Original Title: "From State-Owned Enterprise Factory Director to Losing 3 Million, the Disheartened Cryptocurrency Trader in Peak Brother's Lens"

Original Source: Shenchao TechFlow

When you open crypto Twitter, you can always see those big names in the crypto world boasting about their assets exceeding eight figures, making a fortune with just one contract.

Whether it's filters or real strength, achieving big results in the crypto space is a stroke of luck that doesn't belong to every ordinary person.

Recently, a well-known Bilibili content creator "Peak Brother on the Run" (Peak Brother) captured the story of a man who was once the deputy director of a state-owned coal washing plant in Handan, Hebei, who lost 3 million due to cryptocurrency trading and fell from grace.

As of the time of writing, the video has already garnered 750,000 views, and discussions about this story are ongoing on social media.

Peeling away the glamorous illusion of sudden wealth, this is a true story of an ordinary trader constrained by information asymmetry and trapped by greed.

From Factory Director to Debt-Ridden Ride-Hailing Driver

Since the original interview did not mention the specific name of the story's protagonist, the interviewee's Bilibili ID is "Zheli Chongsheng," and he will be referred to as Brother Chongsheng in the following text.

Once, Brother Chongsheng's life was enviable.

According to his own revelations on camera, he was once the deputy director of a state-owned coal washing plant in Handan, Hebei, with a post-tax monthly salary of 9,000 yuan, living in a mortgage-free house, driving an Audi, managing 20-30 people, and enjoying the respect that came with being a deputy-level cadre.

In 2018, Brother Chongsheng married his wife, and they have a five-year-old daughter, leading a happy and fulfilling family life.

"We were considered a moderately well-off family… not enough compared to others, but better than many." He recalled with a tone that carried a distant warmth.

At that time, he took his daughter to travel to Shandong and Zhengzhou, practicing the concept of "raising a daughter well," and his parents' retirement pensions relieved the family of any financial pressure. Such a stable life was solid as a rock, and it was hard to find any signs of collapse.

Now, everything has turned to dust.

