The Federal Reserve's interest rate decision is about to be announced, the U.S. Senate has historically passed the GENIUS Act; BTC network transaction fee revenue ratio hits a three-year low!

Macroeconomic Interpretation: The U.S. Senate's historic passage of the GENIUS Act marks a key step in federal-level regulation of stablecoins. This bill, pushed by Republican Senator Bill Hagerty, establishes a national regulatory framework for the chaotic stablecoin market for the first time. Although the bill still needs to be reconciled with the House version of the Stablecoin Transparency and Accountability Promotion Act, its passage itself has sent a positive signal to the market that a regulatory framework is gradually taking shape. As a core link connecting traditional finance and the crypto ecosystem, the compliance process for stablecoins will significantly lower the barriers for mainstream capital to enter.

Meanwhile, the Federal Reserve will hold a meeting tonight to discuss relaxing the supplementary leverage ratio requirements for large banks, which may exempt safe assets like government bonds, releasing liquidity for banks to participate in the government bond market. If the policy is implemented, combined with the current market expectation of an 85.5% probability of the Federal Reserve cutting interest rates this year, expectations for U.S. dollar liquidity easing will continue to rise. This macro backdrop subtly echoes Zhou Xiaochuan's warning at the Lujiazui Forum today: global monetary policy coordination remains in a "three no state" (no institutions, no tools, no consensus), and the spillover effects of policies from reserve currency countries are becoming increasingly prominent. The potential shift of the Federal Reserve is like throwing a stone into a global capital pond, with ripples spreading into the realm of risk assets.

On-chain data is revealing the resilient undercurrent of the Bitcoin bull market. Market analysis shows that the selling behavior of long-term holders (LTH) is currently approaching historical lows, a typical "reluctance to sell" state that often corresponds to a market accumulation phase. Historical experience indicates that after the last four similar signals appeared, Bitcoin's price increased by 18%-25% within 6-8 weeks. More critically, changes in holding days momentum and the MVRV Z-score (currently close to neutral) and other on-chain indicators are synchronously validating the accumulation of upward momentum. This "old hands holding their positions" phenomenon resonates with technical signals—despite the weakening predictive power of global liquidity models on BTC's price movements, Bitcoin's performance in maintaining the support range of $105,000-$110,000 still aligns with its projected 13-week oscillation rhythm. If this technical structure holds firm, a surge to $140,000 by the end of summer is not a fantasy.

