Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhangweb3)_

RWA Market Performance

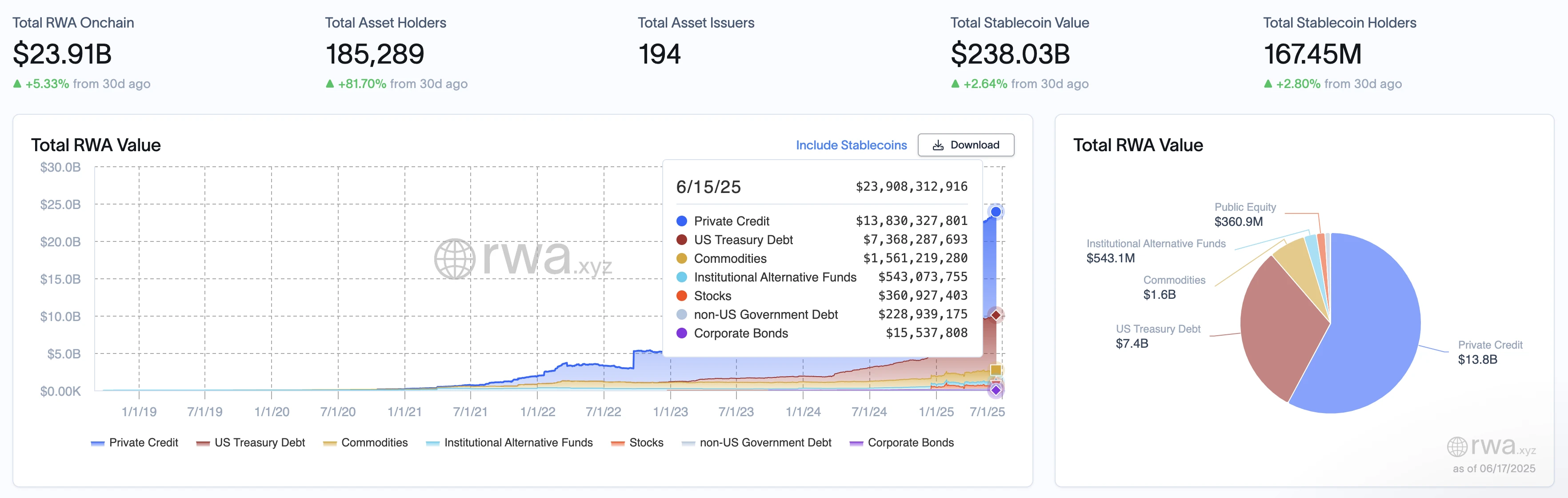

According to the latest data from RWA.xyz, as of June 17, 2025, the total on-chain value of RWA is $23.91 billion, an increase of 3.34% from $23.14 billion on June 10, marking a return to a growth trajectory. The number of on-chain asset holders increased from 167,437 to 185,289, a growth rate of 10.65%, continuing last week's upward trend. The number of asset issuances remained unchanged at 194. The total value of stablecoins increased from $237.49 billion to $238.03 billion, a growth of 0.23%; the number of stablecoin holders also rose from 166.63 million to 167.45 million, an increase of 0.49%.

In terms of asset structure, the total value of private credit increased from $13.3 billion last week to $13.8 billion, showing a significant rebound and reaffirming its dominant position among on-chain assets. U.S. Treasury bonds also grew to $7.37 billion, steadily increasing, indicating a continued demand for safe-haven assets.

Commodity assets slightly increased to $1.6 billion this week, though the growth was small, it marks consecutive growth; institutional alternative funds also rose from $529.7 million to $543.1 million, maintaining a stable upward trend. Equity assets saw a slight increase to $360.9 million, continuing the upward trend for two weeks, reflecting the platform's enhanced transparency and visibility, and also indicating that market acceptance of such assets is on the rise.

Trends (Compared to Last Week)

Market capitalization rebounded, and on-chain activity reached a new high: Following stability last week, RWA's market capitalization strongly rebounded to a historical high, with the total number of asset holders approaching 190,000, and user growth momentum is still being released; private credit assets returned to the growth mainline, with market capitalization rebounding to $13.8 billion: after a slight adjustment last week, it rebounded again, indicating that market funds still have enthusiasm for high-yield assets, which is an absolute pillar of the current on-chain structure; U.S. Treasury assets grew steadily, continuing to exist as a core stable allocation: increasing from $7 billion to $7.37 billion, indicating that its "ballast" role is still highly recognized, suitable for the risk defense needs in the current economic environment; commodity and alternative assets have seen consecutive weeks of growth, becoming a stable source of incremental base. Investors still have a continuous allocation willingness for low-volatility assets, which helps balance the risk exposure in the overall asset structure; equity assets continue to rise, and the on-chain securitization path is gradually gaining market acceptance. Although the total amount is still small, three consecutive weeks of growth indicate that its future potential deserves continued attention.

