Key Points

● The total market capitalization of cryptocurrencies is $3.41 trillion, down from $3.42 trillion last week, representing a 1% decrease this week. As of the time of writing, the cumulative net inflow of the Bitcoin spot ETF in the U.S. is approximately $45.61 billion, with a net inflow of $1.07 billion this week; the cumulative net inflow of the Ethereum spot ETF in the U.S. is approximately $3.85 billion, with a net inflow of $528 million this week.

● The total market capitalization of stablecoins is $260 billion, with USDT having a market cap of $155.5 billion, accounting for 59.8% of the total stablecoin market cap; followed by USDC with a market cap of $61.6 billion, accounting for 23.69% of the total stablecoin market cap; and DAI with a market cap of $5.36 billion, accounting for 2.06% of the total stablecoin market cap.

● According to DeFiLlama, the total TVL (Total Value Locked) in DeFi this week is $111.9 billion, up from $111.6 billion last week, representing a 0.27% increase this week. By public chain, the top three chains by TVL are Ethereum with a share of 54.98%; Solana with a share of 7.67%; and Bitcoin with a share of 5.7%.

● From on-chain data, this week, except for BNBChain and Sui which saw a decline, other public chains generally experienced growth, with BNBChain showing the most significant decline at 15.9% compared to last week; Toncoin showed the most significant increase at 100% compared to last week. In terms of transaction fees, Toncoin increased by 100% compared to last week; Sui decreased by 14.3% compared to last week, while other public chains remained stable compared to last week. In terms of daily active addresses, Solana increased by 7.9% compared to last week; Ethereum decreased by 11.59% compared to last week, with other public chains showing little change. In terms of TVL, except for BNBChain which decreased by 0.3% compared to last week, Aptos and Toncoin remained stable compared to last week, while other public chains showed slight growth.

● Innovative projects to watch: Flipcash is a stablecoin payment platform where users create QR codes and share them with friends for instant gas-free transactions; Bellve is a decentralized yield protocol that uses artificial intelligence to design and manage diversified strategies that align with user risk preferences; LinguardLabs is building a regulation-first Layer 1 aimed at repositioning TradFi as DeFi.

Table of Contents

Key Points

Total Market Capitalization of Cryptocurrencies / Bitcoin Market Cap Share

Fear Index

ETF Inflow and Outflow Data

ETH/BTC and ETH/USD Exchange Rates

Decentralized Finance (DeFi)

On-Chain Data

Stablecoin Market Cap and Issuance Situation

II. This Week's Hot Money Trends

Top Five VC Coins and Meme Coins by Growth This Week

New Project Insights

III. Industry News Updates

Major Industry Events This Week

Upcoming Major Events Next Week

Important Financing and Investment from Last Week

I. Market Overview

1. Total Market Capitalization of Cryptocurrencies / Bitcoin Market Cap Share

The total market capitalization of cryptocurrencies is $3.41 trillion, down from $3.42 trillion last week, representing a 1% decrease this week.

Figure 1 Data Source: cryptorank

As of the time of writing, Bitcoin's market cap is $2.1 trillion, accounting for 61.58% of the total cryptocurrency market cap. Meanwhile, the market cap of stablecoins is $260 billion, accounting for 7.64% of the total cryptocurrency market cap.

