After the phase of "new institutions flooding in" during the market's periodic recovery, the new coin market surged, becoming the focus of speculative capital and hot money. Especially with a large number of projects recently distributing airdrops during their Token Generation Events (TGE) and consecutively listing on exchanges, there has been widespread discussion regarding new coin strategies in the crypto market—should we continue the short-term mindset of "selling immediately after listing" in the current environment, or should we adopt a more long-term value-oriented approach?

To dissect this issue, this article focuses on the price performance of new coins after their listing on centralized exchanges (CEX), providing crypto market traders with a more comprehensive and realistic judgment reference. We hope to offer a set of meaningful quantitative observation frameworks for new coins through cross-platform data comparison.

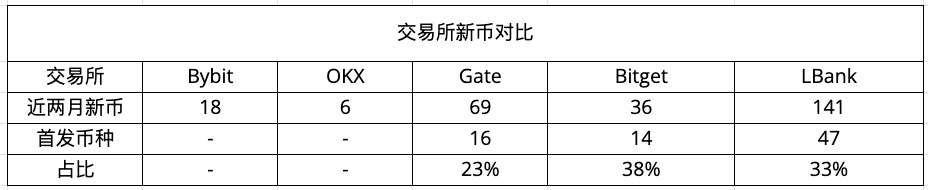

Recent Overview of New Coin Listings on Mainstream CEXs

For this analysis, we selected a nearly six-week window from May 1 to June 12, 2025, to compare the newly listed tokens on five exchanges: Bybit, OKX, Bitget, Gate, and LBank. By statistically analyzing the number of new listings on each platform and their price performance and trading depth over different periods (5 minutes, 1 hour, 24 hours, 7 days),

Bybit, OKX — Traditional "first-tier" platforms with strict project screening and controlled listing pace;

Bitget, Gate — Emerging platforms with user volume and liquidity now ranking among the industry leaders, considered "new first-tier";

LBank — A "latecomer" second-tier representative that has risen rapidly with high-frequency listings in recent years.

From May to June this year, the crypto market once again ignited a wave of new coin listings, with significant differentiation in the listing pace among major centralized exchanges (CEXs).

According to our compilation of listing announcements, official X (Twitter), and community dynamics from each platform, the new coin listing situation for the five exchanges from May to June 2025 is as follows:

LBank ── 141 new coins, a "machine-gun" style of listing, abundant opportunities but mixed quality; 90% of projects showed strong differentiation within 7 days.

Gate ── 69 new coins, maintaining a "daily update" rhythm, with high volatility and uneven depth; ample short-term trading space, but accompanied by liquidity gap risks.

Bitget ── 36 new coins, driven by both spot and contract trading, with intense long-short hedging on the first day; some thematic coins doubled against the trend, but caution is needed against leverage backlash.

Bybit ── 18 new coins, strictly controlling the number of listings, with a clear "stopwatch market"; if the initial surge is missed, subsequent profit windows quickly narrow.

OKX ── 6 new coins, preferring quality over quantity, with the strictest standards; volatility is controlled but profit effects are highly concentrated, requiring precise timing to capture benefits.

Overall, LBank and Gate create numerous trial-and-error opportunities through high-frequency listings; Bybit and OKX compress risk ranges with a selective model; Bitget occupies a middle ground, amplifying short-term speculative space with derivative tools.

In terms of rhythm, platforms like LBank show a high-frequency and dispersed characteristic for new coin listings—averaging 2-3 new coins launched daily, continuously supplying "new blood" to the market. This machine-gun style listing strategy allows LBank to dominate in terms of project richness. Meanwhile, some platforms choose to concentrate their releases: for example, certain exchanges list multiple tokens simultaneously in a single day to generate market attention. In contrast, mainstream exchanges like OKX had very few new coin listings from May to June, tending to carefully select quality projects and slow down the listing pace. Although Bybit and Bitget have fewer new coins than LBank, they maintain a frequency of new token listings every week, actively following market trends.

