Original Author: BitPush

On Friday local time, Trump Media & Technology Group (stock code DJT) announced that its submitted S-3 registration statement has been approved and is effective by the U.S. Securities and Exchange Commission (SEC).

This means that the equity and convertible note agreements previously reached with about 50 investors have officially entered the execution phase, with a total financing amount of approximately $2.3 billion. Most of this funding—according to previously disclosed plans—will be used to purchase Bitcoin, making it the second publicly traded company after Strategy to treat Bitcoin as a core asset reserve.

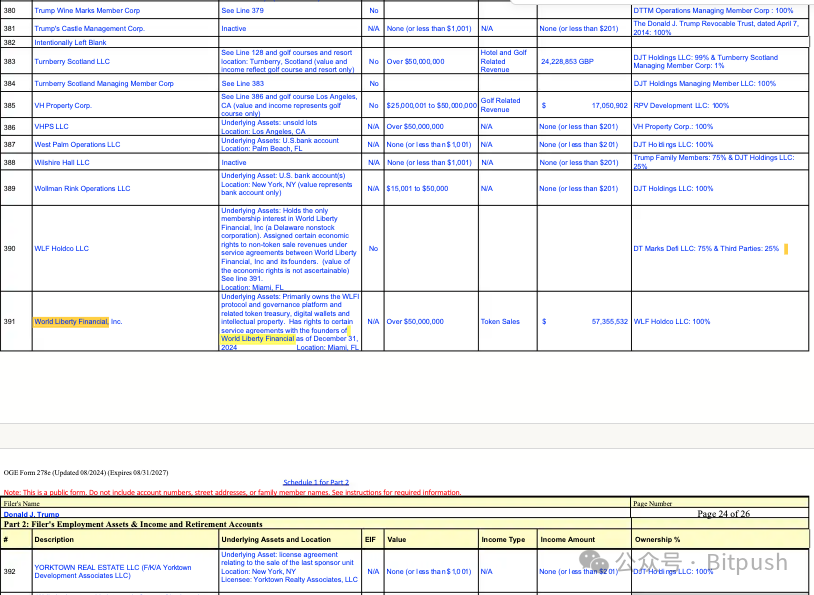

At the same time, financial documents obtained by the New York Post from the U.S. Office of Government Ethics show that Trump personally earned $57.35 million last year from the family-associated cryptocurrency platform World Liberty Financial, making it one of his most significant sources of income.

Trump's crypto income far exceeds his traditional business earnings. In addition to the $57.35 million from World Liberty Financial, his derivative businesses, including "45 Guitar" (earning $1.05 million), "Trump Sneakers and Perfume" ($2.5 million), and Trump-branded watches ($2.8 million), collectively contribute to over $60 million in annual non-political income.

The documents also reveal that he holds a substantial portfolio of stock and bond investments, with related details occupying nearly 145 pages of the disclosure.

"Patriot Economy"

Trump Media's CEO Devin Nunes did not hide his strategic intentions in a statement: "We are rapidly advancing our expansion plans, including enhancing our social media platform, developing streaming services, and establishing a Bitcoin reserve."

He described this series of actions as making Trump Media an indispensable part of the "Patriot Economy." Nunes emphasized multiple times that the company's mission is to "end the suppression of free speech by big tech companies," and Bitcoin is referred to as "the pinnacle tool of financial freedom."

This initiative is not isolated. Since 2024, Trump Media's layout in the cryptocurrency field has gradually become clear: first announcing the launch of the fintech brand Truth.Fi, followed by a partnership with Crypto.com to plan the launch of a Bitcoin ETF.

At the recent "Bitcoin2025" event held in Las Vegas, Trump's core circle—including Vice President J.D. Vance, Donald Trump Jr., Eric Trump, and "Crypto King" David Sacks—attended prominently, further solidifying Trump's image as America's first "Crypto President." This approach of bundling political narrative with financial strategy makes DJT stand out on Wall Street.