Figure 2 Data Source: coingeck

2. Fear Index

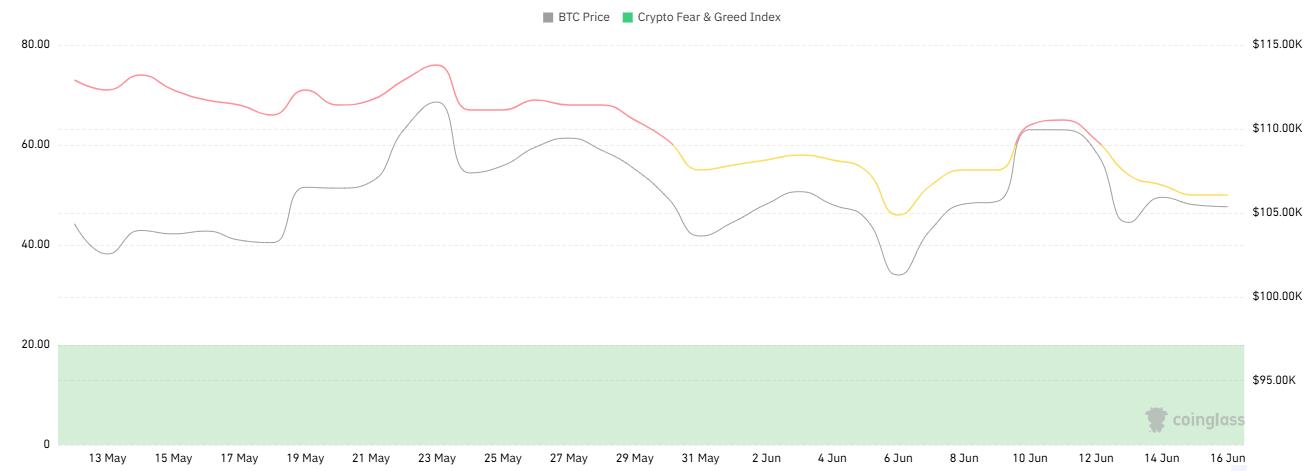

The cryptocurrency fear index is 50, indicating a neutral sentiment.

Figure 3 Data Source: coinglass

3. ETF Inflow and Outflow Data

As of the time of writing, the cumulative net inflow of the Bitcoin spot ETF in the U.S. is approximately $45.61 billion, with a net inflow of $1.07 billion this week; the cumulative net inflow of the Ethereum spot ETF in the U.S. is approximately $3.85 billion, with a net inflow of $528 million this week.

Figure 4 Data Source: sosovalue

4. ETH/BTC and ETH/USD Exchange Rates

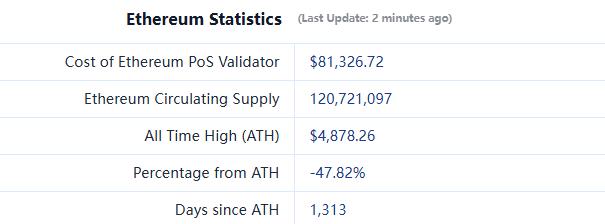

ETHUSD: Current price $2,541, historical highest price $4,878, down approximately 47.82% from the highest price.

ETHBTC: Currently at 0.024114, historical highest at 0.1238.

Figure 5 Data Source: ratiogang

5. Decentralized Finance (DeFi)

According to DeFiLlama, the total TVL in DeFi this week is $111.9 billion, up from $111.6 billion last week, representing a 0.27% increase this week.

Figure 6 Data Source: defillama

By public chain, the top three chains by TVL are Ethereum with a share of 54.98%; Solana with a share of 7.67%; and Bitcoin with a share of 5.7%.

Figure 7 Data Source: CoinW Research Institute, defillama

Data as of June 15, 2025

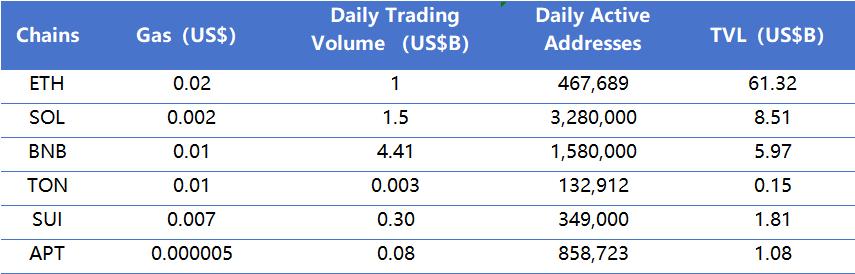

6. On-Chain Data

Layer 1 related data

Mainly analyzing the current data of major Layer 1s including ETH, SOL, BNB, TON, SUI, and APT based on daily transaction volume, daily active addresses, and transaction fees.

