Middle East Situation Intensifies, Israel-Iran Conflict Escalates; Gold Soars, US Stock Futures and BTC Decline

Macroeconomic Interpretation: In the early hours of today, Israel's precise strikes on Iran's nuclear facilities and military command systems not only ignited Tehran's vow of revenge to "make the aggressors pay a heavy price," but also triggered a silent asset migration in the crypto market. As countries urgently closed their airspace and diplomatic rhetoric intensified, on-chain data showed that the 24-hour trading volume of "gold tokens" PAXG and XAUT surpassed $410 million, validating the safe-haven properties of digital gold amidst the smoke of war. Bitcoin's performance during this crisis reveals a deeper asset logic, with BTC prices dropping to the critical support level of $102,600 after the outbreak of hostilities, while US stock cryptocurrency concept stocks generally fell, with MicroStrategy down 2.8% and Coinbase down 1.89%.

BlackRock's dollar institutional digital liquidity fund (BUIDL) had already shown capital movement before the conflict erupted—growing 200% to $2.89 billion since March 26, capturing 40% of the tokenized treasury market. As the traditional bond market experiences severe fluctuations due to war risk premiums, regulated high-yield cash instruments on the blockchain are becoming a safe haven for institutional funds. This migration is not an isolated phenomenon: the Polkadot community's "Bitcoin Strategic Reserve Plan" proposed during the same period aims to gradually convert 500,000 DOT (approximately $25 million) into decentralized Bitcoin asset tBTC through the Hydration protocol, marking the first systematic allocation of BTC as a risk-averse asset in public chain treasuries.

CFTC Acting Chair Caroline Pham's statement at the Coinbase summit sharply contrasts with this: her declaration that "supporting innovation does not equate to condoning illegal activities" not only denies the overly expansive regulatory logic of the Biden era but also delineates the compliance red lines under the Trump administration's open policies. This tendency towards "depoliticized regulation" coincides with key trends revealed in Coinbase's research report: the increased likelihood of a soft landing for the US economy and the accelerated allocation of corporate crypto assets create a delicate balance, while stablecoin legislative progress will become a core variable in the market structure for the second half of the year. The CFTC's focus on combating market fraud may accelerate the internal revaluation of the crypto market. The performance divergence between altcoins and mainstream coins becomes increasingly pronounced during the crisis, as Coinbase warned that "altcoin performance is more dependent on individual factors." This divergence will intensify as the regulatory framework clarifies, with the SEC's decisions on key applications such as physical purchase ETFs, staking mechanisms, and composite funds (expected to be completed by the end of 2025) potentially becoming a watershed moment for the survival space of altcoins.

The Rolling DCA mechanism adopted in the Polkadot proposal automatically executes small DOT-tBTC conversions every 20 blocks, creating compound returns by combining lending functions, showcasing the deep coupling of DeFi and traditional asset management strategies. This innovation of "algorithmic crisis response," along with the miracle of BlackRock's BUIDL fund tripling in size over 90 days, corroborates the core judgment of the Coinbase report: as macro uncertainty becomes the norm, strategies for automating the allocation of on-chain assets will reshape the asset management industry landscape. The actions of public chains like Polkadot incorporating BTC into strategic reserves may trigger imitation from other blockchain projects, forming a historic cycle of "decentralized organizations increasing their holdings of decentralized assets."

The smoke-filled streets of Tehran and the quietly operating blockchain nodes now form a unique footnote in the evolution of digital civilization. As Iran's permanent mission to the United Nations submits an emergency meeting request to the Security Council, on-chain real-time settlement of treasury tokens is completing value exchanges at a rate of one million times per second; when Trump declares that "he is ready to protect Israel," the Polkadot community is still calmly debating whether the proportion of Bitcoin in the treasury allocation should be increased to 3%. This disconnection and coexistence between the physical and digital worlds will ultimately reshape humanity's understanding of wealth security—when sovereign nations draw boundaries with airspace bans, crypto protocols are constructing financial shelters that transcend borders using mathematical rules.