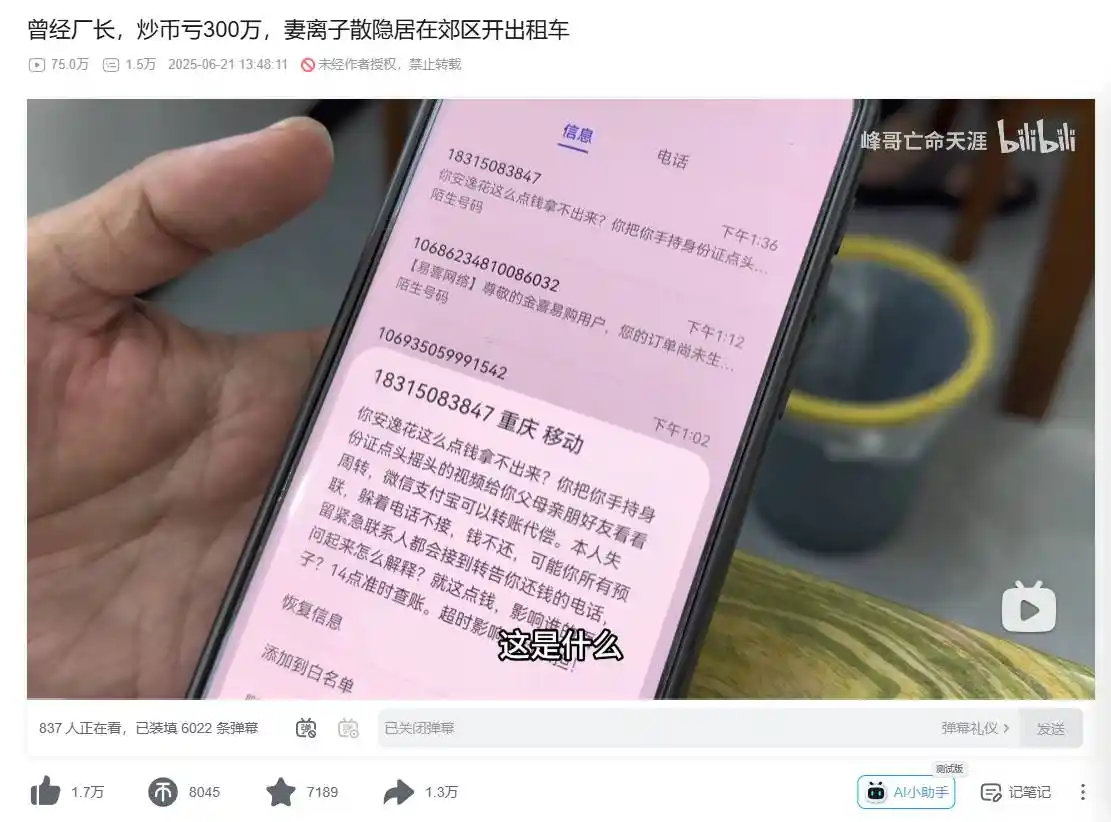

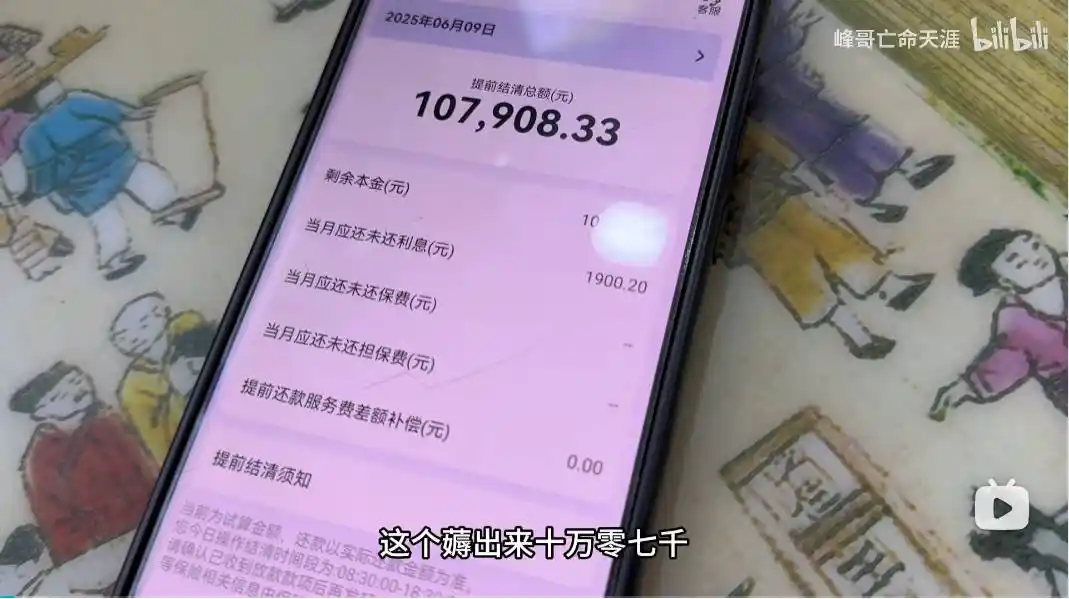

At the beginning of the video, Brother Chongsheng shows the various loan app interfaces and his debt situation on his phone, with one app showing a debt of over 100,000 yuan, and cryptocurrency trading has led him to a total loss of 3 million, as he struggles daily to repay the high loans.

Now he drives for ride-hailing services for 13-14 hours a day, earning 300 yuan, and after deducting car rental and living expenses, he is left with only 100 yuan. Renting a 600 yuan/month single room with a private bathroom is his last semblance of dignity.

The million-dollar debt follows him like a shadow, with annual interest of 200,000 to 300,000 yuan, most of the loans already overdue, and debt collection calls are incessant.

When asked why he agreed to be interviewed by Peak Brother, knowing it might be made public, Brother Chongsheng said:

"The main reason I initially refused your interview was that I was afraid it would affect my job. Now that I don't plan to go back to work, I can't go back anyway, so I have no concerns and just want to earn money to pay off my debts."

