Key Points

–Resolv Labs launched USR—a fully on-chain neutral stablecoin that hedges ETH and BTC, eliminating traditional financial intermediaries and continuously generating returns.

–The $Resolv token is used for governance, transaction fee dividends, and staking rewards, with longer holding periods resulting in higher reward multipliers.

–Users can integrate USR with RESOLV into DeFi protocols such as Pendle, Sommelier, Hyperliquid, and major DEXs, freely combining across multiple chains like Ethereum, Base, and BNB Chain.

–While the project's prospects are promising, complexities such as multi-chain bridges, perpetual contract hedging, and custodial dependencies also introduce contract, market, and counterparty risks.

Since its launch in 2024, Resolv Labs has quickly leveraged "financial-grade returns through on-chain transparency" to disrupt the stablecoin market. By collateralizing ETH and BTC and short hedging in the perpetual contract market, the flagship product USR provides stable returns similar to T-Bills without the need for traditional banks.

Meanwhile, the $Resolv token grants holders governance rights, transaction fee dividend rights, and higher-tier staking rewards. With soaring TVL, backing from major investors, and a multi-chain strategy, Resolv is creating a sustainable yield "on-chain dollar" for DeFi.

Table of Contents

Resolv Token Economics, Distribution, and Lockup

How to Participate and Acquire RESOLV

Competitive Landscape of Resolv Labs

RESOLV Risks and Considerations

Overview of Resolv Labs

Image Credit: Resolv Labs Homepage

Founded in 2023, Resolv Labs aims to redefine stablecoins by embedding yield directly into DeFi. Its core product, USR, is pegged to the dollar (1 USR = 1 USD) but continuously generates returns on-chain through hedging with ETH and BTC collateral in perpetual contracts. This neutral hedging design captures funding rate income and staking rewards without relying on opaque CeFi channels or traditional assets.

In the underlying architecture, USR provides low-risk returns as a senior tranche, while the junior tranche (Resolv Liquidity Pool, abbreviated as RLP) takes on extreme risks for higher returns. With institutional custody from Fireblocks and diversified trading channels, Resolv achieves professional-grade risk management and complete on-chain transparency. In less than a year, the protocol has attracted over 50,000 users, with TVL reaching hundreds of millions, fully validating its product-market fit.

Image Credit: Resolv Labs Official Twitter / X

Resolv Token Economics, Distribution, and Lockup

The total supply of $RESOLV is capped at 1 billion tokens, with no inflation or burn mechanism. The distribution is as follows:

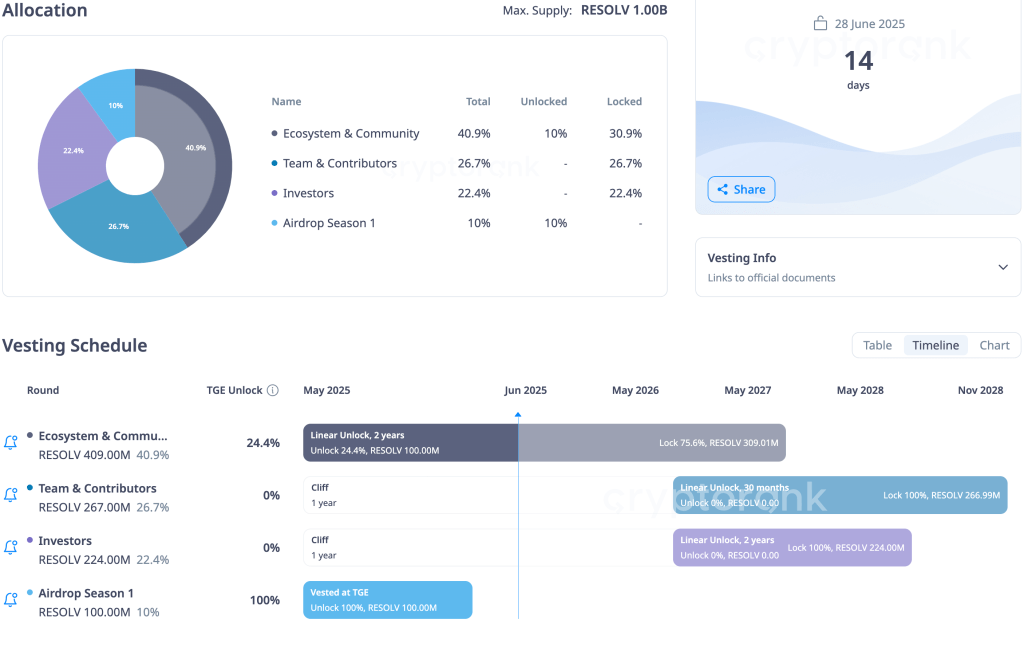

Image Credit: CryptoRank

The total supply of $RESOLV is capped at 1 billion tokens, with no inflation or burn mechanism. The distribution is as follows:

– Airdrop (10%): Full unlock for Season 1 supporters at TGE, with a small lockup for large holders.

