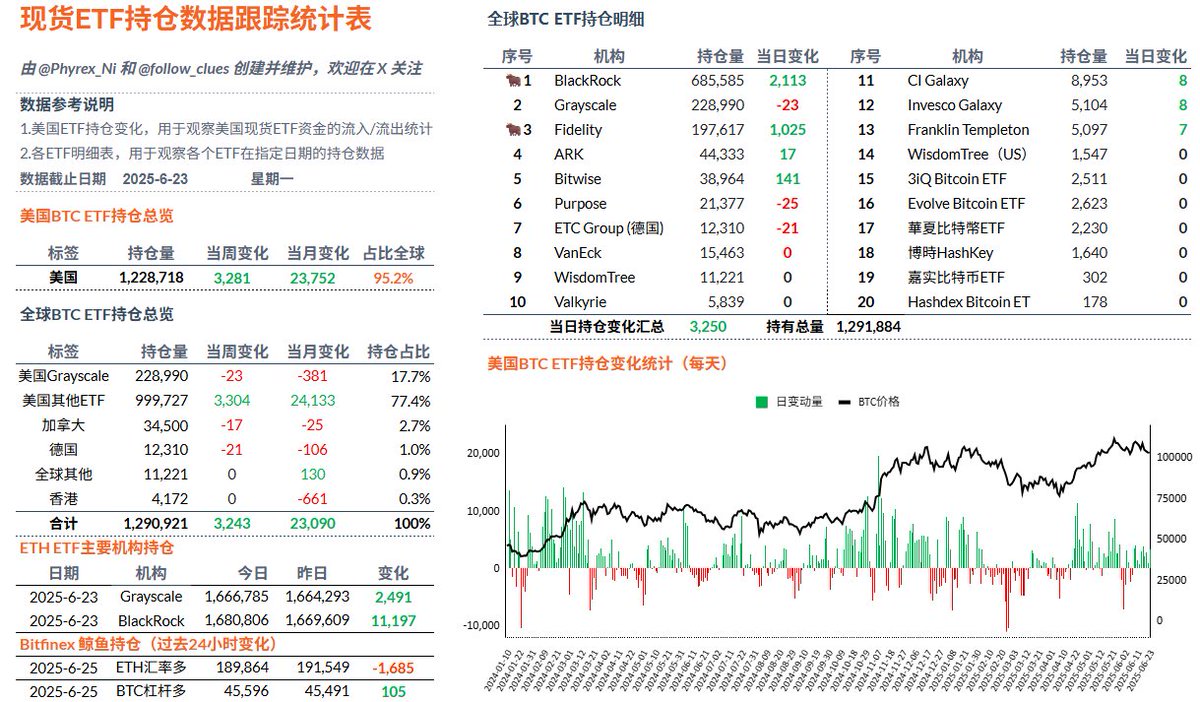

On Monday, with the cooling in the Middle East and the decline in oil prices, the sentiment in the risk markets returned, and the buying volume of the $BTC spot ETF also began to increase. Of course, the increase was within normal limits, and there were no signs of large-scale purchases. This is consistent with what has been said recently: traditional investors have not been buying in large quantities like they did in 2024. On Monday, both BlackRock and Fidelity saw net inflows exceeding four digits.

Moreover, apart from Grayscale's sale of only 24 Bitcoins, there were no net outflows from other institutions, which aligns with what I mentioned yesterday. Even last week, when investor sentiment was poor and in the face of the expanding trend of war, investors did not choose to sell off in large quantities, let alone now.

Overall, BTC investors still seem to be somewhat chasing the market, but it's not a big issue; this is something short-term investors often do. More investors are still leaning towards long-term holding.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。