Table of Contents:

Large Token Unlock Data for This Week;

Overview of the Crypto Market, Quick Read on Weekly Popular Coins' Price Changes/Fund Flows;

Bitcoin Spot ETF Dynamics;

BTC Liquidation Map Data Interpretation;

Key Macroeconomic Events and Important Forecasts and Interpretations for the Crypto Market This Week.

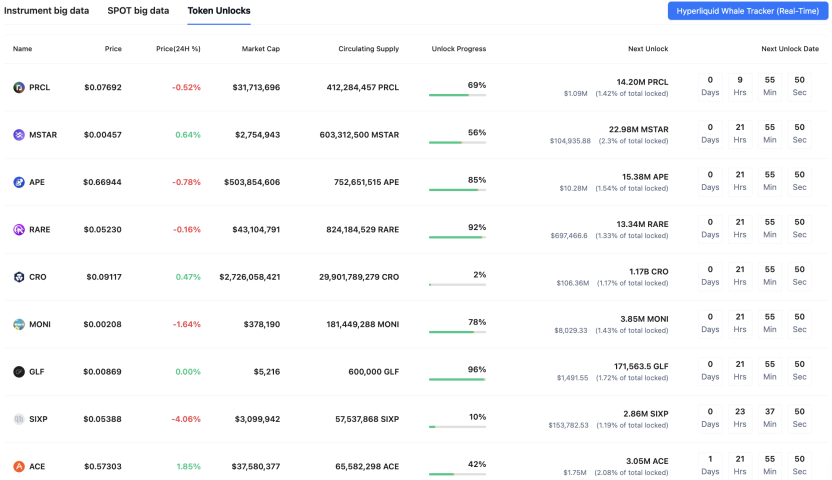

1. Large Token Unlock Data for This Week;

Coinank data shows that tokens such as ZK, ZKJ, and ARB will experience significant unlocks this week, including:

ZKsync (ZK) will unlock approximately 768 million tokens at 4 PM on June 17, accounting for 20.91% of the current circulating supply, valued at about $39 million;

Polyhedra Network (ZKJ) will unlock approximately 15.53 million tokens at 8 AM on June 19, accounting for 5.04% of the current circulating supply, valued at about $30.3 million;

Arbitrum (ARB) will unlock approximately 92.65 million tokens at 9 PM on June 16, accounting for 1.91% of the current circulating supply, valued at about $30.2 million;

Sonic (S) will unlock approximately 47.63 million tokens at 8 AM on June 18, accounting for 1.65% of the current circulating supply, valued at about $15.8 million;

SPACE ID (ID) will unlock approximately 72.65 million tokens at 8 AM on June 22, accounting for 16.88% of the current circulating supply, valued at about $12 million;

ApeCoin (APE) will unlock approximately 15.6 million tokens at 8:30 PM on June 17, accounting for 1.95% of the current circulating supply, valued at about $10.6 million;

Lista DAO (LISTA) will unlock approximately 33.44 million tokens at 5 PM on June 20, accounting for 19.36% of the current circulating supply, valued at about $7 million;

Melania Meme (MELANIA) will unlock approximately 26.25 million tokens at 8 AM on June 18, accounting for 6.58% of the current circulating supply, valued at about $6.9 million.

We believe that the concentrated unlock of multiple tokens this week may have some impact on the market, and it is essential to pay attention to the scale of the unlock and its circulation impact. The unlock ratio for ZK is 20.91% (approximately 768 million tokens), far exceeding the typical monthly unlock ratio for regular projects (usually below 1%), which may trigger short-term selling pressure. Similar high-ratio projects like LISTA (19.36%) and ID (16.88%) also face liquidity shock risks.

Additionally, market sentiment and historical references indicate that the valuation of ZK tokens dropped by 40% after their previous launch, and the number of active addresses halved, reflecting the market's sensitivity to tokens with high circulation. Although ARB has a lower unlock ratio (1.91%), historical data shows that significant unlocks are often accompanied by price volatility, necessitating caution regarding potential chain reactions.

Moreover, the macro environment adds to the risks, as current geopolitical conflicts in the Middle East are driving up gold prices, putting overall pressure on the crypto market. In this context, concentrated unlocks may amplify selling sentiment, especially for mid- and small-cap tokens like ZKJ (5.04%) and MELANIA (6.58%), which may experience increased price volatility due to insufficient liquidity.

Investors are advised to distinguish the nature of the unlocks (team/investor releases vs. ecological incentives), prioritize attention on projects with high circulation ratios, and monitor the movements of large holders using on-chain data. Historical evidence suggests that if there is a lack of ecological support after an unlock, the probability of a short-term pullback is relatively high.