Figure 8 Data Source: CoinW Research Institute, DeFiLlama, Nansen

Data as of June 15, 2025

● Daily Transaction Volume and Transaction Fees: Daily transaction volume and transaction fees are core indicators of public chain activity and user experience. This week, except for BNBChain and Sui which saw a decline, other public chains generally experienced growth, with BNBChain showing the most significant decline at 15.9% compared to last week; Toncoin showed the most significant increase at 100% compared to last week. In terms of transaction fees, Toncoin increased by 100% compared to last week; Sui decreased by 14.3% compared to last week, while other public chains remained stable compared to last week.

● Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects the level of trust users have in the platform. In terms of daily active addresses, Solana increased by 7.9% compared to last week; Ethereum decreased by 11.59% compared to last week, with other public chains showing little change. In terms of TVL, except for BNBChain which decreased by 0.3% compared to last week, Aptos and Toncoin remained stable compared to last week, while other public chains showed slight growth.

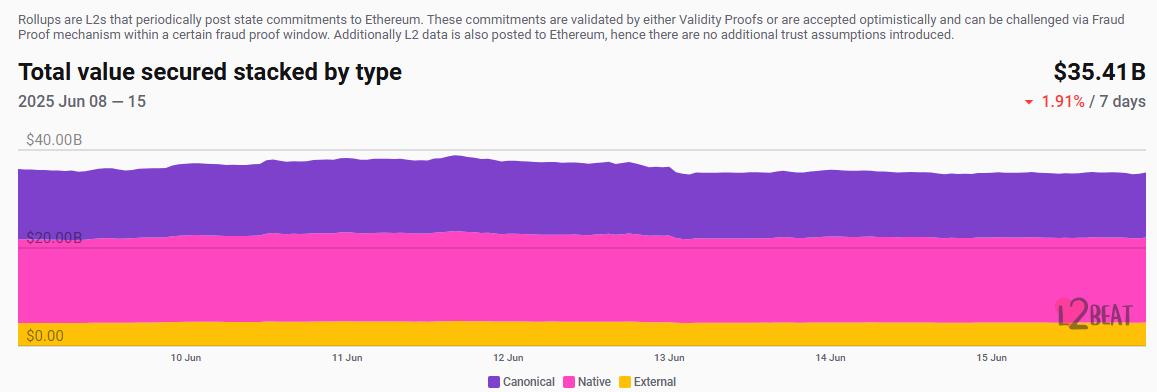

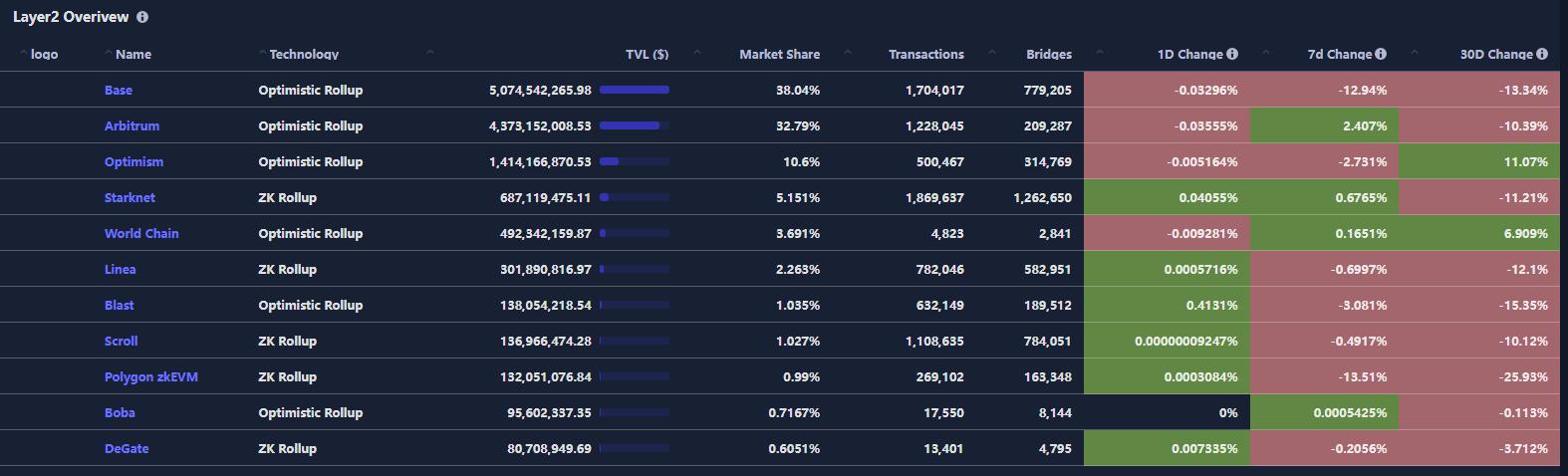

Layer 2 Related Data

● According to L2Beat, the total TVL of Ethereum Layer 2 is $35.41 billion, down from $36 billion last week, representing an overall decrease of 1.91%.

Figure 9 Data Source: L2Beat

Data as of June 15, 2025

Base and Arbitrum occupy the top positions with market shares of 38.04% and 32.79%, respectively, with overall market shares increasing this week.

Figure 10 Data Source: footprint

Data as of June 15, 2025

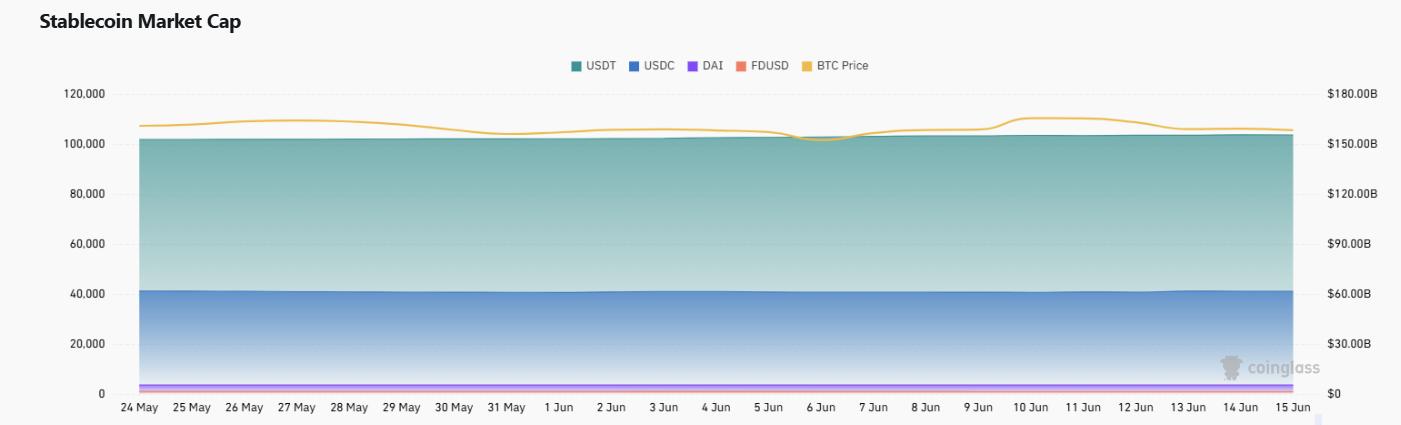

7. Stablecoin Market Cap and Issuance Situation

According to Coinglass, the total market capitalization of stablecoins is $260 billion. Among them, USDT has a market cap of $155.5 billion, accounting for 59.8% of the total stablecoin market cap; followed by USDC with a market cap of $61.6 billion, accounting for 23.69% of the total stablecoin market cap; and DAI with a market cap of $5.36 billion, accounting for 2.06% of the total stablecoin market cap.

