The financial market is always like this: when the truth is putting on its shoes, lies have already run all over the city.

Hello everyone, I am trader Gege. Continuing from the last article, the short-term strategy for Bitcoin should have yielded some results, and I also mentioned the probability of a double top on the daily chart, so be cautious about chasing the rise. The upper limit of Ethereum's breakout and subsequent buy orders also met expectations, hitting around 2880 after the breakout.

Before we dive in, let's talk about the news from the past couple of days. Last night’s CPI data was favorable, coming in below expectations across the board. Trump directly pressured Powell to cut interest rates by 100 basis points, and with the previous conflict between Trump and Biden, Biden had to compromise. However, this did not trigger a new round of increases in the crypto market; instead, bad news from the Middle East caused the market to turn bearish. The conflict between Trump and Biden may have been a carefully planned scheme rather than a spontaneous decision. Although there are differences between leaders and their subjects, they will still compromise for their own interests. For us small investors, it is impossible to rely on news for specific operations; news is for observation, and what’s more important is to have our own trading system, which is honed through the market, continuously executed and repeated. Trading is a tedious and lonely game.

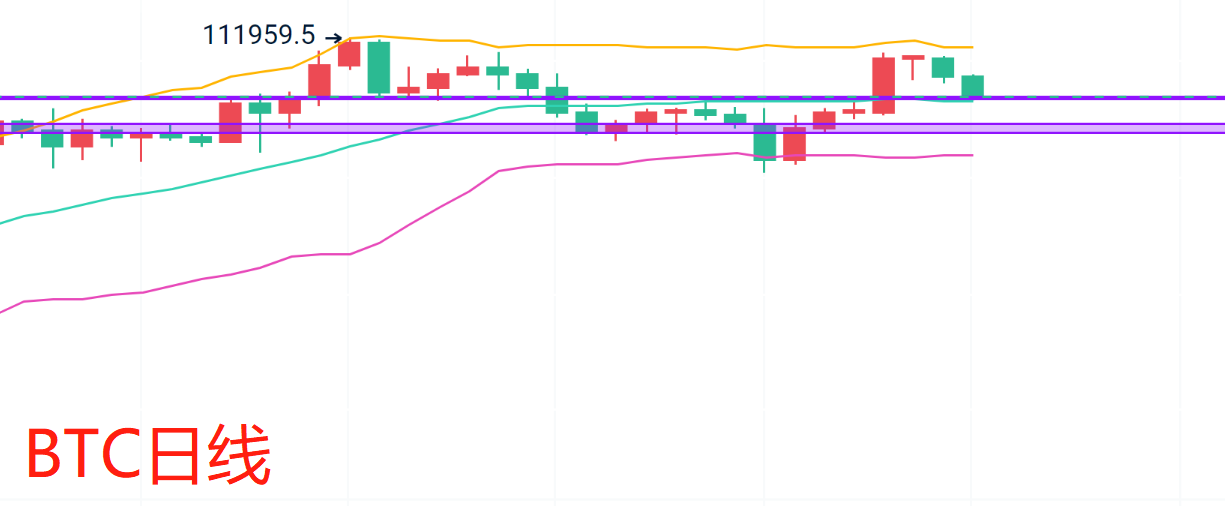

Enough small talk, let’s return to the current market situation. After the daily chart for Bitcoin formed a hammer candlestick, it has seen two consecutive bearish retracements, and a double top structure seems to be forming. The current market is testing the support near the middle track. If it breaks down, it will continue to test the support above 103000. Therefore, in the short term, we should focus on whether the middle track can hold. The article on the 10th also reminded us that although there was a strong bullish candle, we should still respect the resistance at the previous high and emphasize the need for a correction, so chasing the rise is not advisable. Next, while paying attention to the middle track, we should also monitor the closing situation of the daily chart.

Looking at the 4-hour chart, it is currently testing the support near the lower track and MA60, which can be a reference in the short term, and it corresponds to the daily middle track. Therefore, the short-term strategy can be based on whether the daily middle track and the current support on the 4-hour chart can hold. Thus, I will provide two areas as short-term references. I won’t analyze the technical aspects of Ethereum today; the smaller time frames are also testing the support area. The short-term references are as follows.

Bitcoin short-term: Buy at 106800-106000, buy again at 104800-103800 if it breaks down. Sell at 108500-109500.

Ethereum short-term: Buy at 2720-2680, buy again at 2630-2580 if it breaks down. Sell at 2840-2880.

PS: Try to activate the strategy only once.

The suggestions are for reference only. Ensure proper risk control when entering the market, and manage your profit and stop-loss space accordingly. For specific strategies, consult during the trading session.

Alright, friends, we’ll see you next time. I wish everyone success in their trading endeavors and smooth sailing in the crypto world! More real-time suggestions will be sent internally. Today’s brief update ends here. For more real-time suggestions on Bitcoin and Ethereum, find Gege.

Written by/ I am trader Gege, a friend willing to accompany you in your resurgence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。