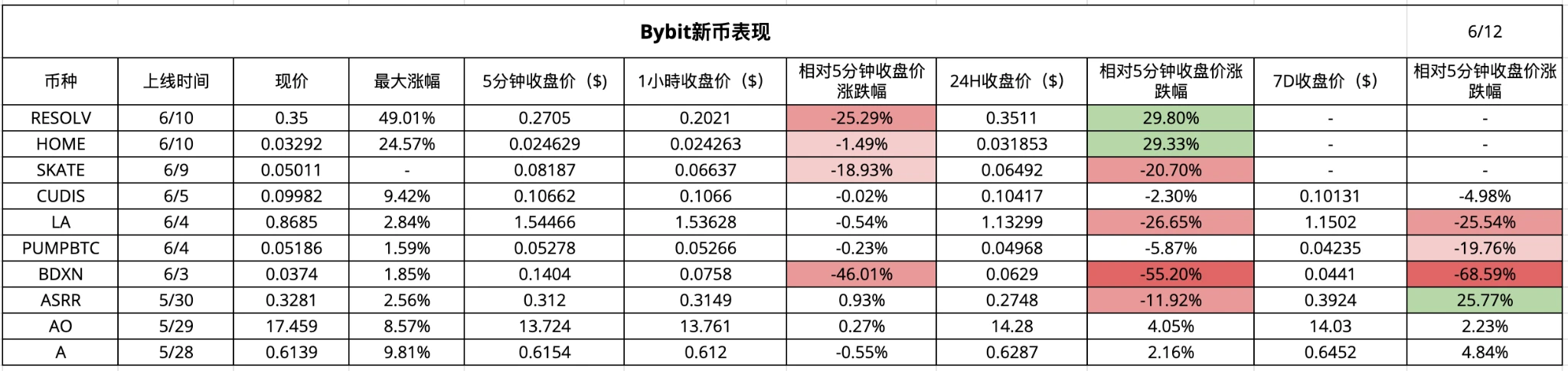

Bybit: High Open, Low Close, First Day Volatility Masks Subsequent Weakness

In the six-week window from May 1 to June 12, 2025, Bybit globally or simultaneously launched 18 new tokens, averaging about 1 every 2-3 days. The majority are Meme and new blockchain ecosystem tokens, accounting for nearly 70%. In this round of samples, Bybit's new coins continue to exhibit "stopwatch market" characteristics: RESOLV and HOME rebounded nearly 30% within 24 hours relative to their 5-minute closing prices, but the surge was concentrated in a few K-lines after the opening; once buying pressure receded, prices quickly retraced. BDXN is a typical "roller coaster" — priced at $0.1404 in 5 minutes, it dropped to $0.0441 in 7 days, a decline of 68.6%. Except for ASRR (+25.8%) and AO (+2.2%), all other tokens showed negative performance over 7 days, indicating that the popularity of new coins on Bybit leans more towards ultra-short-term speculation; if profits are not realized in the first hour, the holding value often faces a stair-step decline.

OKX: A Selective Listing Pace Does Not Guarantee Profits

OKX listed only 6 new coins from May to June, continuing its cautious approach, but the returns show that "preferring quality over quantity" does not equate to "guaranteed profits." RESOLV leveraged the platform's depth to achieve a 48.8% rebound within 24 hours, being the only highlight; SOPH, KMNO, and HUMA lost ground within 24 hours, with 7-day declines of 14-45%, indicating that even selected projects struggle to withstand liquidity withdrawal. JITOSOL, as a high-priced asset, showed narrow fluctuations, with a 7-day increase of only 1.4% relative to the 5-minute price. Overall, the volatility of new coins on OKX is lower than on other platforms, but the profit effect is highly concentrated; missing out on strong performers on the first day leaves limited subsequent opportunities.

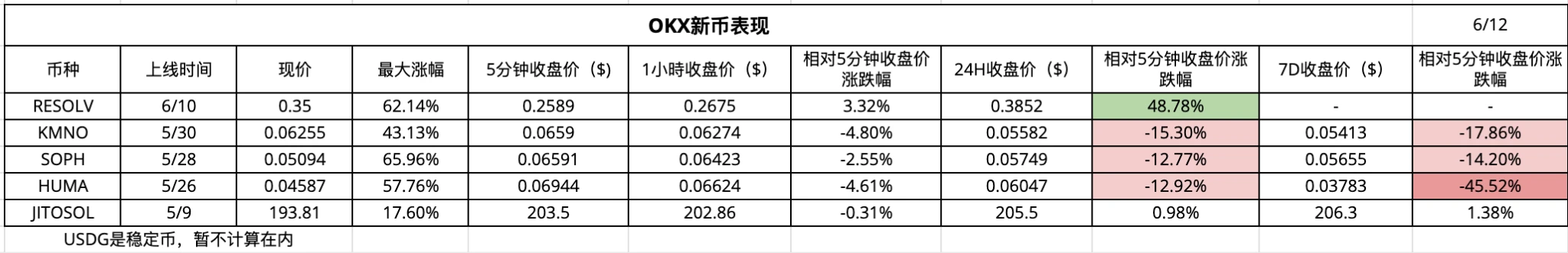

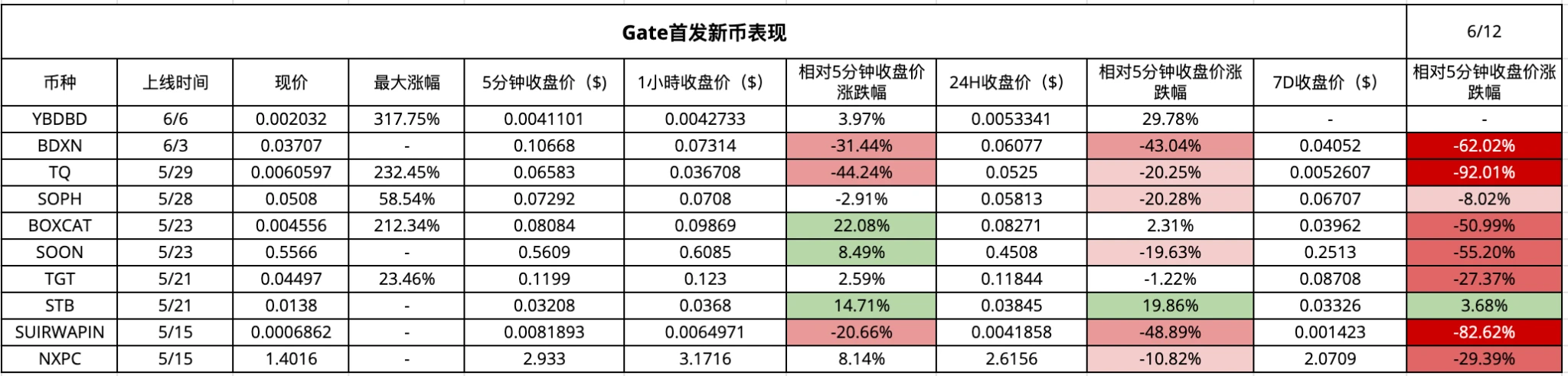

Gate: High Listing Frequency, Broader Depth of Declines

Gate has surged to a new high of 69 new listings in the past two months, but the samples show that its "aftereffects" are also prominent: TQ and SUIRWAPIN saw their prices halved over 7 days relative to the 5-minute closing price, with declines of 92% and 82%, respectively; BDXN and BOXCAT also fell over 50%, with only STB recording a slight positive return (+3.7%). Although there are occasional short-term "bonuses" like YBDBD (+29.8%) in the 24-hour dimension, the vast majority of coin prices quickly lost key support after surging on the first day. Gate's market-making depth is relatively weak, with price fluctuations often amplified by single-point capital—high-frequency listings bring dramatic short-term surges but also magnify the waterfall risk in the liquidity vacuum the next day.

