Regarding today's double explosion of long and short positions, many friends believe that it is the market manipulators using information to operate. Whether this is the case, I don't know, but I am not particularly interested in this theory. In my view, @biancoresearch has a perspective similar to mine, which is the market's concern about the trend of oil prices. This concern about oil prices is not only about the intensity of the war but also depends on the market's assessment of the closure of the Strait of Hormuz.

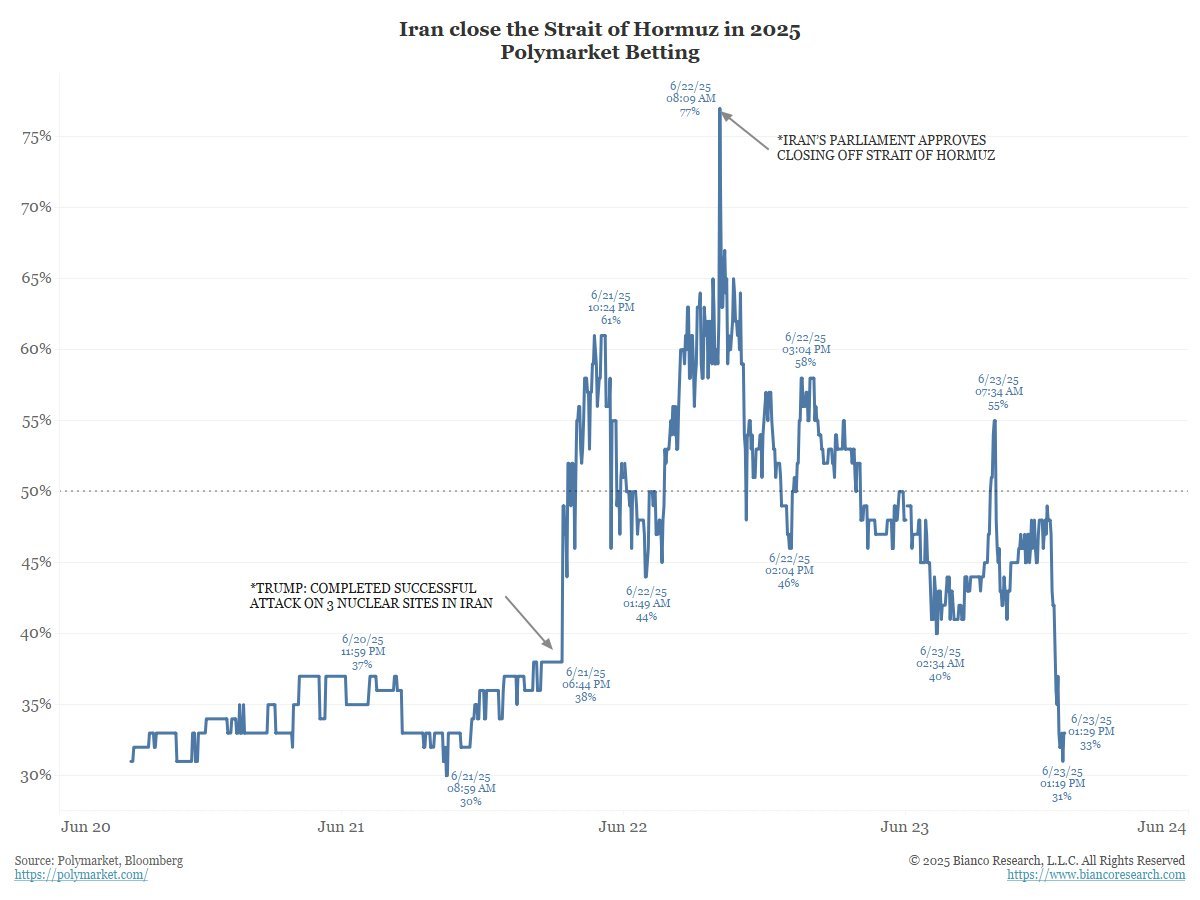

I saw a marked probability chart on Polymarket regarding the closure of the Strait of Hormuz in 2025, which clearly shows that the market's attitude towards the closure has changed, and this should be one of the reasons for today's double explosion of long and short positions. Currently, this probability is only around 30%, indicating that the market believes Iran lacks the actual capability to enforce a blockade, so the expected impact on oil prices will not be significant.

For me, analyzing the war exceeds my current capabilities; at most, I can gather some information. So far, I have not seen any signs of a ceasefire in the short term, and it is likely to last for some time. During this period, anything could happen, so closely monitoring oil prices might be a good choice. After all, oil prices have already dropped to $68.

Of course, if you believe that market manipulators are operating in the market to target your contracts, that is also a possibility. However, my understanding has not reached that level. Currently, oil prices are more influenced by information, and perhaps tracking WTI crude oil might be safer.

This situation is not static. If Iran shows signs of "actually blocking the strait," such as military deployments or naval gatherings, the probability will inevitably rise, and the market will likely enter another phase of volatility.

