Tether, relying on the global circulation of USDT, has long become a giant in the stablecoin industry. Just from government bond interest, its annual profit reaches 13 billion dollars, making it one of the most profitable fintech companies in the world. However, when reviewing its business model, Tether found that while it has harvested enough profits from the issuance and management of USDT, the true "on-chain economic sharing" has not fallen into its hands.

The Gas fees collected by Ethereum daily show that USDT contributes nearly 100,000 dollars, accounting for over 6% of the total Ethereum transaction fee consumption. But that's not all. TRON is actually the stage where USDT captures value most effectively. According to the latest on-chain data, the transaction volume and Gas consumption of USDT on TRON account for over 98% of the entire public chain, meaning that the trading boom on TRON is almost entirely reliant on USDT "blood transfusion."

For each on-chain transfer of USDT, the user typically pays a transaction fee ranging from 0.3 to 8 dollars. To put it in more intuitive terms, the current daily on-chain revenue of the TRON network exceeds 2.1 million dollars, translating to an annualized income of up to 770 million dollars. The vast majority of this comes from the high-frequency transaction fees of USDT. The total number of on-chain transactions on TRON within 24 hours reaches as high as 2.46 million, averaging about 0.85 dollars per transaction, which aligns closely with the average on-chain fee rate of USDT. Currently, TRON's overall market capitalization has exceeded 25 billion dollars, and its stable on-chain revenue scale consistently ranks among the top public chains.

Data Source: DefiLama

For Tether, this is actually a typical case of "value capture imbalance." The issuance and brand of USDT have brought enormous user traffic and industry-level stable demand, but all on-chain transaction fees and ecological dividends have long been "taxed" by the infrastructure rather than being led by Tether itself. This not only weakens Tether's strategic voice in future on-chain payment and settlement networks but also leaves it passive in the face of new threats such as TRON's self-developed stablecoin or even traffic diversion.

If Tether is merely satisfied with being a "super minting factory" for stablecoins without having a leading role in on-chain infrastructure, its future value ceiling will be extremely limited.

This is also the fundamental reason why Tether is fully investing in its own stablecoin chain ecosystem. Through the exclusive chain model, Tether can not only "reclaim its own system" the massive transaction fees and ecological dividends originally flowing to public chains like Ethereum and TRON but also establish its own on-chain closed loop in areas such as B2B payments, compliant settlements, and industrial collaboration.

More importantly, TRON is currently also trying to weaken its dependence on USDT.

Recently, TRON launched the USD1 stablecoin from the Trump family. TRON founder Justin Sun is himself an advisor to the Trump family's DeFi project, and the relationship between the two seems to suggest that TRON may intend to gradually reduce its use and issuance of USDT in the coming years.

Additionally, from the perspective of transaction fee costs, TRON's advantage as a stablecoin settlement network is also gradually diminishing. Without purchasing and burning TRX, the transaction fees on TRON currently exceed those of the traditionally expensive Bitcoin network and are higher than those of the Ethereum mainnet, Apots chain, and BNB chain.

This is not good news for USDT, as the transfer fee for USDC through the Base network is only 0.000409 dollars. Even Circle's Circle Paymaster feature allows users to pay gas fees using USDC on the Arbitrum and Base networks.

Therefore, these trends and competitive threats force Tether to quickly adjust its business strategy.

Plasma: The Source of TRON's Anxiety

Tether's first step was to quietly support a new chain called Plasma by the end of 2024.

Initially, there were just a few announcements and some financing—Bitfinex (Tether's parent company), Peter Thiel's Founders Fund, Framework, and other capital injected 24 million dollars, followed by an additional 3.5 million dollars in external funding, quickly pushing Plasma's valuation to 500 million dollars in just two months.

Plasma uses the Bitcoin mainnet as the final settlement layer, inheriting the security of UTXO while directly being compatible with EVM at the execution layer. Most importantly, all on-chain transactions can be paid for with USDT, making USDT transfers completely free.

It is precisely because of the simple and direct selling point of "zero fees" that when the official released governance token XPL allocation allowed users to deposit liquidity, the first batch of 500 million dollars was snatched up within minutes, and the newly added 500 million dollar deposit cap was sold out within 30 minutes. Some large holders even paid 100,000 dollars in gas fees on the Ethereum mainnet to secure a spot. This shows the market's desire for a "no-fee stablecoin chain."