In stark contrast to his courage to face the camera and life is the collapse of his family:

Two months ago, his wife divorced him due to the debt crisis, taking their daughter with her; his parents were also utterly despairing, with his father's text message being particularly heart-wrenching: "This family no longer has you; everything about you is over."

His five-year-old daughter, still too young to understand the truth, only knows that "Daddy went out to work."

From a state-owned enterprise executive to a debt-ridden driver, the interviewee's fall is indeed lamentable. The rapid descent is attributed to the madness of high leverage in the crypto space and the obsession with borrowing to turn things around.

Altcoins, High Leverage, No Stop Loss

His story may be a microcosm of countless ordinary cryptocurrency traders—consumed by greed and illusions, often not a single gamble but a process.

On camera, Brother Chongsheng candidly shared his journey in the crypto world: from initially tasting success to high leverage, the loss of 3 million was not a sudden collapse but the accumulation of countless impulsive actions.

Brother Chongsheng's introduction to the crypto world began with earlier postal currency trading. In the 2010s, postal currency cards, touted as an online financial product backed by stamps, attracted numerous retail investors. After trying it out, Brother Chongsheng made a small profit of 10,000 to 20,000 yuan and managed to escape the collapse, building confidence in "buying low and selling high."

He admitted that he was still cautious at that time, but this initial success planted the seeds of speculation.

In 2020, he entered the crypto space and began experimenting with spot trading. Initially careful, but greed quickly magnified.

To gain more profit, he started chasing altcoins and opened contracts. Contract trading allows for borrowing to amplify the principal, with leverage of 10x, 50x, or even 100x multiplying both profits and risks.

According to his own description, a few hundred yuan of principal could initially yield a profit of 40-50%, so he gradually increased his investment, both in principal and leverage.

Brother Chongsheng described this as "a dull knife cutting flesh," as he never fully gambled all his borrowed money at once; it was more like boiling a frog in warm water—losing 20,000 yuan today, borrowing another 20,000 yuan tomorrow to invest again.

A humorous detail from the original video interview is that Peak Brother thought his gradual entry was relatively steady, while Brother Chongsheng immediately denied it:

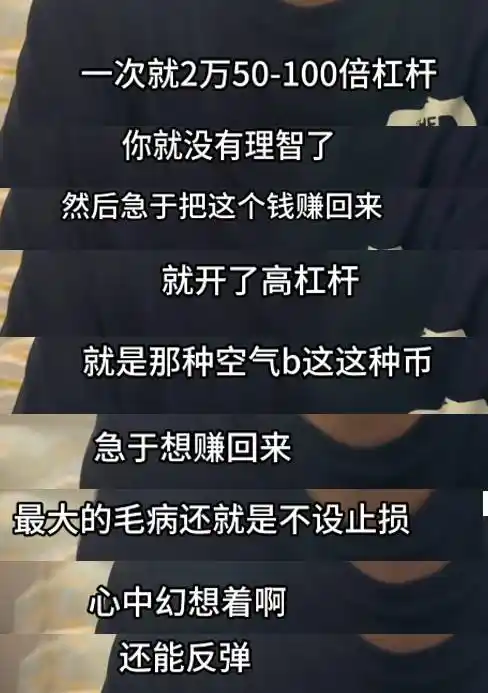

"It's not steady at all. If I had 20,000 yuan to open a contract today, I would use very low leverage; I wouldn't use such high leverage. Low-leverage altcoin contracts generally wouldn't have issues… Because by then, my mindset had already twisted and distorted; I was too eager to make money back, so I would start using high leverage at what I thought was a suitable point, even using 10x, 50x, or 100x."

Clearly, Brother Chongsheng underestimated the volatility of altcoins in the crypto space, and liquidation was within reason. Another reason he kept borrowing money to fill the holes was the lack of discipline in trading.

Brother Chongsheng said his biggest flaw was not setting stop losses; even when he set a stop loss, he would cancel it, fantasizing about a rebound.

This irrational gambling led him to liquidation time and again, borrowing money to continue, but the final outcome is known to all.

