Lookonchain Weekly Report (June 16–22, 2025)

🟢 Market Overview

Bitcoin dropped below $100,000 last week, falling over 9%, while ETH slid below $2,200, down nearly 20%.

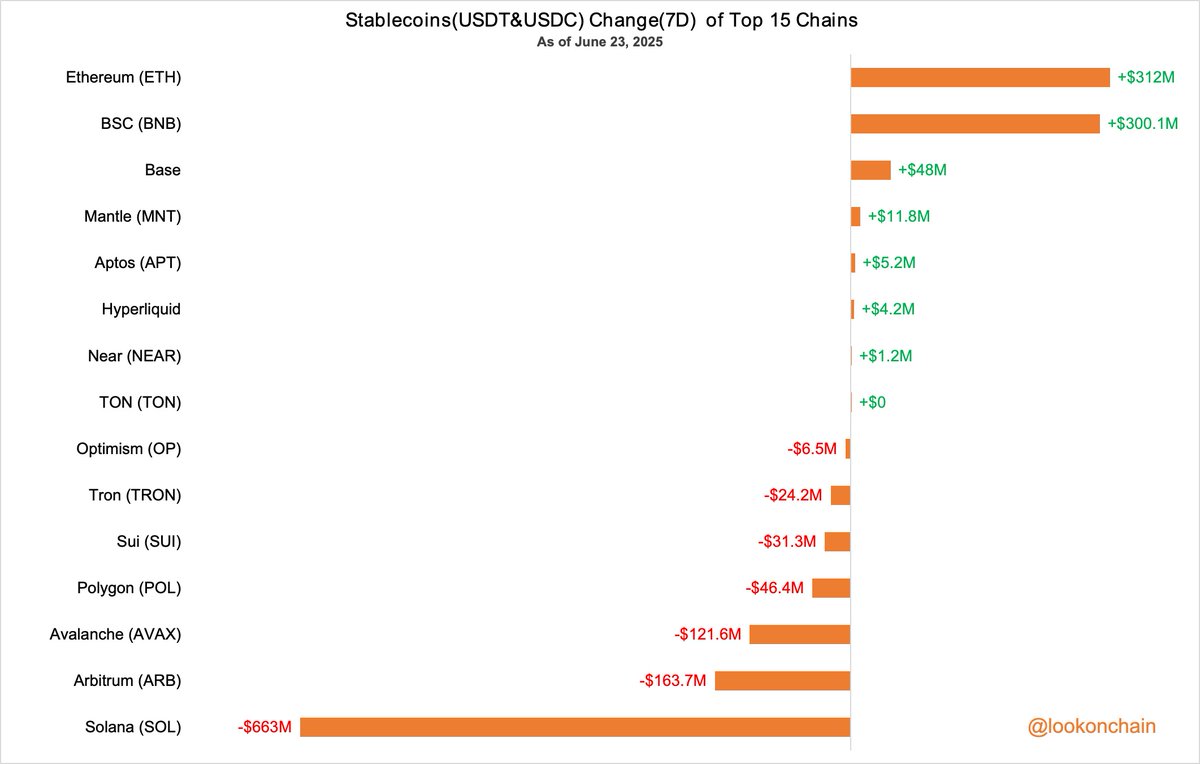

🟢 Stablecoin Market

The total stablecoin market cap decreased by $339M.

stablecoins(USDT&USDC) on #Solana decreased by $663M and stablecoins(USDT&USDC) on #Ethereum increased by $312M.