2. Overview of the Crypto Market, Quick Read on Weekly Popular Coins' Price Changes/Fund Flows

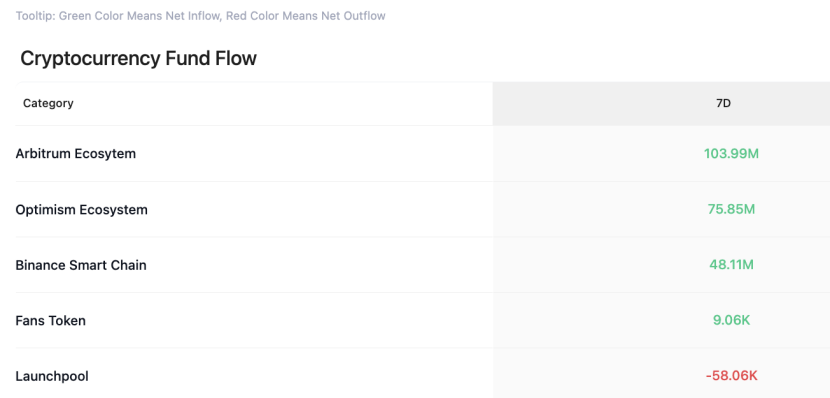

CoinAnk data shows that in the past week, the crypto market, categorized by concept sectors, only saw net inflows in the Arbitrum ecosystem, Optimism ecosystem, Binance Smart Chain, and fan tokens, while Launchpool experienced a small outflow.

In the past 7 days, the following tokens topped the price increase list (selected from the top 500 by market cap): ALT, AERO, SCRT, MNDE, and AB, which are relatively strong and should continue to be prioritized for trading opportunities this week.

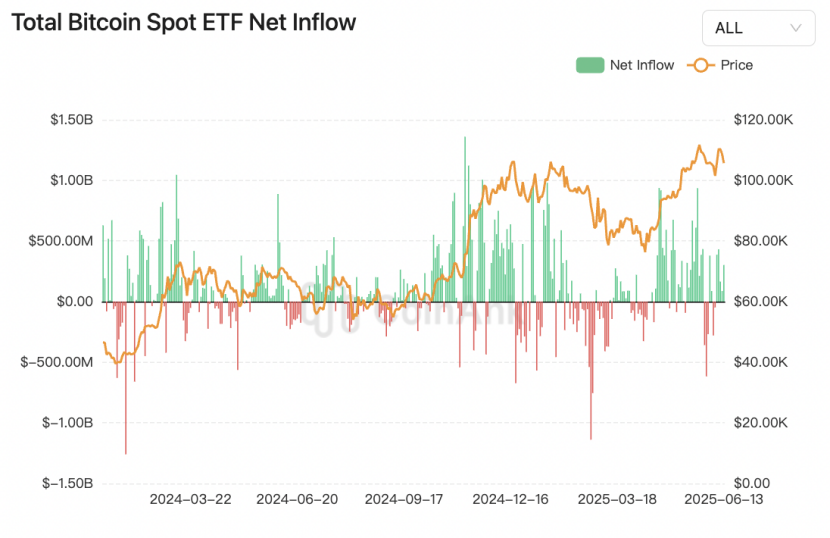

3. Bitcoin Spot ETF Fund Dynamics.

CoinAnk data shows that last week, the net inflow into Bitcoin spot ETFs in the U.S. was $1.37 billion, with BlackRock's IBIT contributing a net inflow of $1.1159 billion.

The total net asset value of Bitcoin spot ETFs is $130.263 billion, with the ETF net asset ratio (market cap compared to Bitcoin's total market cap) reaching 6.18%. The historical cumulative net inflow has reached $45.309 billion.

Last week, Ethereum spot ETFs saw a net inflow of $528 million, marking five consecutive weeks of net inflows, with none of the nine ETFs experiencing net outflows.

We believe that the Bitcoin ETF market is showing a strong recovery trend. The net inflow of $1.37 billion into Bitcoin spot ETFs last week significantly reversed the outflow trend seen in April (which had a single-week outflow of $713 million). BlackRock's IBIT continues to lead the market, contributing $1.116 billion in inflows, accounting for 81.5% of the total inflow for the week, highlighting institutional investors' concentrated preference for its products. The current total net value of Bitcoin ETFs continues to rise, reflecting a significant long-term capital accumulation effect.

Ethereum ETFs are demonstrating unexpectedly strong resilience. They have achieved five consecutive weeks of net inflows, with none of the nine products experiencing net outflows, contrasting sharply with the early days when the Ethereum ETF saw a net outflow of $113 million the day after its launch. The ongoing inflow trend validates Standard Chartered's predictive model, which suggests that Ethereum ETFs could attract $15-45 billion in capital, and the current performance may lay the groundwork for future capital expansion.

Changes in market structure are noteworthy. The net asset ratio of Bitcoin ETFs has surpassed 6%, an increase of 0.7 percentage points from 5.48% in November 2024, indicating that traditional financial channels are accelerating their penetration into the crypto market. BlackRock's historical cumulative inflow accounts for 50% of the entire market, and its dominant position may strengthen the institutional characteristics of Bitcoin's pricing power. The sustained inflow into Ethereum ETFs indicates a growing demand from investors for non-Bitcoin asset allocation, which may drive the diversification of the crypto market.