– Ecosystem and Community (40.9%): For partner incentives, liquidity rewards, and subsequent airdrops, linear unlock over 24 months.

– Team and Contributors (26.7%): Locked for 1 year, with monthly unlock over 30 months.

– Investors (22.4%): Locked for 1 year, with linear unlock over 24 months.

At launch, the circulating supply was approximately 12% of the total, increasing to about 15.6% after listing on major exchanges. All airdrops are distributed in the form of stRESOLV, granting holders governance rights and transaction fee dividends.

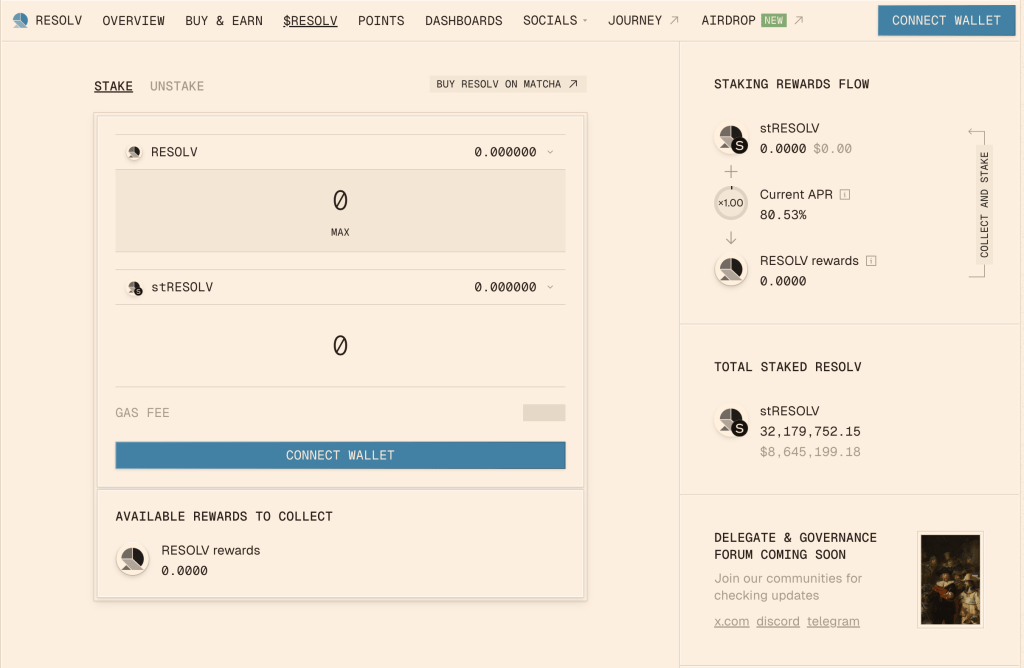

Image Credit: Resolv Token Claim Page

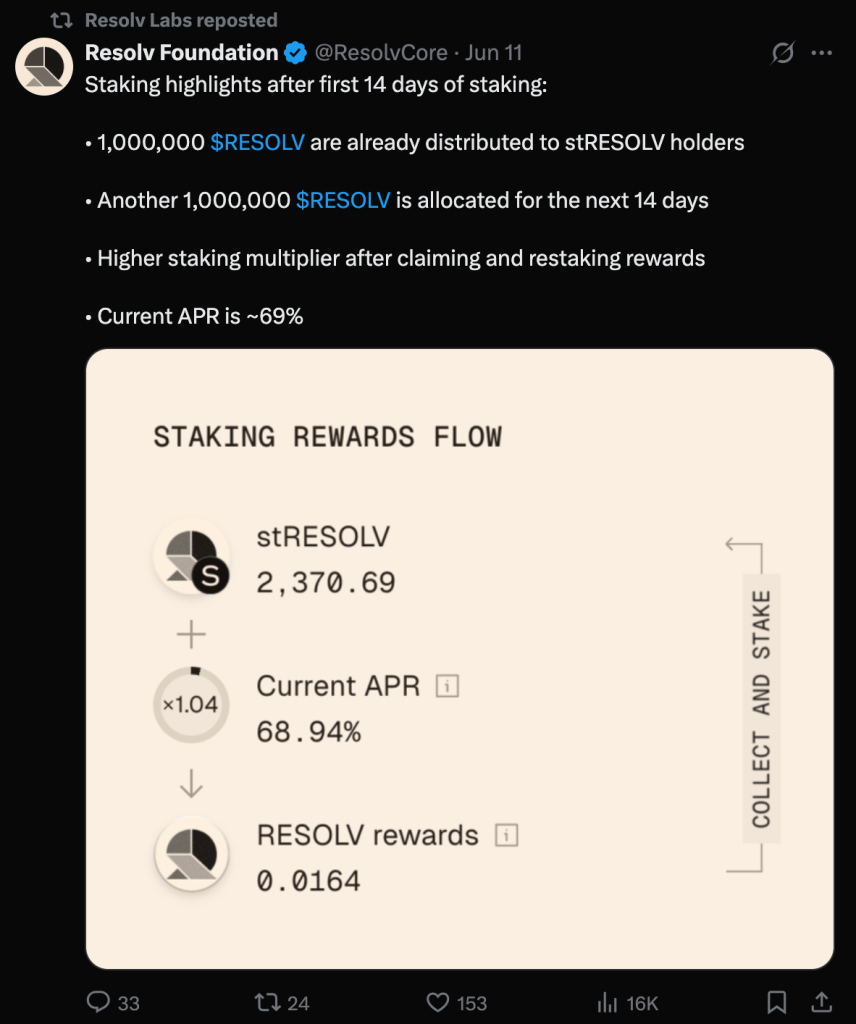

Stakers earn rewards through protocol fees and dedicated distribution pools, with longer holding periods resulting in higher reward multipliers, up to 2x. Although there is no burn mechanism, staking RESOLV allows holders to simultaneously gain governance rights and a share of USR mint/redeem income.

Core Use Cases of Resolv

The Resolv ecosystem is rapidly expanding through various integrations with DeFi and CeDeFi:

– Yield Tokenization (Pendle, Sommelier): Wrap staked USR into wstUSR, which can be traded separately for its yield in the market; during joint activities, users providing liquidity can earn up to 30× RESOLV reward points.

– AMM Liquidity (Uniswap, Aerodrome, Jupiter): Establish USR/RESOLV and USDC/RESOLV pools on the Ethereum, Base, and Solana aggregated networks, achieving tight spreads and cross-chain combinations through LayerZero.

– Perpetual Contract Hedging (Hyperliquid): Collaborate to hedge USR in both decentralized and centralized exchanges with perpetual contracts, with ETH leverage funding rates reaching 20–24% annualized.

– Institutional Access: With custody from Fireblocks and Ceffu, support asset management institutions in using yield-generating dollar assets, promoting USR as the preferred "crypto-native treasury."

– Cross-Chain Coverage: Deployed on Ethereum L2, Base, and BNB Chain, with plans to launch on more networks to facilitate the interaction of USR and RESOLV across ecosystems.

