Powell Reiterates Cautious Rate Cuts at Congressional Hearing, but Morgan Stanley Predicts 7 Rate Cuts Next Year! BTC Network Hashrate Declines Due to U.S. Airstrikes on Iran

Macro Interpretation: Today, Federal Reserve Chairman Powell reiterated a cautious stance on rate cuts during a congressional hearing, clearly rejecting political pressure and suggesting that a rate cut in July is unlikely. Market expectations for the first rate cut may be delayed until December, with a modest reduction of only 25 basis points. This stance has strengthened the dollar in the short term, suppressing the preference for risk assets. However, Morgan Stanley's latest report predicts that the Federal Reserve will initiate 7 rate cuts by 2026, ultimately bringing the rate down to 2.5%-2.75%. This long-term easing signal injects potential momentum into crypto assets. In terms of dollar policy, the U.S. is achieving the tokenization of U.S. Treasuries through dollar stablecoins, aiming to maintain its global dominance. Specifically, the U.S. encourages the issuance of stablecoins backed by U.S. Treasuries to attract cryptocurrency capital to "take over" U.S. debt, which is both a response to the weakening of the SWIFT system and promotes the compliance of stablecoins. For example, Coinbase recently received MiCA authorization from Luxembourg, becoming the first compliant U.S. exchange, while the U.S. GENIUS Act establishes a framework for stablecoins, indicating a trend towards regulatory integration. Meanwhile, the EU is pushing forward its own stablecoin regulations, ignoring warnings from the European Central Bank, which may lead to a fragmentation of the stablecoin market, benefiting decentralized stablecoin projects. Overall, the policy game has intensified short-term pressure on dollar liquidity, but expectations for rate cuts and the trend of tokenization provide BTC with inflation-hedging properties, potentially attracting safe-haven funds in the medium to long term.

In terms of market dynamics, derivatives activity and capital flow indicators are amplifying short-term volatility. Deribit exchange will see over $14 billion worth of Bitcoin options expire this Friday, accounting for more than 40% of open contracts, with a majority being call options, and the put/call ratio rising to 0.72. Market analysis indicates that the maximum pain point is around $102,000, with traders generally selling straddles, and implied volatility remaining high, suggesting increased price fluctuations before expiration. This corresponds with the global money supply indicators that the market is closely monitoring: this indicator has previously captured Bitcoin pullback signals, and current market sentiment is highly sensitive to it. The upcoming week is crucial for validating its effectiveness; if the indicator shows liquidity improvement, it may trigger buying momentum. Recent institutional behavior confirms market resilience: ProCap Fund increased its BTC holdings by $386 million, bringing the total corporate holdings to 3.45 million coins, while Coinbase's stock surged to a six-month high due to favorable regulatory news. Combining this with network information, BTC is currently consolidating around $65,000, and the options event and capital indicators may exacerbate short-term volatility, but institutional accumulation provides support at the bottom, and investors may consider spread strategies.

Geopolitical risks unexpectedly disturb the fundamental aspects of the Bitcoin network. On June 22, the U.S. airstrikes on Iranian nuclear facilities, including the power infrastructure of Fordow and Natanz, led to a sharp decline in Iran's Bitcoin hashrate. Iran accounts for about 3.1% of global mining share, with cheap electricity being its advantage, but the attacks caused power outages and network disruptions, leading to a significant offline of mining machines. Although this was not intentionally targeting mining, it highlights the Bitcoin network's vulnerability to geopolitical events. The decline in hashrate may temporarily weaken network security and affect transaction confirmation speed, but history shows that hashrate recovers quickly, and the event has driven up the stock prices of mining companies like Riot Platforms and Hut 8, indicating market recognition of decentralized resilience. Coupled with a rebound in risk appetite after the Middle East ceasefire (e.g., NASDAQ hitting new highs), geopolitical disturbances may present short-term buying opportunities, but investors need to monitor the risk of escalating conflicts.

In terms of market performance, there is a clear differentiation among crypto assets, with institutional narratives reshaping the landscape. U.S. crypto concept stocks saw impressive gains in June: Circle surged 618% after its listing, Coinbase rose 39.82%, and mining companies Riot and Hut 8 increased by 24.16% and 12.9%, respectively, while SRM Entertainment skyrocketed 1273% due to a reverse merger with TRON. During the same period, the total market cap of altcoins (excluding BTC) rose from $1.231 trillion to $1.304 trillion, an increase of 5.93%, but lagged behind U.S. crypto stocks, indicating that funds prefer compliant targets. This trend aligns with the views of European analysts: after the Middle East ceasefire, investor preference has shifted towards tech stocks (such as the Magnificent 7), and Coinbase's regulatory breakthroughs and institutional accumulation of BTC highlight the linkage between crypto and the AI/tech sector. Overall, the rise in crypto stocks and the recovery of altcoins reflect a restoration of market risk appetite, but BTC benefits from institutional accumulation, showing relatively stable performance. In terms of impact, policy delays and geopolitical events may suppress short-term gains, but the trend of tokenization and institutional entry provide BTC with "digital gold" properties. In the medium to long term, if the Federal Reserve implements rate cuts, BTC may break through previous highs, while the hashrate events warn of the need to strengthen network decentralization. Investors should focus on compliant platforms and BTC spot ETF inflows, avoiding high-volatility altcoins.

