DTSP Regulations Reshape Singapore's Web3 Industry

Author: Aiden and Jay Jo

Source: Tiger Research

Translation: Baihua Blockchain

Summary

Singapore has attracted numerous Web3 companies with its flexible regulatory environment, earning the title of "Delaware of Asia." However, the surge in shell companies and the high-profile collapses of firms like Terraform Labs and 3AC have exposed regulatory loopholes. In 2025, the Monetary Authority of Singapore (MAS) will implement the Digital Token Service Provider (DTSP) framework, requiring all companies providing digital asset services in Singapore to obtain a license; mere registration will no longer suffice to conduct digital asset business. Singapore continues to support innovation, but regulatory enforcement has significantly intensified, with the government demanding greater accountability and compliance. Web3 companies in Singapore must develop operational capabilities or consider relocating to other jurisdictions.

1. Changes in Singapore's Regulatory Environment

For years, global enterprises have referred to Singapore as the "Delaware of Asia" due to its clear regulations, low corporate tax rates, and fast registration processes, attracting companies worldwide. This foundation also applies to the Web3 industry. Singapore's business-friendly environment has naturally made it an ideal destination for Web3 companies. MAS recognized the growth potential of cryptocurrencies early on and proactively established a regulatory framework, providing space for Web3 companies to operate within the existing system.

MAS enacted the Payment Services Act (PSA), incorporating digital asset services into a clear regulatory framework and launched a regulatory sandbox allowing companies to experiment with new business models under specific conditions. These measures reduced uncertainty in the early market, making Singapore a hub for the Web3 industry in Asia.

However, recent policy directions in Singapore have shifted. MAS has gradually abandoned its flexible regulatory approach, tightening standards and revising frameworks. Data clearly shows this shift: since 2021, the approval rate for over 500 license applications has been below 10%. This indicates that MAS has significantly raised approval standards and adopted stricter risk management measures under limited regulatory capacity.

This report explores how these regulatory changes are reshaping Singapore's Web3 landscape.

2. DTSP Framework: Why Now and What Changes?

2.1. Background of Regulatory Tightening

Singapore recognized the potential of the crypto industry early on, attracting numerous companies with flexible regulations and sandboxes, leading many Web3 companies to view Singapore as their Asian base.

However, the limitations of the existing system have gradually become apparent. A key issue is the "shell company" model, where companies register entities in Singapore but operate overseas, exploiting regulatory loopholes in the Payment Services Act (PSA). At that time, the PSA only required companies providing services to Singapore users to obtain a license, allowing some companies to evade this requirement by operating overseas. These companies leveraged Singapore's institutional credibility while escaping actual regulation.

MAS believes this structure complicates anti-money laundering (AML) and counter-terrorism financing (CFT) enforcement. Although registered in Singapore, the operations and flow of funds occur entirely overseas, making it difficult for regulators to implement effective oversight. The Financial Action Task Force (FATF) referred to this as an "offshore virtual asset service provider (VASP)" structure, warning that inconsistencies between registration and operational locations lead to global regulatory loopholes.

The collapses of Terraform Labs and Three Arrows Capital (3AC) in 2022 brought these issues to the forefront. Both companies registered entities in Singapore but operated overseas, preventing MAS from effectively regulating or enforcing actions against them, resulting in billions of dollars in losses and damaging Singapore's regulatory reputation. MAS decided to no longer tolerate such regulatory loopholes.

