Today, the news about #OKX preparing for an IPO has taken over the headlines. I had previously predicted that #OKX would take the IPO route and move towards compliance, which aligns with the interests and demands of shareholders.

Now, let me make a bold prediction: if #OKX goes public, its market value will exceed that of #Coinbase. Today, #COIN has a total market value of 78.5 billion USD, so let's note that down. I'll briefly explain the logic behind this:

If #OKX can indeed go public on the US stock market, it will be the first compliant CEX with a non-US, Chinese background to successfully enter the mainstream market on Wall Street, which is as significant as the "IPO breakthrough event in the crypto space."

First, let's understand why #OKX wants to go public in the US:

✅ The answer is quite simple: financing + branding + compliance moat

• Financing: OKX has already made a substantial profit, but going public will allow it to raise more low-cost capital through the public market for global expansion;

• Brand endorsement: Having a listing in the US will significantly enhance global customer trust (especially among traditional financial institutions);

• License moat: Obtaining certification from the US SEC/CFTC means that competitors like Bybit and Bitget will have to incur very high compliance costs to catch up.

Next, let's look at #OKX's core profit pathways:

1️⃣ Trading fees (Spot + Futures): This is the main cash cow, similar to Coinbase.

2️⃣ Deposit and withdrawal fees + fiat currency channels: This represents stable income.

3️⃣ Potential future revenue from Web3 wallets (such as swaps, staking, etc.): This is a growth potential.

Currently, the wallet segment has not started charging fees, but once it expands in the US market, the potential is significant. Compared to #Coinbase's revenue structure, #OKX is in the early stages of a "diversified income structure," which will have better growth prospects.

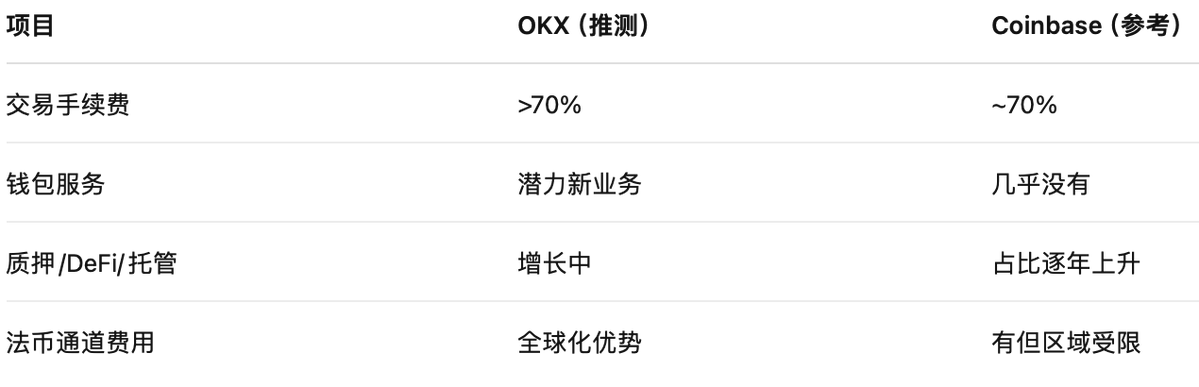

Finally, let me discuss #OKX's core advantages compared to #Coinbase:

✅ Wallet + Derivatives

• Wallet: #OKXWallet is currently one of the strongest (it has outperformed others like Rabby and MetaMask), and if it opens up swap fees in the future, it will be stable and high-margin, similar to "App Store revenue sharing."

• Derivatives trading: OKX is much more flexible in contracts, options, and other products compared to Coinbase, allowing it to earn more at a lower cost.

✅ Globalization advantage:

• Coinbase is more limited to North America, while #OKX has a global presence and multiple licenses, enabling it to engage in "compliance arbitrage"—reasonably positioning its business segments across different regulatory zones.

Overall, while the difficulty of #OKX going public remains significant, if successful, it will provide a tremendous boost to the entire exchange industry. It will mark the true beginning of the "regularization" of the crypto industry, allowing institutional capital (hedge funds, pension funds) to invest in legitimate CeFi equity, thereby activating a new round of 'financing-IPO-exit' cycles in the primary market. This undoubtedly creates new opportunities and valuation increases for the crypto industry. 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。