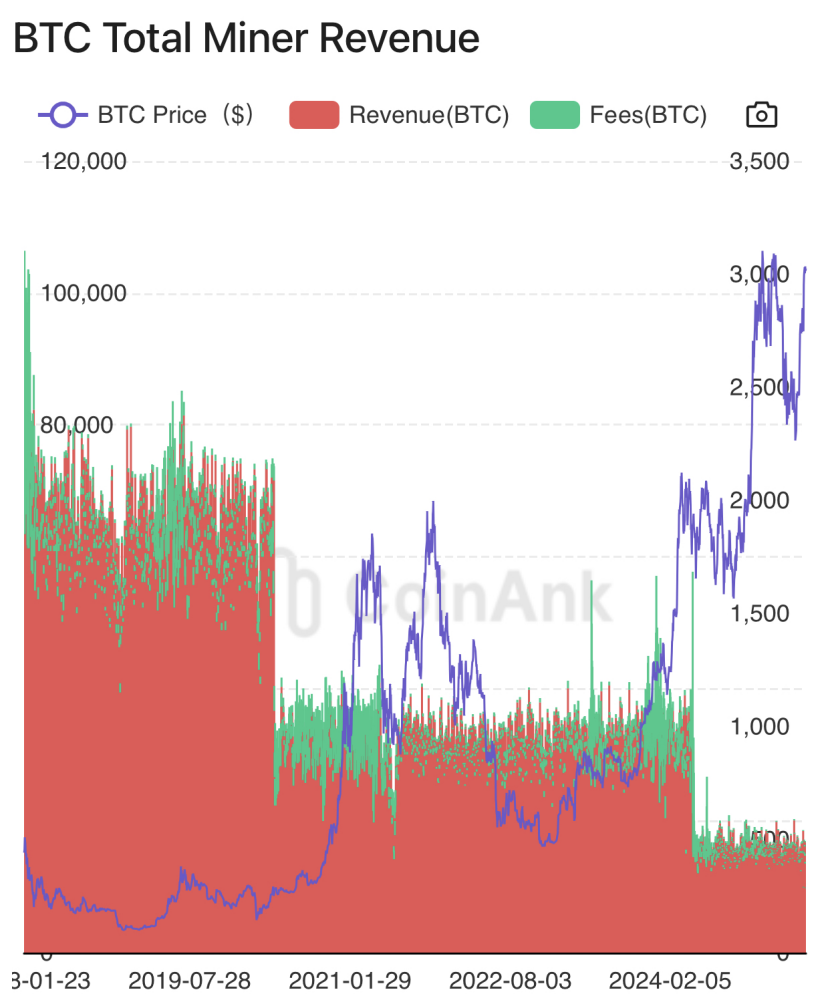

However, beneath the prosperity lies structural challenges. The mining community is experiencing "post-halving growing pains": data shows that in June, Bitcoin transaction fees fell below 1%, hitting a new low since 2022. Although the value of block rewards remains high at $327,000 due to rising coin prices, Compass Mining points out that the overall revenue of the industry is still close to historical lows. This paradox of "high coin prices, low income" stems from insufficient network usage (average transaction fee is only $1.45) and intensified competition for computing power. The harsh reality is forcing mining operations to accelerate technological iteration—only companies with efficient mining machines and low-cost electricity can survive the cycle, and industry reshuffling is inevitable.

Institutional dynamics reflect strategic adjustments of capital. Cathie Wood's Ark Invest sold nearly $100 million in Circle stock over two consecutive days as its price hit a new high. This sharply contrasts with its initial investment of $373 million on Circle's listing day. While this operation has raised market doubts about stablecoin concept stocks, it essentially reflects institutions taking profits after regulatory frameworks have become clearer, rather than a bearish outlook on the industry. The deeper logic is that the advancement of the GENIUS Act has reduced policy uncertainty, and early investors choosing to cash out aligns with capital operation norms.

Regulatory breakthroughs open up institutional ceilings, on-chain accumulation signals upward momentum, while expectations for liquidity easing provide macro fuel. Although the short-term difficulties in mining and institutional reallocation bring volatility, the core logic of the market remains unchanged—the global demand for non-sovereign value storage continues to expand. As the Federal Reserve's interest rate cut window approaches and the regulatory path for stablecoins becomes clearer, combined with the fermentation of the on-chain accumulation cycle, Bitcoin is likely to welcome a new round of value discovery after a period of consolidation. Investors need to pay attention not only to price fluctuations but also to three major variables: mining clearing efficiency, the speed of regulatory details implementation, and the turning point of U.S. dollar liquidity, as they will collectively outline the roadmap for Bitcoin to reach new highs.

BTC Data Analysis:

According to CoinAnk data, as of June 2025, the Bitcoin network transaction fee revenue ratio has plummeted to below 1%, hitting a three-year low. Although rising coin prices have kept block rewards at a high of $327,000, total miner revenue is still approaching historical lows, creating a significant "revenue divergence" phenomenon. The root cause lies in the weak on-chain transaction activity (the average transaction fee is only $1.45) and the inevitable result of intensified competition for computing power across the network. This dual pressure is driving deep changes in the mining industry: the iteration of efficient mining machines and the layout of low-cost electricity have become key to survival, accelerating the industry's reshuffling process.

From a market impact perspective, the continuous shrinkage of the fee ratio may weaken the network's security foundation. Miners' income overly reliant on block rewards will amplify the impact of price fluctuations on computing power, especially against the backdrop of block subsidies being reduced to 3.125 BTC after the halving. If computing power significantly declines due to profit pressures, it may weaken Bitcoin's network's ability to resist 51% attacks. In the medium to long term, this structural dilemma will force the acceleration of second-layer expansion solutions and promote mining companies to optimize operational efficiency through mergers and acquisitions (such as CleanSpark's acquisition of mining sites). Although the short-term market volatility index has dropped to a four-month low, the current situation of miners holding below bull market cycle levels (1.8 million BTC) suggests that if selling pressure intensifies, it may constrain BTC's price upside potential.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。