Figure 11 Data Source: CoinW Research Institute, Coinglass

Data as of June 15, 2025

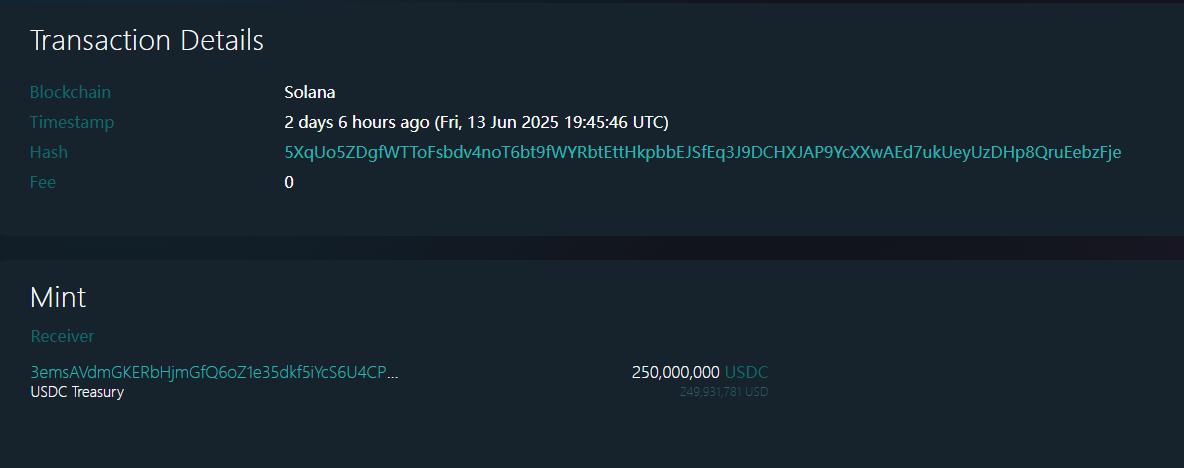

According to Whale Alert, this week the USDC Treasury issued 350 million USDC, and the Tether Treasury issued 1 billion USDT, with a total issuance of stablecoins this week amounting to 1.35 billion, up approximately 7.8% from last week's total issuance of 1.252 billion stablecoins.

Figure 12 Data Source: Whale Alert

Data as of June 15, 2025

II. This Week's Hot Money Trends

1. Top Five VC Coins and Meme Coins by Growth This Week

The top five VC coins by growth in the past week

Figure 13 Data Source: CoinW Research Institute, coinmarketcap

Data as of June 15, 2025

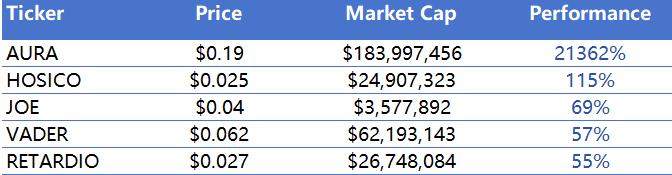

The top five Meme coins by growth in the past week

Figure 14 Data Source: CoinW Research Institute, coinmarketcap

Data as of June 15, 2025

2. New Project Insights

● Flipcash: A stablecoin payment platform where users create QR codes and share them with friends for instant gas-free transactions.

● Bellve: A decentralized yield protocol that uses artificial intelligence to design and manage diversified strategies that align with user risk preferences. Users' funds will be allocated to carefully selected investment opportunities that automatically adjust based on market changes, allowing them to easily earn returns.

● Linguard Labs: Building a "regulation-first" Layer 1 aimed at repositioning TradFi as DeFi.

III. Industry News Updates

1. Major Industry Events This Week

● Coinbase announced at the 2025 Crypto Summit the launch of the Coinbase One credit card supported by American Express, expected to go live this fall. Cardholders can earn up to 4% cashback in Bitcoin on purchases, with the specific percentage depending on the amount of digital assets held on the Coinbase platform. This credit card will be part of the Coinbase One subscription service, which offers zero transaction fees, priority customer service, and higher staking rewards after a monthly subscription fee is paid.