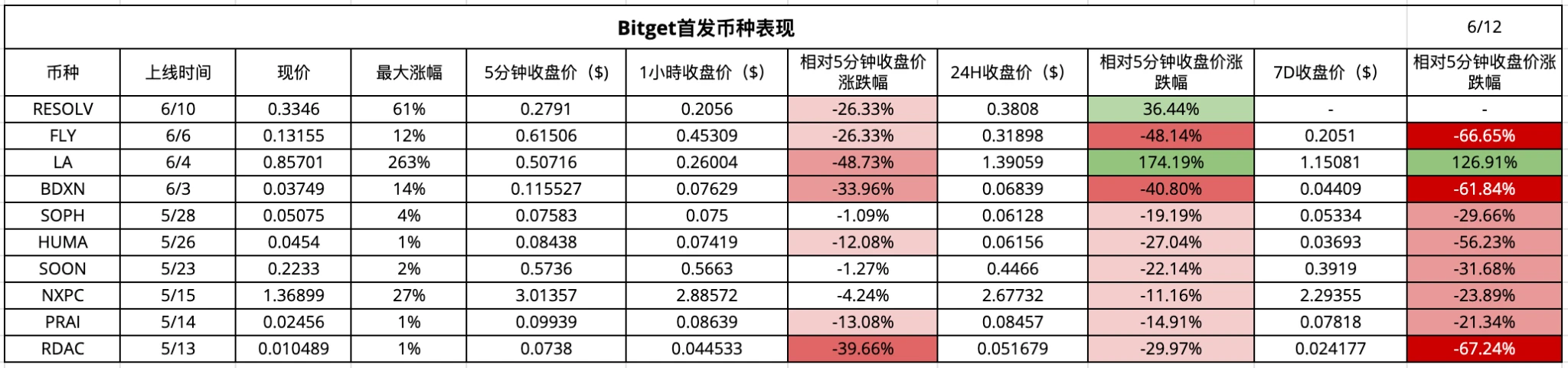

Bitget: "Ice and Fire" Under the Derivative Lens

Overall, Bitget's 36 new coins from May to June show a distinctly right-skewed return distribution: only LA maintained an approximate 1.3 times increase within the 7-day range, barely making it into the "doubling club"; a few others (about 15% of the total sample) recorded small increases of 0%-30%; about a quarter of the tokens experienced declines in the range of -10% to -30%, showing moderate performance; while over half of the projects faced deep retracements of -30% to -70% in the first week, including typical cases like FLY, BDXN, and RDAC. Overall estimates suggest that the average 7-day decline for new coins on Bitget is about -28%, with a median decline of about -31%, and the probability of a "green day" in seven days is less than a quarter. This means that the overall profit effect on the platform is concentrated in a very small number of popular tokens, while the vast majority of new coins quickly sink under the dual pressure of contract shorts and plummeting liquidity, completing an "elimination round" in the first week.

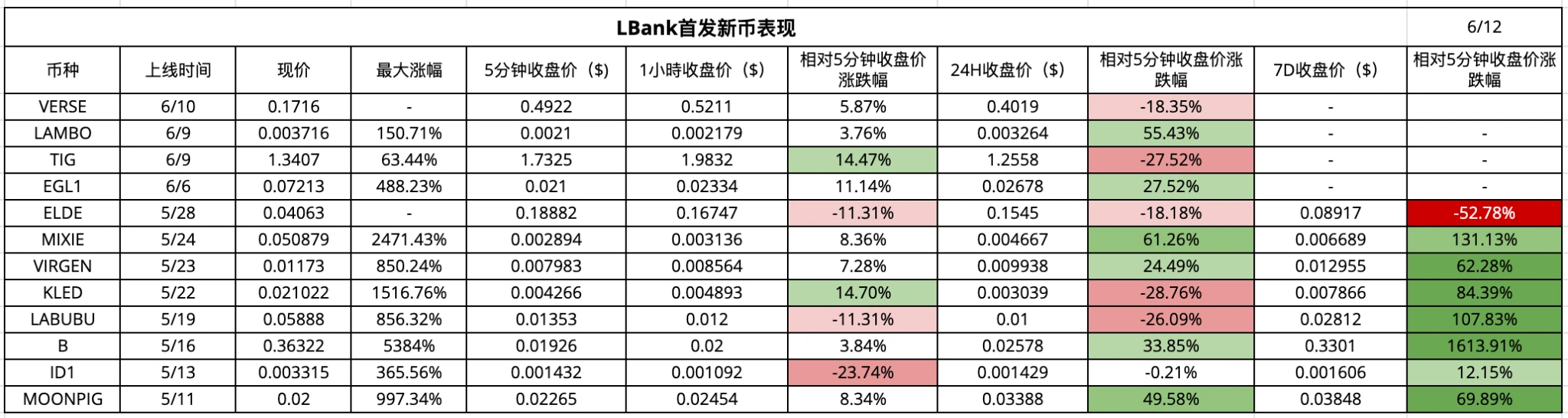

LBank: Extreme Differentiation with High Multipliers and Deep Retracements Coexisting

LBank leads the industry with 141 new listings, and within the sample, rapid surges can be seen with LAMBO (+55.4%) and MIXIE (+61.3%) within 24 hours; however, after cooling down, most tokens show a "dumbbell" distribution over 7 days—on one end are multiple high-flying tokens like B (+1,613.9%), LABUBU (+107.8%), and KLED (+84.4%), while on the other end are deep retracements like ELDE (-52.8%). Calculating the average 7-day arithmetic decline yields about -24%, with a median decline close to -27%, and the "doubling rate" is only 3%. In other words, the relaxed listing gates indeed increase the probability of hitting extreme dark horses, but they also lead to most tokens quickly falling silent: without agile profit-taking strategies, investors are more likely to be continuously eroded by negative returns among the vast choices, with only a few lucky positions able to realize the myth of hundredfold returns.