Beyond the technical architecture, Plasma also quietly incorporates two chips. The first is "native privacy." On-chain transfers are publicly visible by default, but if users need to obscure addresses and amounts, they can simply check an option in their wallet to enter privacy mode; they can also choose to selectively disclose information when facing audits or compliance requirements. The second is "Bitcoin liquidity." Plasma promises to seamlessly bring native BTC onto the chain through a permissionless bridge, allowing low-slippage exchanges and BTC collateralized borrowing of stablecoins to be completed in the same environment, supported by Tether's deep dollar pool.

All of this aligns perfectly with Tether's actions over the past year of "stockpiling Bitcoin." The Plasma team and Bitfinex's partners have long been advocates of Bitcoin.

At the center stage of the 2025 Bitcoin conference, Tether CEO Paolo Ardoino stood in front of an image of Wukong, stating, "Bitcoin is my Wukong, it is our friend."

In the spring of 2025, Tether announced that it would become a major shareholder of Twenty One Capital, a company that went public on NASDAQ through mergers and acquisitions, similar to MicroStrategy, and is a Bitcoin financial company.

Tether invested 458.7 million dollars to increase its BTC holdings and transferred 37,000 Bitcoins to a new address, providing ammunition for Twenty One Capital. Currently, Tether and Twenty One Capital together hold approximately 137,000 Bitcoins, making them the third-largest publicly traded company holding Bitcoin, only behind MicroStrategy and mining company MARA Holdings.

Data Source: https://bitbo.io/

The outside world was originally puzzled about what Tether aimed to achieve by converting stablecoin profits into "digital gold," but now the answer is clear: USDT serves as the settlement currency, while BTC acts as the reserve asset, merging the two in Plasma to consolidate the 150 billion dollars of USDT scattered across dozens of networks into a unified settlement layer, allowing transfers, exchanges, and recoveries to occur within Tether's own territory.

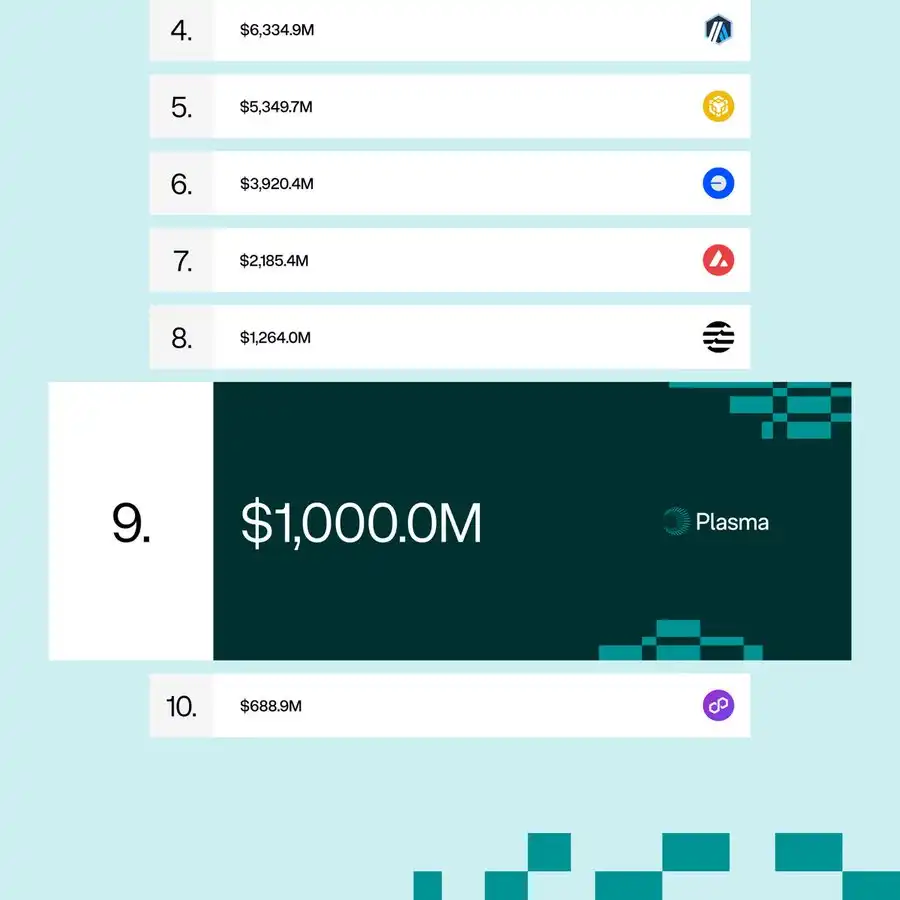

When the mainnet test version is released, Plasma will rank as the ninth-largest blockchain globally in terms of stablecoin liquidity, valued at 1 billion dollars.