The mid-2025 crypto market is approaching a turning point amid policy, geopolitical, and capital waves. BTC is under short-term pressure from delayed rate cuts and hashrate disturbances, but institutional accumulation and improved regulatory frameworks have built a solid bottom, with the potential to lead in the tokenization trend in the medium to long term. It is recommended that investors balance their positions, prioritize BTC and compliant targets, while monitoring monetary indicators and options market signals. In the coming year, the true test for the crypto market will be whether it can convert volatility into sustainable growth.

BTC Data Analysis:

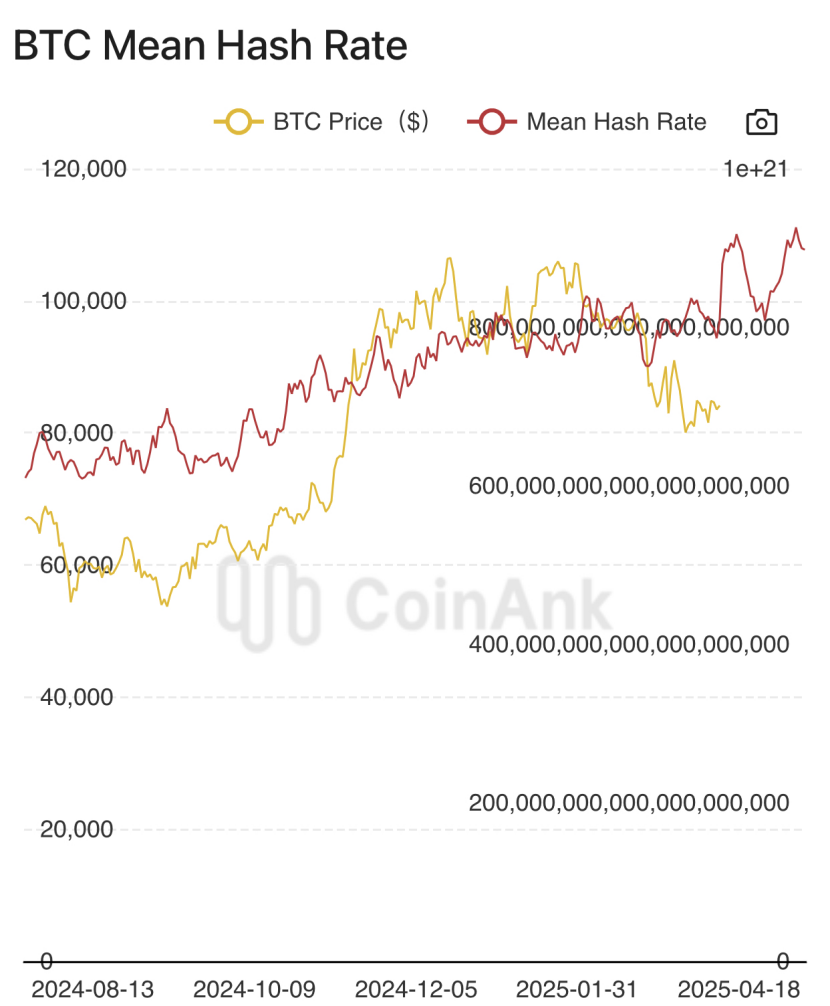

According to CoinAnk data, the overall hashrate of BTC saw a significant decline in late June 2025, primarily due to U.S. military airstrikes on Iranian nuclear facilities affecting the power system, leading to a notable drop in mining activities in Iran, which accounts for over 3% of the global share. The interruption of cheap electricity caused mining machines to go offline; although not directly targeting mining, it exposed the potential weaknesses of the Bitcoin network in geopolitical conflicts. In the short term, the decline in hashrate may weaken transaction confirmation efficiency and affect security, but historical experience shows that mining difficulty adjustments will attract miners back, recovering relatively quickly.

Such events highlight that while Bitcoin's decentralized nature is resilient, it is susceptible to external disturbances. For the crypto market, BTC prices are under short-term pressure, falling below $100,000 and triggering large-scale liquidations; however, the rising stock prices of mining companies reflect market recognition of systemic resilience. The rebound in risk appetite in the Middle East may present buying opportunities, but investors need to be cautious of sustained volatility triggered by escalating conflicts, avoiding leverage risks. Overall, the long-term trend of BTC still depends on fundamentals rather than a single geopolitical event.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。