On June 25, 2025, the SEI cryptocurrency made a stunning impact on the market, with its price breaking through $0.33, rising 23.66% within 24 hours, and accumulating a staggering 107% increase over the past seven days, bringing its market capitalization to $1.812 billion. This explosive growth not only highlights SEI's strong momentum in the crypto market but also sparks enthusiastic discussions among investors about its future potential. As a Layer 1 blockchain optimized for decentralized exchanges (DEX), what has enabled SEI to achieve such significant breakthroughs in a short period?

The Technical Driving Force Behind the Price Surge

SEI's price performance is remarkable, and its breakthrough above $0.33 is supported by strong technical factors. Currently, SEI has surpassed the 50-day and 200-day moving averages, establishing a bullish trend for both the medium and long term, with prices stabilizing around $0.33. The next key resistance level may be at $0.40. Trading volume data further confirms market enthusiasm, with SEI's trading volume surging 253% in the past 24 hours to reach $780 million, indicating high investor participation and increased market liquidity.

The Relative Strength Index (RSI) is currently around 50, indicating that market momentum leans towards the bulls, but it has not yet entered the overbought zone, suggesting there is still room for short-term growth. However, investors should be cautious of potential pullback risks, especially if market sentiment shifts, as prices may retest the support range of $0.25 to $0.28. Technical analysis shows that SEI's bullish alignment and market greed (Fear and Greed Index at 34) together provide momentum for further price increases, with the potential to challenge highs of $0.34 or even $0.44 in the short term.

