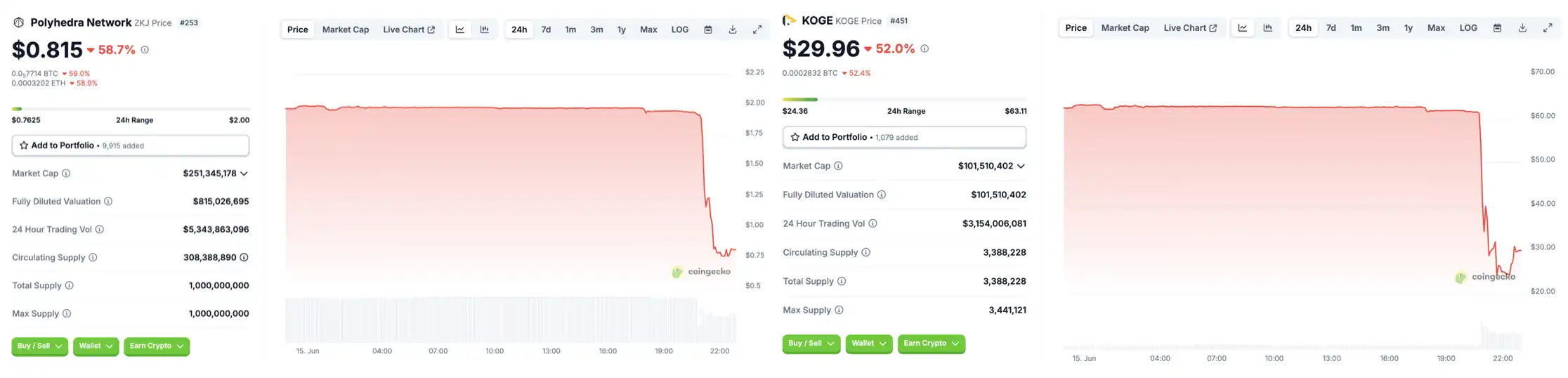

Previously, the most popular choice for score boosting on Binance Alpha—$ZKJ and $KOGE—both experienced a sudden crash.

On Binance Alpha, this token pair was once regarded as the most cost-effective tool for score boosting, with extremely high LP annual returns and very low slippage, quickly becoming the preferred pool for Alpha users. A large influx of funds and a surge in trading activity created an appearance of "stable growth," which also laid the groundwork for subsequent systemic sell-offs.

To understand the starting point of all this, we first need to return to the incentive mechanism of Binance Alpha itself.

Everything Starts with Binance Alpha

Binance Alpha is an incentive mechanism launched by Binance at the end of 2024, where users earn points by providing LP, participating in trading, and engaging in holdings, which can be used to participate in the platform's regular airdrops and exclusive events.

Due to its clear incentive ratio and distribution rhythm, it has gradually become a focus for profit-seekers since its launch, with volume boosting and LP formation becoming the most mainstream scoring methods, indirectly giving rise to token combinations specifically optimized for Alpha.

