Original Title: "Binance's Capital Chess Game: From Exchange Giant to Global Financial Player"

Original Author: Master Brother from Australia, Crypto KOL

Under Trump's administration, crypto compliance has ushered in an unprecedented "Age of Exploration." Besides the favored stablecoins, I believe the CEXs, which were once the core of the crypto industry, are also gearing up for action.

In my last article, I discussed how @starokx painstakingly bet on an IPO. This time, I will talk about Binance. Although there is relatively less information on the capital market layout, analyzing Binance and CZ's actions reveals some clues. Some of these are my personal speculations and may not be accurate; I hope @czbinance will forgive any mistakes.

In addition to its aggressive expansion through Alpha in the traditional crypto space, Binance is quietly advancing a more ambitious layout in the capital market:

Upgrading BNB from a "exchange platform token" to a global financial asset, thereby constructing a capital landscape that spans chains, countries, and markets.

This is not just a game of coin prices; it is also Binance's bet on the "new global financial order."

This article will systematically analyze Binance's layout in the capital market, from national strategic reserves, the diffusion of BNB micro-strategies, to ETF explorations, gradually outlining its greater ambitions.

1. National-Level Cooperation: BNB as a Tentative Sovereign Asset

In recent years, cooperation between Binance and certain countries has gradually shown characteristics of "quasi-sovereign cooperation." Notable interactions include @cz_binance with countries like Bhutan, Kyrgyzstan, and Pakistan. These occurred in 2025, indicating this is part of CZ's new strategic direction.

Among them, Bhutan's Gelephu Mindfulness City (new special administrative region) announced plans to include Bitcoin, Ethereum (ETH), and BNB in its strategic reserves, aiming to enhance economic resilience and expand Bitcoin mining participation.

Essentially, this is Binance's attempt to embed BNB into sovereign financial systems, laying the groundwork for its future multinational identity and legitimacy. Currently, it has become popular for small countries to include $BTC as digital gold in their national reserves, and if $BNB can break through the "national use" threshold, its asset narrative will be completely restructured.

2. Micro-Strategy Diffusion: The Leverage Engine of BNB Financialization Narrative

Recently, CZ stated that several companies are preparing to build "micro-strategies" around BNB and plan to list on the US stock market, including:

• A $100 million BNB fund led by former Coral Capital Holdings executives (now called Build & Build Corporation)

