Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $3.34 trillion, with BTC accounting for 61.55%, which is $2.06 trillion. The market cap of stablecoins is $251.5 billion, with a recent 7-day increase of 0.63%, of which USDT accounts for 62.14%.

This week, BTC's price has shown range-bound fluctuations, currently priced at $105,300; ETH has also shown range-bound fluctuations, currently priced at $2,551.

Among the top 200 projects on CoinMarketCap, a small number have risen while most have fallen, including: KAIA with a 7-day increase of 45.16%, AERO with a 7-day increase of 45.15%, AB with a 7-day increase of 43.15%, and RVN with a 7-day increase of 43.63%.

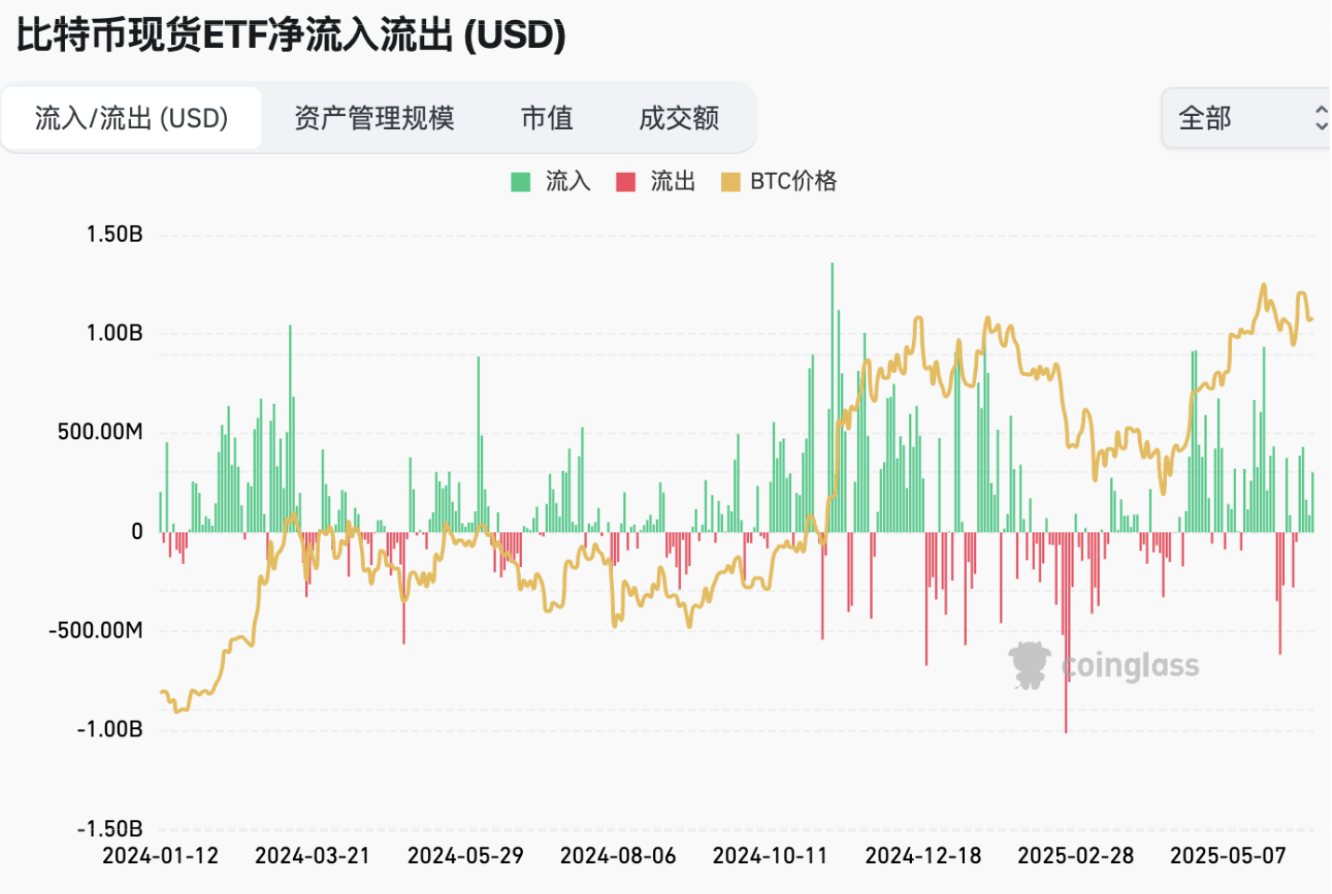

This week, the net inflow for the U.S. Bitcoin spot ETF was $1.3703 billion; the net inflow for the U.S. Ethereum spot ETF was $527.6 million.

