant differences in state financial structures; some states have large investment accounts, while others wish to integrate Bitcoin into existing portfolios or experiment with more cutting-edge financial instruments, such as "Bitcoin municipal bonds (BitBonds)," which could even provide investors with tax-free Bitcoin returns.

"A few years ago, I discussed with legislators how to incorporate Bitcoin into Texas's balance sheet. Initially, we wanted to use a charitable trust model, with the state Comptroller as the beneficiary, but this still faced political difficulties. Later, in November last year, the political environment changed, Bitcoin matured, and received strong support from Governor Greg Abbott, the Lieutenant Governor, and the Speaker of the House. The bill was finally submitted, undergoing some modifications in the process."

He added that the $10 million expenditure in Texas only accounts for 0.00004% of the state's annual budget, which is quite small and can be seen as a "trial." The most important thing now is to ensure that the Comptroller's office and the Texas Treasury Safekeeping Trust Company (TTSTC) have sufficient capabilities to collaborate with qualified custodians to ensure the secure custody and compliance auditing of the reserves.

Lee Bratcher, chairman of the Texas Blockchain Council, also added, "We hold monthly meetings with companies interested in responding to the Texas Treasury Trust's RFP (Request for Proposal). TTSTC is a private entity closely related to the Comptroller's office. We are assisting these crypto companies in establishing connections with them, showcasing their products and services, and will subsequently conduct a transparent bidding process. The bill authorizes the Comptroller to use derivatives to gain exposure to Bitcoin. We hope they do not simply purchase ETFs but instead directly custody physical Bitcoin and control the private keys."

According to him, the SB21 bill sets detailed conditions for "liquidity providers," such as being headquartered in Texas and operating for over five years, but the definition of "qualified custodians" is more flexible, possibly to expand the competitive range. Institutions like Coinbase, Fidelity, Anchorage, Unchained, and Onramp all have different custody solutions. The Comptroller's office and TTSTC will need a learning process to evaluate various proposals.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。