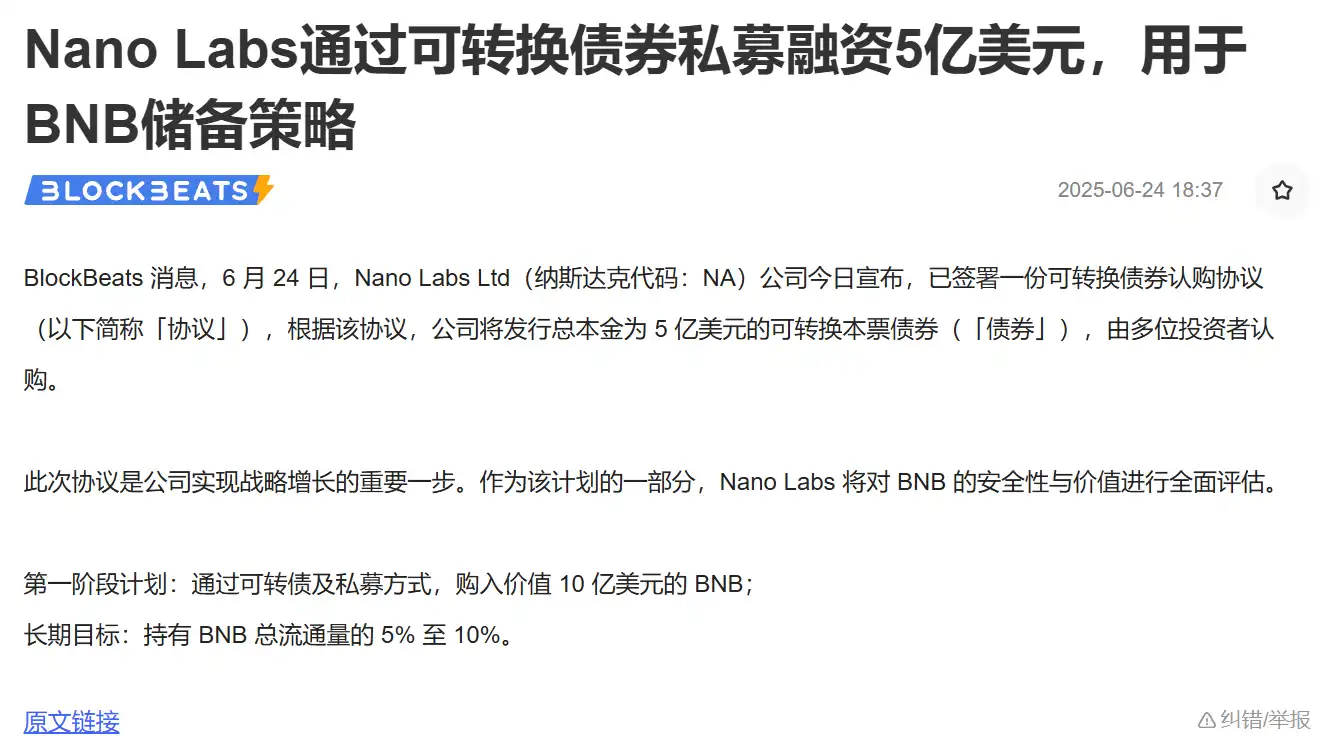

• The recently popular $NA Nabite publicly announced plans to purchase 5%-10% of BNB's circulating supply.

These companies are mimicking the MicroStrategy model in the US stock market, using "public shell + crypto assets" to gain valuation premiums and financing capabilities.

Of course, these plans are not entirely credible—some companies seem to be using micro-strategies and the BNB narrative for market harvesting and topic marketing.

However, it is undeniable that BNB has begun to possess financial attributes that can be packaged, issued, and speculated upon in mainstream capital markets. This means BNB is transitioning from "on-chain functional assets" to "off-chain investment tools."

3. $BNB ETF in Progress: Dual Exploration of Compliance Turnaround

On April 2, 2025, asset management company VanEck registered the VanEck BNB ETF in Delaware, becoming the first ETF application targeting BNB in the United States.

On May 2, 2025, VanEck officially submitted S-1 registration documents to the US Securities and Exchange Commission (SEC), clearly proposing to issue the VanEck BNB ETF, aiming to track the spot price of BNB and become the first ETF to directly hold BNB in the US.

The timing of the application is related to VanEck CEO Jan van Eck's meeting with @cz_binance at the Token2049 conference in Dubai in April 2025, where CZ stated that the success of Bitcoin ETFs would "spill over" to other crypto assets, possibly catalyzing VanEck's accelerated application.

If this action succeeds, it not only means that the compliance channel is opened but also that passive funds (such as pensions and asset management funds) can legally allocate BNB, potentially driving up demand and prices.

However, since early 2025, the SEC has received over 70 applications for alternative coin ETFs (including Solana, Dogecoin, etc.), so the final decision may take months or even years.

4. The Uncertainty of Binance.us's Listing

Will Binance go public or not? After OKX was revealed to be planning a US stock market listing this year, this has become a topic of great concern for many.

After gathering information online, it seems that CZ's thinking has changed.