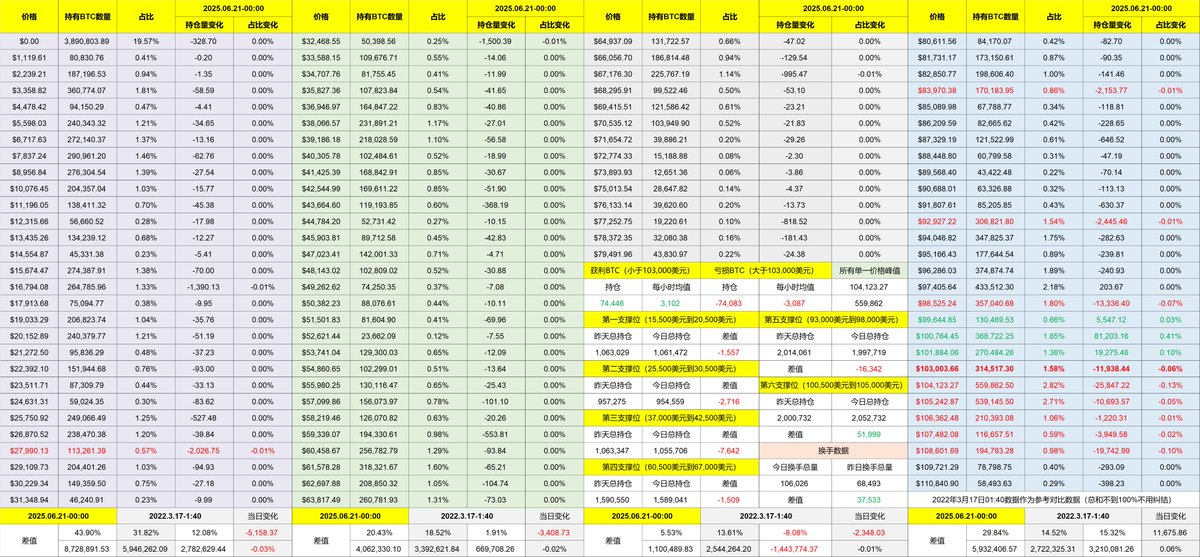

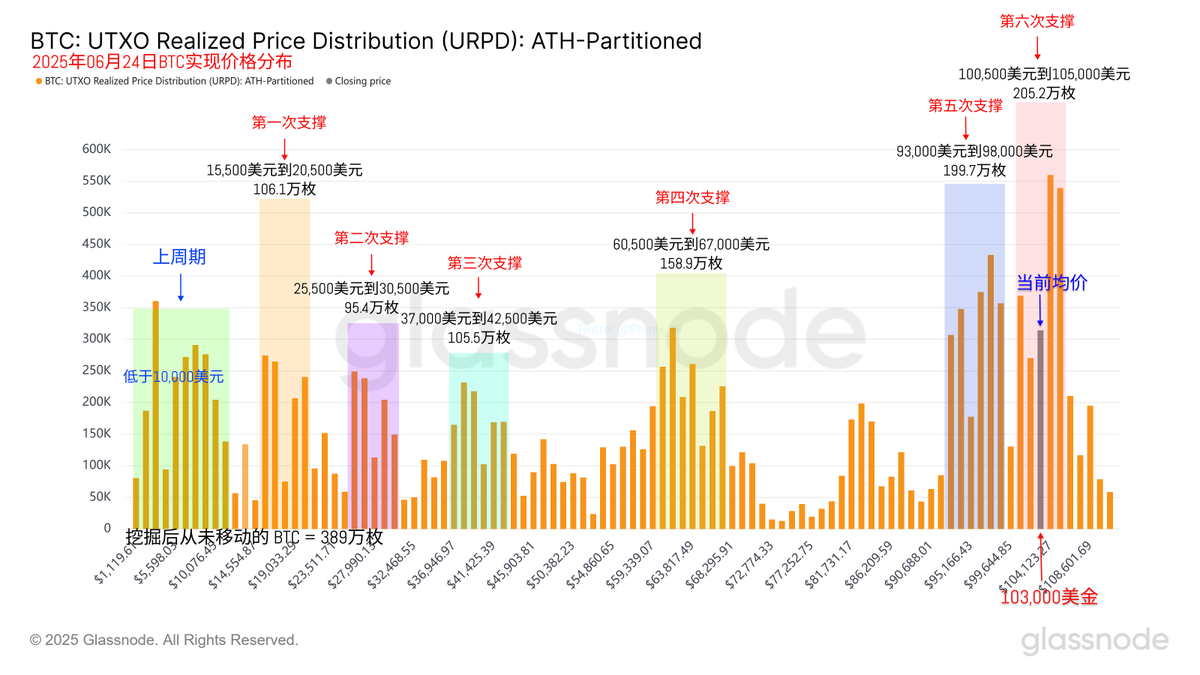

Looking back at Bitcoin's data, although the price volatility is still quite large, there are no obvious signs of panic. The turnover rate has not significantly increased, and I have not seen a large number of investors in a state of panic. The most active trading remains with short-term bottom-fishing investors, while earlier investors are still on the sidelines.

From the supporting data, it remains healthy, with concentrated price ranges for $BTC between $93,000 to $98,000 and $105,000 to $105,000. The former is more stable, while the latter, with more accumulation, still carries rising risks.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。