Table of Contents:

Large Token Unlock Data for This Week;

Overview of the Crypto Market, Quick Read on Weekly Popular Coins' Price Fluctuations/Fund Flows by Sector;

Bitcoin Spot ETF Dynamics;

BTC Liquidation Map Data Interpretation;

Key Macroeconomic Events and Important Predictions and Interpretations for the Crypto Market This Week.

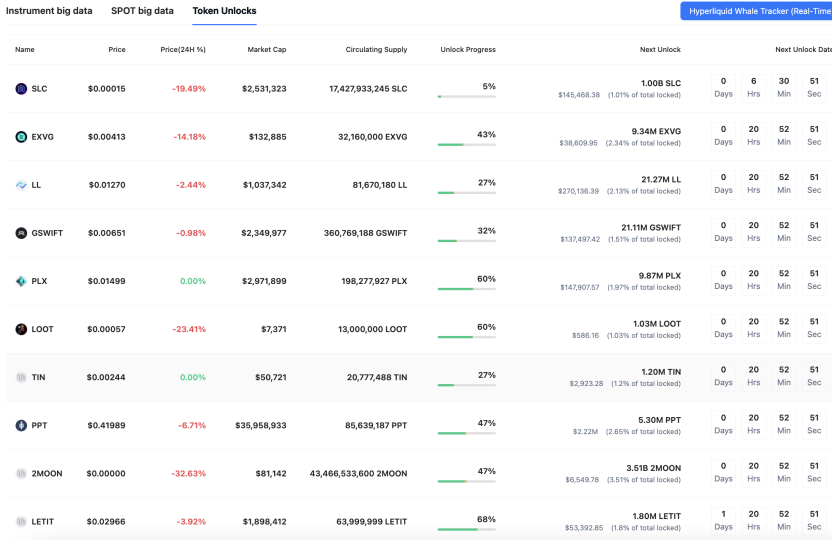

1. Large Token Unlock Data for This Week;

Coinank data shows that tokens such as BLAST, VENOM, and SOON will experience significant unlocks this week (the following times are in UTC+8), including:

Blast (BLAST) will unlock approximately 10.5 billion tokens at 10 PM on June 26, accounting for 34.98% of the current circulating supply, valued at about $22.5 million;

Venom (VENOM) will unlock approximately 59.26 million tokens at 4 PM on June 25, accounting for 2.84% of the current circulating supply, valued at about $10 million;

SOON (SOON) will unlock approximately 41.88 million tokens at 4:30 PM on June 23, accounting for 22.41% of the current circulating supply, valued at about $8.4 million;

AltLayer (ALT) will unlock approximately 240 million tokens at 6 PM on June 25, accounting for 6.83% of the current circulating supply, valued at about $6.7 million;

Undeads Games (UDS) will unlock approximately 2.15 million tokens at 8 AM on June 26, accounting for 2.13% of the current circulating supply, valued at about $2.3 million;

IOTA (IOTA) will unlock approximately 15.16 million tokens at 8 AM on June 25, accounting for 0.39% of the current circulating supply, valued at about $2.3 million;

Velo (VELO) will unlock approximately 182 million tokens at 8 AM on June 26, accounting for 2.47% of the current circulating supply, valued at about $2.1 million;

Yield Guild Games (YGG) will unlock approximately 14.08 million tokens at 10 PM on June 27, accounting for 2.68% of the current circulating supply, valued at about $1.9 million;

SingularityNET (AGIX) will unlock approximately 7.15 million tokens at 8 AM on June 28, accounting for 2.38% of the current circulating supply, valued at about $1.9 million;

Artificial Superintelligence Alliance (FET) will unlock approximately 3.1 million tokens at 8 AM on June 28, accounting for 0.12% of the current circulating supply, valued at about $1.9 million.