2.2. Key Changes and Impacts of the DTSP Regulations

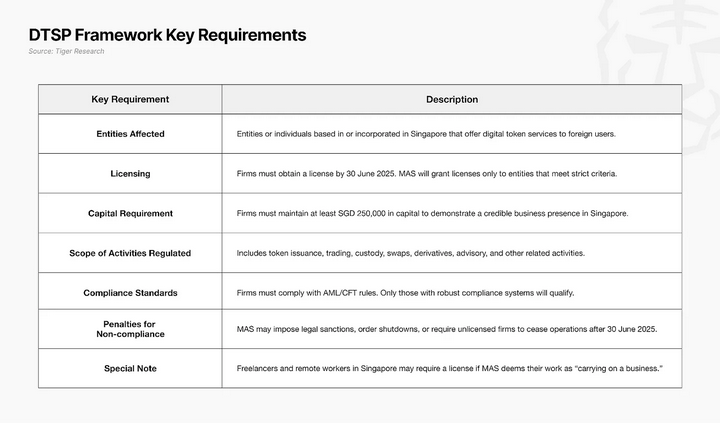

The Monetary Authority of Singapore (MAS) will implement the new Digital Token Service Provider (DTSP) regulations on June 30, 2025, under Part 9 of the Financial Services and Markets Act (FSMA 2022). The FSMA consolidates MAS's previously fragmented regulatory powers into comprehensive financial legislation to address the new financial environment, including digital assets.

The new regulations aim to address the limitations of the PSA. The PSA only required companies providing services to Singapore users to obtain a license, allowing some to evade regulation by operating overseas. The DTSP framework directly targets this structural evasion, requiring all digital asset companies based in or conducting business in Singapore to obtain a license, regardless of where their users are located. Even companies serving only overseas clients must comply if they operate in Singapore.

MAS has made it clear that it will not issue licenses to companies without a substantive business basis. Companies that do not meet the requirements by June 30, 2025, must cease operations immediately. This is not merely a temporary enforcement action but signals Singapore's long-term transformation into a trust-centered digital financial hub.

3. Redefining the Regulatory Scope under the DTSP Framework

The DTSP framework requires digital token service operators in Singapore to comply with more explicit regulatory requirements. MAS mandates that any entity considered "based in Singapore" must obtain a license, regardless of user location or organizational structure. Previously unregulated business types are now included within the regulatory scope.

Key examples include: companies registered in Singapore but operating entirely overseas; and companies registered overseas but with core functions (such as development, management, marketing) in Singapore. Even Singapore residents participating in projects in a continuous business manner may need to comply with DTSP requirements, regardless of whether they belong to a formal organization. MAS's criteria are clear: Is the activity occurring in Singapore? Does it have a commercial nature?

These changes not only expand the regulatory scope but also require operators to have substantive operational capabilities, including AML, CFT, technology risk management, and internal controls. Operators must assess whether their activities in Singapore are regulated and whether they can maintain operations under the new framework.

The implementation of DTSP indicates that Singapore is transforming, no longer merely a place that leverages regulatory reputation. Singapore now requires companies to assume responsibilities and discipline above a certain threshold. Companies and individuals wishing to continue crypto operations in Singapore must clearly understand their activities, recognize the regulatory implications under DTSP standards, and establish appropriate organizational structures and operational systems when necessary.

4. Conclusion

Singapore's DTSP regulations reflect a shift in the regulatory authority's attitude toward the crypto industry. MAS previously maintained a flexible policy to help new technologies and business models enter the market quickly. However, this regulatory reform is not just a simple tightening; it imposes clear responsibilities on entities that have Singapore as their actual business base. The framework has shifted from an open experimental space to one that only supports operators meeting regulatory standards.

This change means operators must fundamentally adjust their operations in Singapore. Companies unable to meet the new regulatory standards may face difficult choices: adjust their operational framework or relocate their business base. Jurisdictions like Hong Kong, Abu Dhabi, and Dubai are developing crypto regulatory frameworks in different ways, and some companies may consider these regions as alternative bases.

However, these jurisdictions also require licenses for services provided to local users or operating within their territories, involving capital requirements, AML standards, and substantive operational rules. Therefore, companies should view relocation as a strategic decision rather than a simple regulatory evasion, considering regulatory intensity, regulatory approaches, and operational costs comprehensively.

Singapore's new regulatory framework may create entry barriers in the short term, but it also indicates that the market will restructure around operators with sufficient accountability and transparency. The effectiveness of this system depends on whether these structural changes are sustainable and consistent. Future interactions between institutions and the market will determine whether Singapore can be recognized as a stable and reliable business environment.

Article link: https://www.hellobtc.com/kp/du/06/5908.html

Source: https://reports.tiger-research.com/p/singapores-web3-exodus-eng

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。