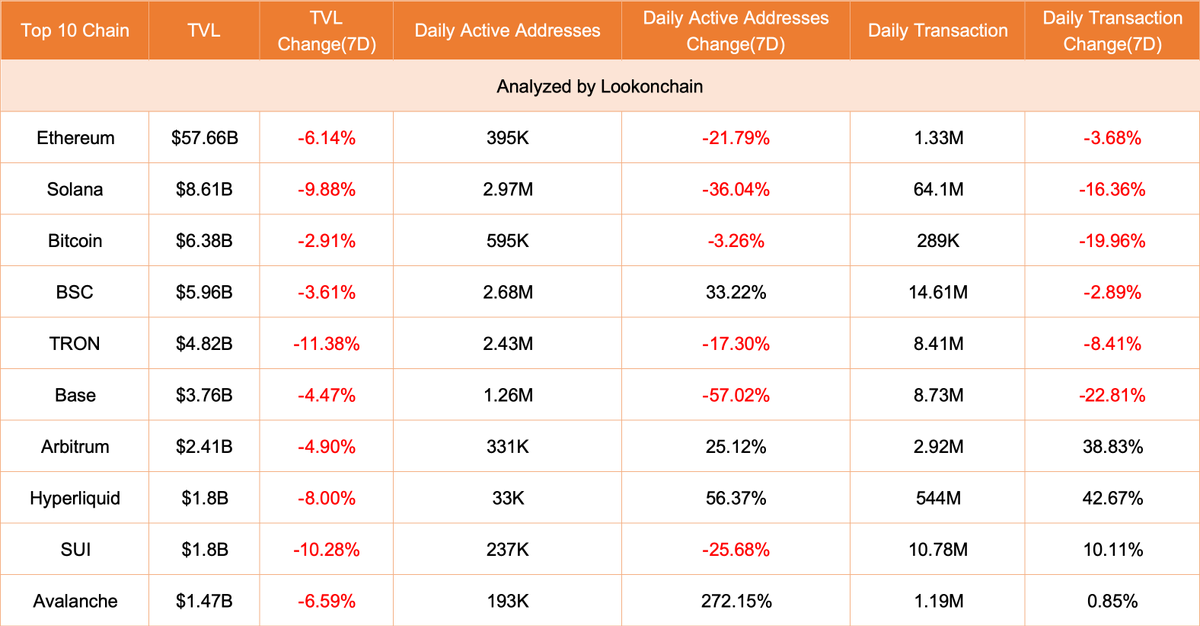

🟢 Top 10 Chains

Due to the market crash, TVL on all top 10 chains declined.

However, the sharp volatility fueled trading activity on Hyperliquid, with daily active addresses up 56.37% and daily volume rising 42.67%.

Notably, Avalanche saw a 272.15% surge in daily active addresses.

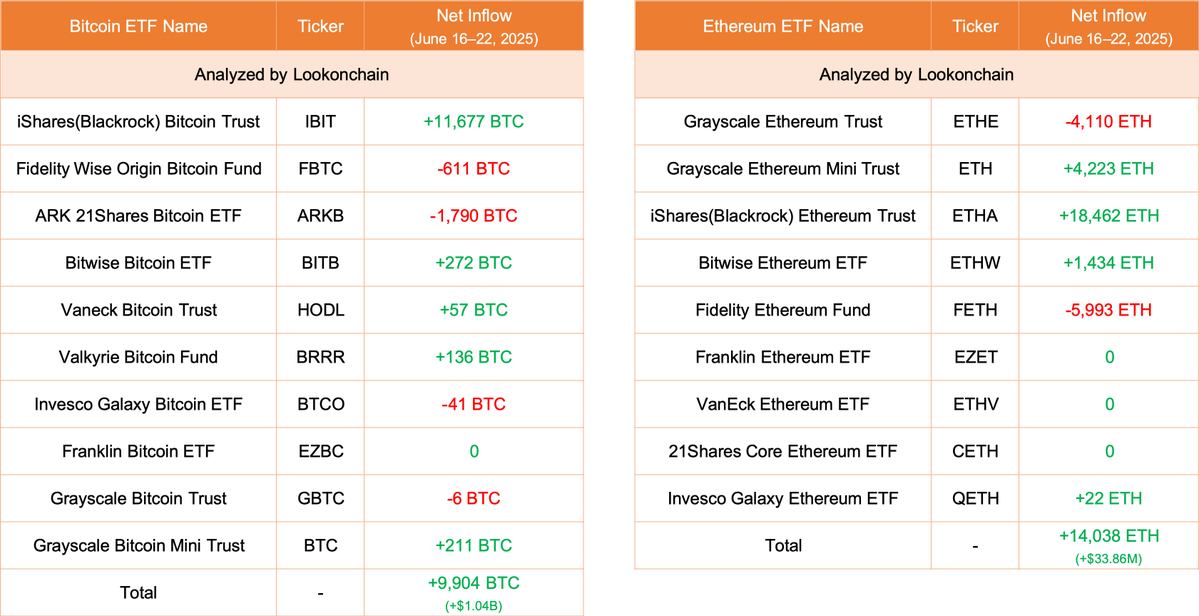

🟢 Bitcoin & Ethereum ETFs

The 10 Bitcoin ETFs added a total of 9,904 $BTC ($1.04B). iShares (BlackRock) alone added 11,677 $BTC ($1.23B).

9 Ethereum ETFs saw net inflows last week, but the amount of net inflows decreased significantly.

The 9 Ethereum ETFs added only 14,038 $ETH ($33.86M). iShares (BlackRock) led with 138,016 $ETH ($44.53M).

