Original Title: How to use Grok for real-time crypto trading signals

Translation by: Asher(@Asher_0210)

Editor’s Note: This article focuses on the application value of Grok in crypto trading, especially its ability to capture early trading signals and macro event reactions by scanning sentiment dynamics on X in real-time. It also states that Grok and ChatGPT have different focuses; the former excels in real-time sentiment monitoring, while the latter is suitable for strategy design and logical reasoning.

However, Grok is not an all-purpose tool; it cannot execute trades, interpret charts, or manage risks, and it is easily influenced by social noise. A reasonable combination of Grok with other analytical tools is necessary to enhance trading decision efficiency and accuracy.

How to Use Grok to Obtain Market Sentiment, Trading Signals, and Macro Event Insights

If users have traded cryptocurrencies during a Meme cycle, they will understand how quickly market sentiment can change and how lagging most tools are. Grok changes this. With its direct integration with X, Grok can scan thousands of posts, tags, and comment threads in real-time. If used wisely, Grok is not just a "sentiment reader," but a tool that can be used to "trade sentiment." Here are some practical ways crypto traders are using Grok:

Real-time Sentiment Monitoring

Grok can dynamically scan crypto-related posts on X, capturing potential keywords and sentiment fluctuations that may impact the market, such as "bottom is in," "huge unlock," "whale sell-off," or "rate cut confirmed." It is not just a surface scan; it analyzes the context, emotional tone, and posting intent of each post. By accessing X's API, some traders have begun to use Grok to:

1. Track early sentiment signals for obscure tokens

In April 2024, discussions around TURBO increased on X, primarily driven by developers' announcements about new features. This change occurred about 36 hours before chart signals, followed by a 22% price increase for TURBO, demonstrating that sentiment tools can capture momentum early.

2. Sense sentiment fluctuations triggered by macro events

During the March 2024 FOMC update by the Federal Reserve, Grok detected rising anxiety in BTC-related discussions. Market sentiment had already turned negative before the actual price drop, helping some traders adjust their positions early.

3. Identify "sentiment-price" divergences

In February 2024, community discussions around FET noticeably increased, but the price remained stable. Some traders viewed this as an entry signal, and indeed, a price breakout occurred two days later.

