The homework from the past couple of days has been quite torturous for me. My understanding of geopolitical conflicts is still lacking a lot, making it difficult to predict the future trends of the conflicts. I can only estimate the current situation by looking at oil prices. However, I have already opened long positions around 104. Moving forward, my speculation will not only focus on geopolitical conflicts but also include Thursday's dot plot and the Federal Reserve's interest rate meeting.

First, regarding the geopolitical conflict, it seems that the U.S. is preparing to intervene. Even if it's just Trump's "verbal" intervention, it's still a good thing. Additionally, the geopolitical conflicts in the Middle East have the most significant impact on U.S. stocks and $BTC, primarily through rising oil prices, which may lead to recurring inflation in the U.S. In fact, Nick's tweet today has already clarified many issues.

If it weren't for Trump's tariff policy, the Federal Reserve might have already cut interest rates in June. This signal could also indicate that Powell will have more dovish remarks this time. Of course, he may still say dovish things while doing hawkish actions, which I think is quite likely. After all, the macro data that has been released so far is still good, and inflation has started to decrease without the impact of reciprocal tariffs.

Moreover, the impact on Bitcoin prices comes from multiple aspects, including JPMorgan issuing "deposit certificates" on the BASE chain aimed at institutional users. In a certain sense, this deposit certificate is a type of stablecoin and represents a significant step taken by traditional banks in the RWA field.

So even if oil prices rise and U.S. stocks continue to decline, it has indeed boosted investor sentiment in the cryptocurrency sector.

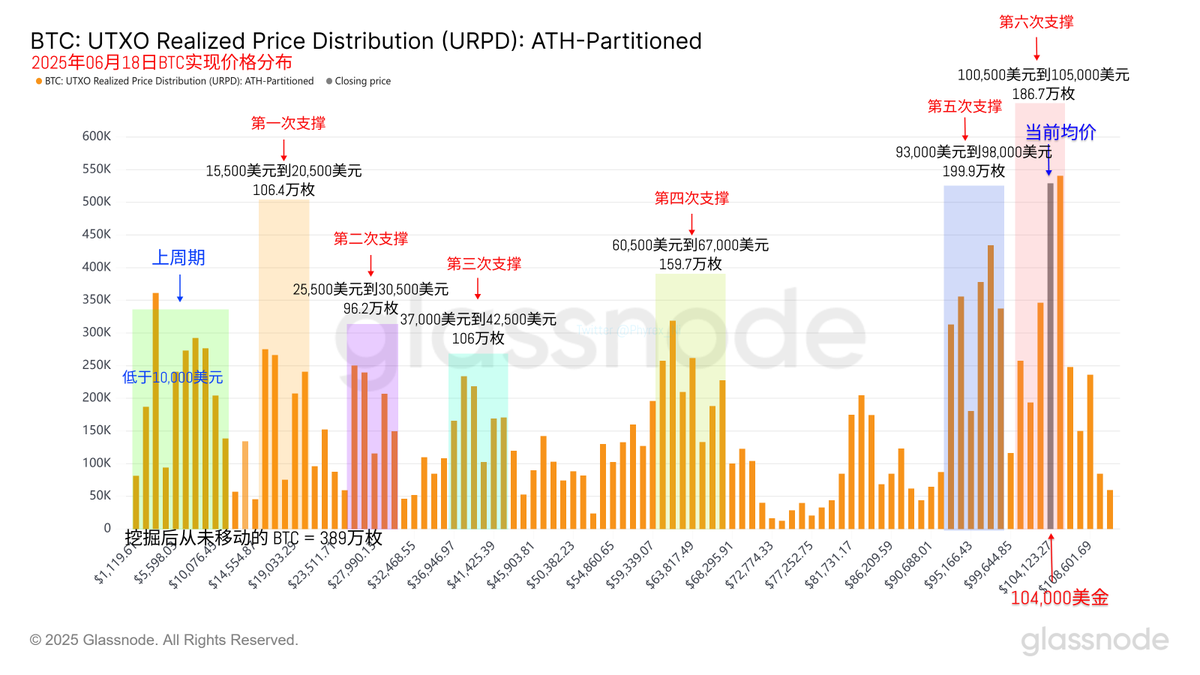

Looking back at Bitcoin's data, the price fluctuations have not caused panic among investors. The turnover rate has not only not increased but has actually decreased. More investors are not worried about the short-term BTC price trends; only the short-term investors who bought in the last two days have strong expectations to exit. Most investors may still want to speculate on Thursday's interest rate meeting or believe that the impact of geopolitical conflicts will not be significant, at least not lasting for long.

Additionally, from the supporting data, the range of $93,000 to $98,000 remains the most stable at the moment. The turnover of this group of investors is also decreasing, while the inventory from $100,500 to $105,000 is gradually increasing. Currently, there are over 1.07 million Bitcoins accumulated around the $105,000 mark. Although this is not a large amount yet, if this position continues to accumulate, it is still primarily composed of short-term investors, so it is not stable.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。