Rapid Expansion of the Ecosystem

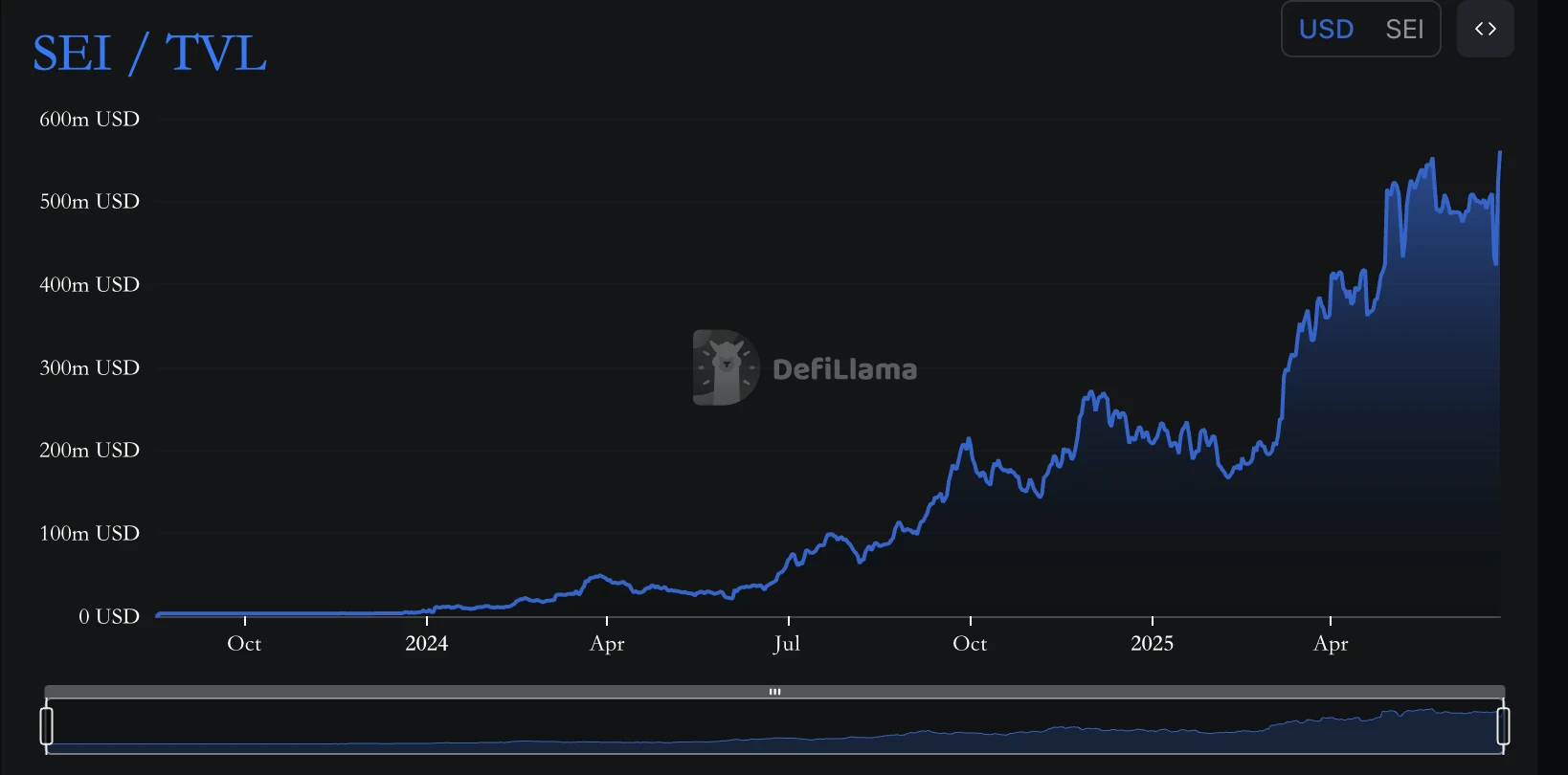

SEI's success is not only reflected in its price but also in the rapid development of its ecosystem, which provides solid fundamental support. As a Layer 1 blockchain optimized for decentralized exchanges, SEI has attracted a large number of developers and users with its high performance and low-cost transactions. According to on-chain data, the number of active wallets on the SEI network surpassed 600,000 in the third quarter of 2024, with daily trading volume significantly increasing, reflecting the growing activity within its ecosystem. The Total Value Locked (TVL) surged from $185 million at the beginning of the year to $540 million in June 2025, indicating the robust growth of decentralized finance protocols on the SEI network.

SEI has also further promoted ecosystem development through a long-term partnership with Binance. Since the launch of the SEI mainnet in August 2023 and its introduction on Binance Launchpool, SEI has continuously engaged in activities on the Binance platform, such as staking and Launchpool activities supported by Binance Wallet, attracting users to stake assets like BNB, TUSD, and FDUSD in exchange for SEI rewards.

These activities typically last for 30 days or longer, providing users with passive income opportunities while enhancing the liquidity and community engagement of SEI tokens. For example, the Binance BNB Vault supports SEI Launchpool, allowing users to stake BNB to automatically participate in SEI reward distribution and earn daily returns. This long-term activity not only boosts SEI's visibility but also injects more liquidity into its ecosystem through Binance's vast user base. SEI employs a Twin-Turbo consensus mechanism and parallel order execution technology, reducing transaction confirmation times to milliseconds, making this technical advantage particularly suitable for high-frequency trading scenarios, attracting numerous decentralized exchanges and GameFi applications. Its compatibility with the Ethereum Virtual Machine (EVM) also allows SEI to seamlessly integrate developer resources from the Ethereum ecosystem, further broadening its application scenarios in non-fungible tokens (NFTs), social media, and gaming. This multidimensional ecosystem expansion lays a solid foundation for SEI's long-term value growth.

Policy Benefits and Market Sentiment Boost

Recently, SEI has also benefited from a series of external favorable factors, significantly enhancing market confidence. On June 19, SEI was selected as a candidate network for the stablecoin pilot project (WYST) in Wyoming, USA, scoring 30 and surpassing mainstream public chains like Ethereum and Solana. This news quickly sparked discussions in the crypto community and was seen as an important catalyst for SEI's price increase.

The discussion heat on platform X continues to rise, with users expressing optimistic expectations for SEI to break through $0.40 or even higher. Additionally, the SEI exchange-traded fund (ETF) application submitted by Canary Capital on May 1 further ignited market enthusiasm, attracting the attention of institutional investors. These policy and institutional supports not only enhance SEI's credibility but also provide external momentum for its sustained price increase. Meanwhile, the growth of the SEI Marines community injects a strong user base into the project, with active participation and promotion from community members further amplifying SEI's market influence. Against the backdrop of a recovering overall cryptocurrency market, SEI's outstanding performance resonates with its technical advantages and external benefits.

Investment Considerations and Risk Warnings

Although SEI demonstrates strong growth potential, the high volatility of the cryptocurrency market requires cautious handling. Rapid changes in market sentiment, macroeconomic factors, and regulatory uncertainties may lead to short-term price pullbacks. Additionally, SEI's tokenomics indicate that the unlocking of approximately 33.33 million tokens per month may exert some selling pressure on the price. In terms of competition, the rise of high-performance public chains like Solana and SUI also poses challenges to SEI, which needs to continue innovating to maintain its market advantage. For investors, short-term traders should focus on resistance levels of $0.34 and $0.40, developing strategies based on RSI and trading volume indicators; long-term investors should closely track SEI's ecosystem development and institutional adoption dynamics, gradually building positions to reduce risk. It is recommended to use non-custodial wallets like Keplr or Ledger to store SEI, ensuring asset security while conducting thorough market research to avoid emotional trading.

Can SEI Become the Star Public Chain of 2025?

On June 25, 2025, SEI demonstrated its unique position in the cryptocurrency market with an impressive performance above $0.33. Its high-performance Layer 1 architecture, rapidly growing ecosystem, and support from policies and institutions collectively drove its price surge and market capitalization growth. SEI's potential in decentralized finance, non-fungible tokens, and GameFi makes it an investment target worth watching in 2025. However, cryptocurrency investments require caution, and it is advisable for investors to conduct thorough research and develop risk management strategies. Token prices are influenced not only by the project's own development and technological advancements but also by the overall liquidity of financial markets, macroeconomic conditions, and the selling pressure of project tokens. For example, regular token unlocks may lead to short-term price fluctuations, while tightening policies in global financial markets may affect the inflow of funds into crypto assets. Investors should fully assess their risk tolerance, develop reasonable investment strategies, and avoid putting all their funds into a single asset.

Disclaimer: This article is for informational reference only and does not constitute investment advice. Cryptocurrency investments carry high risks; please make decisions cautiously.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。