Overall, in mid-June 2025, the RWA on-chain asset market exhibits characteristics of "capital inflow, structural stability, and steady growth." On one hand, total market capitalization and user activity are rising simultaneously; on the other hand, the asset distribution pattern remains balanced, with no significant imbalances or one-sided tilts. It is also recommended that investors continue to base their allocation logic on a "high yield + low volatility" dual-wheel strategy: continue to increase allocations in U.S. Treasury bonds, commodities, alternative funds, etc., while moderately participating in private credit opportunities according to market risk preferences; for equity assets, maintain a medium to long-term observation perspective to capture the potential dividends brought by the expansion and structural upgrade of on-chain securities assets.

Key Events Review

The U.S. Senate will hold a final vote on the GENIUS Act on June 17, Eastern Time

According to reporters Eleanor Terrett and Senate Cloakroom, the U.S. Senate will hold a final vote on the GENIUS Act (S.1582) at 4:30 AM Beijing time on June 18 (4:30 PM Eastern Time on June 17). The bill has completed the amendment process and, if passed, will be sent to the House of Representatives for review. This is the last round of voting for the bill in the Senate.

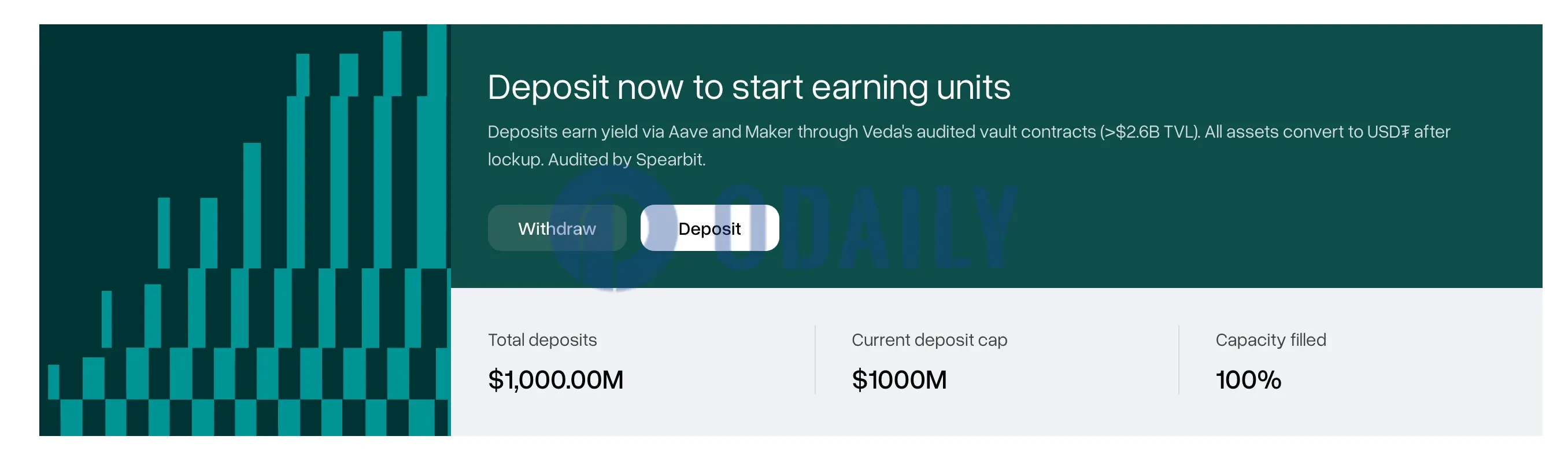

Plasma's public offering of $500 million sold out in minutes

Plasma announced on the X platform that its deposit function is now online, and the project's public token sale completed the $500 million subscription in just a few minutes. Subsequently, Plasma's official account announced that an additional $500 million public deposit limit was filled in about half an hour on June 12 at 9:00 AM.