In the past, Tether had to follow the rhythm of Ethereum and TRON. Once either party raised fees or modified rules, USDT could only passively comply, and the supporting infrastructure for USDT (settlement, execution, bridging, etc.) was largely beyond Tether's control. Now, Plasma consolidates issuance, circulation, and recovery entirely within its own ecosystem, allowing Tether to gain more pricing power and voice, naturally holding the toll gate of this network.

How Much More Can Plasma Earn for Tether in a Year?

Although Plasma offers zero fees for USDT transfers, it does not mean that Plasma has no income.

Plasma's ability to claim "USDT transfers are completely free" does not rely on Tether subsidizing with real money, but rather on breaking down transactions by complexity and priority into two billing methods. To put it simply, it’s like saying "children under 1.2 meters are free."

Ordinary USDT transfers occupy a small block, akin to "children under 1.2 meters," and nodes directly package these transactions into blocks without charging users Gas. However, to prevent spam transactions, Plasma has a basic throughput limit. Additionally, to avoid malicious transaction spamming, users need to leave a small deposit on-chain, serving as collateral: once the abuse threshold is triggered, this deposit will be automatically forfeited. This preserves the "free" experience while blocking spam traffic.

Other requests that exceed simple transfers, such as calling multiple contracts at once, batch settlements, and institutional-level rapid settlements, will be recognized by the system and will require payment. The main income for Plasma nodes comes from these transactions, along with small fees collected from cross-chain asset transfers and custody services, giving the entire network self-sustaining capabilities. Because simple transfers are no longer charged, the pricing model can be more flexible: based on current on-chain estimates, thousands of free payments per second consume very low resources, allowing nodes to cover costs and maintain surplus with a small amount of high-level business.

Supporting this mechanism is Plasma's "dual-layer framework." The bottom layer periodically anchors the block state back to Bitcoin, outsourcing security to BTC's proof of work; the upper layer is directly compatible with EVM, allowing developers to migrate Ethereum contracts seamlessly. By removing traditional Gas calculations, execution efficiency is actually higher. Messari's evaluation report mentioned that Plasma's improved consensus can stably handle thousands of payments with a single-core CPU under stress testing, while node rewards come entirely from that portion of complex transactions.

So how does Plasma make money? The answer is becoming clear.

First, enterprise-level "dedicated lines"—cross-border remittance companies or game publishers that want to push transfers from millisecond to sub-millisecond levels must enter the paid lane and pay a fixed monthly fee in USDT to ensure bandwidth.

Second, contracts and batch settlements—DeFi protocols that invoke complex logic still need to pay Gas, but the pricing unit changes from ETH to USDT.

Third, bridging and custody—bringing assets from other chains to Plasma or redeeming from Plasma incurs a small export tax, which goes into the Plasma treasury and is then distributed to nodes and the foundation according to rules.

Fourth, governance token XPL inflation—validators staking XPL receive block rewards, and the Plasma treasury retains a portion to auction over time, used to continuously subsidize point-to-point USDT payments with 0 gas.

The combination of these four factors is sufficient to cover the network costs of free transfers and may even bring a whole new cash flow to Tether.

Assuming Plasma can successfully take on the majority of USDT traffic currently running on TRON and Ethereum, the first direct income would be the majority of on-chain fees intercepted by TRON and Ethereum—annual revenue could reach about 1 billion to 2 billion dollars. Adding enterprise services and cross-chain fees, the new income range is expected to reach 1.2 to 3 billion dollars.

However, due to Plasma's exemption from ordinary USDT transfer fees, a conservative estimate suggests that Plasma could bring Tether 1 billion dollars in revenue per year.

Moreover, Plasma may have other hidden benefits and ecological spillovers: for example, attracting new large liquidity and projects to join, collecting certain "taxes"; providing SDKs and enterprise node access, charging commercial fees for on-chain applications, etc.

Comparing this new cash leg with Tether's existing ledger makes it even more intuitive: in 2024, of Tether's approximately 13 billion dollars in revenue, 7 billion dollars comes from government bond interest, 45 million dollars from a 0.1% issuance/redemption fee, and nearly 6 billion dollars from investment gains in Bitcoin, gold, and early projects. This means that Plasma could potentially increase Tether's annual profit by an additional 15% to 20%.

