On the evening of June 15, the market experienced another upheaval as two major tokens, ZKJ (Polyhedra Network) and KOGE (48 Club DAO), faced a severe flash crash within just a few hours, resulting in a market cap evaporation of over $600 million, triggering panic among investors and intense debates within the community. This incident exposed the structural liquidity risks in the DeFi market and brought the vulnerabilities of the Binance Alpha mechanism into sharp focus.

Event Overview: Market Cap Shrinks Overnight

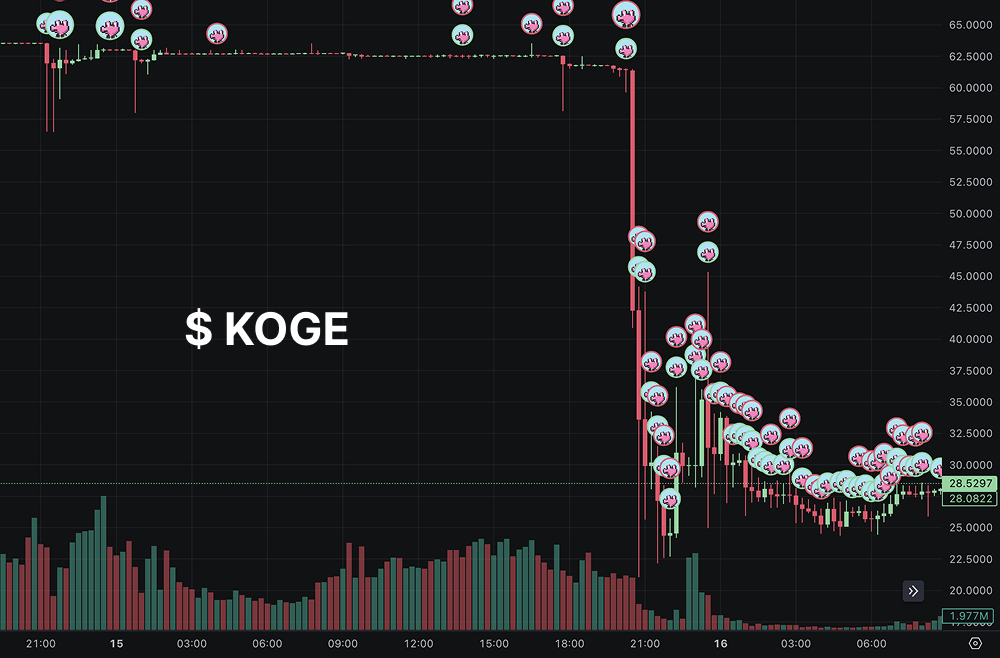

Around 22:00 (JST) on June 15, the ZKJ and KOGE trading pairs exhibited abnormal fluctuations on Binance and other major exchanges. The price of ZKJ plummeted from $1.98 to $0.32, with a 24-hour decline of up to 83.7%, hitting a low of $0.25, and its market cap shrank from $700 million to approximately $94 million, dropping to around the 350th rank.

KOGE also suffered, with its price crashing from $61 to $8.46, a decline of approximately 55.78%-60.75% (with slight variations across different platforms), and its market cap reduced to about $89.21 million. The flash crash of both tokens led to a total liquidation of approximately $210 million across the network, with ZKJ contracts accounting for over 70% of the liquidations.

User @wublockchain12 on platform X reported the severe fluctuations immediately, stating that both tokens were "cut in half" within an hour, with ZKJ down 60.56% and KOGE down 60.75%. Community investors expressed their despair, with one user lamenting, "An investment of $1,000 is now just $200 overnight, losing everything." This flash crash not only severely impacted the confidence of holders but also raised questions about the governance and transparency of Polyhedra Network and 48 Club.