Payment giant Stripe acquires crypto wallet provider Privy

Payment giant Stripe has agreed to acquire crypto wallet provider Privy, with the specific transaction amount undisclosed. This is Stripe's significant move following its acquisition of stablecoin infrastructure company Bridge.

Bank of America CEO: Willing to launch a stablecoin with partners

Bank of America CEO Brian Moynihan stated that he is willing to launch their own stablecoin with partners, as the trading volume of stablecoins is mainly concentrated in transactions between cryptocurrencies.

As early as the end of February this year, Bank of America CEO Brian Moynihan had stated, "We have no choice but to enter the stablecoin market." Despite its previously conservative stance on crypto assets, its position has significantly shifted in the face of regulatory pressure and competition from peers. Previously, Bank of America explored issuing stablecoins in collaboration with financial giants like JPMorgan, although it did not ultimately materialize, it shows its strong interest in blockchain infrastructure.

Ant Group to apply for stablecoin licenses in Hong Kong and Singapore

According to informed sources, Ant Group's international business unit, Ant International, plans to apply for a fiat-pegged stablecoin issuer license in Hong Kong after the "Stablecoin Regulation" takes effect this August, and is simultaneously preparing applications for related licenses in Singapore and Luxembourg. An Ant International spokesperson has confirmed the plans for Hong Kong.

This move aims to strengthen its blockchain-based "Whale" platform's role in cross-border payment and fund management businesses. The Whale platform processed over $1 trillion in global transactions last year, accounting for one-third of Ant Group's total cross-border processing volume, supporting tokenized assets issued by various banking institutions, and employing privacy computing technologies such as homomorphic encryption for multi-party verification.

Currently, Ant International has established partnerships with over 10 global banks, including HSBC, BNP Paribas, JPMorgan, and Standard Chartered, and recently announced a strategic cooperation with Deutsche Bank, focusing on on-chain fund flows and payment clearing. This unit generated nearly $3 billion in revenue in 2024, achieving adjusted profitability for two consecutive years and laying the foundation for future spin-offs and IPOs, with a valuation range potentially reaching $8 billion to $24 billion.

Hot Project Updates

Bedrock (BR)

One-sentence introduction:

Bedrock is a multi-asset liquidity re-staking protocol supported by a non-custodial solution designed in collaboration with RockX. Bedrock utilizes its universal standard to unlock the liquidity and maximum value of PoS tokens (such as ETH and IOTX), as well as existing liquid staking tokens (referred to as uniETH and uniIOTX).

Latest updates:

On June 14, Bedrock announced that BR staking rewards are now live on the @River4fun platform, offering yield opportunities of up to 5000% APR, but risks should be noted.

Additionally, Bedrock partnered with WLFI to launch a USD1/BR liquidity pool on PancakeSwap, providing users with the opportunity to earn farming rewards with stablecoin USD1 and BR.

Usual (USUAL)

One-sentence introduction:

Usual is a decentralized stablecoin protocol aimed at creating a fair, community-driven financial ecosystem through the tokenization of real-world assets (RWA). Its core goal is to transform the profit model of traditional stablecoins (such as USDT) from a centralized approach to a user-owned and governed model, redistributing value and control to the community through its stablecoin products USD0 and USD0++, as well as the governance token USUAL. The project combines the stability of physical assets with the composability of DeFi, dedicated to providing users with secure, transparent, and high-yield financial tools.

Recent Updates:

On June 12, Usual announced ETH0 (a synthetic asset supported 1:1 by Lido's wstETH) officially launched, with an initial minting cap of $1 million (500 ETH), offering over 10% native APY, and USUAL stakers enjoying 105% APY (with 60% paid in stablecoins), with earnings directly derived from protocol revenue. Fully liquid, with no lock-up period. The initial cap sold out in about 10 minutes.

On June 13, Usual announced that USD0 and USUAL are now supported on BNB Chain and Base through LayerZero's cross-chain protocol, and can be bridged via transporter. Support for USUAL on Arbitrum has also gone live on interport, with plans to expand to more chains through Stargate.

Recommended Articles

RWA Weekly Report: Summarizing the latest industry insights and market data.

As of June 6, the total market capitalization of the global RWA market has soared to $23.39 billion (excluding stablecoins), a significant increase of 48.9% from $15.7 billion at the beginning of the year. However, behind this impressive performance lies deep-seated issues such as high concentration of asset classes, limited liquidity, questionable transparency, and low correlation with the native crypto ecosystem, indicating that RWA still has a long way to go to become a truly "mainstream track."