● The stablecoin protocol Usual announced that ETH0 has gone live, with the first cap now open, capped at $1 million (500 ETH). ETH0 is supported 1:1 by Lido's wstETH, offering over 10% native annualized yield and full liquidity. During this genesis phase, there is no lock-up period, and users can decide whether and when to migrate to the future ETH0++ to continue earning yields when the genesis phase ends.

● Walmart and Amazon are exploring the issuance of their own stablecoins in the U.S. market, or using them for payments and settlements within their merchant ecosystems. According to sources, this move could shift a significant amount of cash and card transactions out of the traditional financial system, reducing billions in fees and speeding up payment processes.

● The DeFi lending platform Spark announced the launch of the Spark Ignition airdrop, with the first phase of Ignition opening for airdrop queries on June 12. Users of SparkLend, as well as holders of USDS, sUSDS, sUSDC, DAI, sDAI, xDAI, or SAI, who interact with selected chains and protocols, are eligible for the airdrop.

● On-chain asset management company Maple Finance has added support for stETH. stETH is an Ethereum liquid staking token issued through the Lido protocol. This integration will allow Maple to enable institutions to use stETH holdings as collateral to borrow stablecoins, providing liquidity without requiring institutions to exit their liquid staking positions.

2. Upcoming Major Events Next Week

● Play Solana announced that Player2 will officially mint on June 16, with a total supply of 8,000, phased open to multiple groups: Player1 holders, PSG1 pre-orderers, application system applicants, and designated whitelist community members.

● The decentralized social protocol Farcaster will launch three professional subscription benefits during the week of June 16, including 10K character content publishing, four embedding features (including images, videos, URLs, CA, and mini-apps), and a new personal profile banner image feature.

● According to Polyhedra Network, the Panbubu community vote will close on June 17. Users participating in the vote will receive exclusive commemorative NFTs; ordinary SBT holders who do not participate in the vote will receive ordinary NFTs, while participating VVIP SBT holders will receive limited edition NFTs.

● The Solana ecosystem's liquid re-staking protocol Fragmetric announced that its TOPU Inc. NFT series will officially launch minting on June 18 through the Magic Eden Launchpad. The series includes a total of 10,000 NFTs, aimed at early supporters of the Fragmetric community and users of its partnered protocols on Solana, with holders receiving 0.75% of future Fragmetric tokens.

● The Nansen Points Season 1 will launch on June 17, where users currently staking, subscribing, inviting, etc., on Nansen will have their actions counted towards their points balance on that day.

3. Important Financing and Investment from Last Week

● Turnkey raised $30 million, with investors including Bain Capital Crypto, Galaxy Ventures, and others. Turnkey is a secure private key infrastructure designed for cryptocurrency developers, enabling them to dynamically generate thousands of wallets using simple APIs and sign tens of thousands of transactions on any blockchain, with flexible programmable permissions ensuring developers only sign what they want. (June 9, 2025)

● Hypernative raised $40 million, with investors including StepStone Group, Boldstart Ventures, and others. Hypernative is a crypto security company dedicated to preventing zero-day network threats, economic and governance risks, and protecting digital asset managers, protocols, and Web3 applications from significant losses. (June 10, 2025)

● Yupp raised $33 million, with investors including Andreessen Horowitz. Yupp is an AI blockchain platform where anyone can explore and compare the latest AI models for free. Users can input questions and view multiple AI-generated answers side by side, select the best results to form a preference package, and use this data for later training and evaluation of AI models. (June 13, 2025)

Reference Links:

Flipcash: https://x.com/flipcash_app

Bellve: https://x.com/bellve_ai

Linguard Labs: https://x.com/LinguardLabs

Turnkey: https://x.com/turnkeyhq

Hypernative: https://x.com/HypernativeLabs

Yupp: https://x.com/yupp_ai

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。