Cross-Platform Comparison

The four platforms exhibit distinctly different risk-return curves: Bybit's "flash market" demands extreme entry and exit speed; OKX sacrifices overall gains for smaller fluctuations through project screening; Gate amplifies retracement depth in high-frequency listings; LBank, with its quantity advantage, produces dark horses but also comes with a higher risk of hitting landmines. Investors need to match their trading cycles and risk tolerance when choosing a platform: those pursuing short-term arbitrage can focus on the high-volatility windows of Bybit and Gate; those preferring stability can wait for the low Beta new coins from OKX; and if willing to "pan for gold" in a vast sea, LBank's large pool remains the top choice for improving hit rates, provided that proper position and risk control are in place.

Short, Medium, and Long-Term Performance After New Coin Listings

The listing of new coins is often accompanied by significant volatility, with substantial differences in returns depending on the holding period. Based on recent data, we selected three representative new coins—B (BUILDon), LABUBU, and LAUNCHCOIN—to analyze their price trajectories after listing, comparing the advantages and disadvantages of short-term trading versus medium- to long-term holding.

- B (BUILDon) – "Long-term Winner": This coin was launched on LBank on May 16. The opening price (5-minute closing price) was approximately $0.019. Within the first hour, the price slightly increased to $0.020 (+~4%), and after 24 hours, it rose to $0.0257 (about +34% from the opening price). More remarkably, B continued to rise: one week after listing, it climbed to about $0.330 (17 times the opening price), and as of now, it is approximately $0.363, nearly 18 times the opening price. In other words, while short-term trading also yielded profits, those who truly reaped the "big gains" were the medium- to long-term holders. It is worth noting that the peak intraday price of B once reached 53 times the opening price, indicating that early participants could achieve astonishing daily returns if they successfully sold at high levels. However, such extreme instantaneous surges are difficult for most to grasp; instead, the strategy of patiently holding for several weeks allowed investors to benefit from the subsequent continuous rise.

- LABUBU – "New Highs After the Roller Coaster": LABUBU was launched on May 19 (simultaneously listed on LBank and several other exchanges). The opening price was about $0.0135. Like most new coins, LABUBU experienced a surge and subsequent drop immediately after listing: data shows that its intraday peak increase reached 8.56 times (possibly occurring at the moment of opening), but it quickly retraced most of the gains, with the 5-minute closing price falling back to around $0.0135. It continued to decline to about $0.012 (down approximately 11% from the opening price) within the next hour, and closed around $0.0100 after 24 hours (a drop of about 26% from the opening price). This indicates that investors who chased the price on the first day mostly faced unrealized losses. However, LABUBU rebounded in the following days: one week after listing, the price rose to $0.0281, more than doubling the opening price. Entering June, LABUBU maintained its strength, currently around $0.0589, an increase of about 3.4 times from the opening price. This trend shows that while short-term trading (selling on the first day) can avoid intraday retracement risks, it also misses the opportunity for several-fold increases afterward; medium- to long-term holders, having endured the initial volatility, actually achieved higher returns. Of course, this pattern of initial suppression followed by a rise is not universal, but LABUBU's case reveals a possible path of "initial deep losses, followed by recovery and doubling."

- LAUNCHCOIN – "The Miracle of Instant Hundredfold": As one of the most notable new meme tokens in May, LAUNCHCOIN was launched on April 29 (first listed on LBank, MEXC, etc.) and experienced a rocket-like surge. Official data shows that LAUNCHCOIN achieved a cumulative increase of 15,194% (approximately 152 times) within the first month, becoming the champion of the May increase rankings. This means that if the opening price was around $0.001, it surged to about $0.15 within just a few days. In actual trading, the coin skyrocketed on its first day, and although there was some pullback afterward, it maintained a price significantly above the opening level. As of mid-June, LAUNCHCOIN is still fluctuating around $0.20, maintaining an increase of over a hundred times from the launch price. For such extreme cases, short-term traders who took profits early during the initial surge could achieve hundredfold returns; while long-term holders, even if they missed selling at the peak, still hold substantial unrealized gains. However, it is important to emphasize that such "hundredfold coins" are extremely rare; LAUNCHCOIN's success largely depended on the market's enthusiasm for meme themes. In most new coins, the norm is to see prices decline after an initial surge on the first day. For example, BDXN, which was listed on Bybit during the same period, saw its price halve to nearly -50% within less than an hour after opening; it continued to decline, and after 7 days, it was left with only about 30% of the opening price, currently dropping to less than 27%. In contrast, only a few projects like AO steadily increased after listing, rising over 20% from the opening price within a week, currently maintaining an increase of about 27%. This indicates that in new coin investments, "winners are few, losers are many," and the choice of investment cycle is crucial.

From the above three examples and other new coin data, we can see that the holding period significantly impacts returns:

Short-term (T+0 ~ 1 day): Many new coins experience extreme volatility in the first few hours after listing, presenting opportunities for instant multiples but also accompanying deep retracement risks. The advantage of quick arbitrage lies in the ability to lock in profits from surges or cut losses promptly, avoiding overnight uncertainties. For coins like LAUNCHCOIN, only short-term participants can capture nearly hundredfold intraday increases. However, short-term operations require precise timing; a slight misstep in chasing high prices may lead to losses, as seen with LABUBU, where those who chased the price on the first day faced over 20% unrealized losses.

Medium-term (a few days to 1 week): After the baptism of the first day, many new coins may experience trend reversals or continued declines. Medium-term holding can avoid intraday noise and allow for value recovery over a larger time scale. Some new coins find their low points a few days after listing, followed by rebounds (like LABUBU significantly recovering in days 5-7); however, many new coins continue to decline for a week once the hype fades, leading to even greater losses for holders (like BDXN, which lost over 70% after a week). Therefore, the effectiveness of medium-term strategies varies by coin, testing investors' judgment on the project's potential.