We believe that from the perspective of token economics, unlocking events will significantly increase market supply, potentially triggering short-term price volatility, especially when the unlock ratio is high (e.g., BLAST at 34.98%), exacerbating the risk of supply-demand imbalance. According to dynamic valuation models, token value is primarily driven by user trading demand rather than traditional cash flow discounting; after the unlock, the influx of new tokens into the market may depress prices, but if it can accelerate platform adoption (e.g., by reducing transaction costs), it may instead strengthen network effects and stabilize long-term value. Historical data shows that similar events (e.g., ALT and OP unlocks in June 2024) are often accompanied by downward price pressure, and investors should be wary of the spread of market panic, especially in high-ratio projects. Additionally, the design of tradable tokens may amplify secondary market volatility, as users tend to cash out quickly after unlocking, further exacerbating sell-off risks.

This week's total unlock value is approximately $60 million, which, while lower than historical peaks, still poses localized shocks due to concentrated releases from projects like BLAST. We recommend that investors pay attention to user adoption metrics (e.g., active addresses) to distinguish between short-term disturbances and fundamental changes, while also using S-curve models to anticipate adoption phases and avoid blindly following trends. In terms of risk management, it is advisable to diversify holdings and monitor liquidity changes to cope with potential volatility.

2. Overview of the Crypto Market, Quick Read on Weekly Popular Coins' Price Fluctuations/Fund Flows by Sector

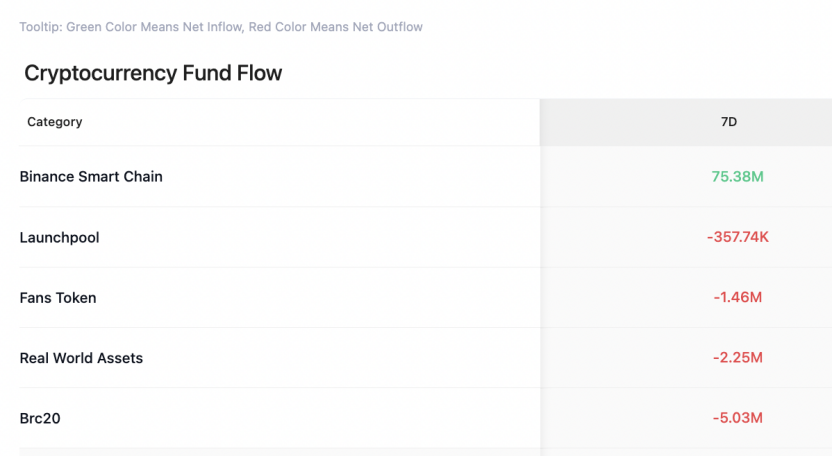

CoinAnk data shows that in the past week, the crypto market, categorized by concept sectors, saw only the Binance Smart Chain achieve a net inflow of funds, while Launchpool, fan tokens, RWA, and Brc20 experienced relatively small outflows.

In the past 7 days, the top gainers among tokens (selected from the top 500 by market capitalization) include FUN, LQTY, SEI, AERGO, T, and OKB, which have shown relatively strong price increases. This week, it is advisable to continue focusing on trading opportunities in strong tokens.