ETF fund flows confirm that institutional investors are systematically increasing their allocation to crypto assets, with traditional asset management giants like BlackRock becoming core channels. The robust performance of Ethereum ETFs is expected to reshape their market positioning. However, caution is warranted regarding the ongoing outflow risks from established products like Grayscale and the potential disruptions to fund flows from macro policy changes.

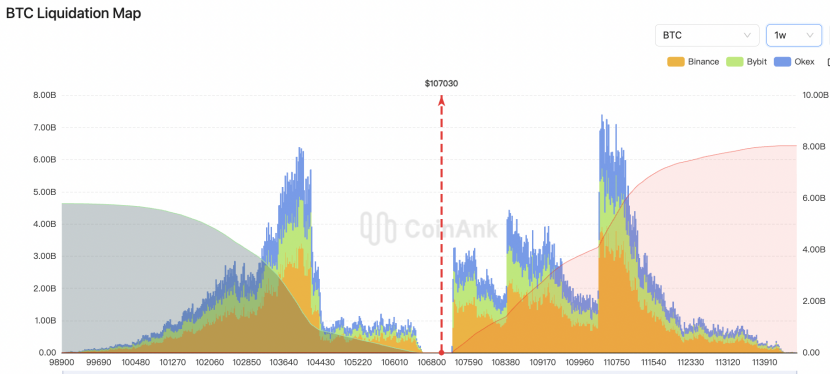

4. BTC Liquidation Map Data.

CoinAnk liquidation map data shows that if BTC breaks through $112,000, reaching a new all-time high, the cumulative short liquidation intensity on major CEXs will reach $7.32 billion. Conversely, if Bitcoin falls below $102,600, the cumulative long liquidation intensity on major CEXs will reach $4.29 billion.

We believe that the current market has formed a critical liquidation threshold in the range of $102,600 to $112,000, reflecting the intense competition between bulls and bears. If BTC breaks through $112,000 (creating a new all-time high), the $7.32 billion short liquidation intensity may trigger a "short squeeze" effect—forcing many shorts to close their positions will accelerate buying pressure, creating a positive feedback loop that drives prices up. Conversely, if it falls below $102,600, the $4.29 billion long liquidation intensity exposes the vulnerability of leveraged long positions, potentially triggering a "long kill long" chain reaction, leading to panic selling and amplifying short-term downside risks.

It is important to note that liquidation intensity is not the actual amount to be liquidated but rather a measure of the potential severity of market liquidity shocks after prices reach certain levels, based on the density of adjacent liquidation clusters. Current data highlights two major features: the risk exposure continues to expand, as compared to early 2025 (where breaking $104,000 corresponded to $260 million in shorts), the current liquidation scale has grown exponentially, indicating that market leverage and volatility are rising in tandem; long position risks are more concentrated, as although the short liquidation intensity is numerically higher, the long liquidation threshold ($102,600) is closer to the current price level, and historical data shows that this support area has a dense accumulation of long positions, making price elasticity weaker and the destructive potential of downward catalysts possibly stronger.

Bitcoin faces dual liquidity risks, and investors should be cautious of the market resonance effects triggered by key price level breakthroughs.

5. Key Macroeconomic Events and Important Forecasts and Interpretations for the Crypto Market This Week.

CoinAnk data shows:

June 16, Monday: U.S. June New York Fed Manufacturing Index; Trump Group to release important announcement;

June 17, Tuesday: U.S. May Retail Sales MoM, Import Price Index MoM, and Industrial Production MoM;

Nansen will launch the first quarter points program;

June 18, Wednesday: U.S. Initial Jobless Claims;

Sonic Labs will launch the second season of S airdrop;

June 19, Thursday: The Federal Reserve will announce its interest rate decision, and Powell will hold a press conference; the Swiss National Bank and the Bank of England will announce their interest rate decisions; U.S. stock markets will be closed for one day.

Binance Alpha will change its airdrop rules, distributing in two phases starting June 19.

On the macro level, the Federal Reserve's interest rate decision (to be announced on June 19) is the focus, with expectations to maintain rates unchanged due to a cautious stance amid falling inflation and strengthened employment resilience, with rate cut expectations having weakened to about 0.45 percentage points. Meanwhile, U.S. retail sales data (June 17) will reveal the impact of tariffs on consumption; if the data is weak, it may suppress risk appetite; while initial jobless claims (June 18) exceeding expectations could support the Fed in extending the high-rate period. Additionally, the closure of U.S. stock markets (June 19) may amplify volatility in the crypto market, especially during times of liquidity shortages.

In the crypto market, airdrop activities are active, but rule adjustments are significant: Binance Alpha will distribute in two phases starting June 19, prioritizing high-point users before opening to lower thresholds, aiming to incentivize participation and reduce unclaimed rates; Nansen and Sonic Labs' new points programs emphasize the cancellation of passive mechanisms, shifting to active interactions to enhance fairness. Researchers believe that the Fed's policy caution combined with optimized airdrop rules may temporarily boost market sentiment, but caution is warranted regarding unexpected macro data (such as a decline in retail sales) triggering risk-averse sentiment in crypto assets. Overall, this week marks a turning point in policies and market rules, and investors should pay attention to the optimization of points strategies to cope with potential volatility.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。