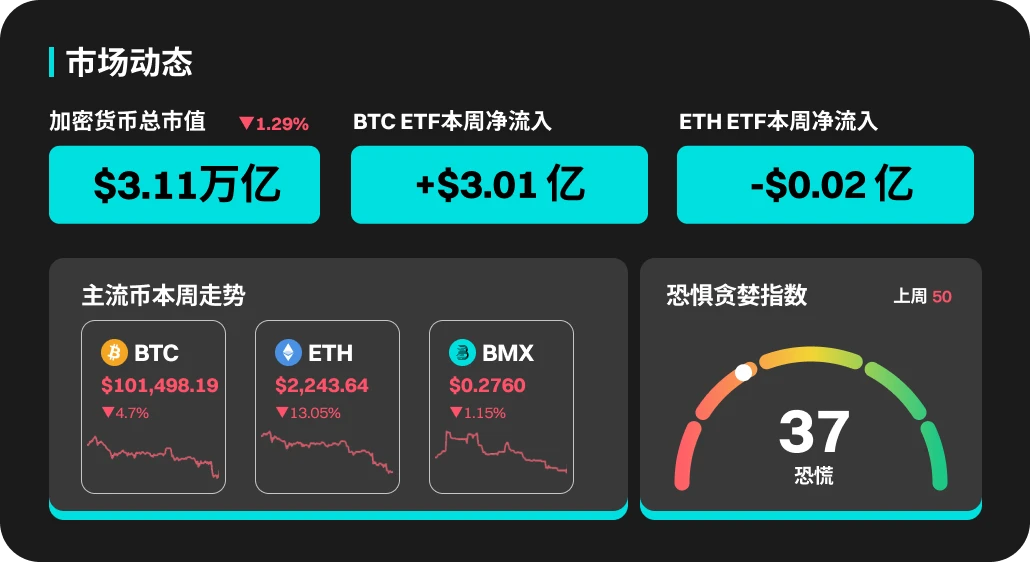

According to BitMart's market report on June 23, the total market capitalization of cryptocurrencies over the past week was $3.11 trillion, a decrease of 1.29% compared to the previous week.

This Week's Cryptocurrency Market Dynamics

In the past week (2025.06.16–2025.06.22), BTC ETFs saw a net inflow of $301 million, maintaining positive capital inflow for two consecutive weeks, although the scale has significantly narrowed compared to earlier periods. Over the past week, BTC fell below the $100,000 mark, reaching a low of about $98,000, and is currently fluctuating around $101,498.19, with overall market sentiment becoming cautious. BTC's market share is reported at 63.2%, slightly down but still in a high range.

ETH ETFs recorded a slight net outflow of $2 million last week, ending a three-week streak of net inflows. The price of ETH has been under pressure, dropping significantly over the past week, with a weekly decline of about 13%, currently priced around $2,243.64. The ETH/BTC exchange rate continues to be constrained by the key resistance level of 0.025, with both capital and price performance being relatively weak compared to earlier periods. Despite multiple attempts to rebound, ETH has failed to effectively reclaim the key position above $2,400.

This Week's Popular Cryptocurrencies

In terms of popular cryptocurrencies, FUN, AICELL, GOUT, DATA, and BANANAS31 have all performed well. FUN's price increased by 236.39% this week, with a current market cap of $13M. GOUT's price rose by 99.58%, reaching a peak price of 0.0002286 USDT.

U.S. Market Overview and Hot News

U.S. Stock Market: The three major U.S. stock indices closed mixed on June 20. At the close, the Dow Jones Industrial Average rose by 35.16 points from the previous trading day, closing at 42,206.82 points, an increase of 0.08%; the S&P 500 index fell by 13.03 points, closing at 5,967.84 points, a decrease of 0.22%; the Nasdaq Composite Index fell by 98.86 points, closing at 19,447.41 points, a decrease of 0.51%.

Most large tech stocks declined, with Google down nearly 4%, Meta, Intel, Amazon, and Nvidia down over 1%, and Microsoft slightly down; Apple rose over 2%, while Netflix and Tesla saw slight increases. Circle surged over 20%, reaching a historic closing high. Biotech company Capricor Therapeutics Inc. (CAPR) fell over 30%. Kroger Co. (KR) rose nearly 10%, marking its best single-day performance in the last 15 months.

On Tuesday at 10 PM, Federal Reserve Chairman Powell will testify on the semiannual monetary policy report before the House Financial Services Committee;

On Wednesday at 10 PM, Federal Reserve Chairman Powell will present testimony on the semiannual monetary policy report before the Senate Committee.

The SEC will hold a roundtable on June 26 to review executive compensation disclosure rules.

Popular Sectors and Project Unlocks

SOON (SOON) will unlock approximately 41.88 million tokens at 4:30 PM Beijing time on June 23, representing 22.41% of the current circulating supply, valued at about $8.4 million.

Venom (VENOM) will unlock approximately 59.26 million tokens at 4 PM Beijing time on June 25, representing 2.84% of the current circulating supply, valued at about $10 million.

AltLayer (ALT) will unlock approximately 240 million tokens at 6 PM Beijing time on June 25, representing 6.83% of the current circulating supply, valued at about $6.7 million.

IOTA (IOTA) will unlock approximately 15.16 million tokens at 8 AM Beijing time on June 25, representing 0.39% of the current circulating supply, valued at about $2.3 million.

Blast (BLAST) will unlock approximately 10.5 billion tokens at 10 PM Beijing time on June 26, representing 34.98% of the current circulating supply, valued at about $22.5 million.

Stablecoins

With the U.S. Senate passing the "GENIUS Act" to set a new regulatory framework for stablecoin issuance, Circle (USDC) saw its stock price surge by 16%, and Coinbase also benefited with a rise of about 17%.

Risk Warning:

The risks associated with using BitMart services are entirely borne by you. All cryptocurrency investments (including returns) are inherently highly speculative and involve significant risk of loss. Past, hypothetical, or simulated performance does not necessarily represent future results.

The value of digital currencies may rise or fall, and buying, selling, holding, or trading digital currencies may involve substantial risks. You should carefully consider whether trading or holding digital currencies is suitable for you based on your personal investment goals, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。