Long-term (several weeks and beyond): For a very few high-growth projects, long-term holding can yield cumulative returns far beyond expectations. Coins like B and LAUNCHCOIN can yield dozens of times returns over several weeks. However, most new coins struggle to maintain their hype for months, and in the long run, they may gradually approach zero or fall silent. Therefore, holding newly listed tokens long-term is essentially betting on whether they can emerge as "dark horses." Few will succeed, but those that do can offer astonishing returns.

Overall, the typical trajectory of new coins after listing is a short-term surge followed by a gradual return to rationality. The vast majority of tokens decline shortly after reaching their peak on the first day, with many never returning to their opening prices. This means that short-term arbitrage strategies often lock in unique gains during the early listing phase, avoiding losses from subsequent deep retracements; while long-term holding only reflects value in a few projects with fundamental support or ongoing topicality, for many new coins, it may mean continuously shrinking assets. Because of this, for new coin investors, the choice between "quick in and out" or "long-term holding" remains a dilemma.

Differences in Cross-Platform Trading Performance of Focused New Coins

Different trading platforms often show starkly different prices and trading data for the same new coin, including both spot market performance and contract trading dynamics. Taking B, LABUBU, and LAUNCHCOIN as recent hot assets, we compare their performance in spot and perpetual contract trading across multiple exchanges (such as LBank, Gate, Bitget, etc.) to explore platform differences and the possible reasons behind them.

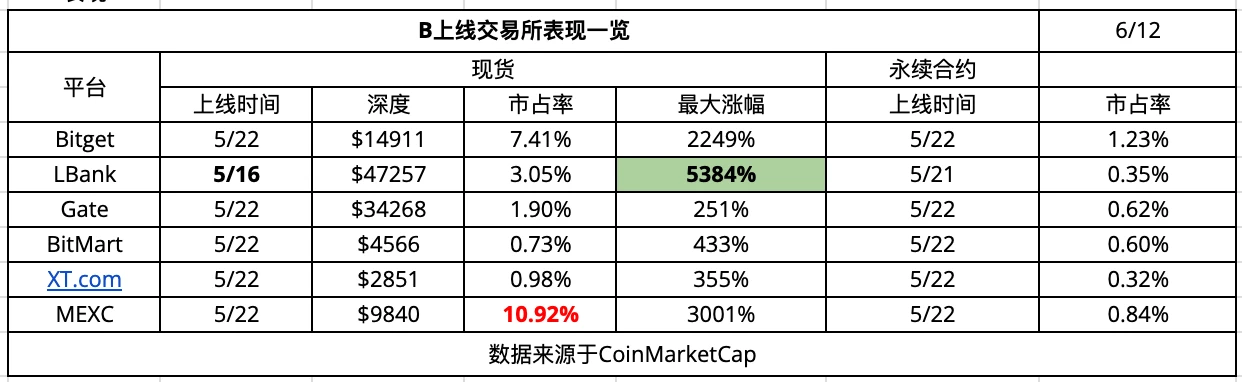

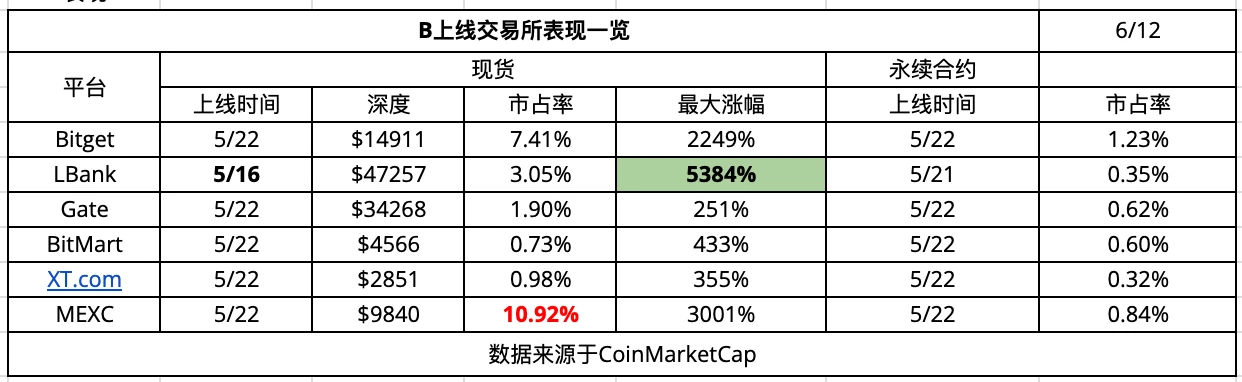

B (BUILDon) Cross-Platform Performance: B coin was first launched globally on LBank on May 16, followed by listings on several exchanges such as Gate, Bitget, and MEXC within the following week. On the day of its debut on LBank, B coin experienced an astonishing instantaneous surge—its maximum increase reached 53.8 times (corresponding to the intraday peak on LBank). Due to LBank's early listing, which attracted a large influx of speculative funds, the trading activity and volatility of B coin on this platform were significantly higher than those on later platforms. The order book depth on LBank reached approximately $47,257 at the time of B coin's launch, significantly higher than other platforms that launched around the same time (for example, Gate at about $34,268 and Bitget at about $14,911). Deeper liquidity means that LBank provided relatively more support during the explosive surge, which may have prevented B coin from experiencing an extreme one-sided market despite its rapid rise. In contrast, platforms like Gate, which listed B coin on May 22, faced a market that had already been ignited, resulting in a relatively rational price: on its first day, B coin on Gate only rose to about 2.5 times the opening price. This indicates that the timing of the listing directly affects the price performance across platforms—the earlier a platform lists, the greater the increase it can enjoy, while later listings often face a market where prices have already been discovered.

