This article provides a great perspective on examining stablecoins from the angle of "the evolution of modern payment systems."

1/ Evolution of Modern Payment Systems:

Early Payments (Before 1950s):

Payments primarily relied on cash or localized bilateral credit agreements, which were inefficient and had limited reach.

The Rise of Credit Cards (1950s-1960s):

1950: Diners Club launched the first multi-purpose credit card, acting as an intermediary between merchants and consumers.

1958: Bank of America introduced BankAmericard (later Visa), targeting the mass market and promoting the popularity of credit cards. However, high default rates (20%+) and fraud issues led to chaos.

1960s: Bank of America authorized other banks to use the technology, forming a network of issuing banks, laying the foundation for scaling.

Formation of the Four-Party Payment Model (1960s-1970s):

Dee Hock and others created Visa to resolve the chaos of the BofA project, establishing the "open-loop" four-party payment model (issuing bank, acquiring bank, card network, merchant).

The California Bank Association launched Master Charge (later Mastercard), and the four-party model became the global payment mainstream.

Digitalization and E-commerce (1990s-2000s):

The rise of the internet drove e-commerce, with NetMarket completing the first online credit card transaction in 1994, and Pizza Hut's PizzaNet becoming the first retailer to accept online payments.

Companies like Amazon, eBay, and PayPal promoted payment digitalization, integrating merchant-side services through payment gateways and processors, but still relied on traditional banks and card networks.

Alternative Payment Methods (2000s-Present):

Companies like PayPal, Alipay, M-Pesa, Venmo, and Wise focus on digital wallets and peer-to-peer transactions, serving customers overlooked by traditional banks, providing better experiences and lower costs.

Banks and card networks (like Visa Direct, Mastercard Send) launched real-time payment networks to respond to competition, but remained constrained by pre-funding, foreign exchange/credit risks, and opaque clearing processes.

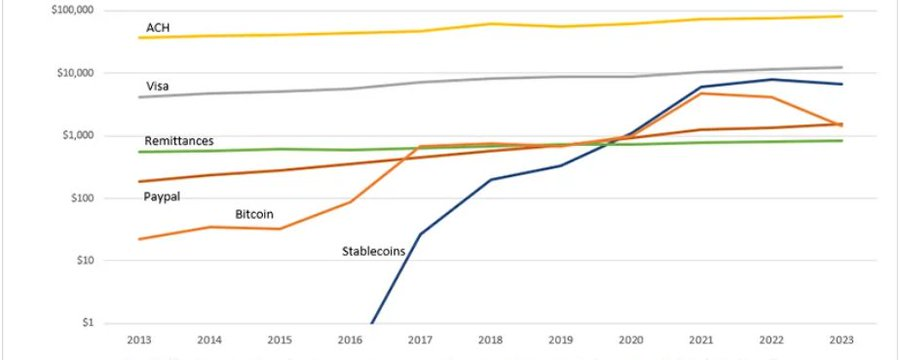

2/ Why are Stablecoins a Superior Payment System?

Compressed Value Chain: Stablecoins enable direct ledger transfers through blockchain, eliminating intermediaries like issuing banks, acquiring banks, and card networks.

Transparency and Efficiency: The open-source ledger of blockchain provides transaction transparency, reducing opacity.

Low Cost: Traditional cross-border payment fees can be as high as 6.6%, taking 7-14 days; stablecoin transactions are nearly instantaneous, with significantly reduced costs, especially when no fiat currency conversion is needed.

Programmability and Interoperability: Stablecoins support programmable payments and cross-currency/product exchanges, outperforming real-time payments (RTPs).

The final question is, are there any entrepreneurial opportunities in the rise of stablecoins as a global payment system? How can individuals benefit from it?

Food for thought.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。