Image Credit: Resolv dApp

Multiple integrations make USR the "stablecoin Lego" between protocols and institutions, while RESOLV is responsible for governance and incentivizing ecosystem growth.

How to Participate and Acquire Resolv Tokens

– Season 1 Airdrop: Eligible users (score ≥ 1000) can directly claim stRESOLV on the official website after TGE (May 15, 2025), with liquidity available after a 2-week cooling period.

– Liquidity Bootstrapping Pool (LBP): A $3 million launch pool on Jupiter aids initial pricing, allowing USR or USDC to be exchanged for RESOLV on the Base network.

– Decentralized Trading: Uniswap (on Ethereum) and Aerodrome (on Base) continuously provide liquidity; please verify the contract address (0x259338…768A1) before trading.

– Centralized Exchanges: OKX (June 10), MEXC, XT.com, and Binance (June 11 Innovation Zone) have all launched, with multiple trading pairs (RESOLV/USDT, USDC, BNB, FDUSD, TRY); Gate.io and Phemex will follow closely.

XT.comRESOLV/USDT Spot Trading Pair

In the future, more airdrop rewards can be obtained by participating in Season 2 (staking, providing liquidity, or completing collaborative tasks).

Competitive Landscape of Resolv Labs

Resolv is positioned in the emerging yield stablecoin sector, competing alongside various projects:

– Ethena's USDe: Also employs neutral hedging but lacks a junior insurance pool. Ethena has a larger TVL due to its first-mover advantage, while Resolv's RLP can absorb volatility risks and provide higher yields.

– Traditional Fiat Stablecoins (USDC, DAI): Centrally issued with no native yield; DAI's deposit rates depend on off-chain assets. Resolv generates yield through the crypto market itself, with 1:1 collateralization and higher capital efficiency.

– LSD-type Stablecoins (e.g., Lybra's eUSD): Depend on ETH staking yields, providing stable returns but with limited upside; Resolv's perpetual contract strategy can achieve higher yields in bull markets, but with greater volatility.