In terms of contract trading, the performance across different platforms also varied. Bitget launched B coin's perpetual contracts on May 22 and quickly attracted a high level of leveraged trading interest, with its B coin contract trading volume and open interest leading all platforms. Data shows that Bitget captured about 1.23% of the total contract market share for B coin, slightly higher than Gate's approximately 0.62%, while LBank's contract share was only about 0.35%. This unusual phenomenon (where the initial platform LBank has a lower contract share) may stem from: on one hand, LBank users had higher participation in spot trading, opting to profit directly from spot trades; on the other hand, users on platforms like Bitget were more inclined to use leveraged tools to speculate on price fluctuations, thus gaining a greater advantage in the contract market. Additionally, it is possible that LBank's B coin contracts were launched slightly later (on May 21) and had different leverage mechanisms, leading some high-risk preference traders to switch to other platforms. Overall, the cross-platform differences for B coin reflect that LBank led the market during the spot phase and provided deep liquidity, while Bitget and others later caught up in the derivatives market, attracting speculative funds.

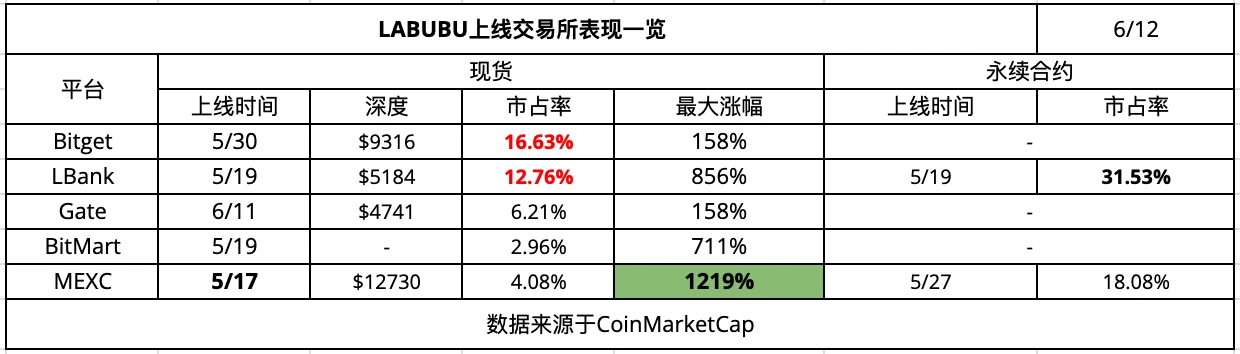

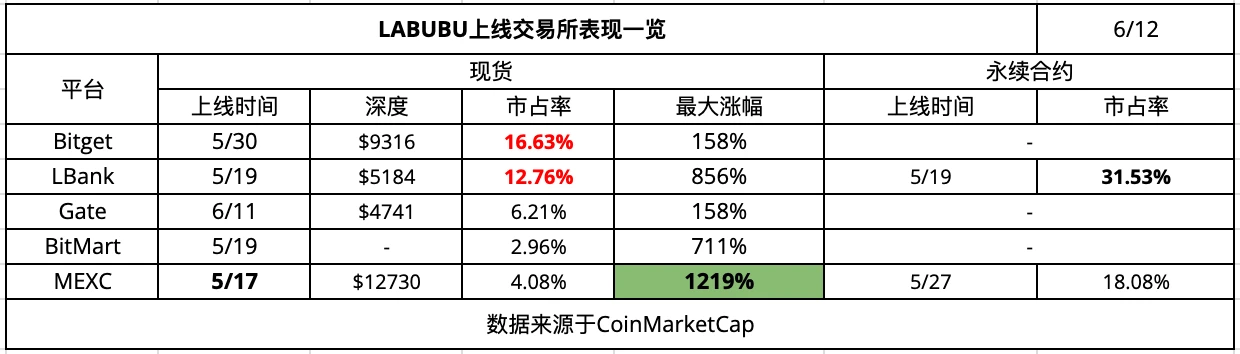

LABUBU Cross-Platform Performance: LABUBU was launched almost simultaneously on multiple exchanges in mid to late May, but trading conditions varied significantly across platforms. MEXC was the first to launch LABUBU on May 17, being one of the earliest platforms, which led to a maximum first-day increase of 12.19 times. Two days later, on May 19, LBank and BitMart also launched the coin simultaneously: LBank, with its experienced user base and liquidity support, saw LABUBU rise to about 8.56 times the opening price on its first day; while BitMart, due to its smaller size and limited depth, actually triggered a higher increase of 11.11 times—this suggests that on platforms with weak liquidity, small funds can also drive significant price fluctuations. It wasn't until May 30 that Bitget finally launched LABUBU, by which time market enthusiasm had waned, and the coin's peak increase on Bitget was only about 1.58 times, with the market being quite subdued. Similarly, Gate, which launched on June 11, also only saw a slight fluctuation of about 1.58 times. The timing difference in launching once again played a crucial role: the later the entry, the smaller the increase.

In terms of spot trading, the contribution of each platform to LABUBU varied. By mid-June, Bitget (approximately 16.63%) and LBank (12.76%) had the highest market share in trading volume, followed by MEXC (4.08%). Although Bitget launched later, it achieved considerable trading volume in a short time, even surpassing the earlier LBank. This may be because Bitget users concentrated their trading activity when the coin officially launched, boosting its market share. On the other hand, some of LBank's user enthusiasm for LABUBU shifted to the contract market. LBank was one of the first platforms to offer LABUBU perpetual contracts (launching contracts on May 19), resulting in its LABUBU contract trading volume accounting for 31.53% of the total market, far exceeding other platforms. This indicates that a large number of speculators chose to open leveraged positions on LBank, whether to go long for greater profits or to short to hedge against spot risks, allowing LBank to dominate in the derivatives space for this coin. In contrast, until the LABUBU hype faded, platforms like Gate and BitMart did not offer contract trading. It can be inferred that LBank's simultaneous launch of spot and contract trading provided traders with a richer strategy selection, helping it attract high-frequency trading and hedging demand, thereby solidifying its dominant position in trading this coin.