However, the market's reaction is not entirely optimistic. Despite Bitcoin prices remaining relatively stable, Trump Media's stock price has fallen 42% this year, with its 2024 financial report showing revenue of only $3.6 million and a loss of up to $400 million.

Some analysts question that the company's valuation relies more on political narrative than on actual profitability.

Controversy Over the President's "Call to Action"

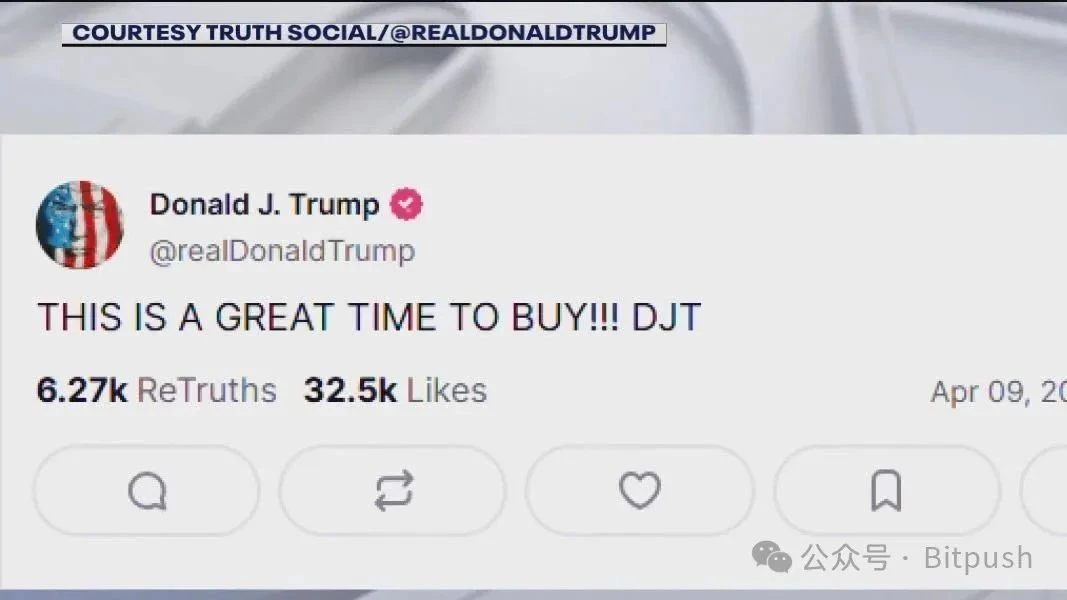

What has sparked further discussion is Trump's personal role. As the company's major shareholder (holding about 114 million shares through a trust), he previously posted on Truth Social urging investors to "buy DJT," after which the company's stock price rose. This blurring of the lines between presidential identity and business interests has raised concerns about market manipulation.

According to CNBC, DJT's actions are closely related to the growing dissatisfaction within the Republican Party regarding the discrimination against conservative businesses in banking.

Several Republican leaders, including Trump himself, have publicly accused traditional financial institutions of "excluding" conservative clients. The launch of the Truth.Fi platform by DJT, along with the rise of cryptocurrencies associated with Trump, is seen as a proactive response from the private sector to this trend of "de-banking."

Converting a significant portion of the company's treasury assets into Bitcoin is also a popular trend this year. Initiated by Michael Saylor's Strategy company in 2020, it is now being pushed to a climax by Trump's political movement and his crypto allies. The core goal of this strategy is to continuously increase the per-share Bitcoin holdings, leveraging the potential appreciation of Bitcoin. New Bitcoin companies supported by Tether and SoftBank, such as Jack Mallers' venture, as well as David Bailey's Nakamoto Holdings, are actively laying out in this field, attempting to replicate and surpass the success model of Strategy.

Now, with the effectiveness of the S-3 registration statement, Trump Media's Bitcoin strategy has entered a substantive phase. If the plan goes smoothly, it will become the third-largest corporate holder of Bitcoin globally.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。