《Comprehensive Interpretation of RWA Ecological Projects》

A comprehensive report written by DePINOne Labs, detailing the main categories and representative projects of the RWA ecosystem in 2025.

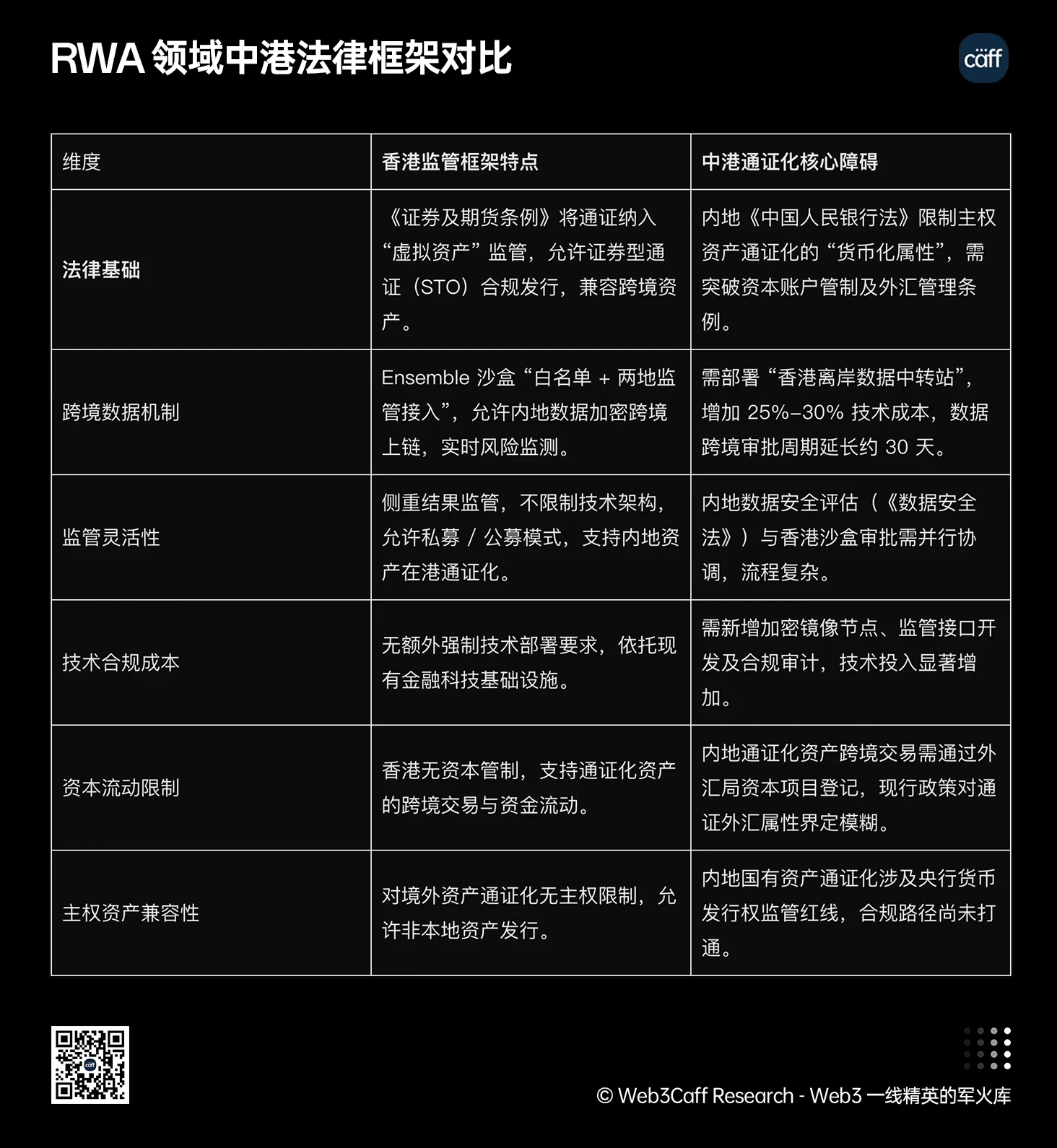

Written by a Web3Caff researcher, this report contains over 25,000 words, providing an in-depth analysis in conjunction with the most cutting-edge regulatory frameworks, while also focusing on the progress of future key directions such as standardized assets, physical asset RWA, and infrastructure service providers in the field of technological regulation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。