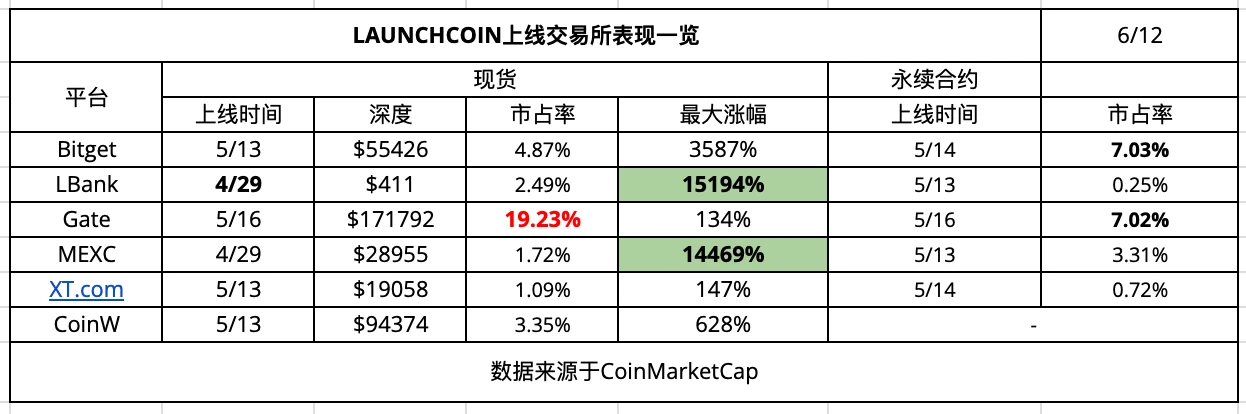

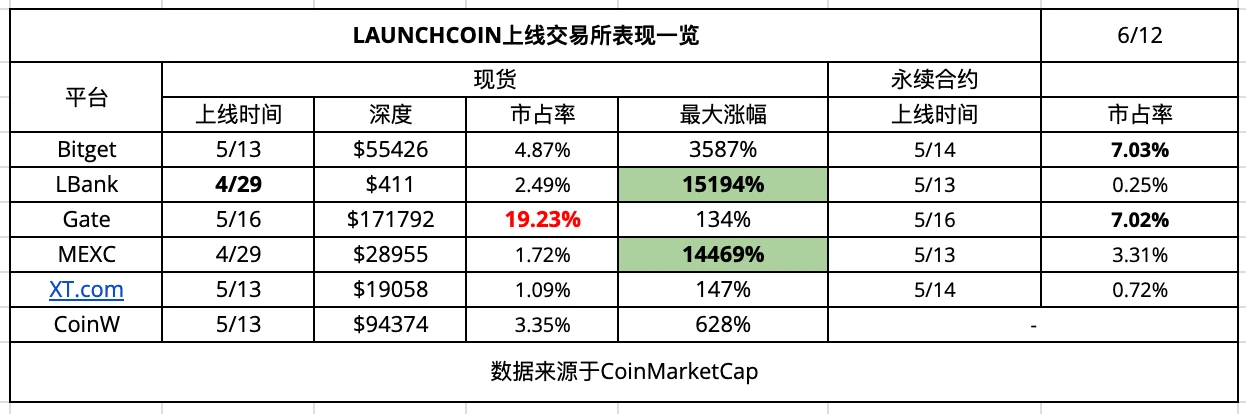

LAUNCHCOIN Cross-Platform Performance: The cross-platform trading of LAUNCHCOIN exhibited an extreme contrast of "early entrants thriving, later entrants subdued." As a star in the meme craze, LAUNCHCOIN was first launched on April 29 on platforms like LBank and MEXC, igniting the hundredfold myth (with a maximum increase of about 151.94 times on LBank; MEXC also reached as high as 144.69 times). Early-launch platforms captured the initial market enthusiasm, causing prices to soar. However, this trend was not universally replicated on later exchanges: when Bitget joined the trading on May 13, LAUNCHCOIN's maximum increase was about 35.9 times—though not as exaggerated as the initial platforms, it was still a significant increase compared to most new coins. By May 16, Gate began trading the coin. Thanks to the price discovery that had already occurred on various platforms, LAUNCHCOIN opened at a relatively reasonable price on Gate, with the first day's maximum increase only rising by 34% (1.34 times) before stabilizing, showing almost no speculative frenzy. This difference is also related to the user composition and risk control of each platform: LBank and MEXC users are known for chasing hot trends, willing to buy at high prices to drive the market; while Gate's user base and market makers tend to provide deep liquidity (with Gate's order book depth reaching $171,792 at launch, the highest among all platforms), suppressing the possibility of explosive surges.

In terms of perpetual contracts, the timing of their launch also influenced the trading landscape for LAUNCHCOIN. LBank and Bitget opened contract trading the day after the coin's launch (around May 14), and Gate also launched contracts on the same day. This means that from the mid-term stage onward, most mainstream platforms provided short-selling mechanisms. As rational traders utilized contracts for hedging, LAUNCHCOIN's price did not exhibit the outrageous surges seen in the early days. Data indicates that Gate and Bitget captured relatively high shares in the LAUNCHCOIN contract market (each around 7%), reflecting the participation of their professional trading users; while LBank, having attracted most speculative funds during the spot phase, saw its contract market share divided among later entrants, accounting for only about 0.25%. This may reflect differences in user preferences across platforms: LBank users are more inclined to speculate on spot surges, while Gate/Bitget users are more actively utilizing contract tools for trading. Additionally, since top platforms (like Binance and OKX) have not yet listed these coins, each exchange essentially digests market sentiment within its own ecosystem, creating a misalignment: some focus on "early speculation," while others concentrate on "later stages." Overall, the experience of LAUNCHCOIN across platforms illustrates that the more mature and stable the platform, the later it enters, and the smaller the initial volatility; conversely, emerging platforms that dare to be the first to launch experience significant volatility and trading volume. Such differences reflect the varying strategies of exchanges: some focus on capturing market enthusiasm by launching numerous new coins to attract trading volume; others prioritize project quality and risk control, preferring to be selective. This strategic difference directly impacts the number of new coin opportunities available to users on each platform. For example, LBank users have had far more than a hundred "tasting" opportunities in the past two months, while users on OKX have only seen a handful of new projects. This also lays the groundwork for subsequent analysis—differences in the new coin effect across platforms, in terms of quantity and timing, may lead to variations in price performance and investment strategies.