On June 14, the "Fear & Greed Index" was at 52 (higher than last week), with the sentiment this week being: 4 days neutral, 3 days greedy.

Market Forecast:

This week, stablecoins continue to be issued, with significant net inflows into the U.S. Bitcoin spot ETF and net inflows into the Ethereum spot ETF. Both BTC and ETH remain range-bound. The RSI index is at 39.65, indicating weakness, while the altcoin season index is at 24. This week, the U.S. May CPI and PPI indices were in line with market expectations, and the impact of tariffs on inflation has yet to manifest. The fear and greed index remains between neutral and greedy.

The probability of the Federal Reserve cutting interest rates by 25 basis points in June is only 2.2%, with rate cuts expected to begin in Q3 of this year. The market has absorbed the expectation that the Fed will not cut rates in June, so next week's rate announcement is not expected to have a significant impact. The expected price range for BTC next week is $102,000-$107,000. Currently, the conflict between Israel and Iran is quite sharp, and in the short term, the market may experience a decline due to this. However, in the long term, a bull market is brewing in the final sprint phase. If the U.S. stablecoin bill is officially passed in August and the Fed cuts rates in September, a significant increase is expected. At this stage, it is recommended to accumulate on dips.

Understanding Now

Review of Major Events of the Week

On June 9, according to crypto journalist Eleanor Terrett, a substitute amendment for the U.S. digital asset market bill "CLARITY Act" has been released. This substitute amendment is an updated version of the submitted bill, incorporating recent amendments and new content. The text will serve as the basis for the Republican review in the U.S. House Financial Services Committee this Tuesday;

On June 9, Bloomberg senior ETF analyst Eric Balchunas revealed that BlackRock's IBIT holdings have surpassed $70 billion, becoming the fastest ETF to reach this milestone in just 341 days, five times faster than the previous record held by GLD at 1,691 days;

On June 10, the Ethereum Foundation announced that last month it launched the "Trillion Security" (1TS) initiative, which is an ecosystem-wide effort aimed at upgrading Ethereum's security. Today, the first 1TS report was released to outline the existing security challenges in the Ethereum ecosystem;

On June 11, the meme project Slerf released product screenshots on its official Twitter, hinting at the upcoming launch of the token issuance platform Slerrrfpad;

On June 12, the U.S. Senate passed the procedural vote for the "GENIUS Stablecoin Act" (Guiding and Establishing the National Innovation Act for U.S. Stablecoins) by a vote of 68 to 30, which will initiate full chamber debate and a final Senate vote on the bill. If the Senate passes it, it will be submitted to the House for further review;

On June 11, Bloomberg reported that payment company Stripe has agreed to acquire crypto wallet provider Privy, based on its recent acquisition of stablecoin infrastructure company Bridge. The terms of the deal have not been disclosed. Privy helps companies integrate crypto wallets into user experiences and primarily provides wallet integration services for businesses, having supported platforms like OpenSea;

On June 11, Sonic Labs announced that it will launch the second season of the S token airdrop on June 18;

On June 13, Israeli Defense Minister Katz stated that following Israel's attack on Iran, missile and drone attacks against Israel and its civilians are expected in the near future;

On June 13, Coinbase announced that it will launch perpetual contracts in the U.S.;

On June 12, The Information reported that a little-known company at the core of the U.S. financial system is exploring the issuance of a stablecoin, a move that could accelerate the adoption of digital assets across various markets. This company is the U.S. Securities Depository Trust Company (DTCC), which is responsible for clearing U.S. stock trades;

On June 13, Bitcoin Magazine reported that Japanese mobile game studio Gumi purchased Bitcoin worth 1 billion yen (approximately $6.96 million).

Macroeconomics

On June 12, Canadian listed company Matador increased its holdings by 5.38 Bitcoins. After this acquisition, Matador Technologies' total Bitcoin (and Bitcoin-equivalent assets) holdings have reached approximately 69 Bitcoins;

On June 13, according to an official announcement, Japanese listed company Remixpoint recently added 56.87 Bitcoins, worth approximately $5.915 million (887 million yen), at an average price of about $104,000 per Bitcoin. This purchase brings its Bitcoin holdings to 1,038.27 Bitcoins, breaking the 1,000 Bitcoin milestone for the first time;

On June 11, Trump stated on the social platform Truth that an agreement with China is close to being reached. China will supply rare earths; the U.S. will provide terms including student admissions; U.S. tariffs are set at 55%, and Chinese tariffs are set at 10%;

On June 11, the U.S. May unadjusted CPI year-on-year rate recorded 2.4%, with market expectations at 2.5%. The U.S. May unadjusted CPI month-on-month rate recorded 0.1%, with market expectations at 0.2%. The U.S. May adjusted core CPI month-on-month rate recorded 0.1%, with market expectations at 0.3%. The U.S. May unadjusted core CPI year-on-year rate recorded 2.8%, with market expectations at 2.9%;

On June 12, the number of initial jobless claims in the U.S. for the week ending June 7 was 248,000, with expectations of 240,000;

As of May 31, according to CME's "FedWatch," the probability of the Federal Reserve cutting rates by 25 basis points in June is 2.2%, while the probability of maintaining rates is 97.8%.