Stable: A USDT L1 Dedicated Chain Tailored for Institutions

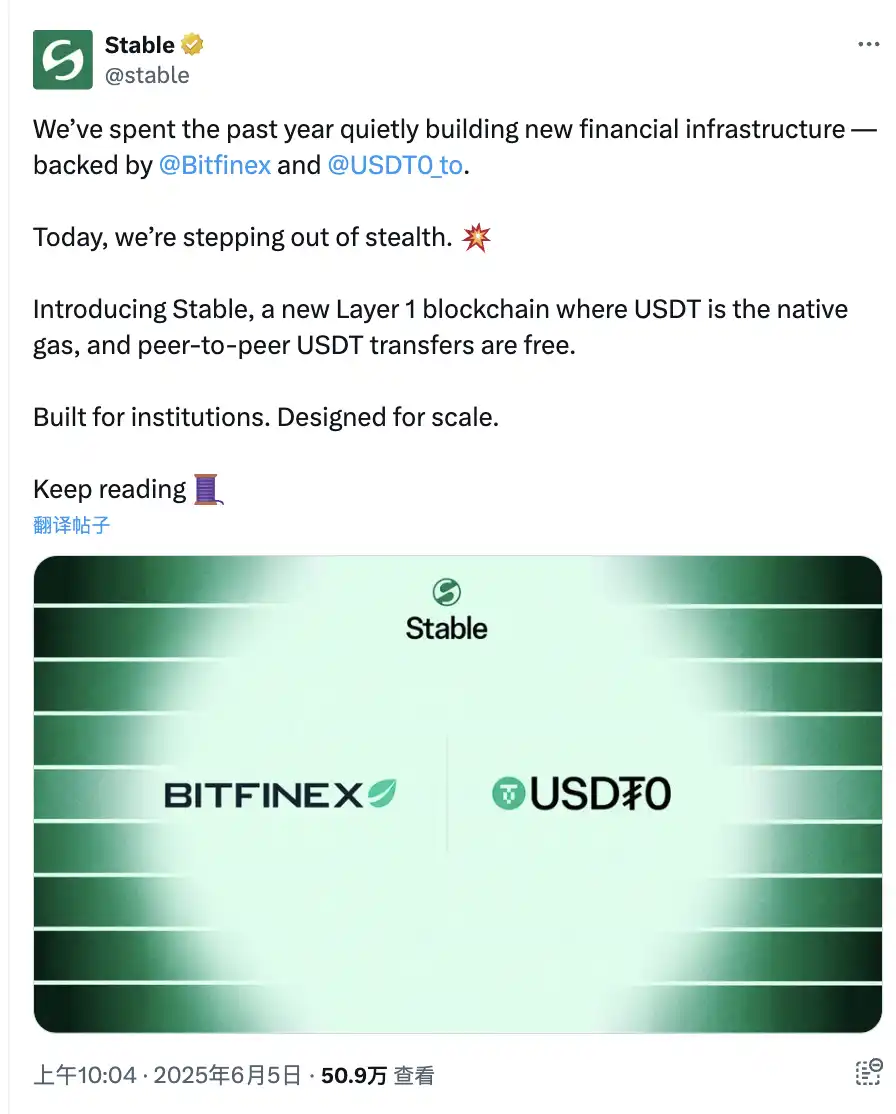

After Plasma has embraced the liquidity of large on-chain players and the developer ecosystem, Tether did not stop there. This month, a new L1 chain called Stable, supported by Bitfinex and the unified liquidity protocol USDT0, was officially announced, with Tether CEO Paolo Ardoino serving as an advisor for the project.

Unlike Plasma, which is a Bitcoin L2, Stable is an L1 chain. Although it also uses USDT as gas and offers free point-to-point USDT transfers, it targets a completely different audience: global financial institutions, corporate settlements, bulk clearing, on-chain corporate finance, B2B cross-border transactions, etc., rather than retail/small-scale scenarios.

Currently, the internal testnet for Stable has been launched, and the team is guiding early builders to explore SDKs for wallet, application, and custody integration, including rapid fiat onboarding, smart contracts operating in US dollars, and wallets that run without gas, so users may not even realize they are on a blockchain.