🟢 Spot & Perps Trading Volume on DEXs

According to DeFiLlama, spot trading volume on DEXs reached $97.86B last week, up 1.88% from the previous week.

Perps trading volume totaled $103.37B, marking an 8.44% week-over-week increase.

🟢 Institutional/Whale Activity

MicroStrategy bought only 245 $BTC($26M) last week — a sharp drop from previous purchases.

Metaplanet bought 1,111 $BTC($116.6M) last week.

The whale who previously made $30M on $ETH continued to buy 47,071 $ETH($114M) last week, buying a total of 132,536 $ETH($333.8M) at an average price of $2,518.

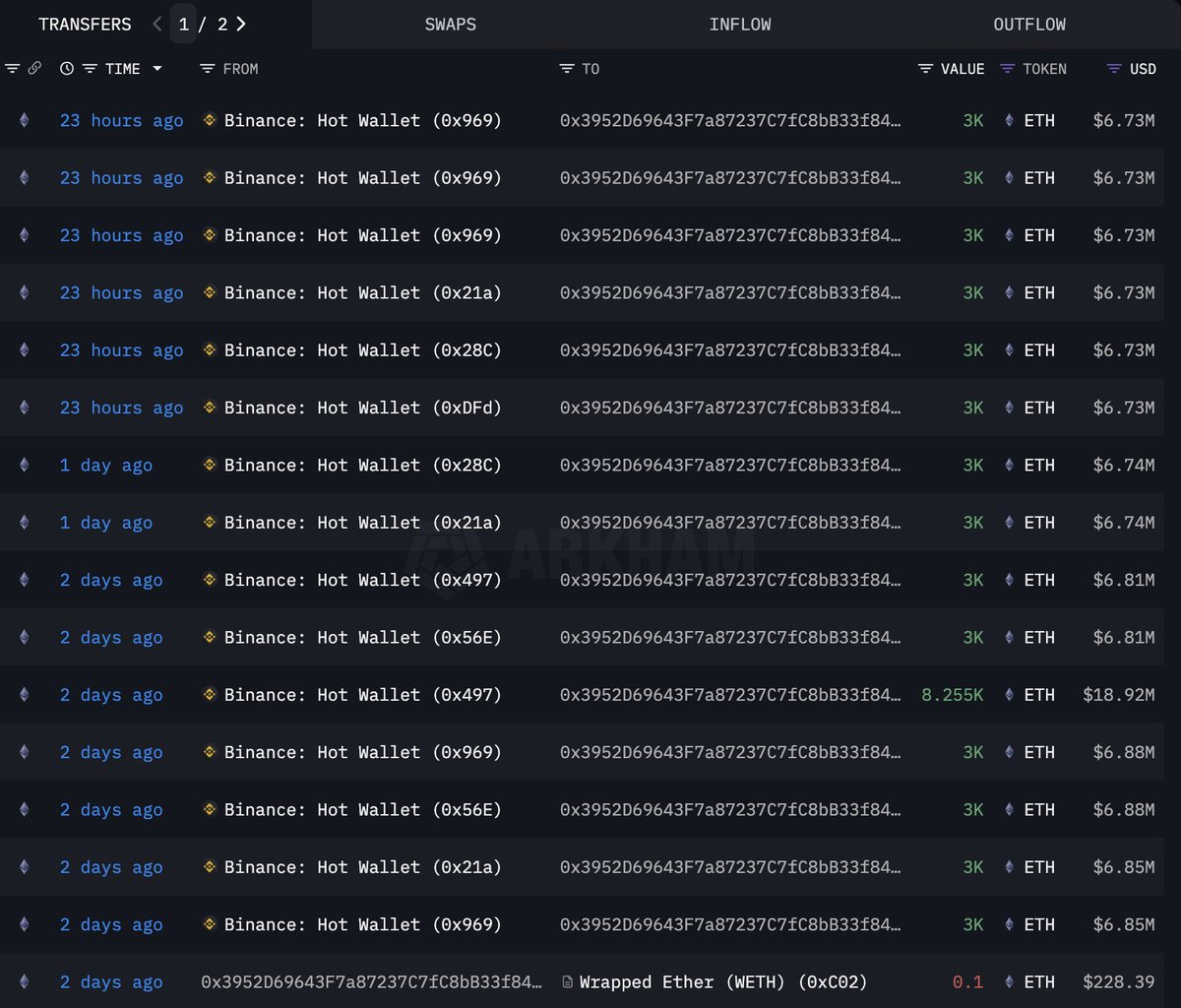

A mysterious whale created a new wallet 0x3952 and withdrew 50,256 $ETH($112.9M) from #Binance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。