Most DeFi yields are just moving money in circles.

@USDai_Official is aiming to bring real yield through infrastructure powering AI.

While most RWA protocols aim to bring TradFi yields on chain, USDAI is designed for a different approach: direct financing of productive hardware such as GPU clusters and charging stations.

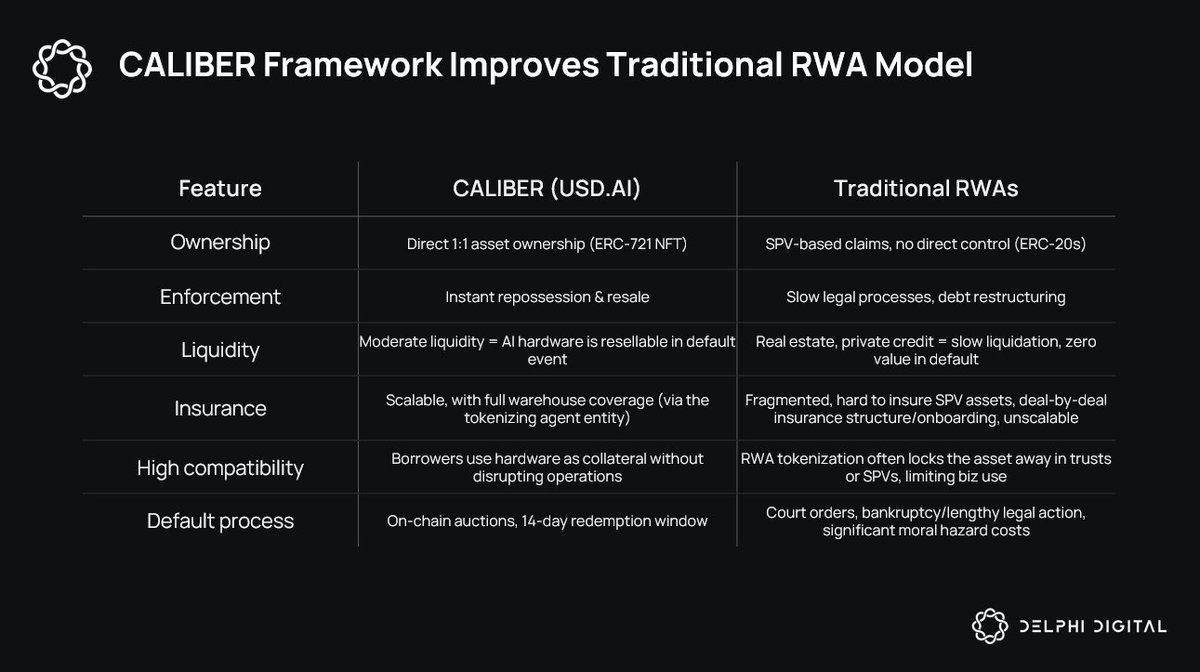

Outside of treasuries, RWA models often struggle with tokenizing physical assets.

Many of them use SPV-based ownership with little insight into legal processes, requiring significant amount of trust in protocol operators.

To fix this, USDAI built the CALIBER framework (Collateralized Asset Ledger: Insurance, Bailment, Evaluation, and Redemption) with UCC Section 7 compliance.

Through Caliber, the borrower sells hardware to a Tokenizing Agent who creates NFTs representing a digital deed with enforceable legal ownership.

Through a bailment agreement, the borrower operates the equipment on behalf of the NFT holder, then receives the NFT back to use as collateral.

This creates direct asset ownership with clear repossession rights. Default means the NFT gets auctioned on-chain and the physical equipment can be legally reclaimed.

The framework is attracting capital. USDAI already closed $10M in partner deposits during their private beta.

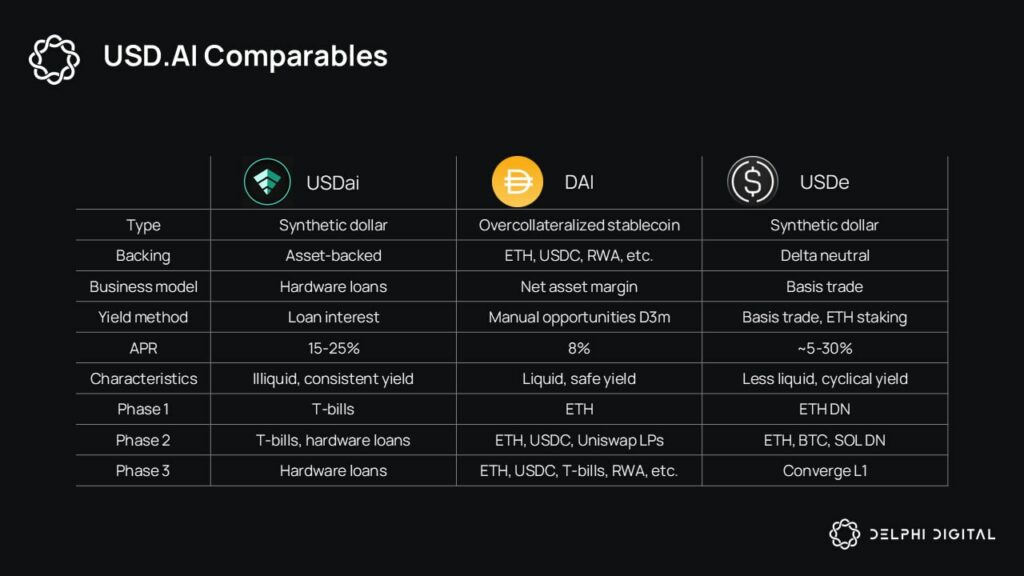

When Maker shifted to RWA, they bought bonds.

When Ethena launched USDe, they used delta-neutral perps.

USDAI is building toward backing USDai with AI infrastructure machines, complete with enforceable ownership rights.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。