🎯 This is a noteworthy structural signal —

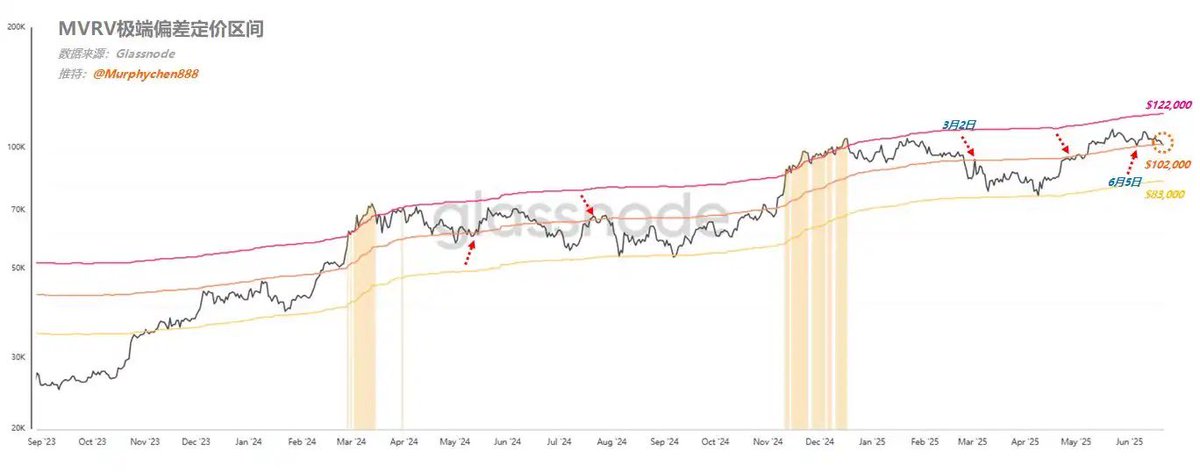

The middle orange line of MVRV mentioned by Murphy (around $102,000) has played a key support/resistance role multiple times over the past three months.

In this current news vacuum and emotional recovery period, whether this line can be maintained is actually a verification of whether the market's structural optimism still holds.

If it cannot be maintained, the dense chip area of URPD below (at $98,000) may become the focus of a new round of speculation —

This is not only the average cost line for short-term $BTC holdings but also the psychological anchor point for the current structural bullish and bearish beliefs.

A break below such key levels often means a temporary failure of price logic and a risk of narrative disruption, which could lead to widespread panic.

📌 Therefore, at this moment, it is not advisable to focus solely on price fluctuations; instead, one should pay attention to three questions to help with internal investment calibration:

Should you actively adjust your position in this price range? Is it a left-side ambush or a right-side realization?

What level of catalyst is the market waiting for? Is it a short-term positive or a structural shift?

If the market moves into a downward consolidation, can your position allocation withstand it? Do you have the capacity to increase your position?

Remember:

Price is lagging, structural changes are leading.

Information is vague, investment actions are clear!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。