– Other Innovative Projects (Angle, UXD, Mero, etc.): Each employs hedging or lending strategies, but are smaller in scale and rarely possess both neutral hedging and layered structure with multi-chain deployment capabilities.

Resolv aims to lead competitors in yield and portfolio flexibility through a dual-token model, complete on-chain transparency, and strong community incentives.

RESOLV Token Risks and Considerations

Complexity of Smart Contracts:

The multi-token, multi-chain bridges, and perpetual contract hedging contracts increase the attack surface. Although audited by MixBytes and Pessimistic, there is no endorsement from top security firms.

Market and Funding Rate Volatility:

If the perpetual contract funding rate turns negative, RLP may incur losses or even be depleted; the protocol will pause RLP redemptions when the collateralization ratio falls below 110% to protect USR payouts.

Counterparty and Custodial Risks:

Reliance on centralized exchanges for perpetual contracts and custodians like Fireblocks and Binance Ceffu may lead to restricted access or losses if an exchange halts operations or goes bankrupt.

Liquidity Crunch:

A large-scale redemption wave may tighten on-chain liquidity and hedge positions, delaying withdrawals for RLP holders.

Regulatory Pressure:

Yield stablecoins may be viewed as securities or fundraising products, facing dual scrutiny from the EU's MiCA and proposed regulations in the U.S.; the team's nationality background may also raise geopolitical concerns.

Outlook for Resolv Labs

The future of Resolv depends on the continued adoption of USR in DeFi and the smooth advancement of its 2025 roadmap:

– Multi-Asset Collateral: BTC has been integrated, enriching yield sources and enhancing market appeal.

– Lending Collaborations: Plans to implement a "circular strategy" for USR through money market protocols, increasing use cases.

– Cross-Chain Expansion: More networks will be deployed beyond Ethereum, Base, and BNB Chain to expand user coverage and network effects.

– DAO Governance: On-chain voting will be launched in Q4 2025, allowing RESOLV holders to fully decide on collateral assets and fee structures.

As long as Resolv can continue to provide stable yields above CeFi solutions and maintain transparency amid market volatility and security audits, it is poised to become a benchmark for the next generation of stablecoins.

Summary

Resolv Labs combines the rigor of traditional finance with the transparency of DeFi to create a yield stablecoin ecosystem. Its dual-layered model, along with governance tokens, coordinates the interests of users, liquidity providers, and the team.

Despite fierce competition from Ethena, LSD stablecoins, and traditional stablecoins, Resolv's rapidly growing TVL, multi-chain strategy, and institutional backing demonstrate strong momentum. However, the project's complexity also brings risks: smart contract vulnerabilities, funding rate volatility, and regulatory uncertainties cannot be overlooked.

For long-term believers, staking RESOLV not only allows for direct sharing of protocol yields but also participation in project governance. In the future, as Resolv maintains its dollar peg and continues to provide substantial yields in both bull and bear markets, it can truly become a cornerstone of the DeFi ecosystem; otherwise, it may serve as a lesson.

Frequently Asked Questions about RESOLV Token

What is the difference between USR and RESOLV?

USR is a neutral stablecoin hedging ETH/BTC collateral, always equal to 1 dollar; RESOLV is a governance and reward token, allowing holders to share protocol fees and participate in decision-making.

How to stake RESOLV? What are the yields?

Staking will yield stRESOLV, granting governance voting rights and sharing protocol income. Yields depend on protocol fees, with longer holding periods allowing for reward multipliers of up to 2x.

Will RESOLV be burned?

No. The total supply of RESOLV is fixed at 1 billion, with no burning mechanism. Its value is primarily accumulated through fee distribution and staking incentives.

What happens if the perpetual contract funding rate turns negative?

Negative rate losses are borne by the junior pool (RLP); if the RLP collateralization ratio falls below 110%, the protocol will pause RLP redemptions to ensure the 1:1 peg of USR.

On which chains and exchanges can RESOLV be traded?

RESOLV can be traded on DEXs on Ethereum, Base, and BNB Chain (Uniswap, Aerodrome, Jupiter) as well as major CEXs (Binance, OKX, MEXC, Gate.io, Phemex). Please verify the official contract address when trading.

How can I participate in governance?

RESOLV holders can vote on key parameters such as collateral asset ratios and fee rates through on-chain proposals. Complete DAO governance is expected to launch in Q4 2025.

Can I use USR as collateral on other DeFi platforms?

Relevant integrations are underway. Currently, USR can be used in yield farming and DEX pools, and in the future, it may be used for lending on money market protocols.

How can I stay updated on Resolv Labs' latest developments?

Twitter (X): https://x.com/ResolvLabs

Telegram: https://t.me/Resolv_Community

Substack: https://resolvlabs.substack.com/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。