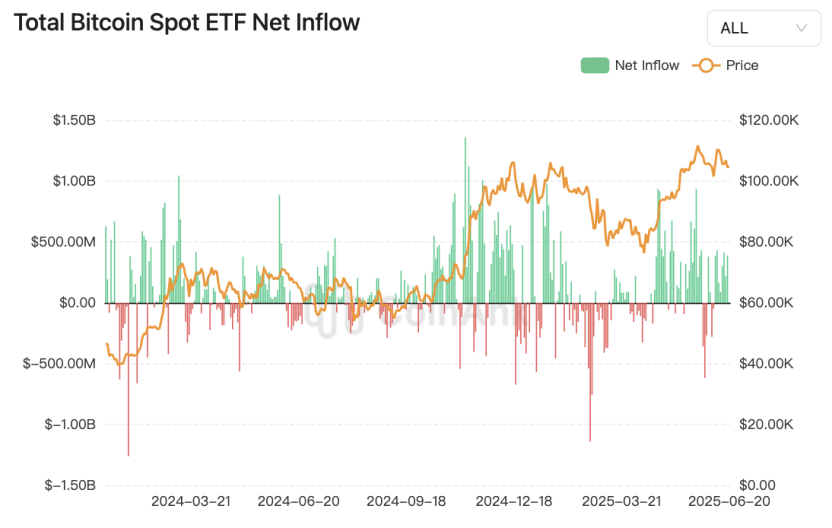

3. Bitcoin Spot ETF Fund Dynamics.

CoinAnk data shows that last week, Bitcoin spot ETFs experienced a net outflow of $1.02 billion. The Bitcoin spot ETF with the highest net inflow last week was Blackrock's Bitcoin ETF IBIT, which saw a weekly net inflow of $1.23 billion. The Bitcoin spot ETF with the highest net outflow last week was Ark Invest and 21Shares' ETF ARKB, which had a weekly net outflow of $188 million.

Currently, the total net asset value of Bitcoin spot ETFs is $126.54 billion, with an ETF net asset ratio (market cap compared to total Bitcoin market cap) of 6.14%, and historical cumulative net inflows have reached $46.66 billion.

We believe that last week’s significant divergence in Bitcoin spot ETFs, with a net outflow of $1.02 billion, reflects short-term market sentiment fluctuations that may stem from profit-taking or macroeconomic factors, such as expectations regarding Federal Reserve policy. Notably, Blackrock's IBIT saw a counter-trend net inflow of $1.23 billion, highlighting its institutional appeal and market leadership, likely benefiting from Blackrock's brand advantage and ongoing accumulation strategy. In contrast, ARKB's net outflow of $188 million may be related to internal strategy adjustments or changes in investor risk appetite.

Overall, the total net asset value of ETFs has reached $126.54 billion, with a net asset ratio of 6.14% and historical cumulative net inflows of $46.66 billion, indicating that Bitcoin ETFs have become mainstream financial instruments with strong long-term capital inflows. This divergence highlights the increasing maturity of the market, where short-term volatility does not affect structural trends, and institutional participation (e.g., Blackrock) remains a core driving force. Future attention should be paid to macroeconomic indicators and regulatory dynamics to anticipate fund flows.

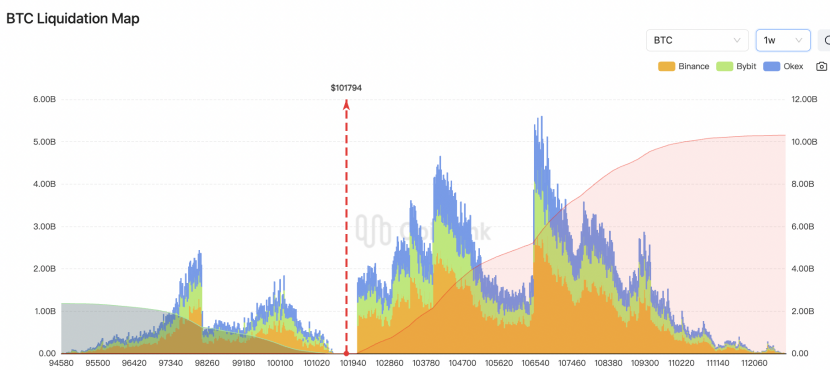

4. BTC Liquidation Map Data.

CoinAnk liquidation map data shows that if BTC breaks through $108,900, the cumulative short liquidation intensity on major CEXs will reach $8.98 billion. Conversely, if Bitcoin falls below $95,000, the cumulative long liquidation intensity on major CEXs will reach $2.35 billion.

We believe that Bitcoin liquidation data reveals a significant escalation of market leverage risks and an extreme trend in long-short battles. According to the latest liquidation map, the short liquidation intensity will surge nearly 8 times compared to the $1.01 billion level when it broke through $100,000 in May; if it is a downward trend, the long liquidation intensity will expand more than 10 times compared to the $229 million level at the same threshold in February. This reflects the accumulation of leverage risks, with liquidation thresholds continuously rising, indicating that speculators are piling on leverage at higher price levels, exacerbating market fragility.

