$STRATOS Subscription Analysis: @virtuals_io has 8 hours left for the new subscription

First, let's discuss the positive points

- Ithaca Protocol's "Re-Entrepreneurship" Project

According to DeFiLlama data, the composable options protocol Ithaca Protocol currently has a TVL of $2.17 million, ranking eighth in the options sector.

The development timeline of Ithaca Protocol is as follows:

January 2024: Ithaca completes a $2.5 million Pre-Seed round led by Cumberland and Wintermute Ventures. Georgios Vlachos (co-founder of Axelar) joins this round as an angel investor. In terms of business, Axelar provides cross-chain interoperability support and collaborates deeply with Ithaca.

December 2024: The $ITHACA token will be listed on exchanges such as KuCoin and Gate.

- Team led by former Chief Strategy Officer of Amber Group

Background of the Ithaca Protocol team:

Founder @Dimitrios160174: Former Chief Strategy Officer of Amber Group and Chief Investment Officer of Harmony Advisors.

CTO @nhaga: Former regional head of Amber Group and Chainlink development expert.

Negative points

- $ITHACA Price Trend

The price trend of $ITHACA after TGE is not optimistic (see Figure 1), especially after February 2025, where it has almost only seen declines.

- Homogenization Issue of STRATOS

$STRATOS is positioned as an AI portfolio manager based on Ithaca's options infrastructure, with the following operational steps:

Users deposit funds;

Funds are allocated to multiple options trading AI agents (Stratos Swarm);

Agents execute 24/7 options trading based on the Black-Litterman model;

Users earn returns through agent performance.

Although the concept of "an AI hedge fund in your pocket" is attractive, the market has seen the emergence of several similarly positioned AI-driven DeFi protocols, and $STRATOS faces the following challenges:

Lack of first-mover advantage: The sector has already been occupied in users' minds by early projects.

Insufficient technical differentiation: The AI strategies of $STRATOS (such as volatility premium capture) rely on rule-based approaches, making it difficult to form significant competitive barriers.

Insufficient market validation: The token is launched before the product, and the product has not been fully validated by the market.

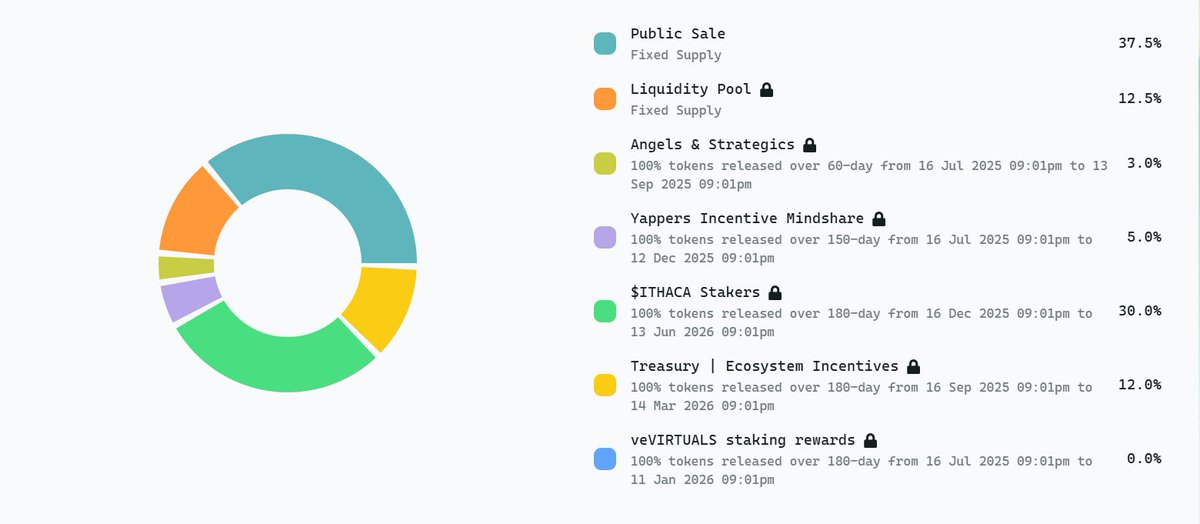

- Token Economics

Airdrop dilution: 30% of the supply will be airdropped to $ITHACA stakers at a 1:1 ratio.

Angel investor unlock: 3% of the tokens will begin linear release on July 16, 2025, which may trigger short-term selling pressure.

My action: Before the arrival of $ROOM, I will allocate 20% of my points to participate in the $STRATOS subscription. But don't have too high expectations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。