Cause Analysis: Liquidity Crisis and Large Holder Sell-off

Multiple sources indicate that the core reason for this flash crash was the depletion of the KOGE/USDT liquidity pool, triggering a chain reaction that led to the collapse of both ZKJ and KOGE prices. Here’s a breakdown of the specific causes:

Depletion of Liquidity and Large Holder Withdrawals

On-chain data shows that on June 15, three major addresses (starting with 0x1A2…27599, 0x078…8bdE7, and 0x6aD…e2EBb) executed large-scale liquidity withdrawals and sell-off operations: address 0x1A2…27599 withdrew 61,130 KOGE (approximately $3.7 million) and 273,017 ZKJ (approximately $530,000), and then quickly sold off. Address 0x078…8bdE7 withdrew 33,651 KOGE (approximately $2 million) and 709,203 ZKJ (approximately $1.4 million). Address 0x6aD…e2EBb received and sold 772,759 ZKJ (approximately $1.5 million).

These operations totaled over $100 million in ZKJ and KOGE sold, directly leading to the depletion of the KOGE/USDT liquidity pool. Investors attempted to exchange KOGE for ZKJ to exit their positions, further exacerbating the selling pressure on ZKJ, creating a vicious cycle.

Binance Alpha Mechanism's "Assistance"

The Binance Alpha platform calculates points based on "trading volume × liquidity," incentivizing short-term capital to flow into the ZKJ-KOGE trading pair, thus boosting trading volume. However, this mechanism also provided large holders with the opportunity for "low slippage swaps." User @ETH_APPLE pointed out that large holders created false trading volume (wash trade) through KOGE-ZKJ swaps, profiting from selling off after withdrawing at high prices.

The high trading volume incentive mechanism of Binance Alpha indirectly amplified the liquidity crisis.

The Shadow of Token Unlocking

According to the tokenomics of Polyhedra Network, 15.53 million new ZKJ tokens will be unlocked on June 19, valued at approximately $30 million (based on pre-crash prices). Concerns about selling pressure from the unlocking had already begun to brew in the market, compounded by the liquidity crisis, triggering panic selling. User @Nazarick_eth commented, "Unlocking leads to a crash; it's the fate of high FDV tokens."

Structural Risks in the DeFi Market

Both ZKJ and KOGE are high fully diluted valuation (FDV) tokens that rely on market makers for liquidity. Once large holders withdraw, the market lacks deep support, making prices highly susceptible to collapse. The high correlation between the ZKJ and KOGE trading pairs further exacerbated the risk, with the collapse of the KOGE liquidity pool directly dragging down ZKJ, creating a chain reaction.

Market and Community Response: Anger and Trust Crisis

Community sentiment shifted from shock to anger. User @ai_9684catheters bluntly stated, "This is a textbook example of harvesting; retail investors are the cannon fodder." Some investors pointed fingers at the project parties, questioning the transparency of 48 Club (the issuer of KOGE) regarding their June 14 statement that "tokens are fully released, with no commitment not to sell," believing it opened the door for large holder sell-offs.

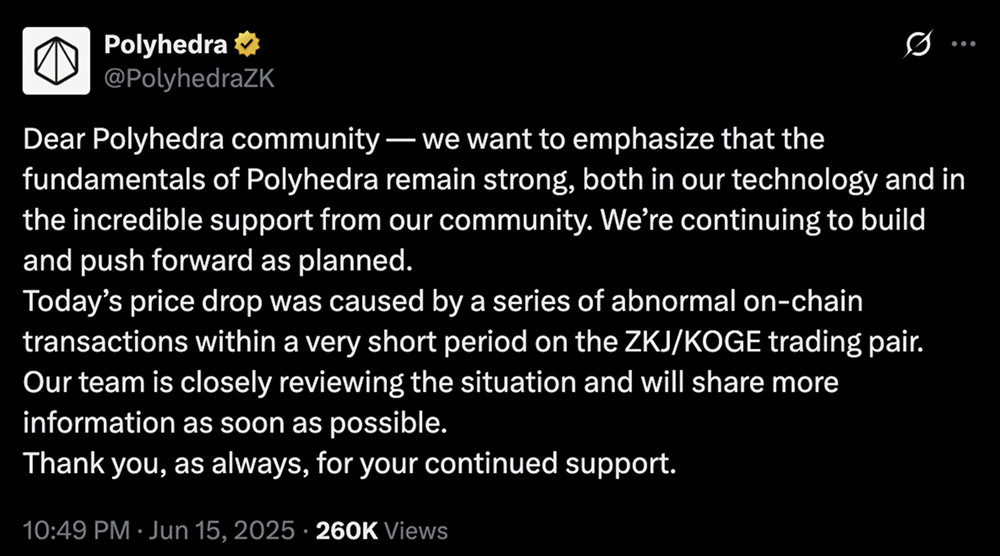

Polyhedra Network released a statement on June 15 on platform X, stating that they had detected "abnormal on-chain transactions" and were investigating and monitoring market dynamics, but did not provide specific solutions.