The clues for Stable's implementation are hidden in Tether's recent aggressive investments in commodities. This spring, Tether invested in acquiring a 70% stake in Latin American agricultural and renewable energy giant Adecoagro, followed by announcing that USDT would directly participate in the settlement of South American grain, oil, ethanol, and even crude oil. On June 5, Tether announced a strategic investment in the African blockchain financial platform Shiga Digital, which provides virtual accounts, OTC trading services, fund management, and foreign exchange (FX) services for African businesses. Most recently, on June 12, Tether announced the acquisition of approximately 31.9% of Canadian-listed mining company Elemental (78,421,780 shares) and signed an option agreement with AlphaStream Limited, allowing it to purchase an additional 34,444,580 shares after October 29, 2025.

Traditional bulk trade has long relied on bank wire transfers and letters of credit, with a single shipment often worth tens of millions of dollars, and funds "clearing" in the banking system can take several days; if this money is converted into on-chain USDT, the cross-border counterpart can almost release it in milliseconds. Stable's enterprise channel precisely reserves a "dedicated fast lane" for this large, compliant, low-latency dollar flow, allowing clearinghouses and custodial banks to bridge their stablecoins in and out through the USDT0 bridge protocol without worrying about which chain the counterpart is using.

For large merchants who control physical assets and must comply with accounting regulations, as long as the clearing efficiency can truly surpass traditional wire transfers, they wouldn't mind paying a little extra in channel fees; for Tether, this flow is also far more stable and higher margin than retail transfers. More critically, by packaging "USDT + physical assets" into the same ledger, Tether can finally embed the dollar flow captured on-chain directly into grains, energy, and the entire supply chain. Paolo Ardoino previously stated in an interview that the largest incremental scenario for USDT in the next five years is not crypto trading, but commodity trading.

The two chains have clearly defined roles: Plasma enhances the on-chain user experience, turning small flows into large volumes with 0 gas; Stable addresses institutional compliance, transforming large volumes into sustainable high profits through dedicated line clearing. Their common goal is singular—to ensure that USDT is no longer limited by the fee rates of any public chain and is not "taxed" by any single ecosystem. From daily remittances to tens of thousands of tons of soybeans, all dollar flows ultimately need to return to the ledger controlled by Tether itself, which is the ultimate point of the "chain sovereignty counterattack."

Tether's Exclusive New Stablecoin in the U.S.?

"What Americans want is a checking account (for daily payments), while overseas users treat USDT as savings (digital savings)." Tether CEO Paolo Ardoino recently articulated Tether's next move: a localized dollar payment coin.

Previously, Paolo had hinted that Tether might establish a new company in the U.S. to issue a new stablecoin specifically for local payment scenarios, while the existing USDT would continue to target international markets and developing regions. When asked whether Tether would create a payment network similar to Square and support stablecoin payments, Paolo responded, "I can't reveal all the plans right now, but your direction of thought is not wrong."

This is inextricably linked to an unavoidable role—the U.S. banking industry.

Last week, Paolo shared news about the first major U.S. bank that explicitly expressed willingness to issue stablecoins on X, accompanied by a meaningful "Select your player." The industry immediately speculated that Tether is likely to collaborate with this bank.

What many people do not know is that Tether has a heavyweight ally on Wall Street: Howard Lutnick, the former Secretary of Commerce during the Trump era and billionaire, leads Cantor Fitzgerald, which currently manages billions of dollars in Tether's government bond positions and is also the most important spokesperson for USDT in traditional capital markets. Once the U.S. version of the stablecoin goes live, Cantor's clearing network and market-making positions will naturally serve as the best liquidity support.

Of course, Tether's "black and gray attributes" are still under intense scrutiny from U.S. regulators: the Treasury Department's report specifically named Mexican drug cartels as frequent users of USDT, and some lawmakers have even treated it as a negative example of crypto. Tether first moved its registration to Bitcoin-friendly El Salvador and then made headlines by purchasing hundreds of billions in government bonds in the U.S. market, using "I am a U.S. bondholder" to counteract policy risks.

In this way, Plasma has firmly absorbed retail zero-fee payments and on-chain developers into the Tether ecosystem; Stable is moving tons of soybeans, crude oil, and cross-border salaries to millisecond-level dollar clearing; and the upcoming "U.S. payment coin" is preparing to uproot the last bastion of bank wire transfers. The three networks have clearly defined roles, yet all hold the "toll gate" in the same hand.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。