In this wave of new coins, some platforms have achieved impressive results through aggressive listing strategies. According to official data, LBank led globally in new coin performance in May: the average first-day increase of new tokens listed on LBank was about 90% higher than that of other exchanges. Meanwhile, a report from CoinGecko also showed that LBank ranked first in the number of hundredfold coins. This indicates that an active listing strategy has provided high returns for platform users and attracted the attention of high-risk, high-return investors.

In summary, the cases of B, LABUBU, and LAUNCHCOIN reflect significant differences in new coin performance across trading platforms. Factors influencing these differences include:

Timing of the listing: Initial platforms often enjoy the highest increases and trading enthusiasm, while subsequent platforms face more moderate price trends due to increased information transparency.

User composition: Platforms that attract speculative emerging market users are more likely to experience extreme market conditions; while platforms with a higher proportion of institutional and rational traders tend to have more stable prices.

Liquidity depth: Greater order depth helps buffer price fluctuations (for example, Gate's depth when launching LAUNCHCOIN far exceeded that of early platforms, thus limiting the increase).

Derivative supply: The earlier contracts are launched, the more they can provide hedging mechanisms for the market, thus suppressing bubble components (for instance, LBank/MEXC did not timely launch LAUNCHCOIN contracts, leading to an initial surge in spot prices; Gate's simultaneous launch of contracts resulted in more rational pricing).

Project visibility: As time passes, project visibility increases, leading to more rational buying and selling on new platforms, making blind speculation less likely.

For investors, this means that participating in new coin trading on different exchanges will expose them to different market ecosystems and risk-return characteristics. Choosing an initial platform means facing the greatest opportunities but also the highest risks, while waiting to trade on larger platforms may miss out on windfall profits but offers more controlled volatility.

Conclusion and Strategy Recommendations

Through the above analysis, it is evident that the "new coin effect" harbors both the myth of sudden wealth and significant risks. In the current market sentiment, whether investors should choose quick speculative arbitrage or long-term holding while enduring volatility depends on their own risk preferences and confidence in the projects.

Short-Term Strategy (T+0 Quick In and Out): From the data, short-term trading can more effectively capture the unique benefits of new coin launches. For example, the average first-day increase of new coins on platforms like LBank far exceeds the industry average, with many tokens achieving several times or even dozens of times their value within hours. However, it is important to note that fleeting market conditions require traders to have excellent execution skills: including monitoring the market, quick entry and exit, and strict profit-taking and stop-loss discipline. If a misjudgment leads to being trapped, short-term positions should also be decisively cut to prevent small mistakes from turning into large losses. In the current market environment (where hot trends rise and fall but sustainability is questionable), this nimble approach can avoid prolonged exposure of funds to high-volatility assets, reducing the risk of black swan events. Especially for investors unfamiliar with the fundamentals of a project, taking profits when available may be a wise move. As the saying goes, "No matter how much it rises, if you don't sell, you don't earn." The core of the short-term strategy lies in timely realization of profits.

Long-Term Strategy (HODL Long-Term Holding): In contrast, holding newly listed tokens for the long term is a high-risk, high-reward gamble. A few projects with real substance or those riding the wave (like the aforementioned LAUNCHCOIN and B) will continue to rise after listing, and long-term holders will achieve cumulative returns far exceeding those from short-term trading. Additionally, long-term holding avoids the transaction costs of frequent trading and the pressure of constant market monitoring. However, it must be emphasized that most new coins will not continuously rise to new highs but will slowly decline or even go to zero after the initial excitement fades. Therefore, adopting a HODL strategy for new coins should involve careful selection of targets, ideally based on fundamental analysis or mid-to-long-term thematic logic (such as project technological innovation, community consensus, etc.) to choose a few trustworthy coins. At the same time, one must be mentally prepared to endure significant drawdowns. In the current volatile market sentiment, unless one has a deep understanding and confidence in the project, blindly holding new coins for the long term may not be the most cost-effective choice.

Balanced View: For most investors, a combination strategy may be adopted: dividing new coin investments into "two layers of positions"—one part for short-term speculation, quickly locking in profits from the initial listing phase; the other part (a small proportion) reserved for holding a base position to capture the potential for future growth of the project. This approach allows for the possibility of long-term high returns while ensuring that the principal is not lost. Additionally, making reasonable use of tools provided by the platform is also part of the strategy. For example, the rich and liquid characteristics of new coins on platforms like LBank provide investors with the opportunity to diversify their investments across multiple projects to increase the chances of hitting a "dark horse," while also being able to hedge some risks through the concurrently launched contract market (for instance, using perpetual contracts to short hedge spot positions after a surge). This combination of diversification and hedging can help balance returns and risk management to some extent.

Conclusion: The recent wave of new coins reminds us once again that high returns are always accompanied by high risks. Whether engaging in intraday arbitrage or long-term positioning, it is essential to have a clear understanding of one's trading abilities and risk tolerance. In the face of the enticing "launch effect," rational investors should maintain a calm, data-driven analysis, choosing the appropriate platform and timing to enter the market. For those skilled in short-term operations, platforms like LBank, which offer a rich variety of coins and active trading, provide a stage to showcase their skills; while for those who believe in value investing, it is advisable to select new projects with long-term value to hold patiently, while being alert to shifts in market sentiment. In summary, in the current market atmosphere, leaning towards short-term speculation to secure certain returns is a relatively prudent strategy, but maintaining a long-term expectation for quality projects is also worthwhile—the key is to find one's own balance between speculation and steadfastness.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。