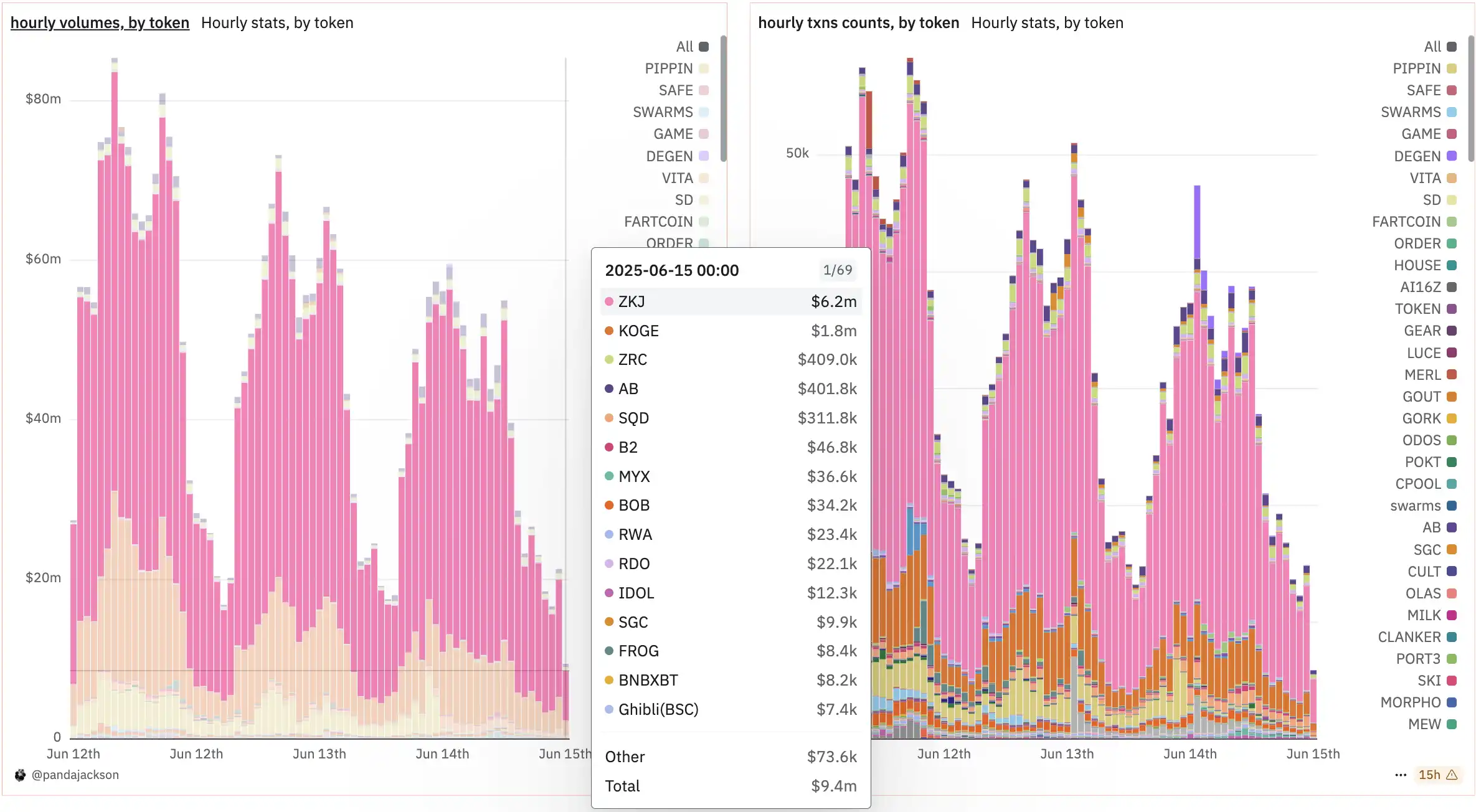

According to data from @pandajackson42, on June 14 alone, the total trading volume on Binance Alpha reached $987 million, with ZKJ and KOGE trading volumes of $703 million and $159 million, respectively, occupying the top two spots on the leaderboard.

However, since the trading volume peaked at $2.04 billion on June 8, the activity level of Alpha has continued to decline, with the trading volume on the 14th dropping over 50% from the peak. On the same day, Binance announced an upcoming adjustment to the airdrop distribution mechanism, which will be divided into "qualifying receipt" and "first-come, first-served" phases. This change was seen by some community members as an indirect catalyst for the early withdrawal of large holders and LP exits.

In the Alpha points acquisition mechanism, the weight of trading volume and liquidity provision is excessively high, leading to the prevalence of the "market making—volume boosting—wash trading" trio, with the $ZKJ and $KOGE dual-token pool becoming a typical example.

The Conspiracy of Large Holders?

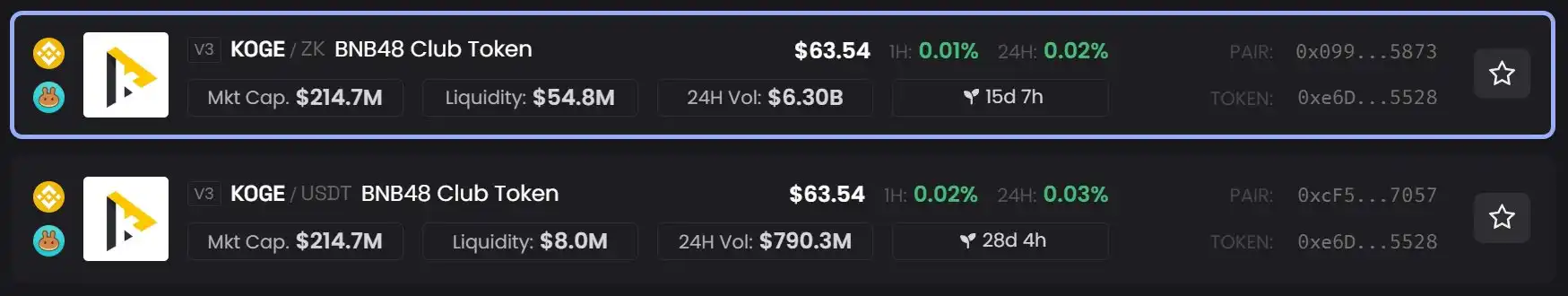

Previously, the project team constructed the KOGE/ZKJ dual-token trading pair and opened permissions to external liquidity studios, guiding large amounts of funds to participate in volume boosting activities. Meanwhile, the liquidity of $KOGE in the BNB and USDT pools remained shallow, meaning that even if large funds wanted to exit, it would be difficult to directly convert KOGE into mainstream assets.