Historical turning points often emerge at the intersection of gunfire and code. On June 13, 2025, as Israeli fighter jets trace fire lines in the night sky over the Persian Gulf, the blockchain quietly records the collision of two parallel worlds: the old order struggles to maintain itself amidst military strikes and economic sanctions, while the new system accelerates its formation through tokenized treasuries and Bitcoin reserve proposals. This crisis will ultimately prove that beyond sovereign credit and military deterrence, value storage networks based on mathematical rights confirmation are becoming a third option for humanity to cope with uncertainty.

BTC Data Analysis:

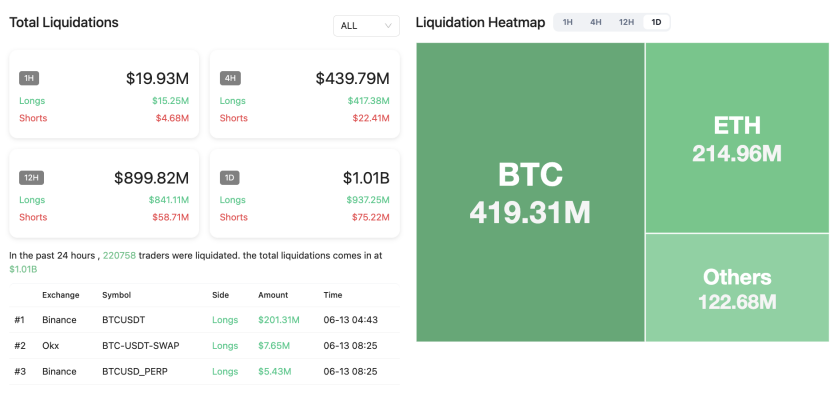

Affected by the Middle East situation following Israel's strikes on Iran, gold prices rose, while US stock index futures and the crypto market fell broadly, with BTC dropping to around $102,600. According to CoinAnk data, in the past 24 hours, the total liquidation amount in the crypto market reached $1.013 billion, with long positions accounting for approximately $937 million and short positions around $75.5 million. The liquidation amount for BTC was $419 million, while ETH's liquidation amount was about $215 million.

The escalation of the Middle East situation shows typical characteristics of geopolitical risk transmission in financial markets, reflecting the increasing divergence between safe-haven assets and risk assets. Israel's military actions against Iran triggered panic, with gold, as a traditional safe-haven asset, rising significantly against the trend, continuing the historical pattern of "buying gold in chaotic times" during Middle Eastern conflicts. Meanwhile, the broad decline in US stock index futures reflects investors' sell-off behavior towards risk assets, consistent with the market response logic when Iran attacked Israel in April 2024, leading to a single-day drop of 475 points in US stocks.

Bitcoin's sharp decline, with a total liquidation of $1.013 billion across the network, of which long positions accounted for 92.4%, highlights the vulnerability of leveraged funds in sudden geopolitical events. This phenomenon echoes the historical case of $966 million in liquidations in the crypto market during the Middle East conflict in April 2024, indicating that the crypto market has not yet detached from its high-risk speculative nature. Notably, the imbalance in long and short liquidations (with long positions exceeding 90%) reflects the majority of investors misjudging the safe-haven function, with actual trends diverging from traditional safe-haven assets like gold.

Although some studies advocate that Bitcoin possesses "digital gold" attributes, this event once again verifies that in sudden geopolitical crises, cryptocurrencies are more prone to amplified volatility due to liquidity squeezes and leveraged liquidations, and their safe-haven function remains unstable. The current divergence in trends between gold and cryptocurrencies essentially reflects the differences in risk pricing between traditional safe-haven mechanisms and emerging assets, suggesting that investors should be wary of asset mismatch risks amid geopolitical uncertainties.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。