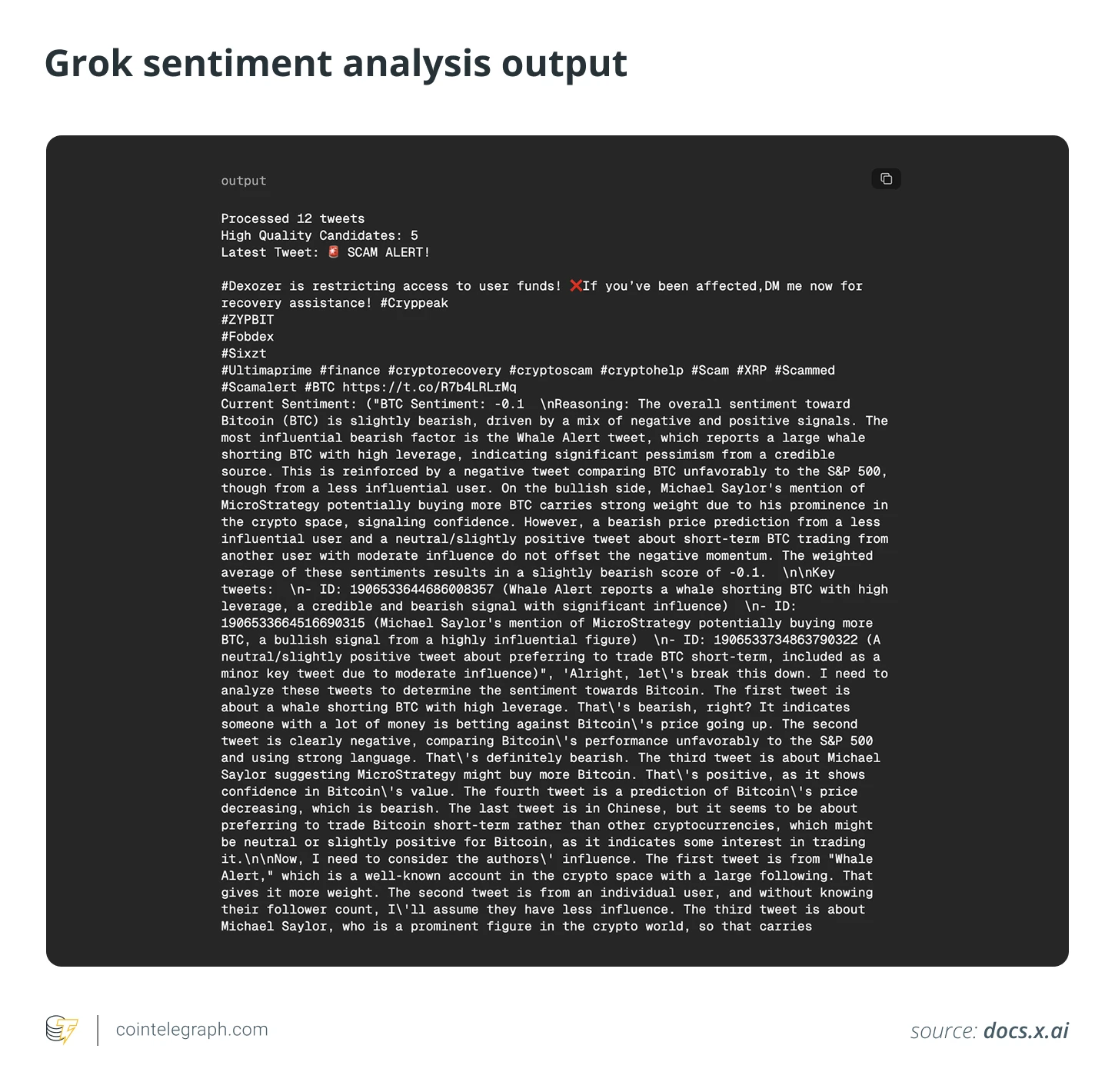

Unlike traditional keyword scanners, Grok uses deep sentiment analysis and real-time data integration from X to capture details more accurately during high-impact events such as CPI announcements, ETF rumors, and shifts in KOL attitudes. The following image is an example of a custom sentiment analysis output from Grok integrated with X, analyzing 12 posts about Bitcoin within six hours (the dataset includes posts from well-known accounts like Whale Alert and Michael Saylor, as well as comments from less influential bloggers on BTC leverage, short-term trading, and macro comparisons), aiming to assess the real-time sentiment trends and tendencies in the crypto market during volatile trading periods.

Dynamic Signal Analysis on X

Thanks to its integration with X, Grok can capture momentum signals as certain content begins to gain traction. Traders using Grok typically utilize it to:

Track surges in token mentions: When a token code (like "FET" or "TURBO") is frequently mentioned by multiple verified or active accounts in a short period, it may indicate that the topic is rapidly heating up.

Monitor KOL movements and behaviors associated with tokens: Especially when an account with a large following hints at an upcoming listing, partnership, or price expectation, accompanied by unusually high interaction levels (such as a surge in retweets or comments).

For example, during a 24-hour period in February 2024, the number of posts about "ORDI" surged from fewer than 50 to over 400, primarily driven by discussions among top traders about its potential listing. Grok had already flagged this narrative speed increase before the price reflected this enthusiasm.

By analyzing such real-time social signals, Grok can help users identify momentum shifts in the crypto community earlier, allowing traders to assess and position themselves before narratives take shape and appear on aggregator sites or news sources, rather than chasing after the fact.

Macro Perception in High Time Frame Trading

Grok can help traders track market sentiment surrounding macroeconomic events (such as CPI announcements, interest rate decisions, crypto regulations, etc.) in real-time. For instance, after the U.S. Consumer Price Index (CPI) was released in December 2024, showing an annual inflation rate of 2.9%, Bitcoin briefly broke above $98,500. This trend aligned with market expectations, and some analysts interpreted it as a positive signal for risk assets, reflecting market optimism about a potential rate cut by the Federal Reserve.

By analyzing data at the group level in real-time, Grok often reflects the true market direction better than traditional news headlines. These signal insights help traders rotate funds more efficiently between BTC, stablecoins, and altcoins, especially during moments when market sentiment shifts rapidly following macro event releases.

Comparison of Grok and ChatGPT in Crypto Trading

Both Grok and ChatGPT are widely explored AI tools for crypto analysis, but their functional focuses differ. For traders, analysts, or researchers looking to enhance decision-making efficiency, understanding the applicable scenarios for each can better optimize workflows.

Grok: Real-time Sentiment Scanning Tool

Platform Attributes: Integrated with X, suitable for X Premium+ users.

Core Advantage: Real-time analysis of social sentiment.

Functional Features:

Track public posts and trending discussions;

Identify early signals about tokens, narratives, or macro events within communities;

Detect potential momentum shifts in advance (such as surges in token mentions, KOL hints, sentiment fluctuations).

Grok is suitable for capturing trading opportunities "as trends begin to emerge," especially in narrative-driven markets.

ChatGPT: Structured Analysis and Strategy Logic Development

Platform Attributes: General AI tool, does not default to accessing real-time social media data (unless using API or plugins).

Core Advantage: Deep understanding and logical reasoning capabilities.

Functional Features:

Explain trading strategies, indicator principles, and risk management concepts;

Summarize structured content such as project research reports and token economic models;

Generate backtesting frameworks, automated trading logic, and simulated scenario assumptions.