Image source: @Emilia88_eth

During the period of high APY, large holders of KOGE and ZKJ continuously added LP to boost pool liquidity and encouraged more users to join. Their core logic was that KOGE itself lacked sufficient trading scenarios and external demand, making it impossible to sell directly. In contrast, ZKJ had a huge open interest in the contract market, providing stronger liquidity. Based on Router's automatic path selection mechanism, constructing the KOGE/ZKJ trading pair could enhance liquidity while laying the groundwork for future sales.

According to community user Emilia's observations, the KOGE project team has been continuously adding unilateral liquidity, controlling the price increase, which also led to the actual liquidity of KOGE/USDT being much smaller than perceived. Once a large holder dumped KOGE, the remaining LP could not exit through the KOGE/USDT pool and would inevitably have to convert to ZKJ, further triggering a sell-off.

At the same time, some large holders established short positions in ZKJ on CEX to prepare for subsequent hedging. As market activity slowed, APY declined, and volume boosting funds decreased, large holders began to withdraw LP in succession and exchanged their KOGE for ZKJ, then concentrated on selling ZKJ to complete their capital exit. The spot price thus fell rapidly, leading to widespread liquidation of long positions in ZKJ contracts, further amplifying the downward trend.

Price fluctuations led to more liquidity withdrawal, creating a typical negative feedback loop. Due to insufficient depth in the KOGE/USDT pool, the exit path for subsequent users could almost only be realized through ZKJ, further crushing ZKJ's price. Throughout this process, the KOGE project team continued to add unilateral liquidity for KOGE, creating an illusion of price support, but in reality, it compressed the actual realizable space and exacerbated the funding dilemma. Once the market experienced concentrated selling pressure, the remaining LP could not exit smoothly through the original path, and funds could only flow towards ZKJ, forming a chain reaction of sell-offs.

Ultimately, this structurally fragile design, combined with LP arbitrage, high-leverage contract positions, and high-yield inducements without actual value inflow, quickly evolved into a typical liquidity crisis, leading to the collapse of both KOGE and ZKJ.

The Process of "Large Liquidity Withdrawal + Continuous Selling"