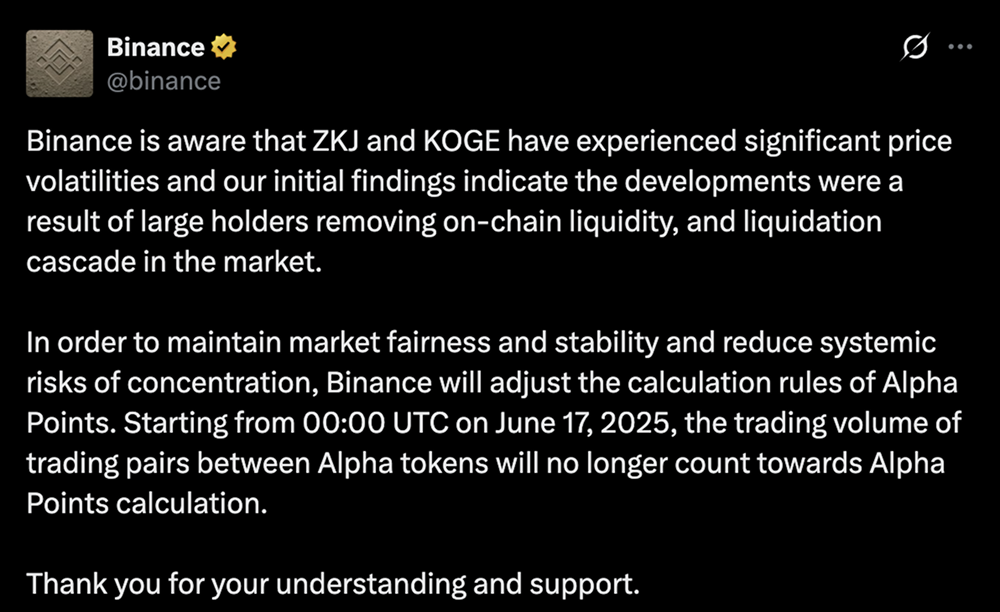

Binance issued an announcement on June 16, acknowledging that the flash crash was due to "large holder withdrawals and chain liquidations," and announced that starting from June 17, 00:00 (UTC), they would adjust the Alpha point rules, eliminating the point calculation for trading volume between Alpha tokens to curb similar incidents.

The community was not satisfied with the responses from the project parties and exchanges. User @hualunjiejie stated, "Exchanges and project parties are shirking responsibility; who will protect retail investors?" Some users characterized the incident as a "rug pull" or "exit liquidity," suspecting collusion between the project parties and large holders, although there is currently no solid evidence to support this accusation.

Background and Impact: Escalation of the DeFi Trust Crisis

This flash crash exposed multiple pain points in the DeFi market: the vulnerability of high FDV tokens, the risks of trading pair coupling, and the potential loopholes in incentive mechanisms. Analysts warn that if Polyhedra and 48 Club cannot rebuild trust through liquidity supplementation or transparent investigations, the prices of both tokens may remain depressed for a long time, and the reputation of the projects will also suffer.

Future Outlook: Unlocking Pressure and Path to Recovery

The unlocking of ZKJ tokens on June 19 is undoubtedly the focus of market attention. The addition of 15.53 million tokens may further exacerbate selling pressure, testing Polyhedra's crisis response capabilities. In the long run, DeFi projects need to learn from this incident, optimize liquidity management and tokenomics design, and avoid similar crises from recurring.

For investors, the flash crash of ZKJ and KOGE serves as another warning in the high-risk crypto market. It is advisable to closely monitor the subsequent dynamics of the project parties, on-chain data, and adjustments in exchange policies, while maintaining a cautious investment attitude.

Related news: Class, Capital, and Trendy Toys: Decoding the Unreplicable Business Empire of Pop Mart

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。