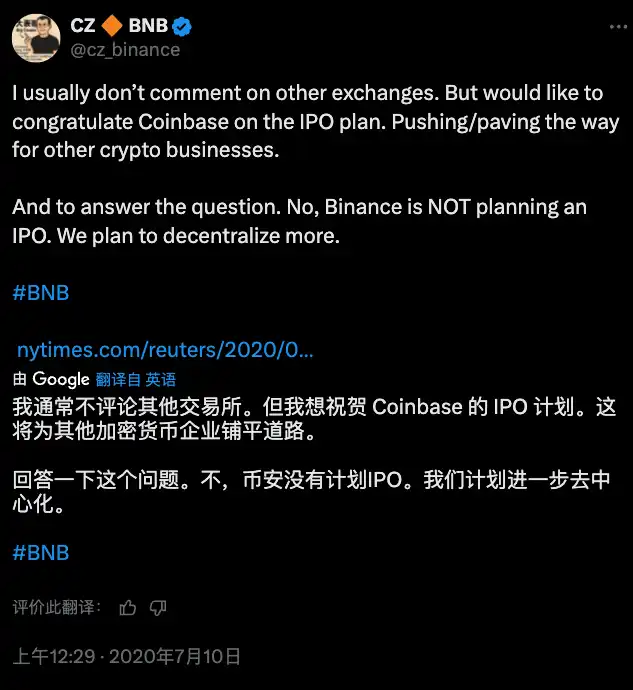

In July 2020, CZ clearly stated that Binance had no plans to go public and aimed for greater decentralization.

However, by 2021, CZ indicated that Binance.us was moving towards an IPO and planned to complete the listing within three years. In 2022, there were also rumors that http://Binance.us was seeking to raise funds at a valuation of $4.5 billion.

Although these plans were stalled due to regulatory conflicts, in May 2025, the SEC officially withdrew its lawsuit against http://Binance.us, reopening the possibility for a listing.

Against the backdrop of OKX clearly pushing for a US listing, if it succeeds, it would act as an icebreaker. Therefore, if Binance chooses to reactivate its listing plan for Binance.us, it is highly likely to reshape the exchange landscape in the US, especially in the political environment under Trump's administration, which may be the most lenient external environment, given that its USD1 is closely tied to Binance.

5. What Does Listing Mean for Us Crypto Players?

It matters a lot, and it has already been reflected in some ways.

If Binance wants to further embrace the capital market, it must address whether BNB is a security. In the previous article on OKX, I mentioned how Star handled $OKB in a way that resembled self-sabotage to ensure it could pass the Howey Test (the standard for determining securities).

From the changes over the past year, we can roughly see some policy shifts from Binance:

• Launchpad: The once most security-like "BNB new token launch" feature has been completely abolished;

• Launchpool: The frequency of rewards has significantly decreased, gradually replacing the "Pool's token airdrop" model with "Holder retrospective airdrops";

In contrast to OKB being directly "sent to the cold palace," Binance has taken a more gentle and implicit adjustment path. The reason behind this is that BNB's size is large, there are many holders, and there are numerous ecosystem stakeholders; any radical adjustment would shake Binance's foundational support.

Thus, Binance chooses a "gentle and gradual" approach, gradually weakening BNB's security attributes without causing panic, paving the way for its compliance and long-term legitimacy.

Of course, I do not believe that $BNB will be abandoned; otherwise, we wouldn't see CZ actively promoting BNB everywhere. It should just be seeking a more reasonable balance. I remain optimistic about $BNB reaching four digits.

Conclusion: From Platform Token to National-Level Asset, BNB is Restructuring Its Financial Identity

We can see that Binance's strategy in the capital market goes far beyond merely "collecting listing fees" or "squeezing out competitors." Instead, it is attempting to construct a three-dimensional system centered around BNB, linking on-chain ecosystems with off-chain capital, and connecting national resources with financial markets.

This layout is still ongoing, and whether it can truly realize BNB's transformation into a financial asset will depend on: • Whether the ETF is approved; • Whether Binance.us truly restarts its IPO; • Whether BNB completely sheds the doubts about its "security attributes"; • Whether the market provides consensus pricing for it as a "non-Bitcoin long-term asset."

But regardless of the outcome, Binance's capital chess game has quietly begun, and its momentum is growing stronger. Opportunities to watch for include:

- Subsequent secondary opportunities for BNB micro-strategy stocks

- The potential positive impact of the BNB ETF approval on BNB prices

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。