ETF

According to statistics, from June 9 to June 13, the net inflow for the U.S. Bitcoin spot ETF was $1.3703 billion; as of June 13, GBTC (Grayscale) had a total outflow of $23.193 billion, currently holding $19.468 billion, while IBIT (BlackRock) currently holds $70.132 billion. The total market capitalization of U.S. Bitcoin spot ETFs is $129.738 billion.

The net inflow for the U.S. Ethereum spot ETF was $527.6 million.

Envisioning the Future

Event Preview

NFT NYC 2026 will be held in New York, USA from June 23 to 25, 2025;

Permissionless IV will be held in New York, USA from June 24 to 26, 2025;

EthCC 8 will be held in Cannes, France from June 30 to July 3, 2025;

IVS2025 KYOTO will be held in Kyoto, Japan from July 2 to 4, 2025.

Project Progress

ARK 21Shares Bitcoin ETF ARKB will undergo a 3-for-1 stock split on June 16 to make the fund more accessible to investors. The company stated that this stock split will not affect ARKB's net asset value, stock code, or investment strategy, and its shares will continue to trade under the same CUSIP;

The decentralized social protocol Farcaster is expected to launch three professional subscription benefits during the week of June 16, including: 10K character content publishing, 4 embedding features (including images, videos, URLs, CA, and mini-apps), and a new profile banner image feature;

Lido has gradually shut down its staking services on Polygon, with a transition period from December 16, 2024, to June 16, 2025. On June 16, front-end support will end, and withdrawals can only be made through browser tools;

The Nansen Points Season 1 will launch on June 17, where users currently staking, subscribing, or inviting on Nansen will have their actions counted towards their points balance on that day.

Important Events

To commemorate the 250th anniversary of the U.S. Army, a large-scale parade and celebration will be held in Washington, D.C. on June 14. This parade coincides with U.S. President Donald Trump's birthday and Flag Day;

On June 17, the Bank of Japan will announce its interest rate decision;

On June 18, the U.S. will announce the number of initial jobless claims for the week;

On June 18, the U.S. will announce the Federal Reserve's interest rate decision;

The U.K. will announce its central bank interest rate decision by June 19;

On June 19, Japan will announce the year-on-year core CPI for May.

Token Unlocking

ApeCoin (APE) will unlock 1,538 tokens on June 17, valued at approximately $10.53 million, accounting for 1.54% of the circulating supply;

Cronos (CRO) will unlock 1.17 billion tokens on June 17, valued at approximately $107 million, accounting for 1.17% of the circulating supply;

Pixels (PIXEL) will unlock 89.37 million tokens on June 19, valued at approximately $3.43 million, accounting for 1.79% of the circulating supply;

Polyhedra Network (ZKJ) will unlock 15.5 million tokens on June 19, valued at approximately $30.89 million, accounting for 1.55% of the circulating supply;

Zksync (ZK) will unlock 759 million tokens on June 19, valued at approximately $39.13 million, accounting for 3.62% of the circulating supply;

Bittensor (TAO) will unlock 216,000 tokens on June 21, valued at approximately $8.105 million, accounting for 1.03% of the circulating supply.

About Us

Hotcoin Research, as the core investment research hub of the Hotcoin ecosystem, focuses on providing professional in-depth analysis and forward-looking insights for global cryptocurrency investors. We have built a "trend analysis + value mining + real-time tracking" integrated service system, offering in-depth analysis of cryptocurrency industry trends, multi-dimensional assessments of potential projects, and round-the-clock market volatility monitoring. Combined with our weekly live strategy sessions of "Hotcoin Selected" and daily news updates from "Blockchain Today," we provide precise market interpretations and practical strategies for investors at different levels. Leveraging cutting-edge data analysis models and industry resource networks, we continuously empower novice investors to establish cognitive frameworks and assist professional institutions in capturing alpha returns, collectively seizing value growth opportunities in the Web3 era.

Risk Warning

The cryptocurrency market is highly volatile, and investing carries risks. We strongly recommend that investors conduct investments based on a complete understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。