Four Times Borrowing, No Recovery

In 2020, he exhausted his 10,000 yuan savings and first tasted the bitter fruit of liquidation.

He borrowed 100,000 yuan through online loans like Alipay's "Borrow" and "Easy Flower," and friends and family contributed 120,000 yuan to fill a 220,000 yuan hole, with his parents emptying their savings to pay it off. After this, he promised not to play anymore, but less than six months later, he reignited the idea, "I saw the news about Bitcoin's surge… which made me mistakenly believe there was an opportunity."

The second time, he borrowed 150,000 yuan from online loans and 150,000 yuan from friends and family, totaling 300,000 yuan, and continued to trade cryptocurrencies with high leverage. After liquidation, he deceived himself, thinking "a few tens of thousands of yuan I can slowly resolve," but it buried a greater hidden danger.

By 2023, his debt soared to over 600,000 yuan, and it became difficult to gather enough money to repay online loans and friends. He sold his sister's less than 70 square meter apartment for 500,000 yuan, and relatives contributed another 100,000 yuan, once again completely clearing his debts.

However, this brief "rescue" did not bring him relief; instead, it deepened the distorted psychology of needing to earn back what he had lost—selling the house deprived his sister of her dowry, and his parents were shocked and emotionally devastated. He clearly felt guilt and openly stated, "I live particularly oppressed."

The crypto space has cycles, and stories of rising from the lows to sudden wealth influence the choices of the disheartened, becoming a motive for re-entry to win back what was lost.

In 2024-2025, he mortgaged his house, borrowed 700,000 yuan at high interest (20-30% interest), and 300,000 yuan in online loans to continue trading cryptocurrencies, pushing his total debt over a million.

Of course, each time he borrowed money to open contracts, it did not lead to his recovery.

The cost of borrowing is not just financial but also the collapse of trust. To raise money, he fabricated lies to deceive friends and family; friends who were often deceived knew that when you try to cover one lie, you often need a bigger lie to cover it, overextending more relationships and credit.

"In front of people, I pretend to be someone else, behind their backs, I act like a ghost, without even a bottom line for being human…" In his torment, Brother Chongsheng faced the consequences.

A friend tipped off his wife, revealing his total debt; his wife collapsed and filed for divorce; his parents learned he had mortgaged the house and were utterly despairing, leaving a text message:

"You have become possessed; you even mortgaged the house… this family no longer has you."

After the interview with Peak Brother, Brother Chongsheng also opened an account and warned everyone not to borrow money to engage in similar products, "I have completely destroyed a particularly beautiful life with my own hands."

The term "turnaround" can refer to a subway station in Shenzhen, a fantasy of unwillingness when losing too much, but more likely it is a bottomless pit of greed that snowballs.

Support from Liangxi, the Long Road Ahead

After Peak Brother's video was circulated, Liangxi, a KOL in the Chinese crypto space known for trading contracts, posted to announce that he would sponsor Brother Chongsheng with 50,000 yuan and additionally provide 60,000 yuan as monthly living expenses for a year (5,000 yuan per month) to prevent him from continuing to trade cryptocurrencies.

Liangxi can naturally understand Brother Chongsheng, as they both dance on the edge of contract trading and have experienced the pain of liquidation. This act of assistance seems more like a rescue of his former self.

However, any act of kindness should perhaps have boundaries during its implementation.

Brother Chongsheng's addiction to trading cryptocurrencies cannot be ignored. With the obsession of "turning around" and the burden of sunk costs, he may still continue down a path of no return, especially in the crypto culture where narratives of "borrowing money to turn around" are everywhere. Moreover, the person lending him money is Liangxi himself, who is deeply entrenched in the dramatic effects of contract trading.

A master of contracts lending you money to rescue you, telling you not to play contracts anymore—would you really stop?

Let’s not forget that in reality, Brother Chongsheng is still relying on driving for ride-hailing services to make ends meet. The hard-earned money from this physically exhausting job is still too slow compared to the instant gratification brought by contracts.

The million-dollar debt follows him like a shadow, and we still do not know which path he will choose, whether it is for another chance at sudden wealth or to redeem the dignity he has lost.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。