There is also a liquidity siphoning effect; the liquidation intensity is not the actual amount but a "relative intensity" indicator of liquidity shocks once the price is reached. The current $8.98 billion short intensity suggests that breaking through key levels may trigger a "short squeeze"—a wave of buying triggered by forced liquidations or self-reinforcing upward momentum; while the $2.35 billion long intensity exposes the risk of a "long kill long" chain reaction during a pullback. We need to pay attention to the market structure's differentiation, as the gap in long and short liquidation scales has evolved from early equilibrium to the current nearly 4-fold disparity, indicating that shorts are betting more aggressively in historically high price areas, which may lead to extreme volatility.

The liquidation positions may have become a "life and death line" for longs and shorts, with any directional breakout potentially triggering significant market shocks due to forced liquidation mechanisms, and investors should be wary of the amplifying effects of liquidity whirlpools.

5. Key Macroeconomic Events and Important Predictions and Interpretations for the Crypto Market This Week.

CoinAnk data shows:

June 23, Monday: The Governor of the Bank of Korea will meet with commercial bank heads, expected to discuss issues such as the Korean won stablecoin; Federal Reserve Governor Bowman will speak on monetary policy and the banking sector.

June 24, Tuesday: Federal Reserve Chairman Powell will deliver semi-annual monetary policy report testimony before the House Financial Services Committee.

June 25, Wednesday: Federal Reserve Chairman Powell will present testimony before the Senate Committee on the semi-annual monetary policy report; FOMC permanent voting member and New York Fed President Williams will speak.

June 26, Thursday: Initial jobless claims in the U.S. for the week ending June 21 (in thousands), previous value 24.5.

June 27, Friday: U.S. May core PCE price index year-on-year, expected 2.60%, previous value 2.50%; U.S. June Michigan Consumer Sentiment Index final value, previous value 60.5.

Deribit: Bitcoin options will see the largest quarterly settlement this Friday, with the maximum pain point at $100,000; CoinList will launch the Pipe Network (PIPE) token sale;

June 28, Saturday: The Thai SEC will block numerous crypto platforms.

We believe that the core of this week's macro events and crypto market forecasts lies in the impact of policy communication, economic data, and regulatory changes on market uncertainty. First, Federal Reserve Chairman Powell's congressional testimony is a key event. Historical research indicates that central bank communication's forward guidance (e.g., interest rate cut signals) has a far greater impact on market expectations than descriptions of current economic conditions; a dovish stance may boost risk assets, while hawkish remarks will increase volatility, especially in policy-sensitive areas like cryptocurrencies. This is due to the increased sensitivity of the market to policy signals following enhanced central bank transparency, which may lead to short-term changes in fund flows.

The release of economic data (e.g., the core PCE price index on June 27) will test the resilience of the U.S. economy. If the data is weaker than expected, it may strengthen interest rate cut expectations, driving a rebound in risk assets like the crypto market; conversely, strong data may exacerbate "higher for longer" concerns, amplifying volatility. As a measure of inflation, changes in the PCE may also affect exchange rates and cross-border capital flows, indirectly impacting liquidity in the crypto market.

In the crypto market, large-scale settlements of Bitcoin options (with a maximum pain point of $100,000) may trigger short-term price volatility, compounded by policy uncertainty (e.g., Federal Reserve speeches), which could lead to liquidation risks for leveraged positions. Meanwhile, the Thai SEC's blocking of multiple exchanges highlights regulatory divergence; similar events have previously heightened regional policy uncertainty, dampening investment confidence, but have limited impact on the global market. Tether's holding of over 100,000 BTC in reserves, while aimed at enhancing stability, may not fully offset macro shocks in a high-uncertainty environment.

In summary, the intertwining of events this week will intensify uncertainty in economic policy, with Federal Reserve communication being the dominant variable, potentially transmitting through market sentiment to the crypto space, necessitating vigilance regarding the chain reactions of data and regulation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。