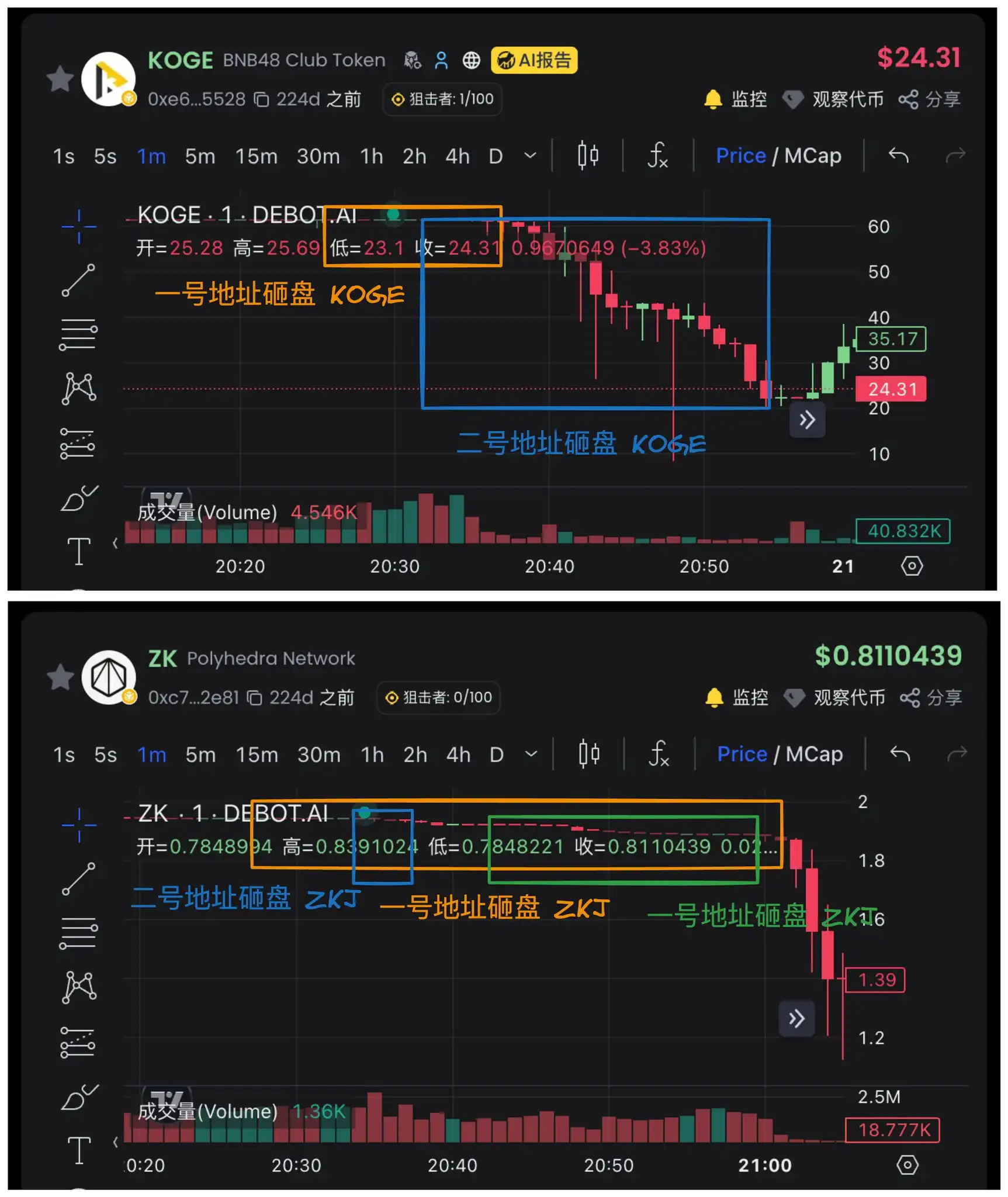

According to on-chain analyst @ai_9684xtpa, the simultaneous crash of $ZKJ and $KOGE was caused by three main addresses exerting dual pressure through "large liquidity withdrawal + continuous selling." The following is an analysis of on-chain traces:

At 20:28:21 and 20:33:15, withdrew a total of 61,130 KOGE (approximately $3.76 million) and 273,017 ZKJ (approximately $532,000) in bilateral liquidity.

Between 20:28:58 and 20:36:57, exchanged 45,470 KOGE for ZKJ, valued at $3.796 million, during which the on-chain transaction volume of KOGE saw a significant increase.

Between 20:30:57 and 20:59:49, sold 1.573 million ZKJ in batches for USDT and BNB, valued at $3.052 million, with an average selling price of $1.94. At this time, both KOGE and ZKJ experienced slight stepwise declines but did not crash.

At 20:30:33, withdrew 33,651 KOGE (approximately $2.07 million) and 709,203 ZKJ (approximately $1.38 million) in bilateral liquidity.

Between 20:31:10 and 20:58:18, exchanged 36,814 KOGE for ZKJ, valued at $2.26 million.

Between 20:35:15 and 20:37:34, sold 1 million ZKJ, valued at $1.948 million, with an average selling price of $1.948. This address's "relay-style dumping" finally pushed the price of KOGE to drop rapidly, resulting in the consecutive large bearish candles seen on the K-line.

Address 0x6aD…e2EBb

At 20:41:55, received 772,759 ZKJ transferred from address 0x078…8bdE7 (the previous dumping address), valued at $1.5 million.

Between 20:42:28 and 20:50:16, cleared 772,000 ZKJ.

The third address mainly acted in coordination, further catalyzing the decline of ZKJ after the price crash of KOGE, completing the harvesting of both token LPs and holders.

Is the Binance Alpha Dividend Fading?

Such liquidity structures driven by short-term incentives can easily evolve into "targeted harvesting" under extreme conditions. The project's fundamentals have not undergone substantial changes, but due to the end of incentives, structural runs, and market-making exits, external factors intervene, leading to a cliff-like price drop, ultimately resulting in losses borne by ordinary users who lack hedging mechanisms.

Especially since KOGE has no hedging tools, most participants hold LP or market-making positions bare, resulting in particularly severe losses. In contrast, some experienced users primarily operated around ZKJ and configured derivative short positions to mitigate some risks.

After the incident, the community reflected on the Binance Alpha incentive mechanism, with many suggestions focusing on weakening the single weight of trading volume and LP, increasing the linkage of points with interaction quality and holding duration, and implementing punitive downgrades for abnormal short-term wash trading and concentrated withdrawals.

For Binance, Alpha remains an important tool for enhancing on-chain activity and guiding quality project participation, but its sustainability will depend on more robust risk control and incentive design.

Looking back, the collapse of $ZKJ was not a black swan event but an inevitable result under the illusion of "low fees." Liquidity does not equate to legitimacy; narratives can amplify risks, and coordinated exits are never coincidental. In the crypto market, high yields without a value closure structure set the stage for sell-offs, and the ZKJ and KOGE events once again confirm this rule.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。