ChatGPT is better suited for building medium to long-term strategies, understanding concepts, and writing automated trading support tools.

Data Acquisition: Real-time Information vs. Processed Analysis

In terms of information acquisition, Grok has a significant advantage in "real-time." Because it is directly embedded in X, Grok can instantly scan the latest posts, community reactions, and trending content. This makes it very useful in the following scenarios:

Capturing sentiment shifts;

Identifying surging token mentions before price changes;

Quickly responding to sudden macro or regulatory news.

In contrast, ChatGPT does not have default access to real-time information streams unless connected to external tools via browser plugins or APIs. However, it excels at structured analysis, such as explaining trading strategies, conceptual backtesting, or summarizing white papers.

Therefore, if quick access to the latest feedback from the crypto community is needed, Grok is superior; if structured insights or technical breakdowns are required, ChatGPT is the better choice.

Sentiment vs. Strategy

Grok excels in analyzing real-time social narratives within the crypto community, particularly suitable for the following scenarios:

Obtaining crypto market sentiment from X;

Identifying early trading signals from popular posts and community discussions;

Recognizing rotations between meme coins and community-driven price movements;

Sensing market reactions to macro events in real-time.

Conversely, ChatGPT is better suited for the following tasks:

Writing or debugging trading bots;

Explaining concepts like liquidation cascades and funding rates;

Developing AI-driven crypto trading strategies.

For instance, in the AI4Crypto GitHub open-source repository, there are scripts that combine Grok's sentiment data with ChatGPT's backtesting logic. Such experimental combinations are becoming increasingly common in the open-source quantitative community: Grok captures signals, while ChatGPT is used to write trading logic or simulate trading responses. This "sentiment + strategy" collaborative approach is gradually becoming a standard configuration in AI-enhanced quantitative trading experiments.

Deployment Speed

Grok is designed as a highly "responsive" tool that can immediately capture signals when a topic begins to gain traction. As a result, an increasing number of crypto automation developers are attempting to build automated trading alert systems based on Grok's sentiment shifts. In contrast, ChatGPT's deployment leans more towards a "set-and-forget" model. Unless connected to a real-time API, it is more suitable for handling historical or static data issues, which is not a drawback but rather a difference in positioning:

Grok is a "market listener," scanning sentiment in real-time;

ChatGPT is a "strategy interpreter," clarifying logic.

Grok's Risks, Limitations, and Shortcomings

Although Grok's prospects are very appealing, it is important to understand its boundaries. Many AI trading experiments fail not because the tools are inadequate, but because there is an expectation for them to be "know-it-alls." Grok can enhance a trader's trading process, but it is not a plug-and-play "magic signal source."

Cannot Execute Trades

Unlike crypto bots connected to exchanges, Grok does not place orders or manage positions. It can alert you that sentiment or narratives are changing, but it cannot determine whether your strategy is "aggressively long" or "conservatively defensive."

Some developers are building automated alert scripts connected to Grok, but these systems still require manual review or connection to third-party execution platforms. In summary, Grok is a signal scout, not an all-purpose trading engine.

No Awareness of Charts or Technical Indicators

While Grok 3 has begun to attempt parsing some market data and basic patterns, it does not yet possess complete technical analysis (TA) capabilities. If traders need precise TA, they still need to use tools like TradingView, professional bots, or ChatGPT that can understand and explain TA.

For example, Grok might tell you, "SHIBA is trending." But it won't say, "This is a bullish flag on the 4-hour chart." To make such judgments, you still need TradingView, CoinGlass, or AI mixed analysis systems.

Susceptible to Noise and Manipulation

Grok retrieves data directly from X, which means it reads unfiltered public content that may include:

Misinformation;

Collective shilling by KOLs;

Emotion-driven or "baiting" hype.

In meme coin markets, it is common for project teams or communities to deliberately inflate mention counts, create false hype, or spread fake news. If Grok is used indiscriminately, these false signals may be misinterpreted as buying opportunities when they are actually just selling traps. This is one of the biggest risks when using Grok for trading: relying on "what the crowd is saying" rather than "what the market is doing."

Weak Signals for Low Market Cap Coins

While Grok excels at identifying trending topics, its support for obscure altcoins or niche DeFi projects is limited. If a token has very few mentions on X, the signals returned by Grok may not be representative or may even be irrelevant.

Therefore, for analysis of low market cap tokens, using on-chain tools like Nansen or pairing with TA software would be more effective.

No Built-in Risk Control Capabilities

Grok cannot identify a trader's position size, stop-loss settings, or risk tolerance, so it will not alert users if they are over-leveraged, chasing prices at highs, or going against the trend. This is also one of the common misconceptions among many beginners, who believe that AI tools can automatically avoid risks. In reality, AI can only point out market hotspots; whether it is worth following up still requires personal judgment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。